Have you ever checked your bank statement only to find unexpected charges that leave you scratching your head? Dealing with unauthorized charges can be confusing and frustrating, but taking action is essential to protect your finances. A well-crafted dispute letter can help you communicate your concerns effectively to your bank or credit card provider. Interested in learning how to write the perfect letter to resolve your issues? Keep reading!

Clearly identify disputed charges

Unauthorized charges on credit card statements can lead to financial distress and necessitate formal dispute processes with financial institutions. Common sources of these disputes include subscriptions from companies such as Netflix or Amazon Prime, where recurring monthly fees often appear. Additionally, clear identification of disputed charges, such as $49.99 for a gaming service or $120.00 for an unrecognized travel booking, is essential for effective resolution. The first step involves obtaining recent statements, with a focus on pinpointing discrepancies or unfamiliar transactions, enabling the cardholder to provide specific details while contacting customer service for the financial institution involved. Documenting each charge's date, amount, and merchant name ensures transparency throughout the dispute process.

Provide account and transaction details

Unauthorized charges can severely impact customer financial security. Individuals receiving unexpected charges on their bank accounts, often linked to credit or debit card transactions, must act promptly. Affected individuals should collect essential account details such as account numbers, transaction dates, and the amounts involved. This information is crucial for disputing fraudulent activity. For instance, a recent transaction of $150 from an online retailer on October 15, 2023, might be flagged as suspicious if the cardholder never made such a purchase. Moreover, writing to financial institutions, such as Chase Bank or Bank of America, is necessary to report the unauthorized activity and initiate a formal investigation. Documenting all correspondence and maintaining records of communication ensures all steps are traceable throughout the dispute process.

Include contact information

Unauthorized charges can create financial stress for consumers. Credit card holders may notice discrepancies when reviewing monthly statements from financial institutions, leading to disputes over unintended transactions. Affected individuals should gather evidence, such as receipts and correspondence, to support their claims. It is crucial to contact the customer service department of the credit card issuer, often accessible through a toll-free number found on the back of the card. Documentation should also be sent via certified mail to ensure it reaches the billing department. Following up with a detailed note outlining the dispute, including date, amount, and nature of the charge, often expedites resolution. Keeping records of all communications is vital in case further action, such as contacting regulatory agencies, becomes necessary.

Request specific resolution action

Unauthorized charges on credit card statements can create significant financial stress for consumers. For instance, fraudulent transactions, often ranging from small amounts (like $5) to larger sums (exceeding $1,000), can lead to comprehensive disputes. According to Federal Trade Commission (FTC) data, millions of Americans report identity theft incidents yearly, prompting the need for swift action. Customers might identify these charges while reviewing their monthly statements, typically on platforms such as PayPal or Visa. Promptly reporting these discrepancies to issuers like Chase or American Express can help recover lost funds. The resolution process often includes a thorough investigation by banks, with consumers advised to provide supporting documentation (like account statements) to expedite refunds. Each card issuer may have a unique protocol, and adhering to their guidelines ensures better chances of a successful outcome.

Attach relevant documentation

Unauthorized charges on credit card statements can lead to serious financial consequences for consumers. Chargeback requests may require detailed documentation, including transaction dates, amounts exceeding $100 in fraud cases, and merchant information from payment processors. Documentation should also encompass reports from banks or financial institutions, illustrating the timeline of unauthorized activity. Bank policies, which serve as guidelines for disputing charges, can vary significantly between established financial entities like Wells Fargo and newer fintech companies. Therefore, it is crucial to follow each institution's specific protocols to maximize the chances of a successful dispute resolution.

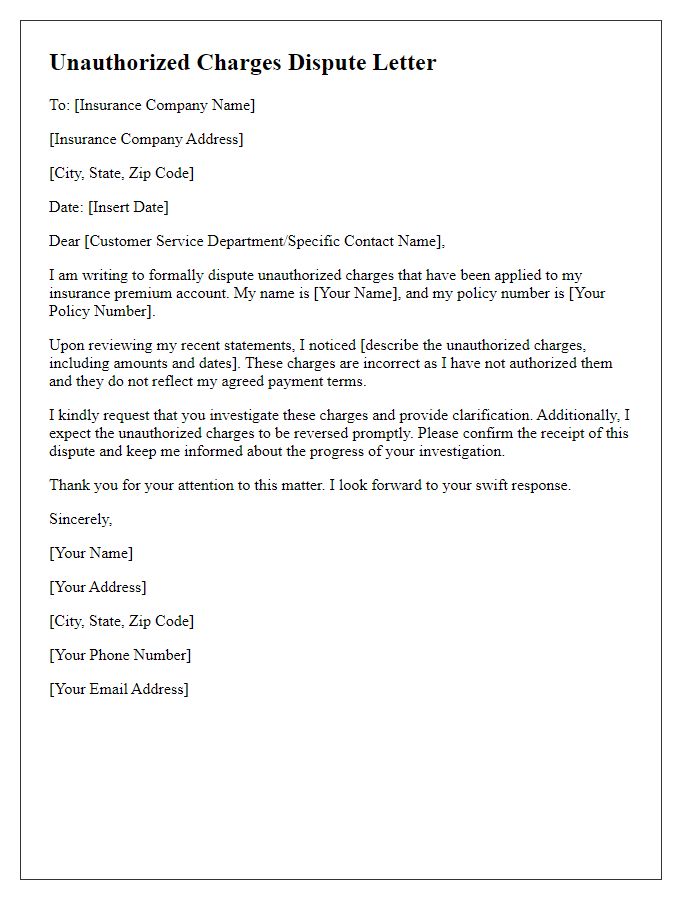

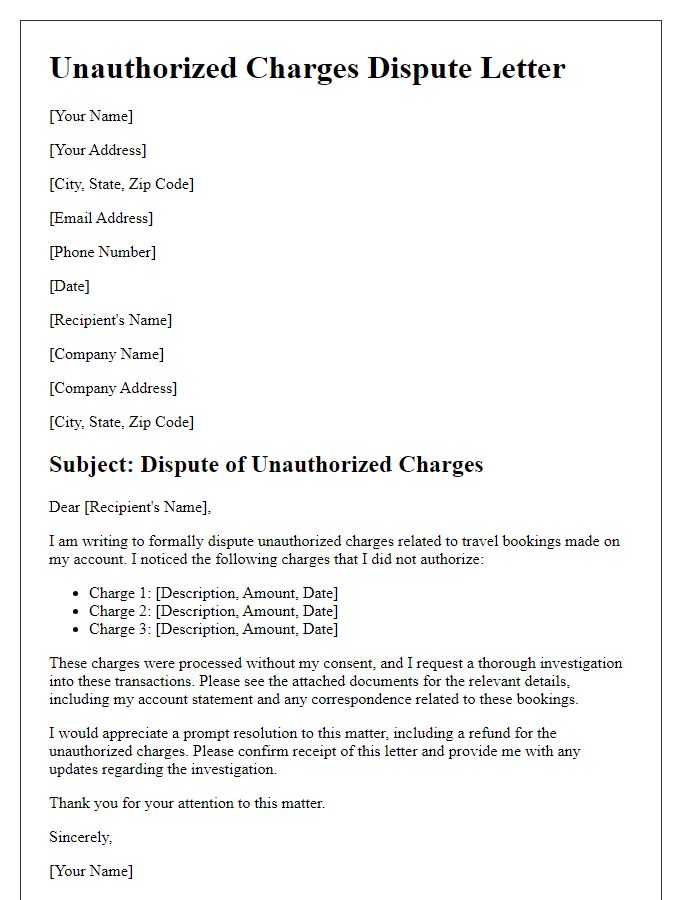

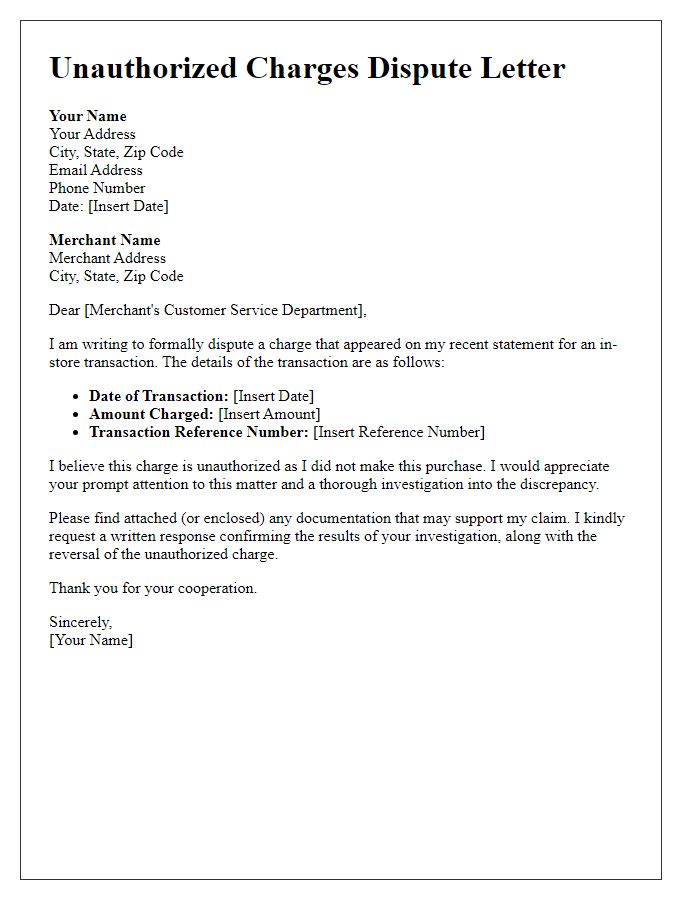

Letter Template For Unauthorized Charges Dispute Samples

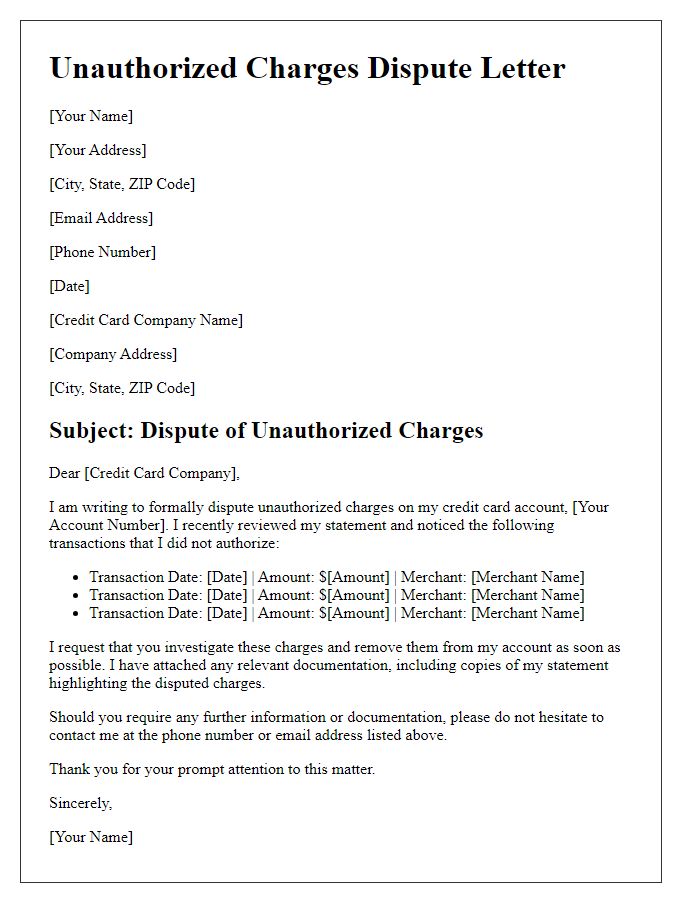

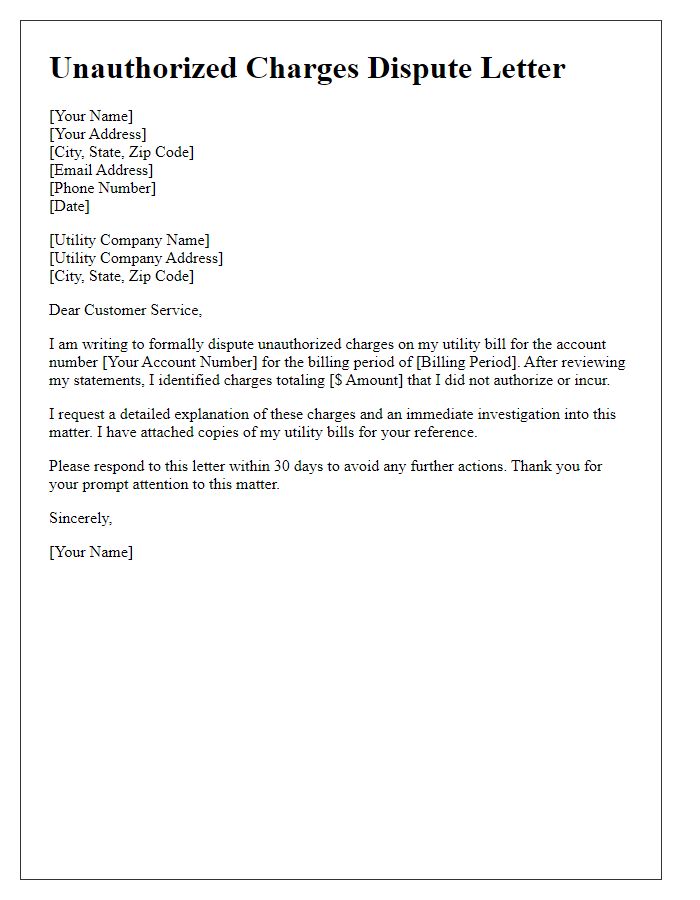

Letter template of unauthorized charges dispute for credit card transactions

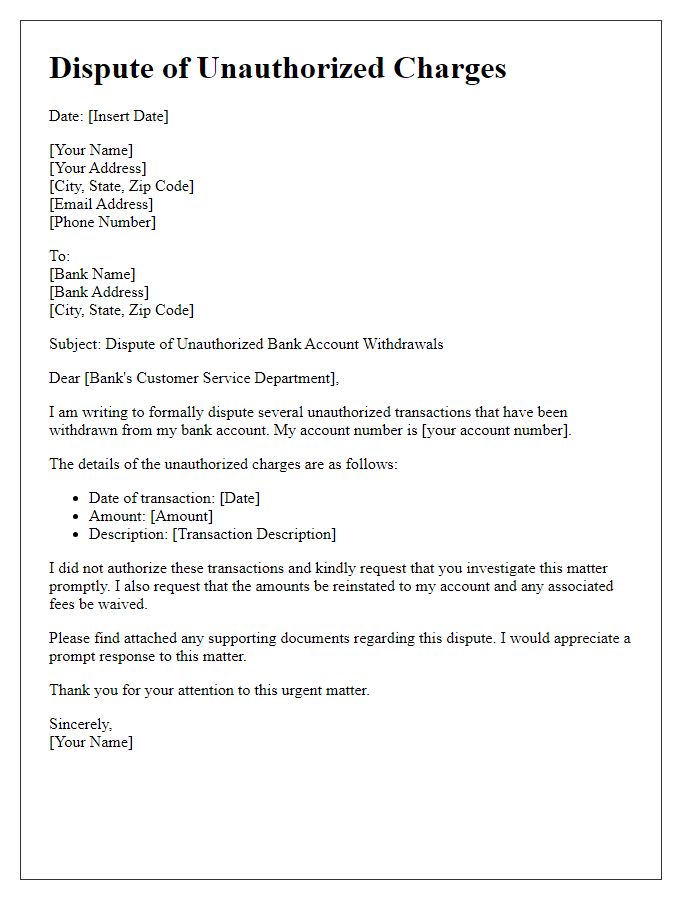

Letter template of unauthorized charges dispute for bank account withdrawals

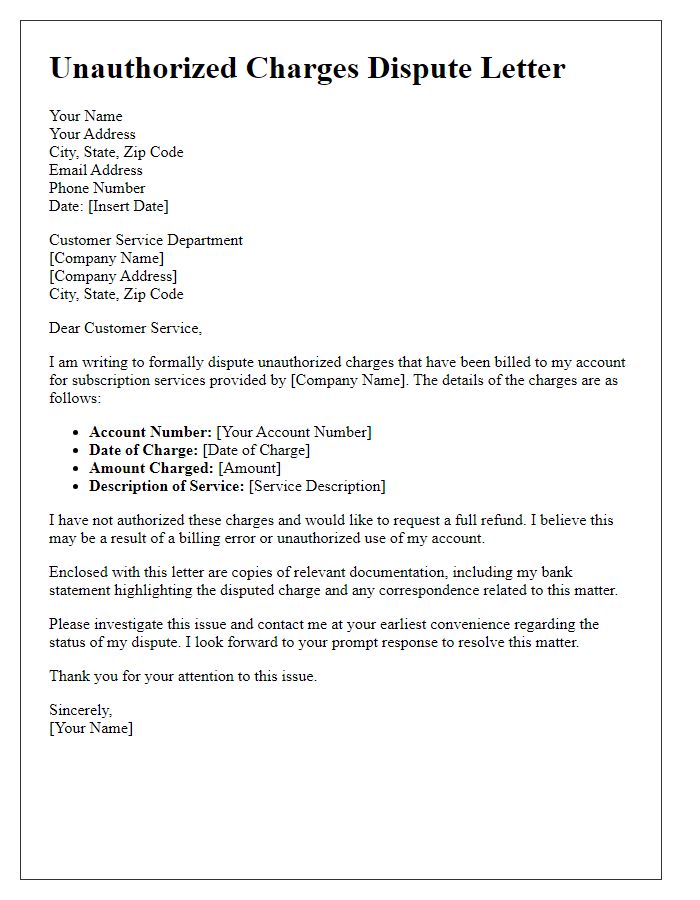

Letter template of unauthorized charges dispute for subscription services

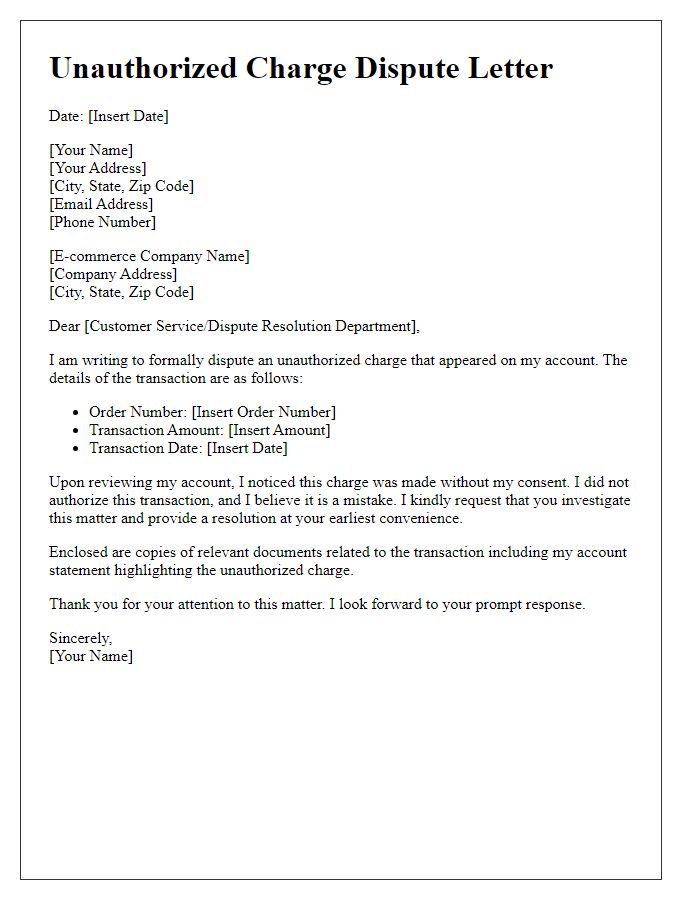

Letter template of unauthorized charges dispute for e-commerce purchases

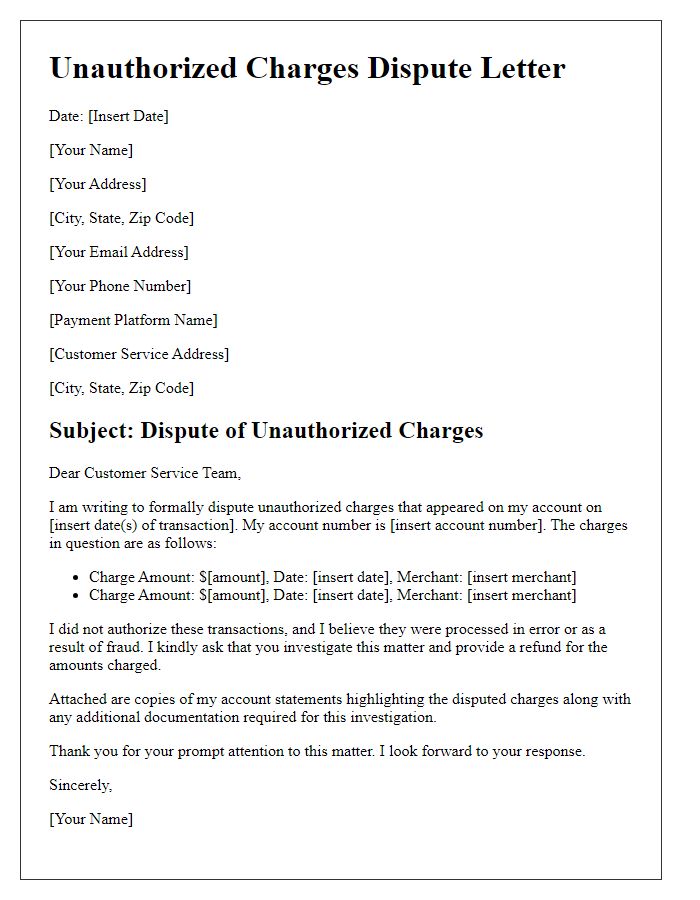

Letter template of unauthorized charges dispute for online payment platforms

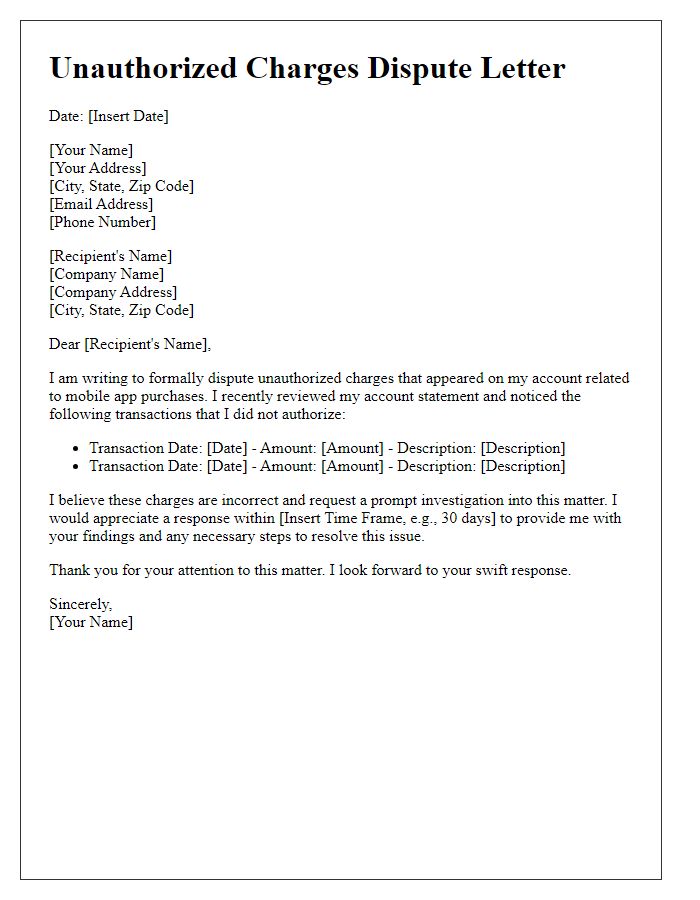

Letter template of unauthorized charges dispute for mobile app purchases

Comments