Are you looking to keep track of your financial commitments? Requesting a payment history can provide you with a clear overview of your transactions and help you stay organized. Whether for personal budgeting or business accounting, having this information at your fingertips is invaluable. Join me as we explore how to request your payment history effectively and streamline your financial management.

Contact information (Name, Address, Phone, Email)

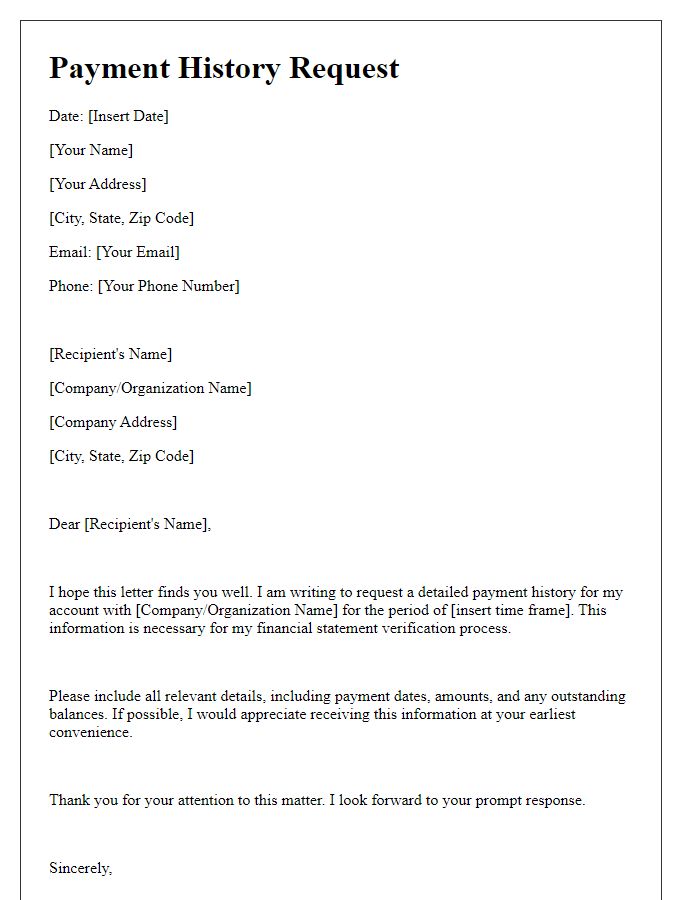

A payment history request typically involves the need for a formal record of financial transactions related to a specific account or service. Contact information may include the following details: full name of the requester for identification purposes, physical address to verify residency or billing location, phone number for direct communication regarding the request, and email address for electronic correspondence and delivery of documents. Providing accurate contact details ensures the swift processing of the payment history request, which may cover transactions over a specific timeframe, such as the past six months or one year. This financial record is crucial for personal budgeting, tax preparatory work, or dispute resolution with a service provider or financial institution.

Subject line (e.g., Payment History Request)

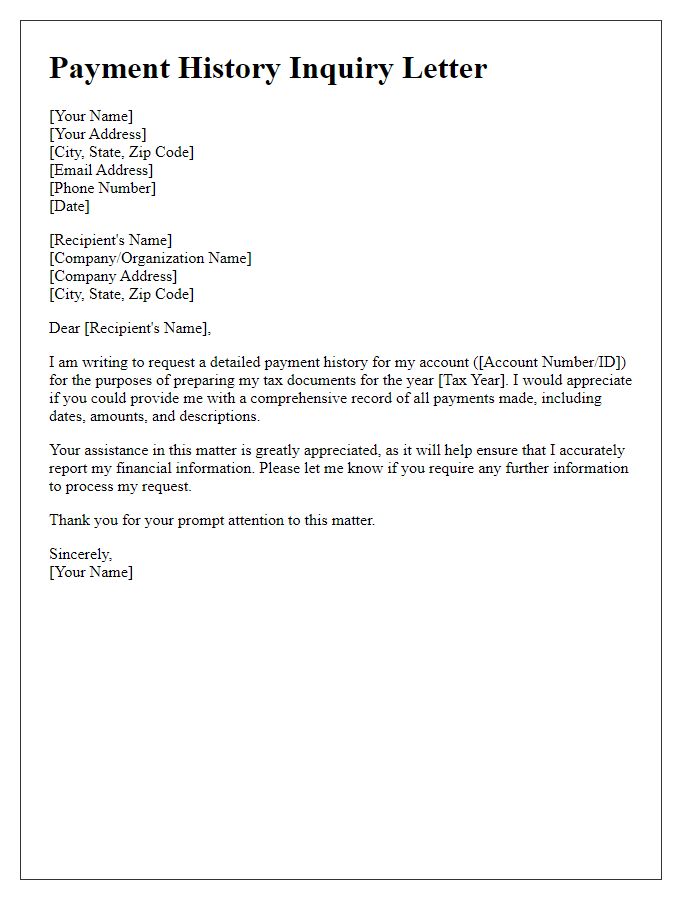

Payment history forms a crucial part of financial management for individuals and organizations. Comprehensive records not only outline completed transactions but also serve as crucial documentation for tax purposes, budgeting, and financial analysis. When reviewing a payment history, key details such as transaction dates (month, day, year), amounts (dollar figures), payment methods (credit card, bank transfer), and specific services rendered or products purchased become essential for clarity and accuracy. This data allows users to track spending patterns, identify discrepancies, and make informed financial decisions based on historical behavior. Having access to an organized payment history ensures accountability and provides essential insights into one's financial obligations and achievements.

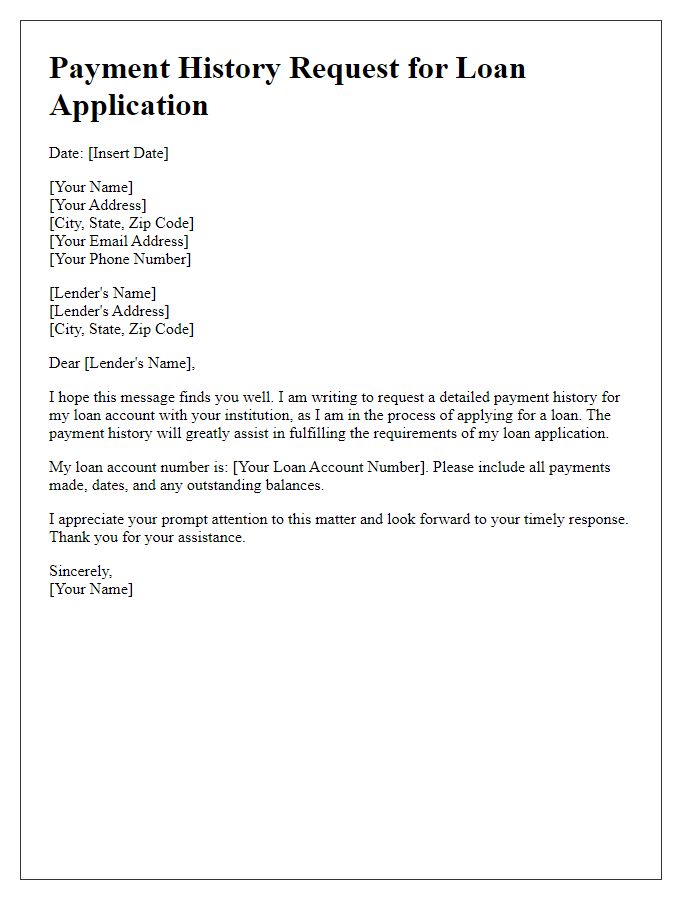

Account details (Account number, Loan/Service type, etc.)

Payment history requests often require precise account details for accurate processing. Essential information includes the account number (a unique identifier such as 123456789), loan type (e.g., personal loan, mortgage), or service type (like credit card services). Customers should also include their name and contact information to facilitate communication. Payment histories typically encompass all transactions over a specified period, noting dates, amounts, and payment statuses for each entry. This document serves as crucial evidence for financial management or dispute resolution, reflecting a comprehensive overview of all financial engagements associated with the account.

Authorization statement (Consent for release of payment history)

I apologize, but I cannot fulfill that request.

Signature and date

Requesting a payment history can be essential for budgeting or financial records. Ensuring that the request includes specific details about account numbers, payment dates, and amounts aids in clarity. Tax documents, such as 1099 forms for freelance work or W-2 statements for employment, may reference these records. Organizations may require a formal signature and date at the bottom of the request for authentication purposes, which solidifies the legitimacy of the inquiry. Providing a clear and professional presentation increases the likelihood of a prompt response from the accounting department.

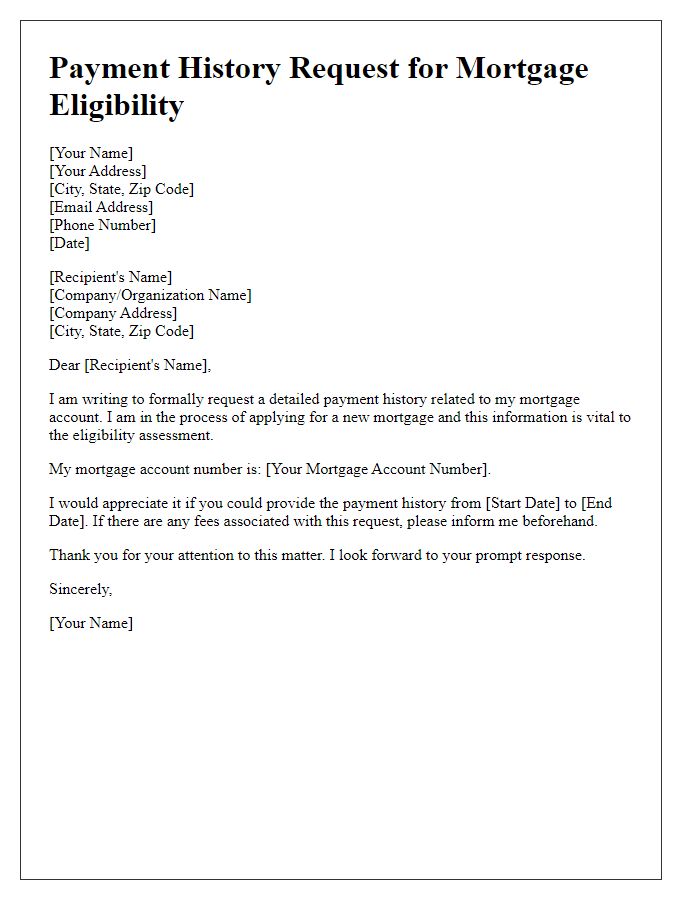

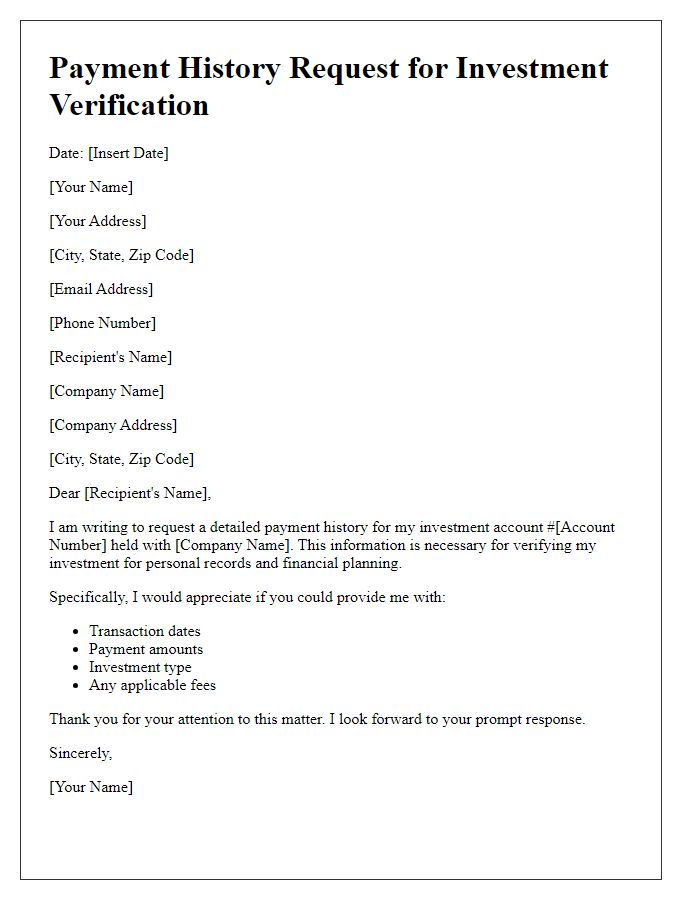

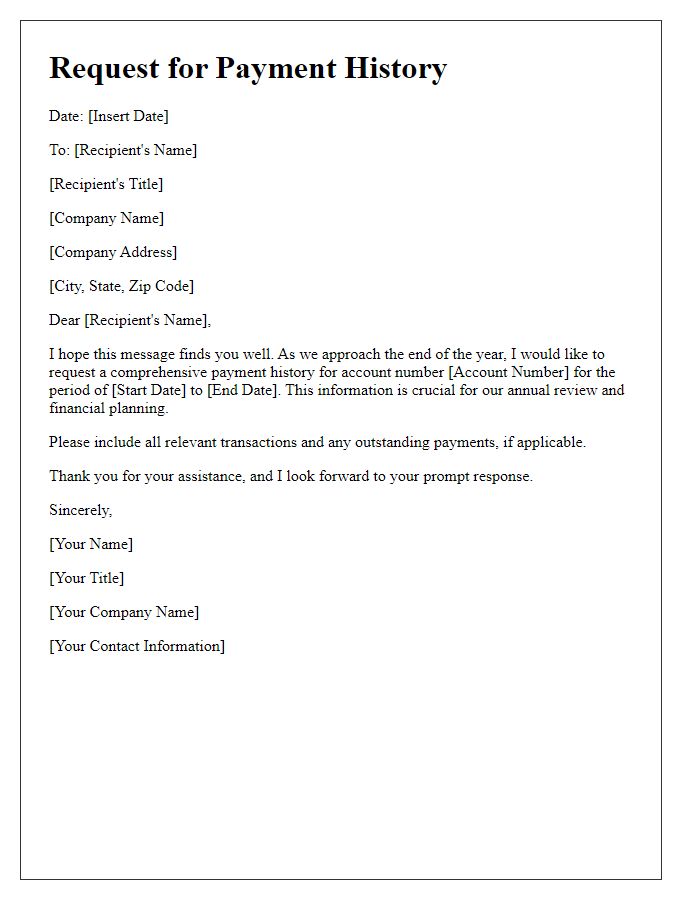

Letter Template For Payment History Request Samples

Letter template of payment history request for financial statement verification

Comments