Are you feeling a bit confused about your account status? You're not aloneâmany people find themselves in a similar situation. Whether it's about outstanding balances, recent transactions, or account benefits, understanding these details is essential for managing your finances effectively. Join me as we explore some helpful tips and resources that will clarify your account status and empower you to make informed decisions!

Clear Subject Line

Clear subject lines in email communication are essential for effective organization and immediate recognition of the email's purpose. For instance, "Account Status Clarification Request" directly conveys the intent of the email. This subject line allows recipients to promptly understand that the email pertains to seeking clarification regarding specific details about an account, such as balance, recent transactions, or account type. Moreover, using a straightforward subject line can lead to faster responses, as it eliminates ambiguity and enhances the likelihood of the email being prioritized in a busy inbox.

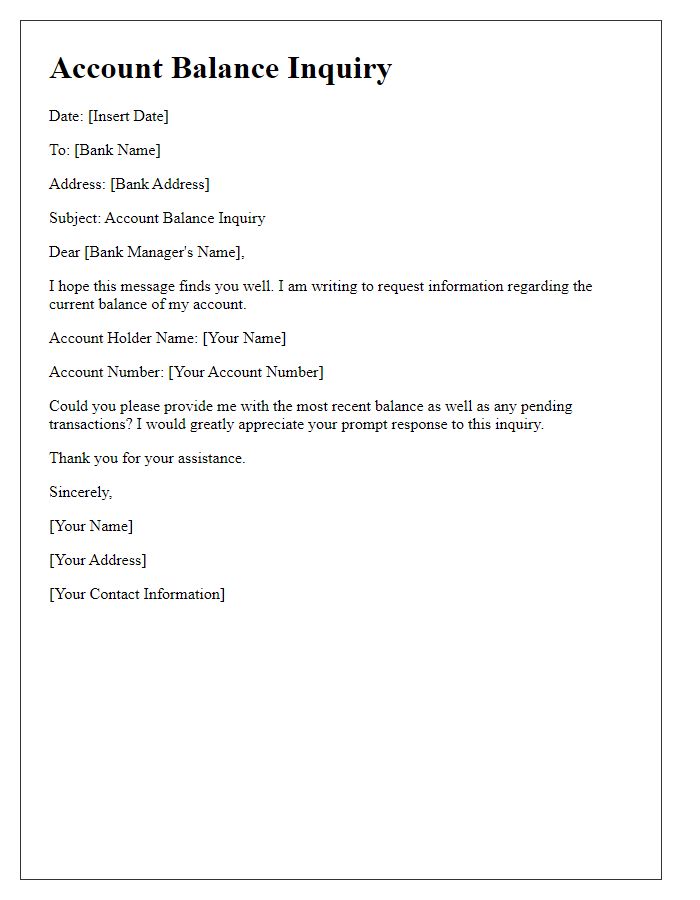

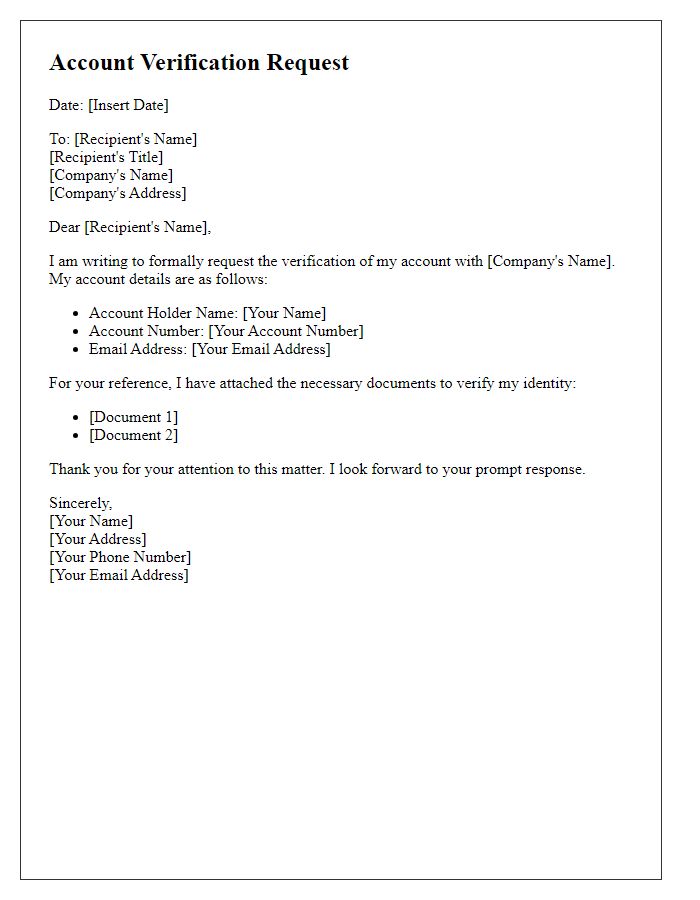

Recipient's Contact Information

The recipient's contact information is crucial for clear communication regarding account status clarification. Essential details include the recipient's full name, which ensures personalized and accurate communication. The address should include street number, street name, city, state, and zip code, allowing for official correspondence if needed. A valid email address enables quick digital communication, while a direct telephone number ensures immediate contact if further clarification is required. Including an account number, which uniquely identifies the recipient's account, is essential for streamlined processing and accurate information retrieval related to their account status.

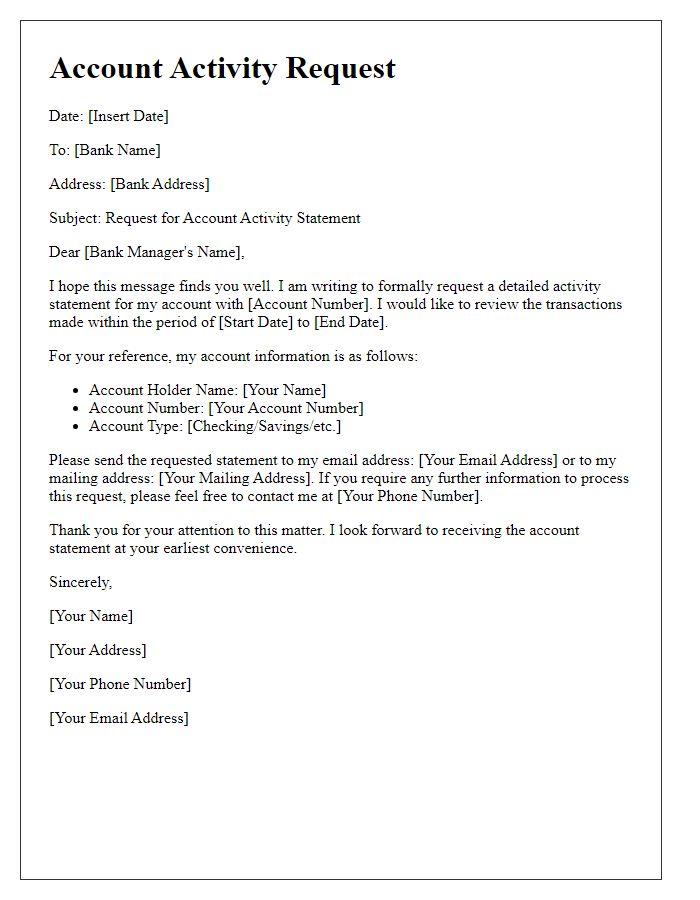

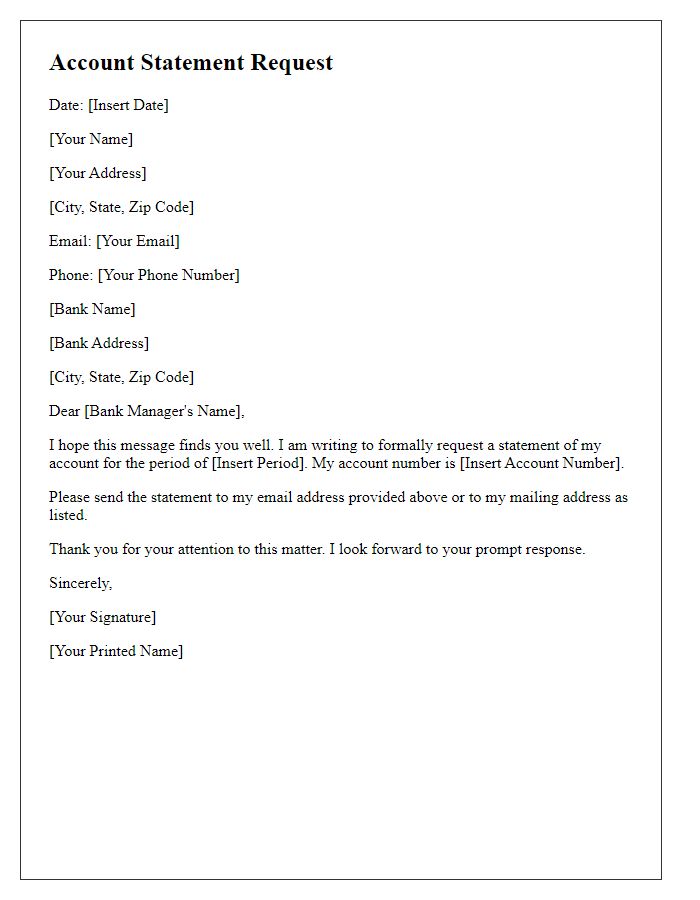

Account Details

In order to gain a clear understanding of your account status, it is essential to review specific account details, such as account number, account type, and recent transaction history. This information can shed light on any discrepancies or issues present in the account management process. Analyzing the balance, fees incurred (like monthly service charges), and services linked to the account (checking, savings, credit accounts) can provide insight. Accessing customer support resources can also help uncover any pending requests or alerts associated with the account, ensuring full transparency of its current condition.

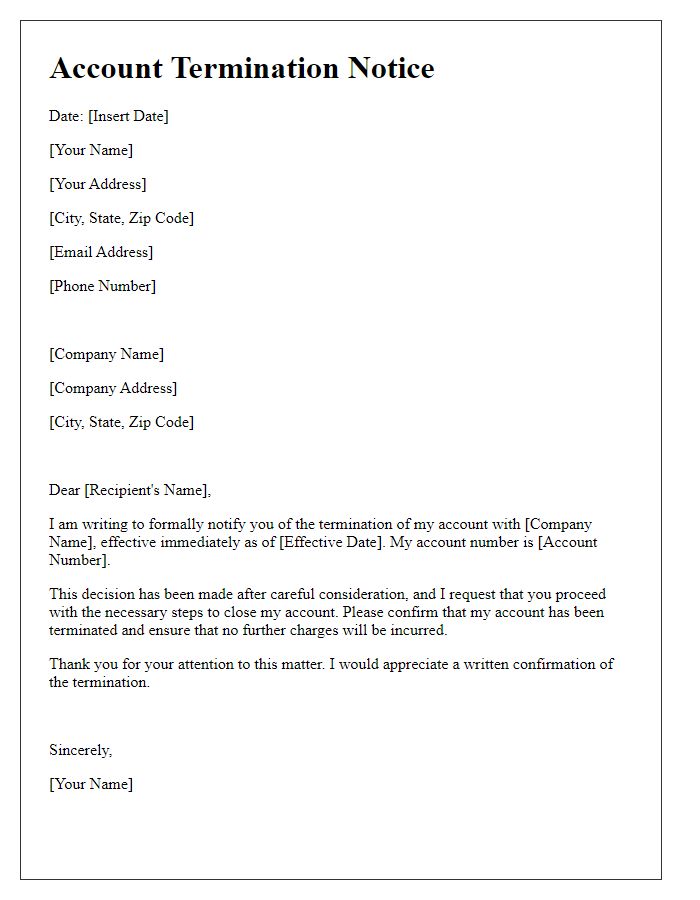

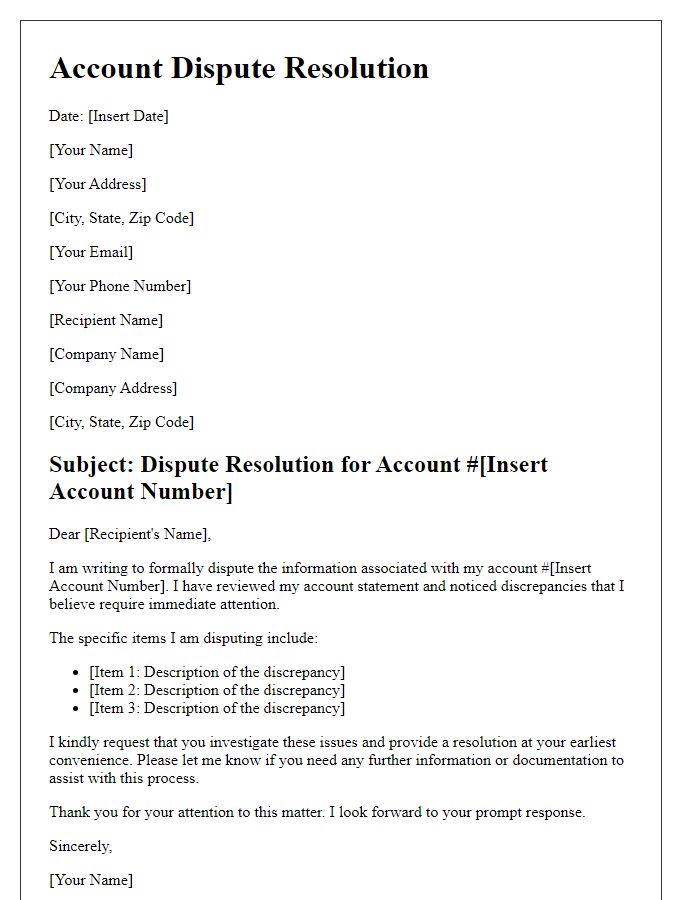

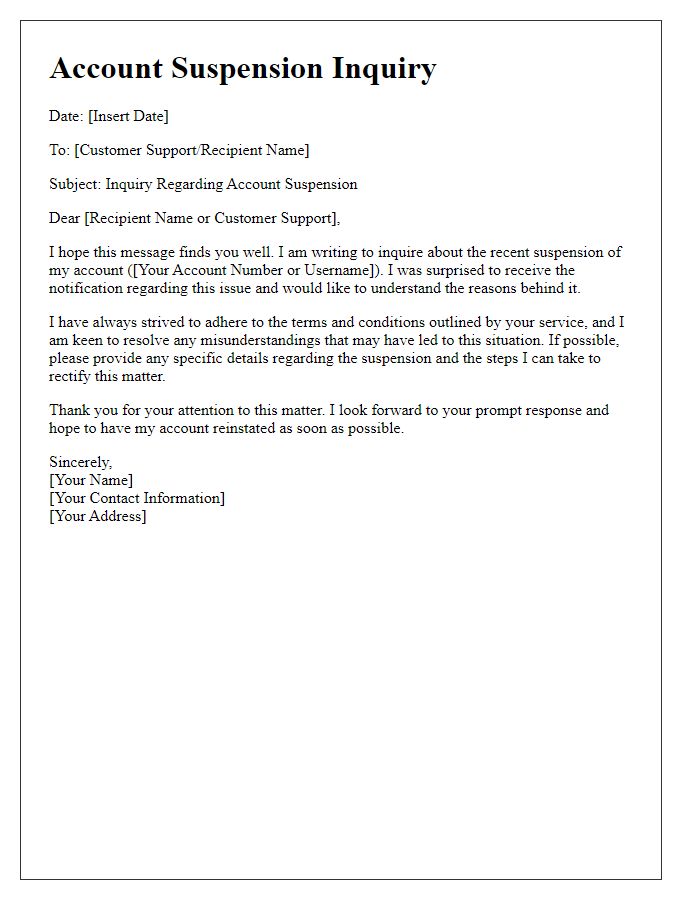

Specific Clarification Request

Account status clarification can provide essential insights for users navigating online platforms. Accurate account information ensures users, residing in diverse locations such as New York City or London, understand their subscription levels, payment history, and any pending issues. For instance, discrepancies in account balance might arise due to recent charges or promotional offers. Verification processes generally include checking transaction IDs or confirmation emails, important for maintaining transparency. Clarity on terms of service and user agreements is crucial, particularly for services with international users or data privacy regulations like GDPR. Engaging customer support representatives can further expedite resolution, enhancing user satisfaction and trust in the platform.

Contact Information for Further Assistance

Contacting customer service for account status clarification often involves providing specific details to expedite the process. Utilize phone numbers such as 1-800-555-0199 for immediate assistance during business hours, typically 9 AM to 5 PM Eastern Time, from Monday to Friday. Alternatively, many companies offer email support at support@companyname.com, allowing for documented inquiries that can be referenced later. For real-time help, live chat options may also be available on the company's website, ensuring quick access to representatives trained to handle account questions. Always include personal information such as account number, name, and specific queries to facilitate accurate responses.

Comments