Are you feeling the pinch of rising interest rates? You're not alone! Many individuals and businesses find themselves seeking ways to negotiate better terms and alleviate financial stress. In this article, we'll explore effective strategies for negotiating interest rates that might just save you some money â so, let's dive in!

Current market interest rates

Current market interest rates play a significant role in financial agreements, influencing borrowing costs for consumers and businesses alike. As of October 2023, average mortgage rates hover around 7.5% for a 30-year fixed-rate mortgage, while personal loan rates range from 10% to 25%, depending on creditworthiness. Financial institutions, including JPMorgan Chase and Bank of America, adjust their rates based on the Federal Reserve's decisions, which aim to control inflation currently at 3.7%. Borrowers seeking favorable terms should consider prevailing rates in relation to their credit scores, as individuals with scores above 740 typically receive better offers, creating leverage during negotiation with lenders.

Loan terms and conditions

Loan agreements often involve detailed negotiations regarding interest rates, which directly influence borrowing costs. For instance, a common mortgage interest rate could fluctuate between 3% and 5%, depending on market conditions and borrower creditworthiness. Lenders, such as banks like JPMorgan Chase or Bank of America, may impose specific terms and conditions, including monthly payment schedules, loan origination fees, or prepayment penalties, impacting overall financial obligations. Economic factors, such as the Federal Reserve's interest rate changes, can also play a significant role in these negotiations, affecting individual loan terms considerably. Establishing clear communication with lenders regarding expectations can lead to more favorable conditions for borrowers.

Credit score and financial history

A well-documented credit score, often reflected as a three-digit number between 300 and 850, plays a crucial role in determining interest rates for loans, particularly in the context of mortgage applications and personal loans. Financial history, including payment patterns, outstanding debts, and any previous defaults, can significantly influence lender perceptions in negotiations. High credit scores typically indicate a responsible borrowing behavior, potentially leading to lower interest rates, while a history of missed payments or high credit utilization ratios can result in unfavorable rates. An understanding of these factors can aid borrowers in successfully negotiating more favorable terms with financial institutions, enhancing their overall borrowing experience.

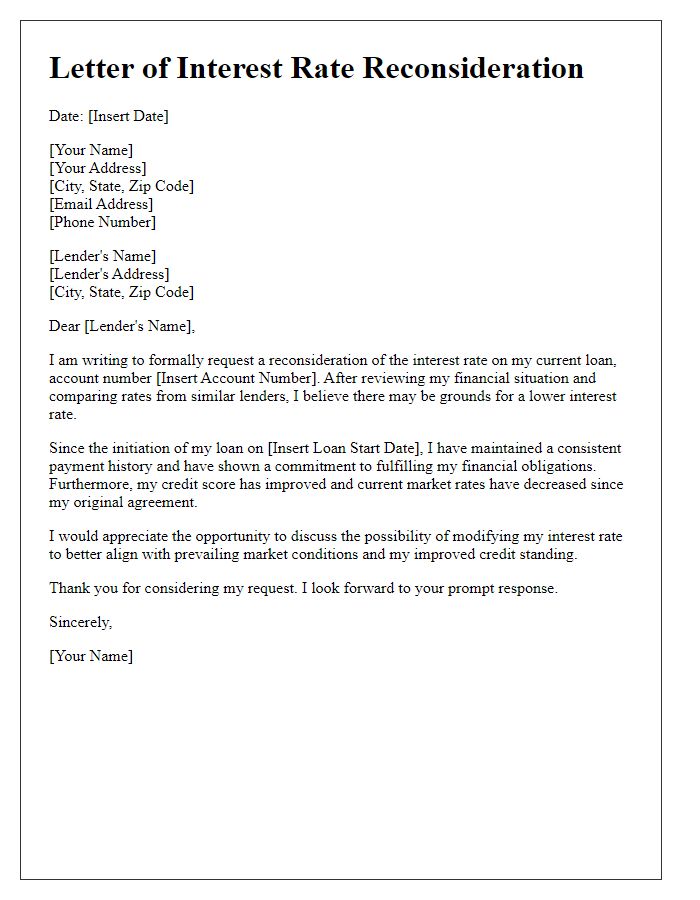

Negotiation objectives and goals

Negotiating interest rates aims to reduce borrowing costs for individuals and businesses, enhancing financial flexibility. Target interest rates (typically below market averages, such as 3% for home loans) can lead to significant savings over time. Key goals involve securing lower rates, reducing fees, and optimizing loan terms (e.g., extending repayment periods). Establishing a compelling financial profile (including credit scores above 700) is crucial for negotiation success. Engaging multiple lenders can create competitive pressure to offer better rates or terms, fostering advantageous agreements. Ultimately, achieving favorable interest rates can contribute to long-term financial stability and improved cash flow management.

Competitor offers and comparisons

Negotiating interest rates can significantly impact financial decisions on loans or mortgages. For example, banks such as Citibank and Bank of America may provide competitive rates, often starting as low as 3.5% APR (Annual Percentage Rate) for qualified borrowers. In contrast, credit unions like Navy Federal may offer even lower rates, sometimes dropping to around 2.99% for specific loan types. Comparative analysis of these offers is essential; a 0.5% difference in interest over a 30-year mortgage of $300,000 can lead to savings exceeding $50,000 in interest payments. Thus, understanding these variations enables consumers to make informed choices while negotiating terms with lenders. Additionally, the Federal Reserve's recent adjustments in interest rates can influence these offers, making timely assessments critical.

Comments