Hey there! If you're facing the tough situation of a repossession alert, you're not alone. Many people find themselves in challenging financial circumstances, and understanding the process is crucial to navigating it effectively. In this article, we'll break down what a repossession alert means for you and what steps you can take nextâso keep reading to empower yourself with knowledge!

Clear Identification of Parties Involved

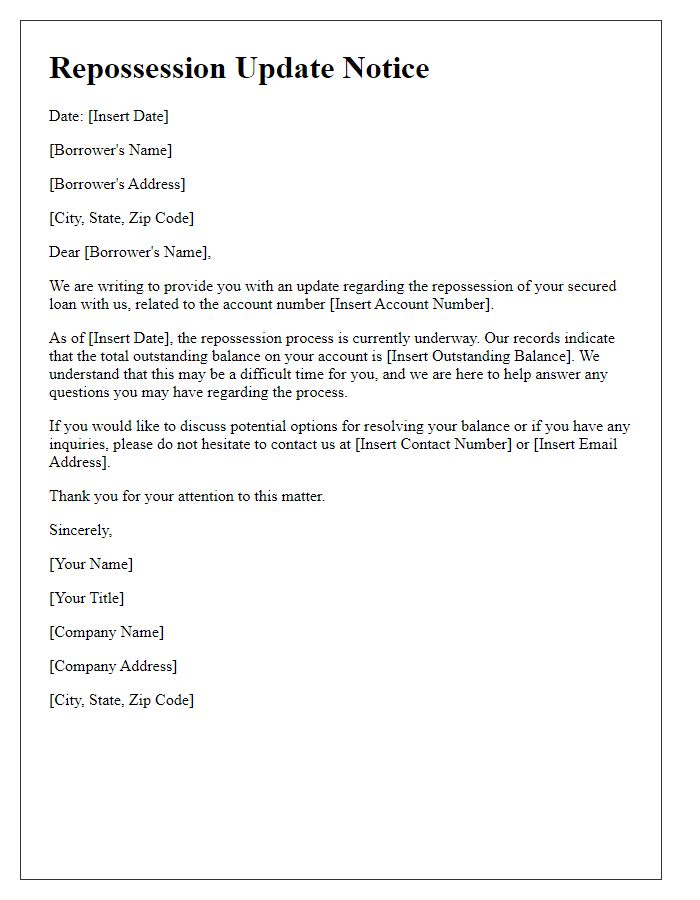

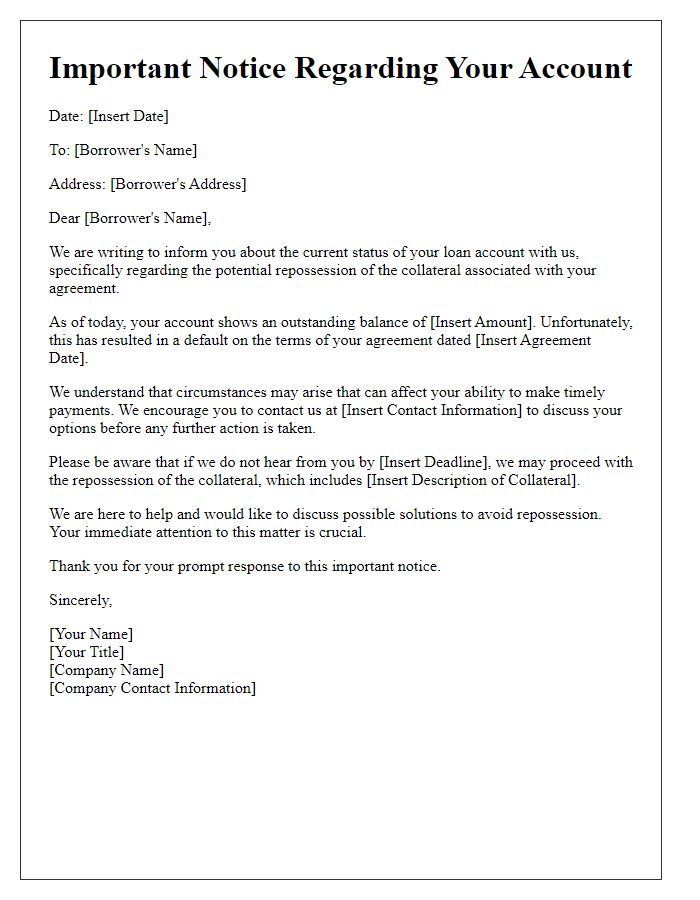

The repossession alert notification must clearly identify the parties involved, such as the lender, often a financial institution like ABC Bank, and the borrower, an individual or entity who has taken out a loan to finance a vehicle, equipment, or property. Accurate identification of the lender includes the bank's name, address, and contact details, alongside the specific account number related to the loan. The borrower's identification should include their full name, current address, and any account identifiers. Both entities play crucial roles in the repossession process, with the lender holding the legal right to reclaim the property due to non-payment, while the borrower is the party affected by the notice, which typically outlines the default status, repossession date, and potential consequences of failure to remedy the situation.

Legal References and Compliance Statements

In the context of repossession alert notifications, compliance with legal statutes such as the Fair Debt Collection Practices Act (FDCPA) is essential for lenders and collection agencies. Proper notification requires clear identification of the borrower, details of the outstanding debt amount, and the specific date of the impending repossession. Relevant laws, such as the Uniform Commercial Code (UCC), provide guidance on the legal framework for secured transactions, including repossession processes. Ensuring notifications adhere to state-specific regulations, such as the requirement of sending written notices at least ten days prior to repossession in certain jurisdictions, is crucial for maintaining compliance. These steps help protect the lender's interests while ensuring transparency in the process, allowing borrowers to be fully informed of their rights and options before their property is taken.

Date of Repossession and Specific Details

Repossession notifications typically inform individuals about the impending recovery of personal property, often due to missed payments or lease agreements. A repossession alert is essential for maintaining transparency in financial transactions. On [specific date of repossession], a formal recovery of the item will occur, affecting properties such as vehicles or appliances that are under legal agreements. The process often involves a licensed repossession agent, adhering to local laws, such as the Fair Debt Collection Practices Act. Key details include the exact location of the property to be repossessed, implications for the debtor, potential fees incurred, and options available for remittance or dispute resolution. Failure to address the situation can result in further legal consequences. Individuals should keep records of all communications regarding this matter to safeguard their rights.

Instructions for Recourse or Resolution

Notification of repossession alert serves as a crucial communication in cases of financial distress related to assets, such as vehicles or properties. This document typically outlines specific steps for recipients to follow to avoid escalation, such as scheduled dates for potential repossession (often within 30 days), contact information for the lending institution or agency, and available options for recourse or resolution, including payment plans or dispute forms. Additionally, it may refer to relevant legal codes (like the UCC - Uniform Commercial Code) governing repossession, emphasizing the importance of prompt action to resolve the issue. Timely responses are essential to prevent loss of property and potential legal complications.

Contact Information for Queries and Assistance

Repossession alerts are critical notifications that inform individuals about the potential recovery of their assets, typically vehicles or properties, due to non-payment issues. In cases of vehicle repossession, lenders may send a formal notice detailing the outstanding balance, due dates, and consequences of continued neglect. The alert often includes contact information for queries, typically a customer service number, often located at the lender's headquarters (e.g., ABC Finance Company, 123 Main St, Cityville). Assistance may also be available through dedicated departments such as loss mitigation, often staffed by trained professionals who help borrowers navigate the repossession process and explore alternatives. This notification serves as a pivotal moment for individuals to address outstanding financial obligations proactively.

Comments