Are you feeling a bit overwhelmed by an outstanding balance? You're not aloneâmany people find themselves in similar situations, and it's important to address it promptly. In this article, we'll walk you through a simple and effective letter template for inquiring about your outstanding balance, making the process straightforward and stress-free. So, let's dive in and help you get the clarity you need to tackle those finances head-on!

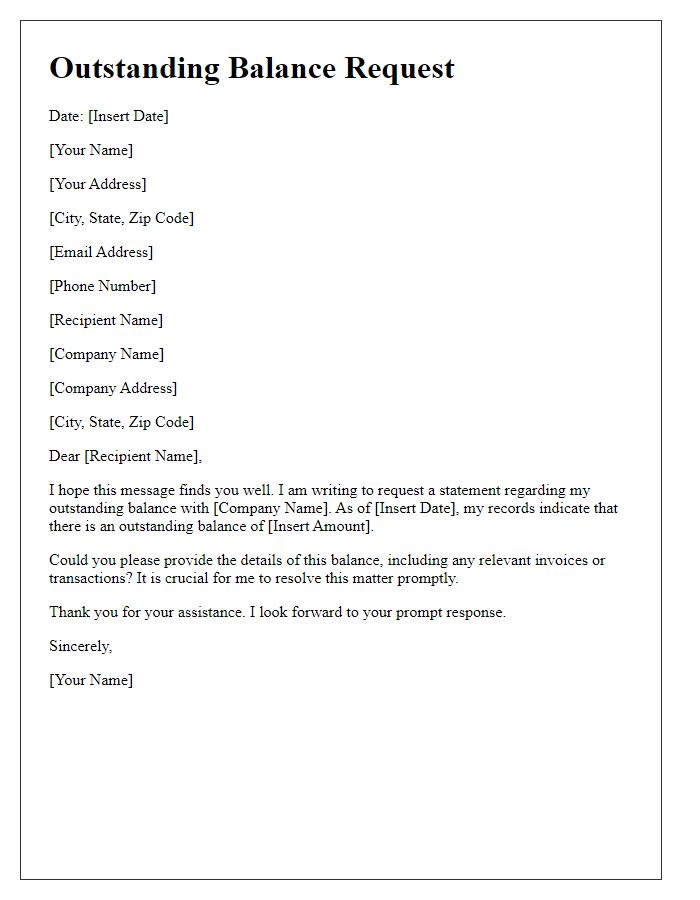

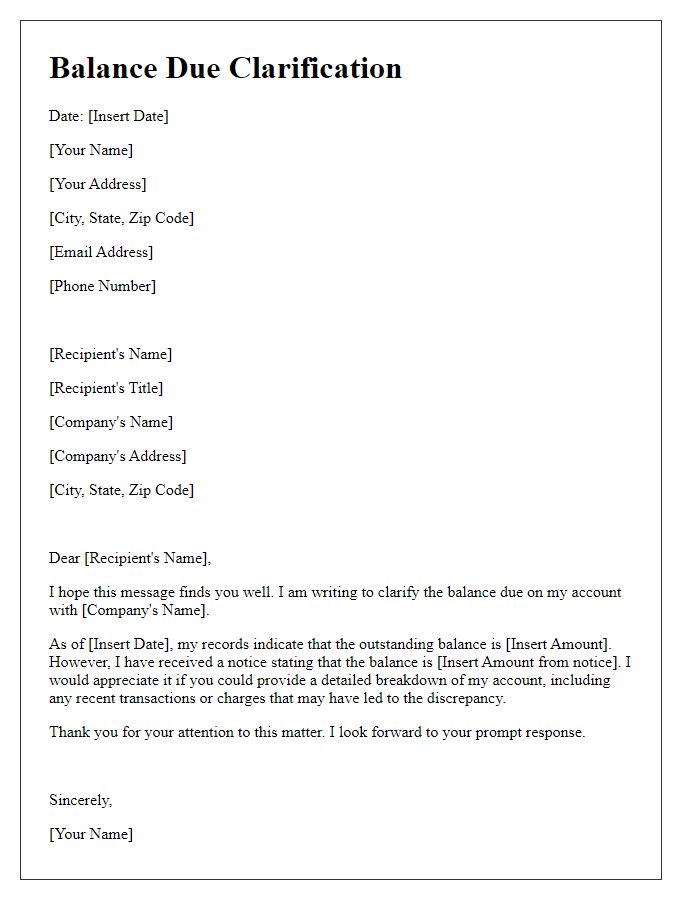

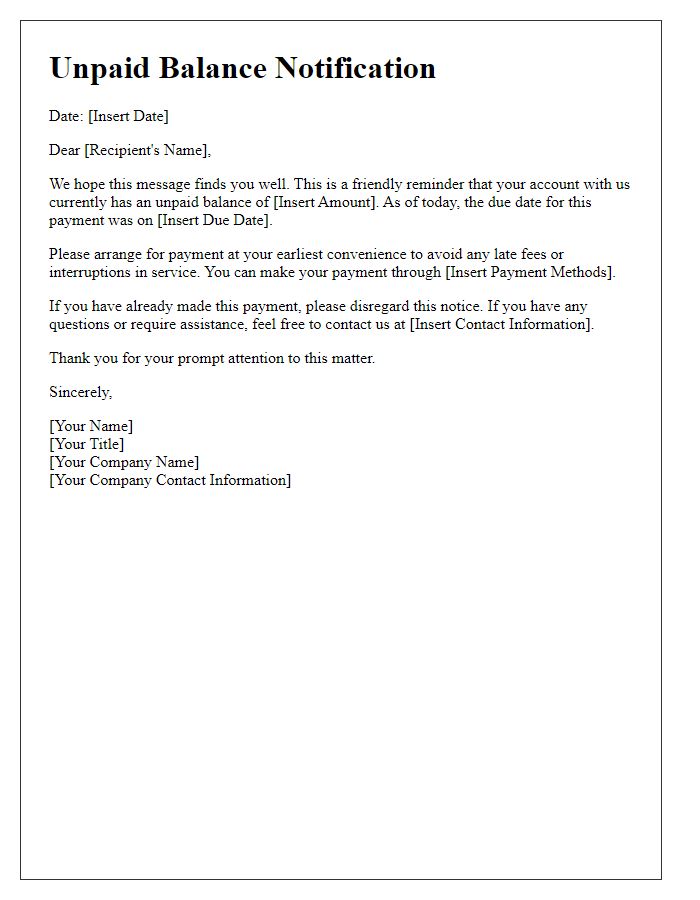

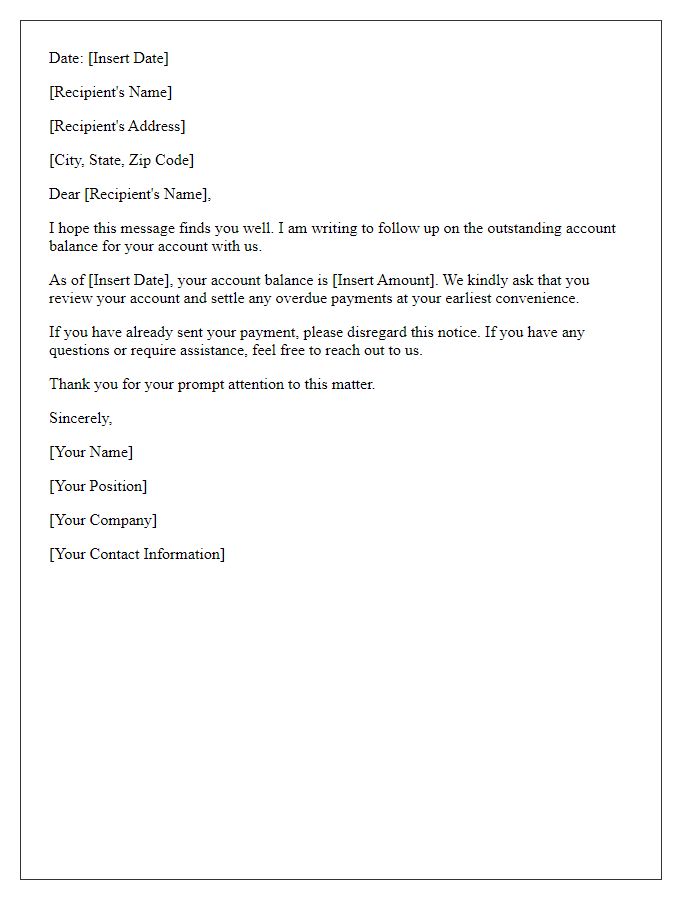

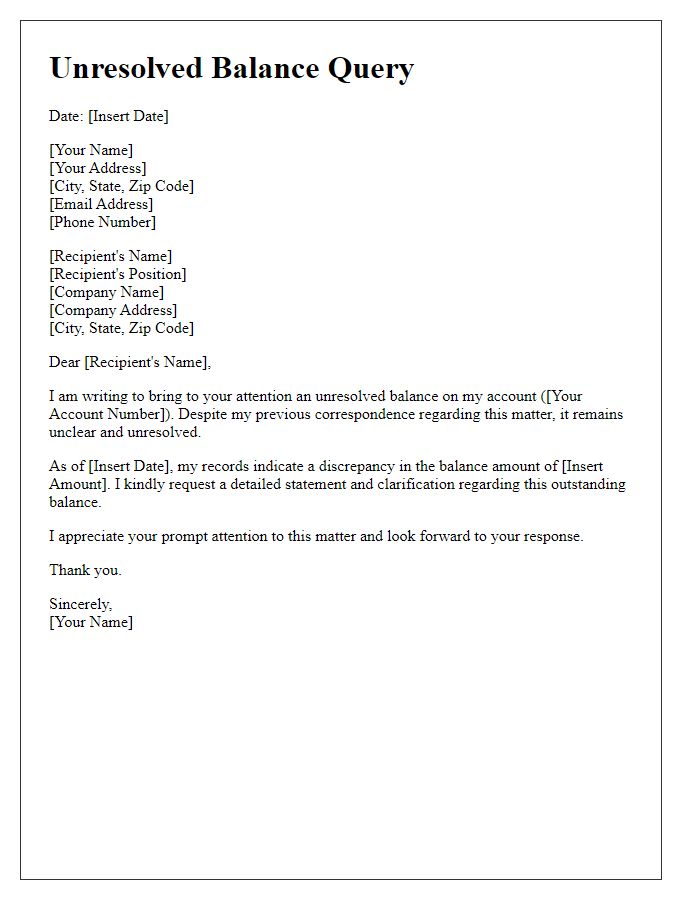

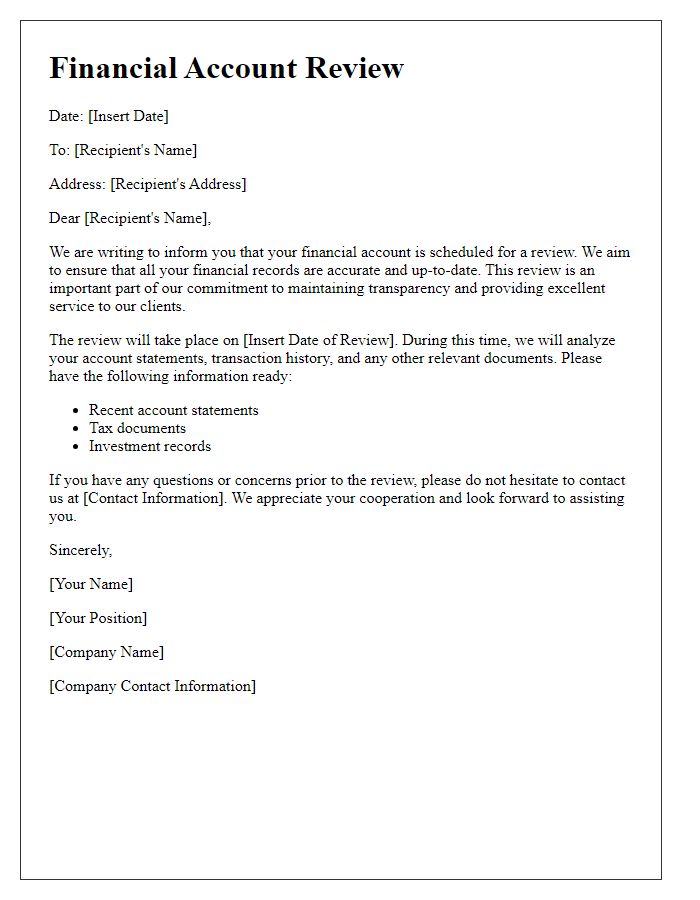

Creditor's Contact Information

Outstanding balances on credit accounts can lead to financial strain, affecting the overall credit score significantly. Original creditors, such as banks or finance companies, often provide specific contact details, including phone numbers (often toll-free), email addresses, and mailing addresses, for customer inquiries. For instance, a creditor's customer service number may operate during business hours, typically from 9 AM to 5 PM Eastern Standard Time, allowing consumers to address concerns directly. The creditor's official website may also include a secure online messaging system for inquiries regarding outstanding balances, making communication efficient and accessible.

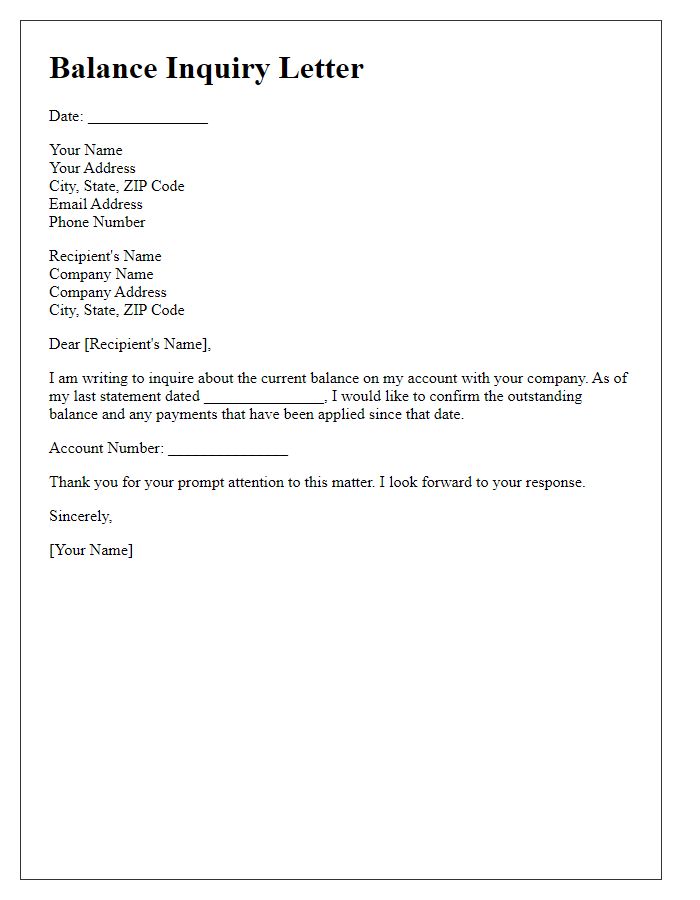

Debtor's Contact Information

An outstanding balance inquiry typically stems from debt management situations, where individuals or businesses seek clarification regarding their financial obligations. Essential contact details, such as the debtor's full name, residential address, email address, and phone number, facilitate effective communication between creditors and debtors. Accurate identification ensures that sensitive information regarding the outstanding balance, including transaction dates and amounts owed, remains secure. Moreover, including account numbers and references helps streamline the inquiry process, allowing for quicker resolution and clarification of any discrepancies. Providing detailed contact information fosters transparency and accountability in financial dealings, ultimately leading to improved payment processes.

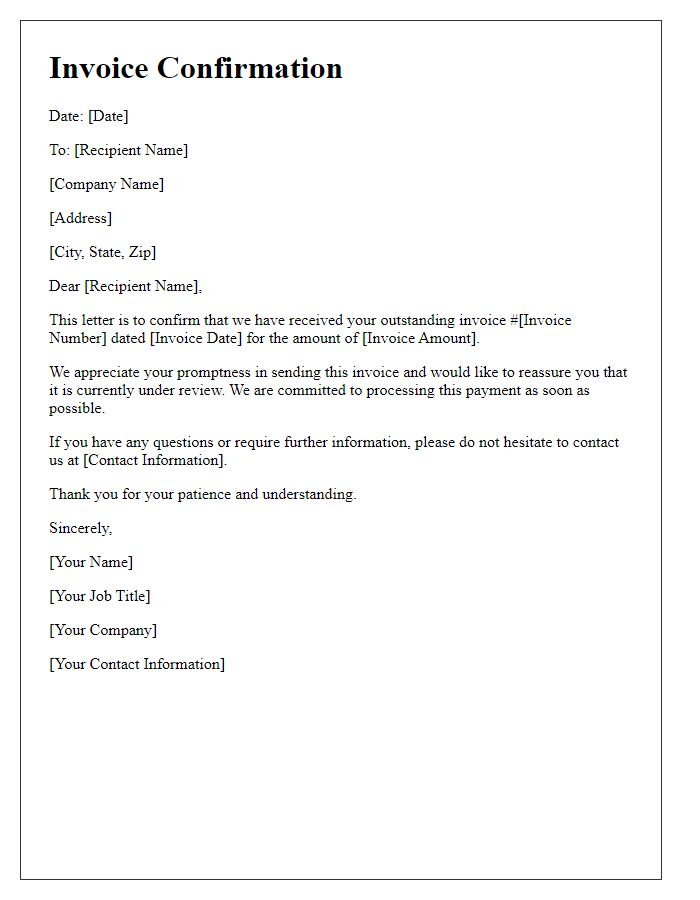

Subject: Outstanding Balance Inquiry

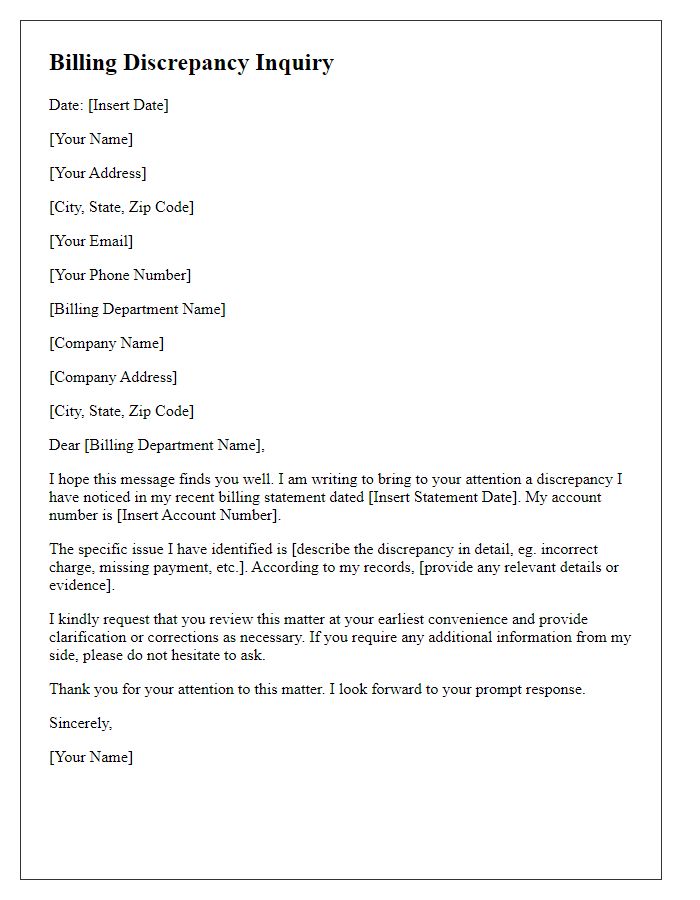

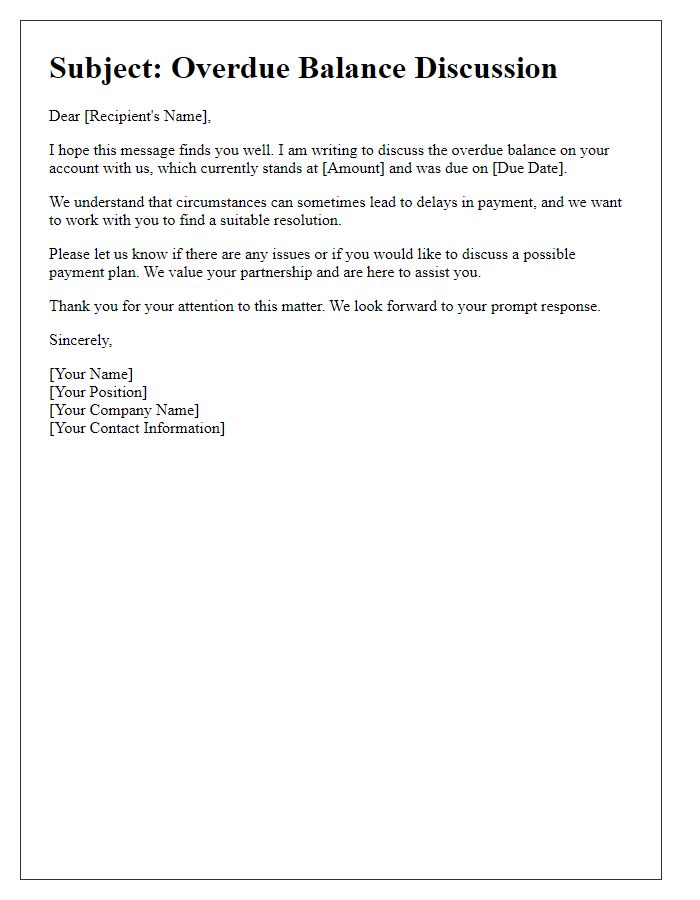

An outstanding balance inquiry often addresses overdue payments on bills, loans, or credit accounts. Individuals may inquire about amounts owed, such as specific figures detailing principal, interest (often varying based on APR rates), and any applicable late fees (which might significantly increase balance). Frequent events like monthly billing cycles can prompt these inquiries, especially if statements reflect discrepancies. This situation commonly occurs in places like financial institutions (banks, credit unions) or utility companies (electricity, water providers) where consumers seek clarity regarding their account statuses. Maintaining awareness of payment due dates is crucial, as failing to address outstanding balances can result in penalties or impact credit scores, specifically measured by FICO or VantageScore metrics.

Account Details and Reference Number

Outstanding balances can impact financial health and credit scores. An account holder might have specific reference numbers tied to their account, facilitating inquiries about unpaid amounts. The reference number, usually unique, enables customer service representatives to quickly locate account details, ensuring an efficient resolution process. Customers should ensure they also include accurate account information when reaching out, as discrepancies can lead to delays. Timely inquiries about outstanding balances can help avoid late fees and maintain good standing with financial institutions, ultimately contributing to a positive credit history.

Request for Balance and Payment Details

Outstanding balances can lead to financial complications, especially in commercial accounts. A customer may seek clarification regarding the outstanding balance amount owed, which could include various charges such as service fees, late payment penalties, or overdue invoices. Specific details from a financial statement or an account summary (covering the period of January 2023 to October 2023) may be requested to accurately understand payment history and discrepancies. Inquiries directed to a billing department within a company in New York, for instance, should include the account number (a unique identifier for efficient processing) to expedite the response regarding any unapplied payments or adjustments. Clear documentation of all transactions will facilitate the resolution of any uncertainties related to remaining amounts due.

Comments