Are you prepared for life's unexpected surprises? Whether it's a sudden medical expense, car repair, or job loss, having an emergency fund can provide the peace of mind you need during tough times. Allocating funds specifically for emergencies isn't just smartâit's essential for financial stability. So, let's dive deeper into how you can create an effective emergency fund and why it matters.

Purpose of Fund Allocation

Emergency fund allocation serves as a financial safety net, providing immediate resources during unforeseen events like natural disasters, medical emergencies, or sudden unemployment. A typical emergency fund should amount to three to six months' worth of living expenses to ensure stability. Allocation amounts can also vary based on individual needs, such as housing costs (averaging $1,500 monthly in urban areas), healthcare expenses (potentially reaching thousands for unexpected medical bills), and essential utilities (including electricity, water, and gas). Timely access to these funds allows individuals to navigate crises without accruing debt or sacrificing long-term financial goals. Proper fund management can include setting up a dedicated high-yield savings account for better growth while maintaining liquidity.

Recipient and Beneficiary Details

Emergency fund allocation is critical for immediate financial relief in crisis situations. Recipients may include individuals, families, or organizations facing unexpected expenses such as medical emergencies, natural disasters, or job loss. Beneficiaries, often identified through community programs or local charities, can vary from distressed households in economically disadvantaged areas (such as neighborhoods in Detroit, Michigan, or rural towns in Mississippi) to healthcare facilities like hospitals experiencing a surge of patients due to a public health crisis. Allocating emergency funds efficiently ensures aid reaches those most in need, allowing for timely support in critical moments.

Amount and Budget Breakdown

Emergency fund allocation requires careful planning to ensure resources are utilized effectively. An allocation amount of $50,000 should cover immediate needs. Budget breakdown includes $20,000 for medical emergencies, addressing unforeseen healthcare expenses; $15,000 for home repairs, ensuring necessary maintenance and safety; and $5,000 earmarked for transportation issues, providing funds for vehicle repairs or replacements. Additionally, $10,000 would serve as a buffer for unexpected circumstances, such as job loss or urgent travel needs. This systematic approach ensures preparedness for a range of emergencies while maintaining financial stability during challenging times.

Urgency and Justification

Emergency fund allocation is essential in unexpected situations, such as natural disasters or economic crises. During events like hurricanes (Category 5, with wind speeds over 157 mph), immediate financial support helps cover unexpected expenses like temporary shelter, food, and healthcare. In financial downturns, allocating funds swiftly can stabilize local economies and prevent business closures (which can reach over 30% in severe recessions). This funding ensures that affected communities recover efficiently, fosters resilience, and safeguards vital resources. The rapid deployment of emergency funds also enhances public trust in financial institutions and government agencies, reinforcing their commitment to community well-being.

Approval and Signature Requirements

Emergency fund allocation requires a thorough understanding of approval and signature protocols, crucial for effective financial management. Emergency funds, typically reserved for unforeseen circumstances, can exceed amounts ranging from $1,000 to $100,000 depending on budgetary constraints. Required approvals often include signatures from department heads and finance officers, with specific thresholds necessitating additional oversight from senior management in organizations like nonprofit institutions. Proper documentation must accompany requests, detailing the urgency of the situation, intended use of funds, and anticipated outcomes. Adhering to established guidelines ensures transparency and trust among stakeholders, particularly during crises such as natural disasters or economic downturns. Regular audits of fund usage reinforce accountability and promote best practices within the financial framework.

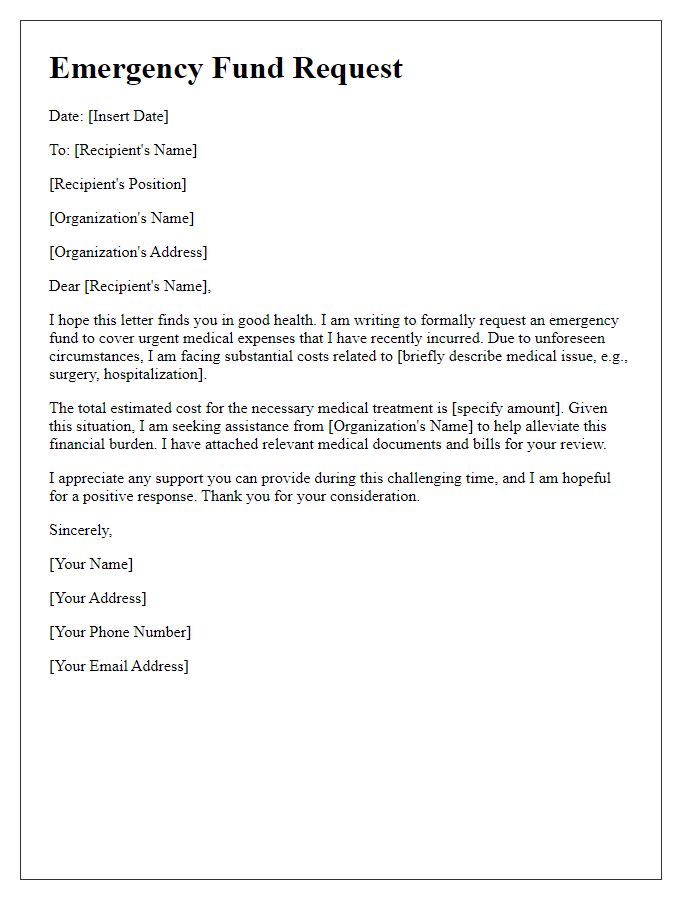

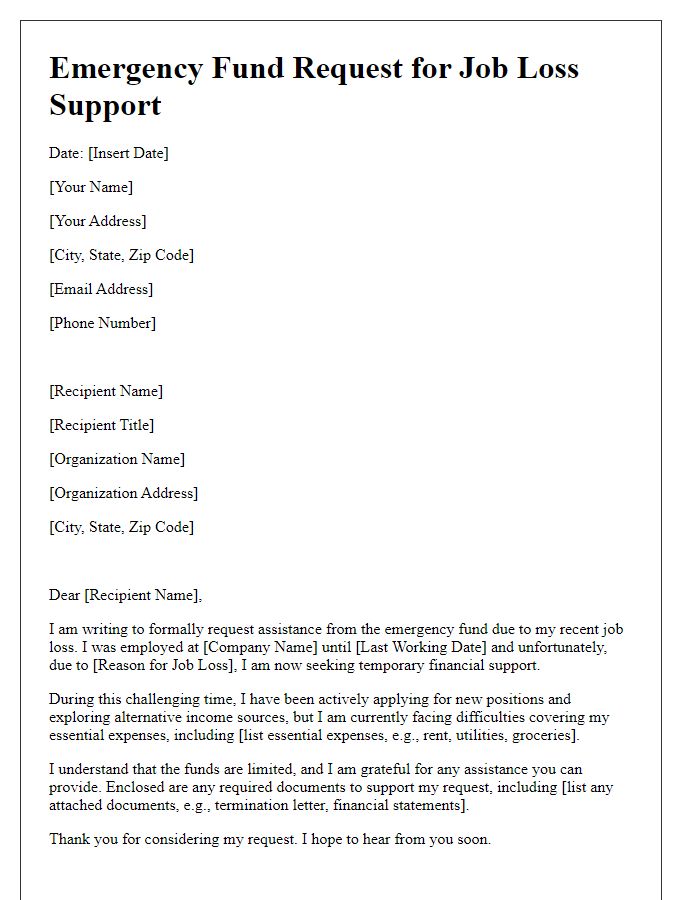

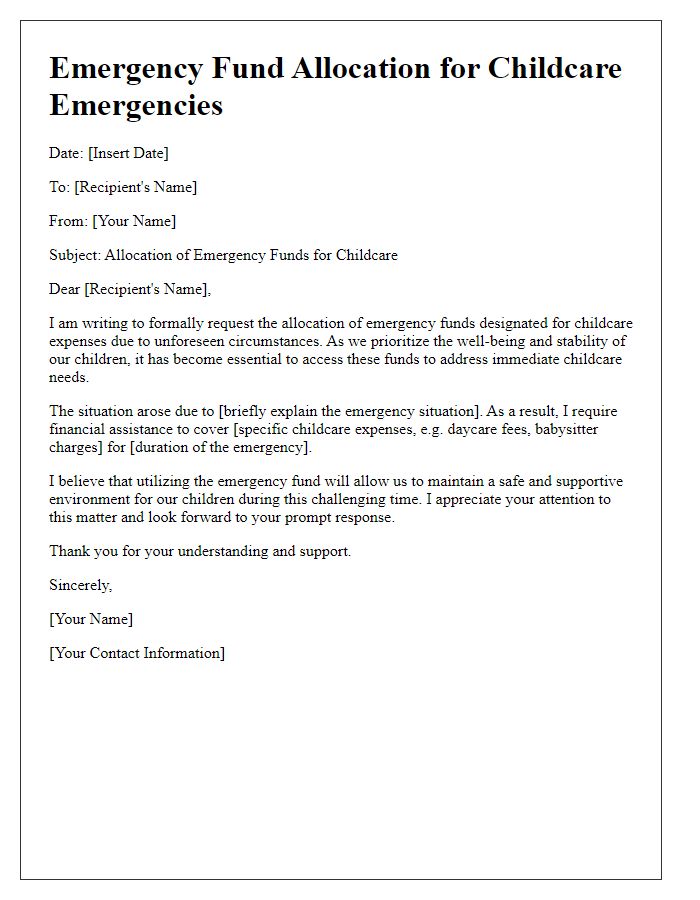

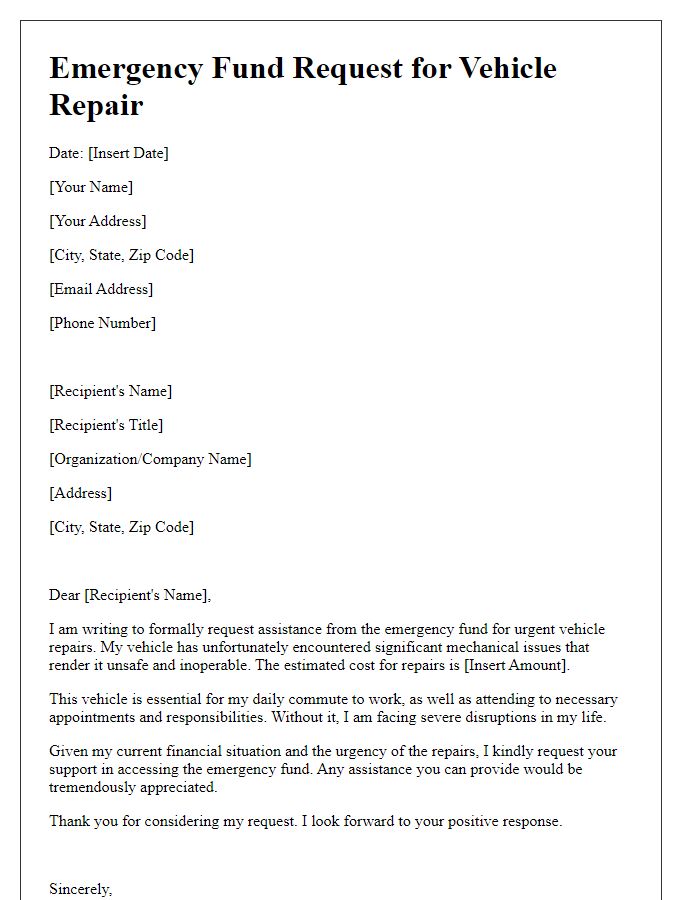

Letter Template For Emergency Fund Allocation Samples

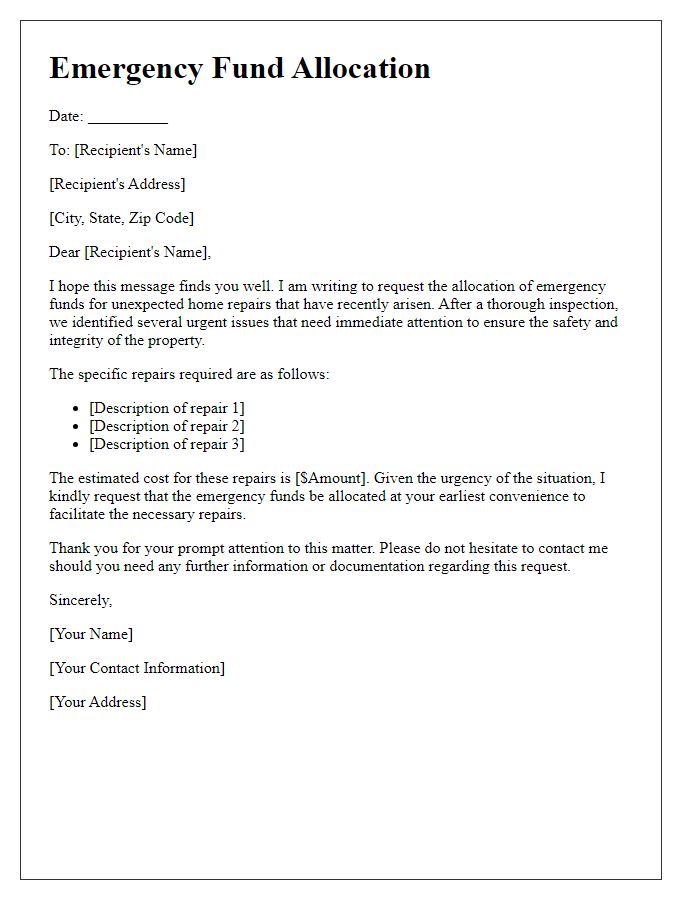

Letter template of emergency fund allocation for unexpected home repairs

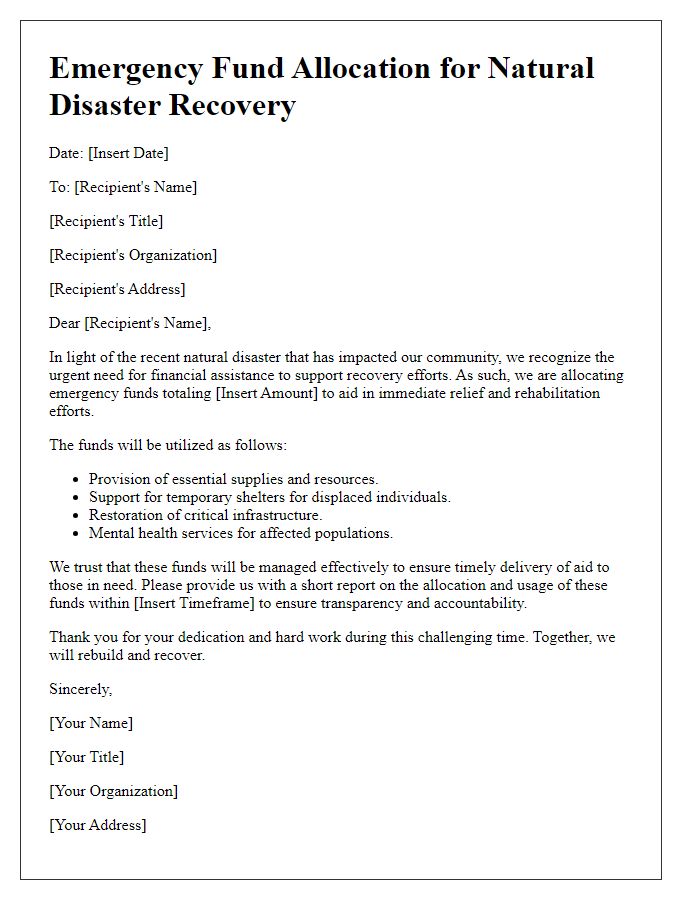

Letter template of emergency fund allocation for natural disaster recovery

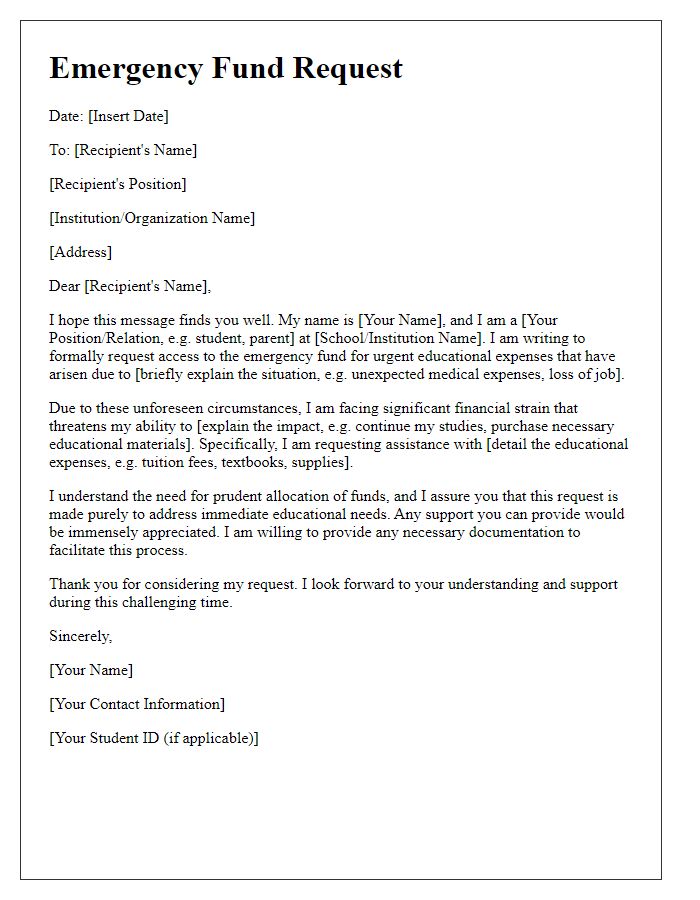

Letter template of emergency fund request for urgent educational expenses

Comments