Have you ever found yourself in a situation where you accidentally made a duplicate payment? It can be frustrating and confusing, but the good news is that getting a refund doesn't have to be complicated. In this article, we'll guide you through the steps to write a clear and effective letter requesting your duplicate payment refund. So, if you want to learn how to reclaim your money with ease, keep reading!

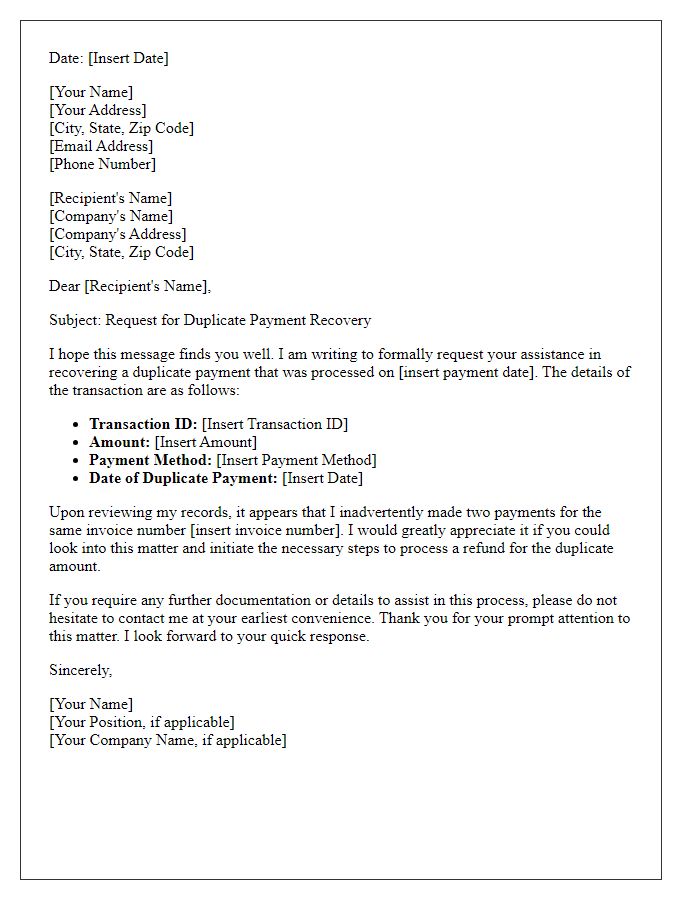

Contact information of both parties

A duplicate payment refund often occurs during financial transactions, impacting various parties involved, such as individual consumers or businesses. Accurate contact information is essential for effective communication in refund cases. The payee, whom the refund is issued to, may need to provide their full name, address (including city, state, and zip code), email address for digital correspondence, and phone number for immediate inquiries. The payer, who initially processed the duplicate payment, should include similar details. Additionally, transaction specifics, such as date of payment, amount, and payment method (credit card, bank transfer, etc.), must be cited to ensure clarity and expedite the refund process. Proper documentation helps to verify the occurrence of the duplicate payment and facilitates smoother resolutions through channels such as customer service departments or financial institutions.

Payment details (amount, date, reference)

A duplicate payment can lead to financial discrepancies, often requiring prompt resolution through the refund process. For instance, a customer may identify an overpayment of $150 made on September 15, 2023, referenced by transaction ID #ABC12345. Such duplicate payments can occur due to errors during online transactions where payment authorization is mistakenly repeated. Organizations typically have a structured refund process to address these situations, often necessitating the submission of specific details including the original payment amount, date of transaction, and any associated reference numbers to expedite processing and ensure accurate reimbursement to the customer's account.

Clear subject line indicating refund request

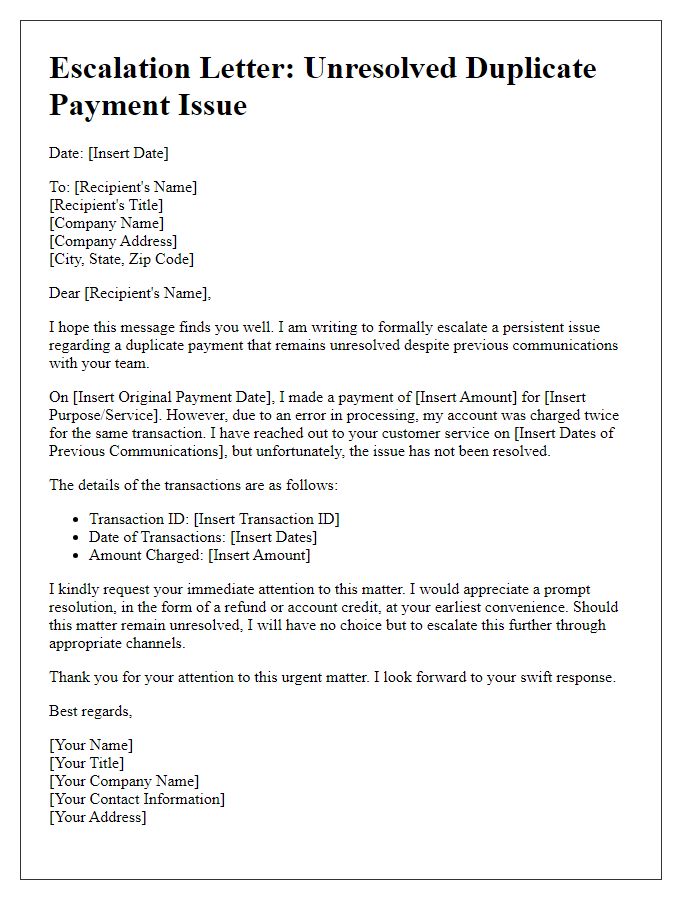

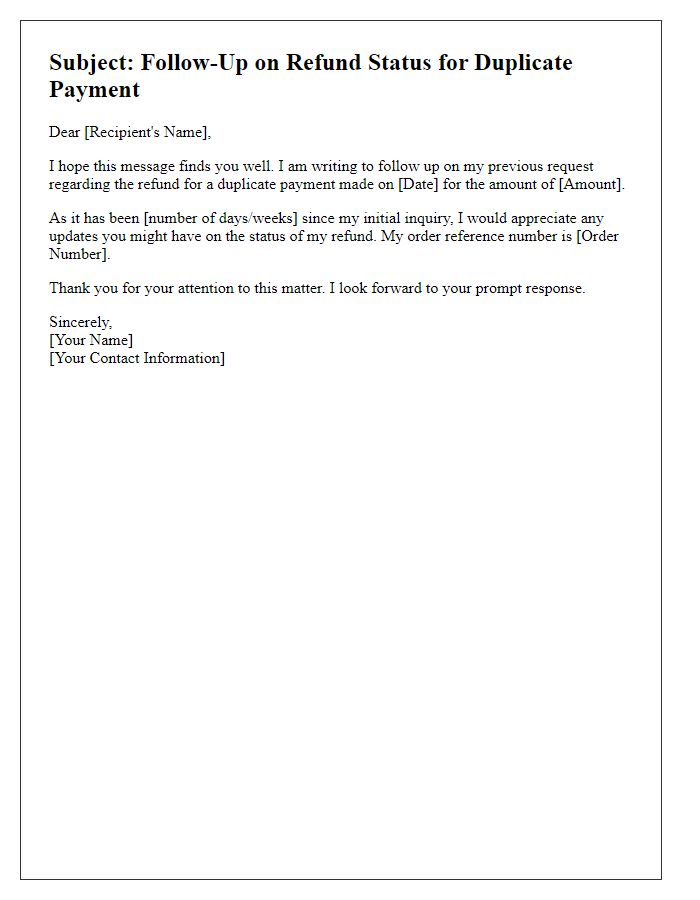

A duplicate payment situation arises when a customer unintentionally processes the same transaction multiple times, often resulting in the need for a refund. For instance, a customer may use payment platforms like PayPal or credit card services, inadvertently clicking the "submit" button twice. This issue commonly occurs with online purchases, leading to two identical charges made to accounts like personal checking accounts or credit card statements. Timely communication is vital; customers should contact the merchant promptly, providing transaction details such as transaction IDs, dates, and amounts to expedite the refund process. Proper documentation, including email correspondence and proof of purchase, aids in resolving the matter efficiently, minimizing delays or misunderstandings.

Polite request for refund

Duplicate payments can create financial strain on individuals and businesses. Customers encountering such issues often reach out directly to the payment service provider or vendor. In this context, a polite request for a refund delineates details: the payment amount, transaction date, and reference number. Maintaining a respectful tone is crucial; it fosters constructive communication. Clear identification of the original transaction alongside supporting documentation, such as bank statements or receipts, enhances the request's credibility. Following established procedures, including the appropriate department contact, helps expedite resolution. Prompt action taken by customer service can alleviate concerns, restoring trust in the payment process.

Supporting documents or receipt copies

Duplicate payments can occur in various financial transactions, leading to unnecessary financial strain. To initiate a refund process, gather supporting documents, such as receipts or transaction statements, clearly indicating the duplicate charge. These documents should include dates of transactions, amounts charged, and payment methods used, such as credit cards or bank transfers. When submitting for refund consideration, note specific payment identifiers like invoice numbers and customer account details for swift processing. Ensure to follow up with the respective financial institution or merchant within a specific timeframe, typically 30 days from the transaction date, to adhere to their refund policy.

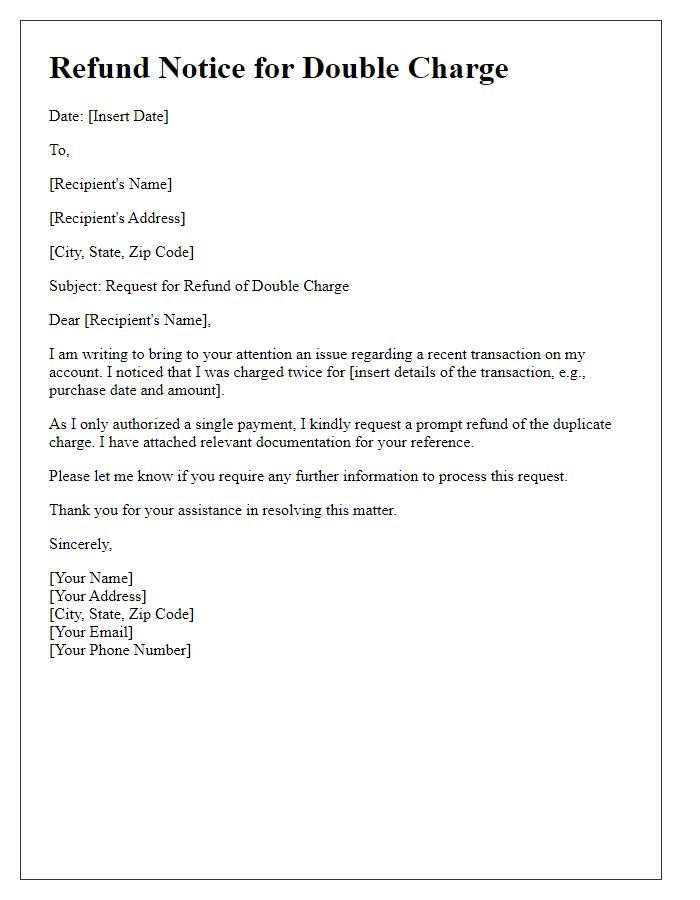

Letter Template For Duplicate Payment Refund Samples

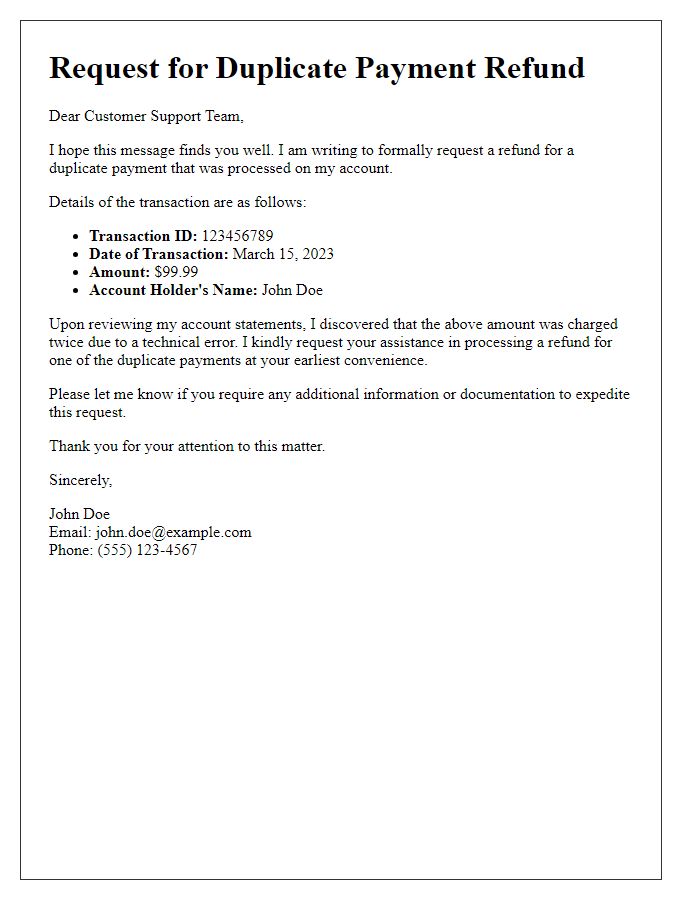

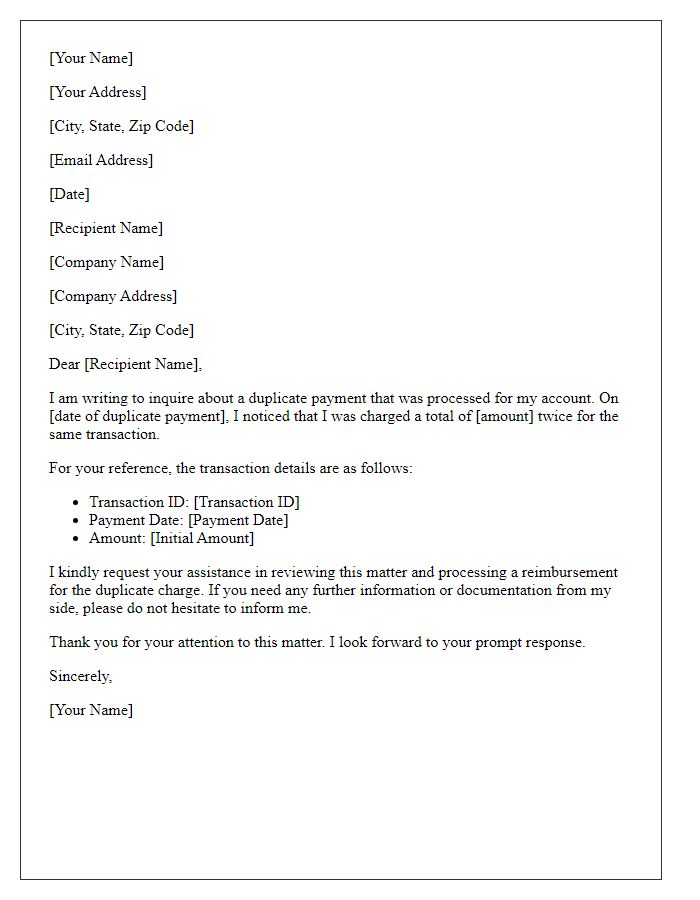

Letter template of request for duplicate payment refund to customer support.

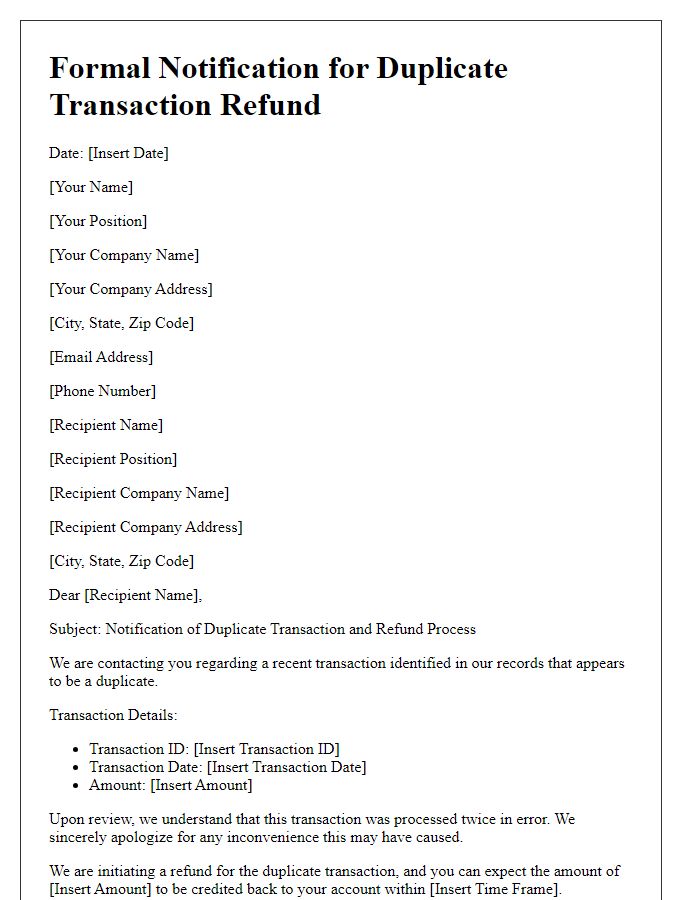

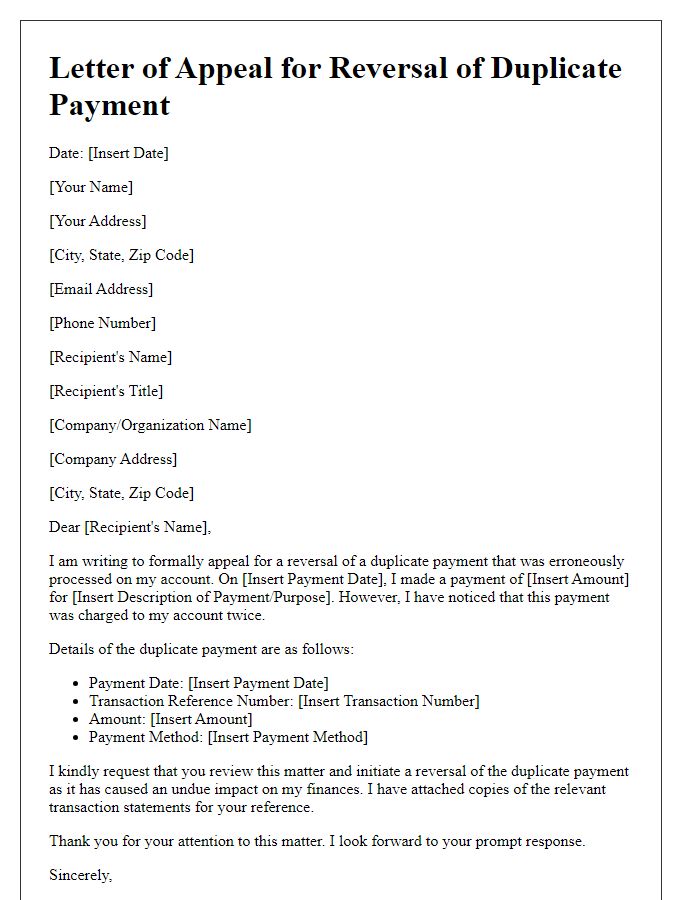

Letter template of formal notification for duplicate transaction refund.

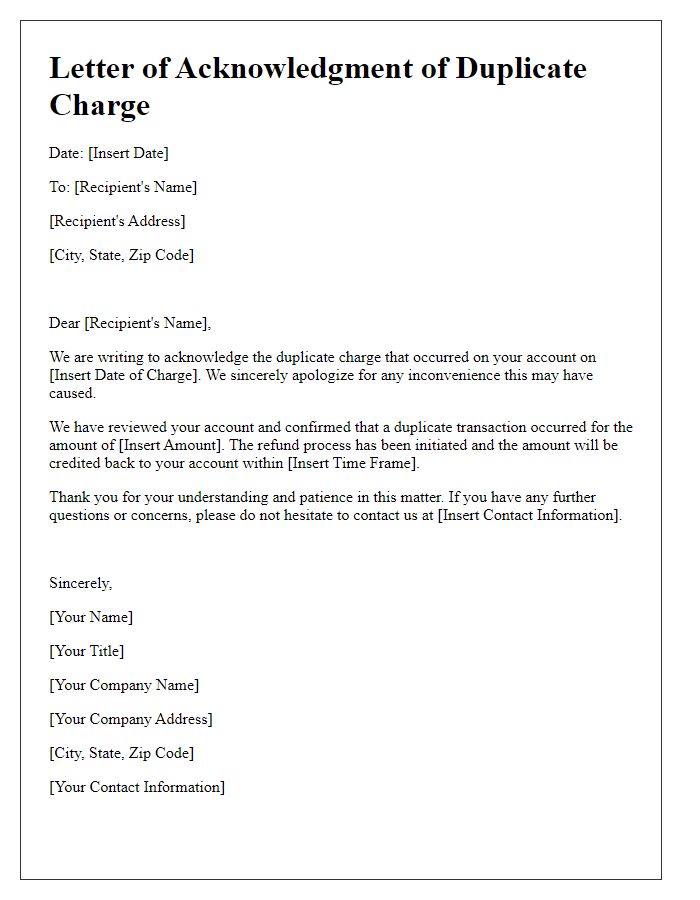

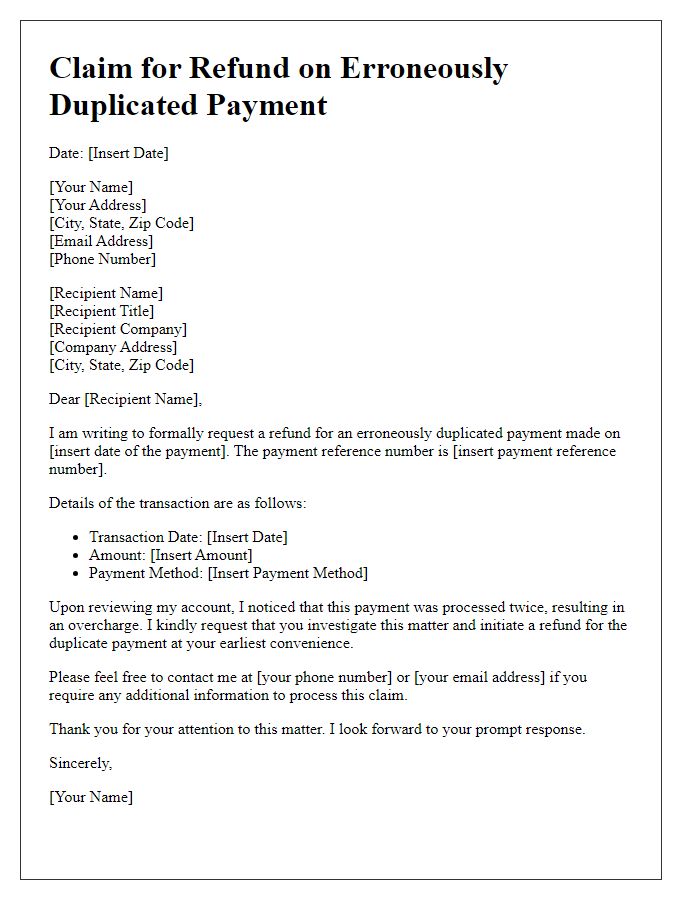

Letter template of acknowledgment of duplicate charge and refund action.

Comments