Are you navigating the responsibilities of being an executor of an estate? It can feel overwhelming, but understanding your role and the steps you need to take is crucial for honoring the deceased while supporting the beneficiaries. From managing assets to settling debts, each task holds significance in ensuring a smooth process during a challenging time. If you're seeking clear guidance and helpful tips on how to fulfill your duties effectively, keep reading to discover more!

Clear identification of all parties involved.

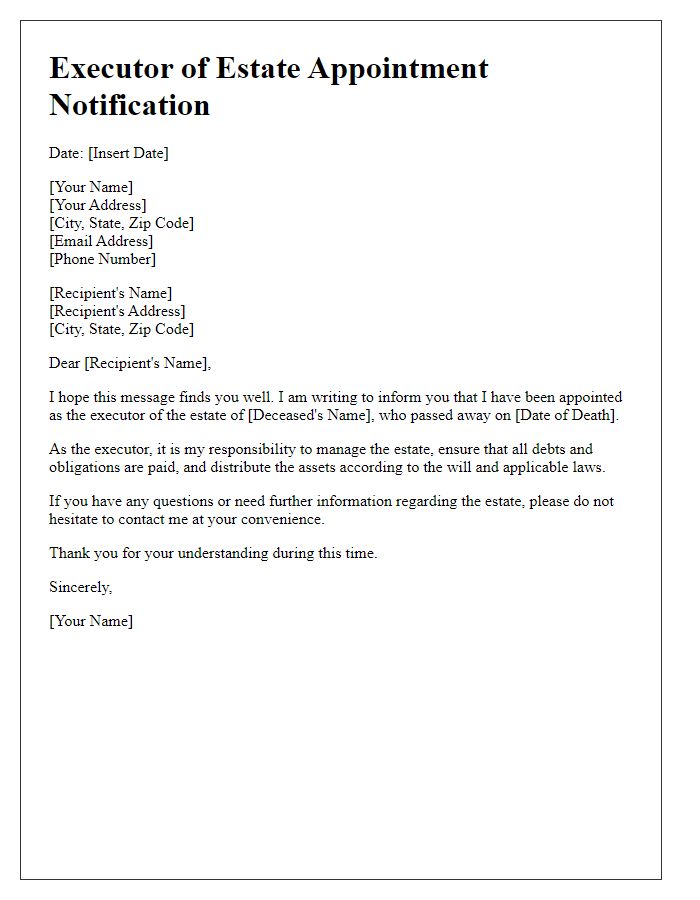

The executor of the estate notification must clearly identify all pertinent parties to ensure clarity and legal compliance. The executor, often a trusted individual or a legal professional appointed in the will, should be named prominently at the beginning of the document. The decedent (the deceased person whose estate is being managed), which includes full name, date of birth, and date of death, should follow for clear identification. Beneficiaries, who are individuals or organizations entitled to receive assets from the estate, must be listed with their full names and contact information to facilitate communication. Creditors and any relevant financial institutions with claims against the estate, such as banks or loan companies, should also be included along with account numbers if applicable. Finally, any legal representatives involved, such as an attorney specializing in estate law, should be acknowledged to provide a comprehensive understanding of the estate's management and ensure all parties are informed of their rights and responsibilities during the probate process.

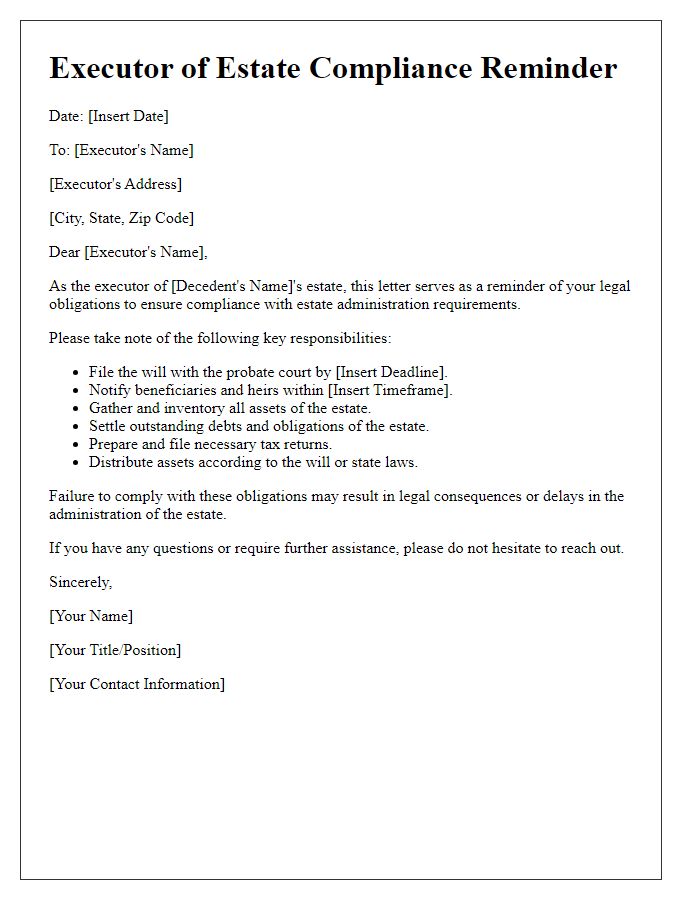

Formal tone and legal compliance.

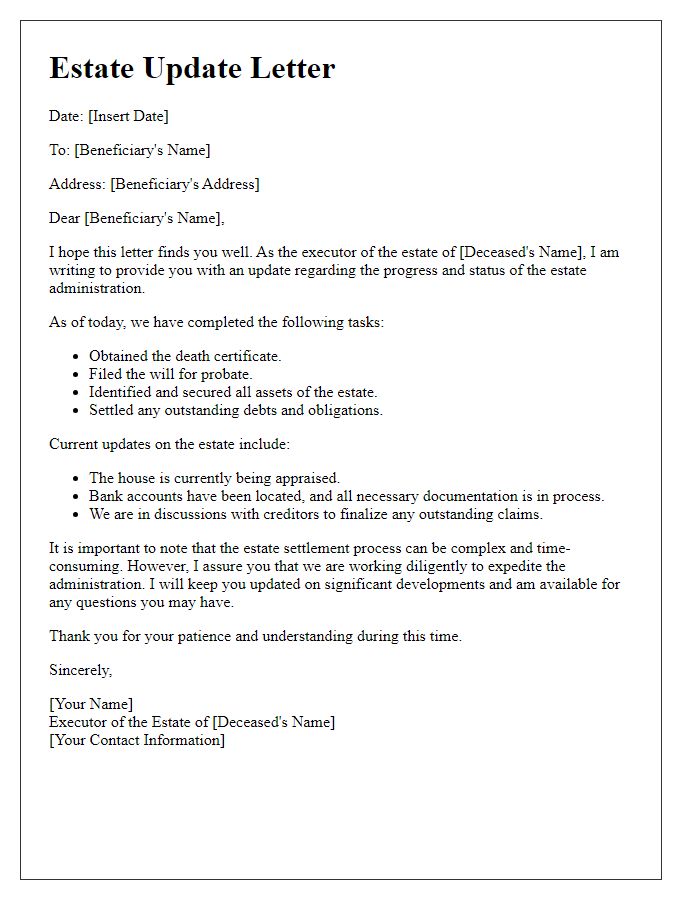

The executor of an estate is responsible for managing the estate of a deceased individual, ensuring that debts are paid, and assets are distributed according to the will's provisions. Notification processes often include informing beneficiaries of their rights and entitlements. Accurate identification of beneficiaries along with their contact details and the decedent's details--including full name, death date, and estate file number--is essential. Proper communication should adhere to local estate laws, which may specify timelines and required documentation. Executors must also prepare to address any questions surrounding the will's contents, burial wishes, or asset valuations to maintain transparency and trust throughout the administration process.

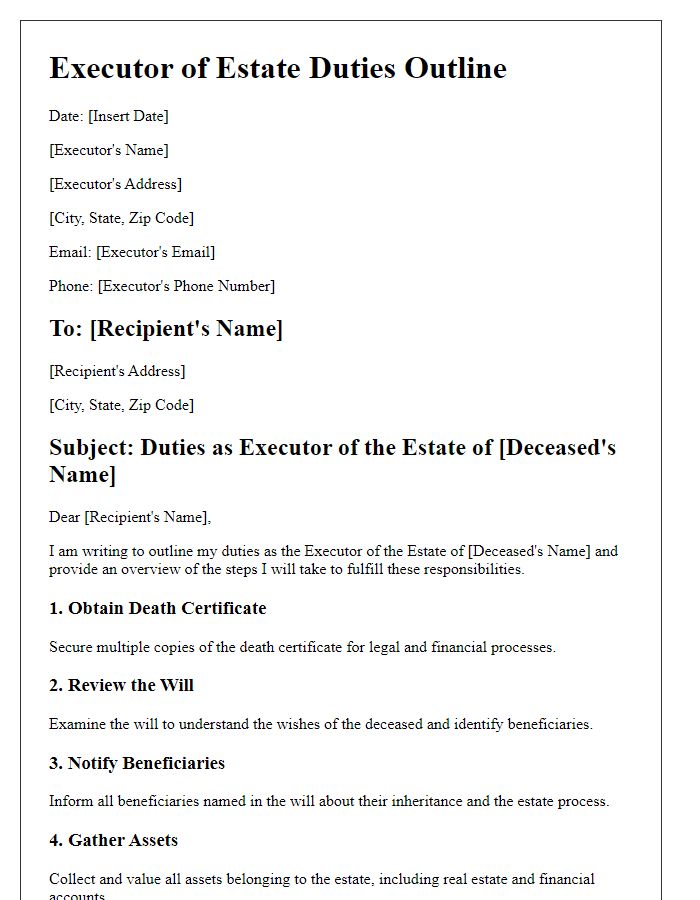

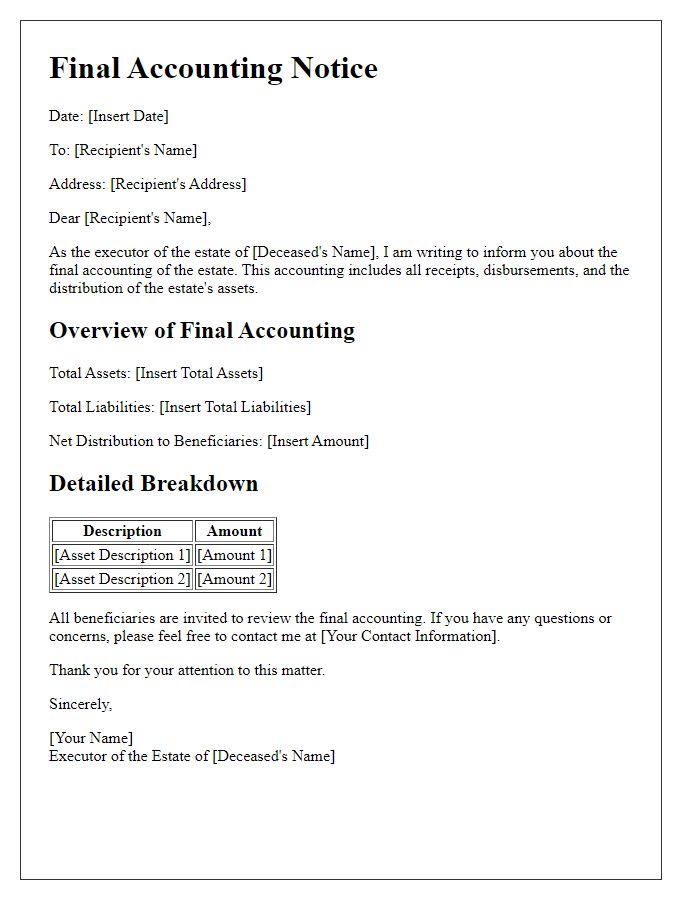

Detailed list of estate assets and liabilities.

The executor of an estate plays a crucial role in managing and overseeing the distribution of a deceased individual's assets and liabilities. A detailed list should include identified estate assets such as real estate properties located in various regions with corresponding market values, financial accounts held at institutions like Wells Fargo or Chase Bank summarizing account balances, and tangible assets including vehicles, art collections, jewelry, and other valuables specifying their estimated worth. It should also encompass liabilities, which might involve outstanding debts like mortgages, credit card balances, and personal loans detailing the amounts owed to creditors, as well as any estate taxes that may need to be settled following applicable regulations within the jurisdiction. Proper documentation and careful accounting are essential to accurately communicate the estate's financial standing to beneficiaries and ensure compliance with legal requirements throughout the distribution process.

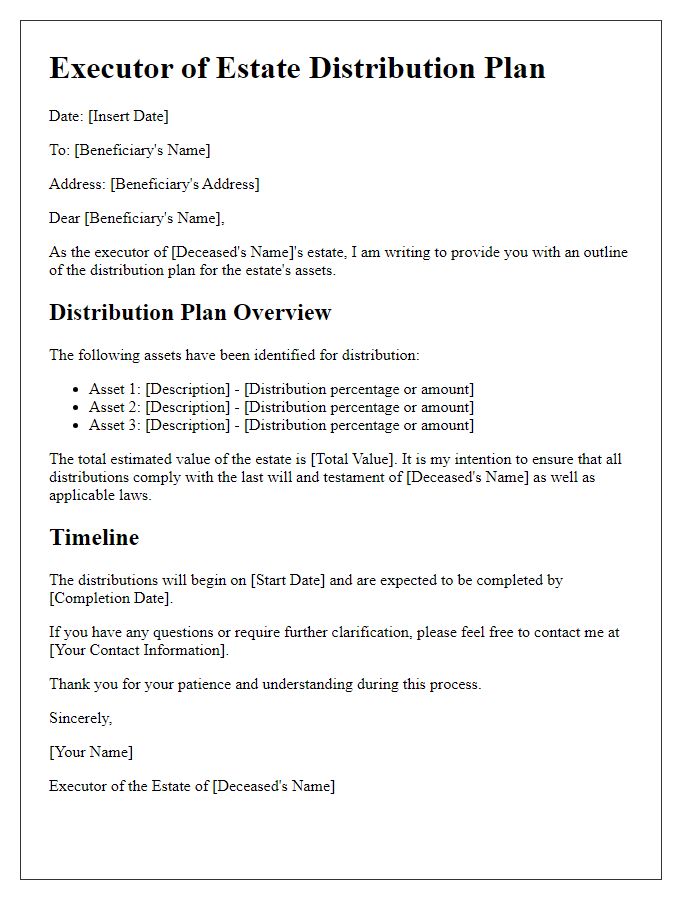

Instructions for beneficiaries and interested parties.

The responsibilities of an executor of an estate, such as overseeing the distribution of assets from a deceased person's estate according to the will, require clear communication with beneficiaries and interested parties. Important details must be conveyed, such as the timeline for asset distribution, legal obligations under state probate law (which can vary by jurisdiction), and the necessity for beneficiaries to provide updated contact information (for notifications and distribution), which ensures all involved parties remain informed. Additionally, any potential debts or liabilities of the estate must be disclosed to manage beneficiary expectations realistically. For instance, specific deadlines for claims against the estate may apply, usually dictated by local laws, requiring attention and action from beneficiaries promptly. Furthermore, the executor must remind beneficiaries to maintain realistic expectations regarding the timing of distributions, as the probate process can span several months, typically ranging from six to twelve months in many states.

Contact information for further inquiries or clarifications.

The executor of an estate, appointed by the last will and testament, plays a critical role in managing the deceased's affairs. For inquiries or clarifications regarding the estate, beneficiaries and interested parties can reach the executor directly through the designated contact methods. This information may include a telephone number (area code), an email address, or a physical mailing address where official correspondence can be directed. Clear communication is essential during this period as it helps streamline the administration process and resolves any uncertainties related to inheritances, asset distributions, or legal obligations involved in settling the estate.

Comments