Are you considering closing an account and unsure how to communicate it? Crafting the right account closure notification can make the process smooth and professional. In this article, we'll guide you through the essential components of a clear and respectful letter that ensures your intentions are understood. So, let's dive in and simplify your account closure experienceâread on for all the details!

Account Holder's Name and Contact Information

Account closure notifications must provide clear details. Account Holder's Name is the primary identifier, ensuring proper recognition of the individual in the system. Contact Information includes essential elements such as email address and phone number, facilitating communication regarding the closure process. This ensures that any questions or issues can be promptly addressed, maintaining a professional standard. Clarity in these details helps prevent misunderstandings and ensures a smoother transition for the account holder.

Account Details (Account Number and Type)

The account closure notification process typically requires essential details, including the account number (unique identifier assigned to a customer's account) and account type (such as savings account, checking account, or business account). Customers aim for a smooth transition, ensuring all transactions are settled before closure. A comprehensive notification includes specific account information, clarifying potential impacts on ongoing services. Timely communication with financial institutions is crucial as customers navigate the operational aspects linked to their account's termination. Proper documentation can aid in resolving any lingering issues relating to balances, fees, or service interruptions associated with account closure.

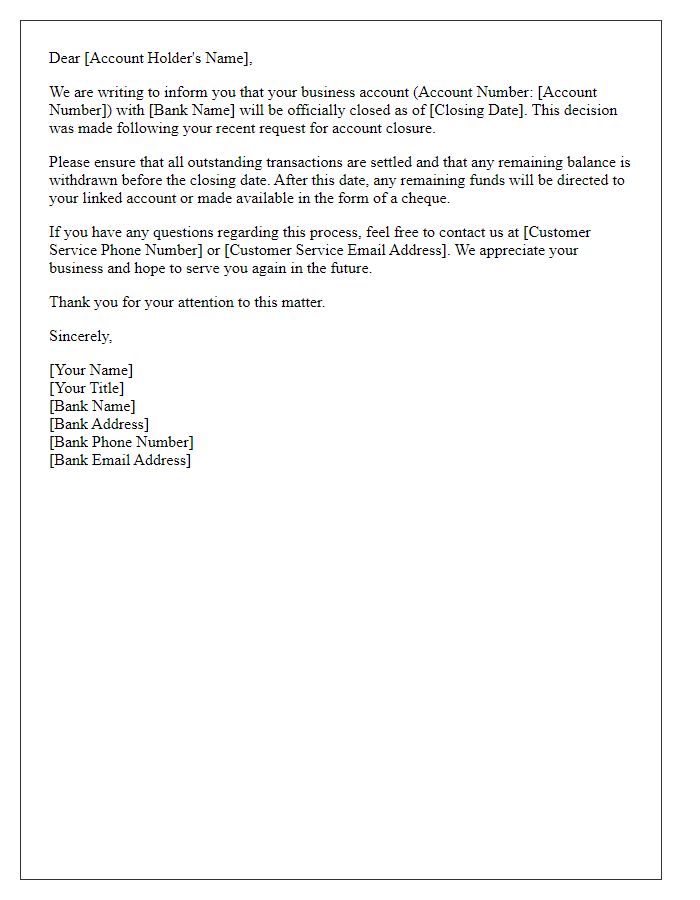

Closure Date and Effective Period

Account closure notifications are essential for maintaining transparency with clients. The closure date, typically noted as 30 days from the notification date, ensures users are informed and can take necessary actions regarding their finances. This effective period allows for the resolution of any outstanding transactions or balances, preventing potential issues that may arise from abrupt account termination. Clients must also be aware of any applicable fees or pending credits. Adequate communication throughout this timeline is crucial to ensure a seamless transition for those affected.

Reason for Closure and Any Required Actions

Account closure notifications typically involve important details about the reason for closure, any necessary actions the account holder must take, and potential implications of this decision. For example, account holders may need to settle outstanding balances, retrieve personal data stored within the account, and ensure the cancellation of associated services to prevent further charges. It is crucial to communicate clear instructions so that account holders can address these elements efficiently. Additionally, closure reasons might stem from inactivity, security concerns, or the account holder's request, each impacting the process differently. Users should also be informed about retention policies regarding personal data after account deactivation and any potential fallout regarding services linked to the account.

Contact Information for Assistance or Inquiries

When closing a bank account, customers often seek assistance or clarification on the process. Having comprehensive contact information can provide reassurance and guidance. Most banks offer customer service hotlines, typically reachable at specific hours, often 8 a.m. to 8 p.m. Eastern Standard Time, where representatives can address concerns regarding account closure. Additionally, many institutions provide dedicated email addresses or online chat options on their websites, allowing for convenient, real-time support. Some banks also feature localized branch contacts for face-to-face inquiries, offering a personal touch and further assistance for customers finishing their banking relationships. It is advisable to check the official bank website for the most accurate and updated contact details tailored to individual needs.

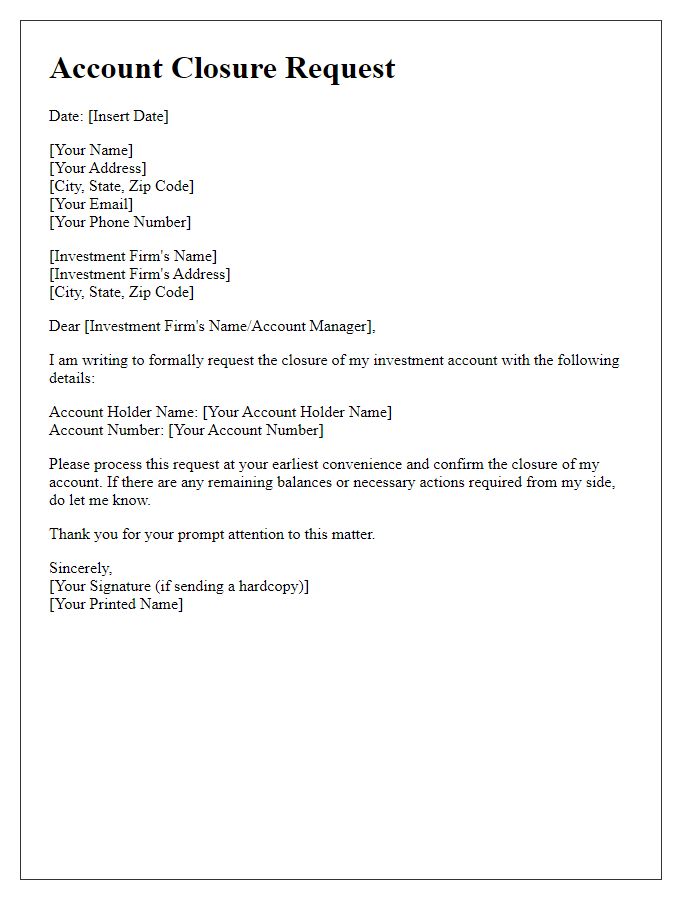

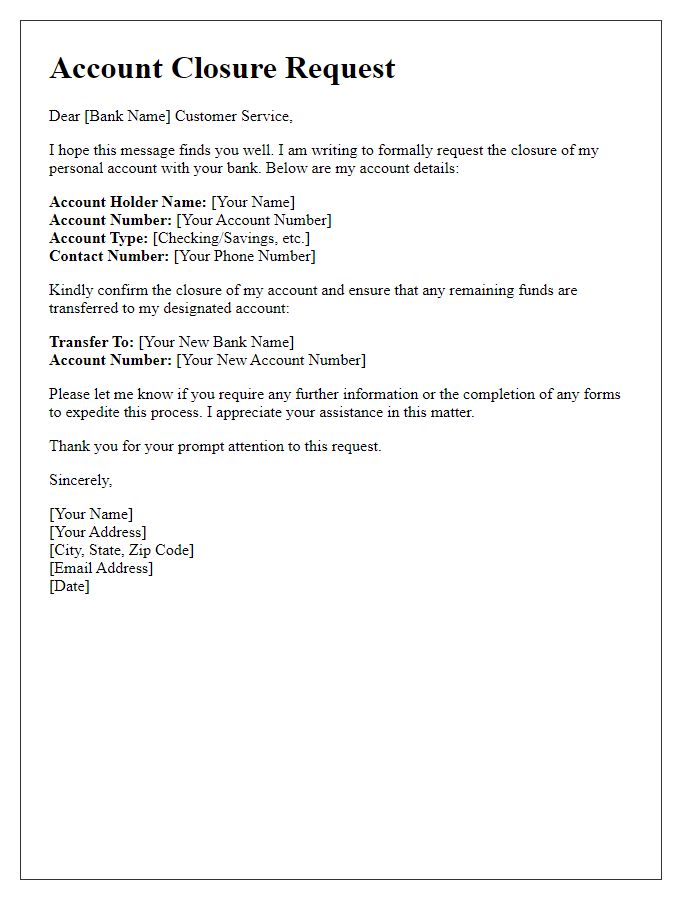

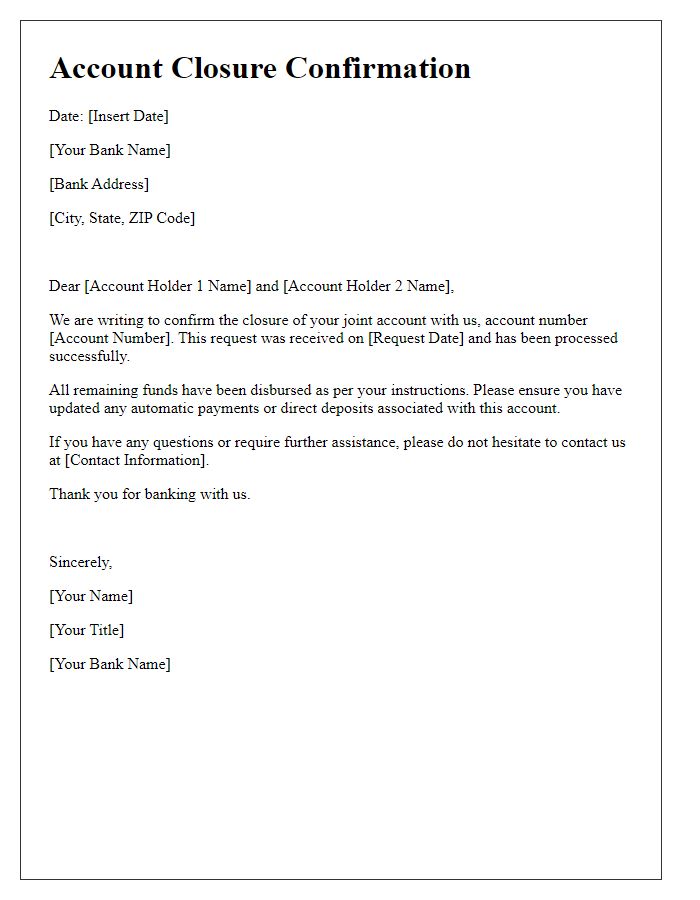

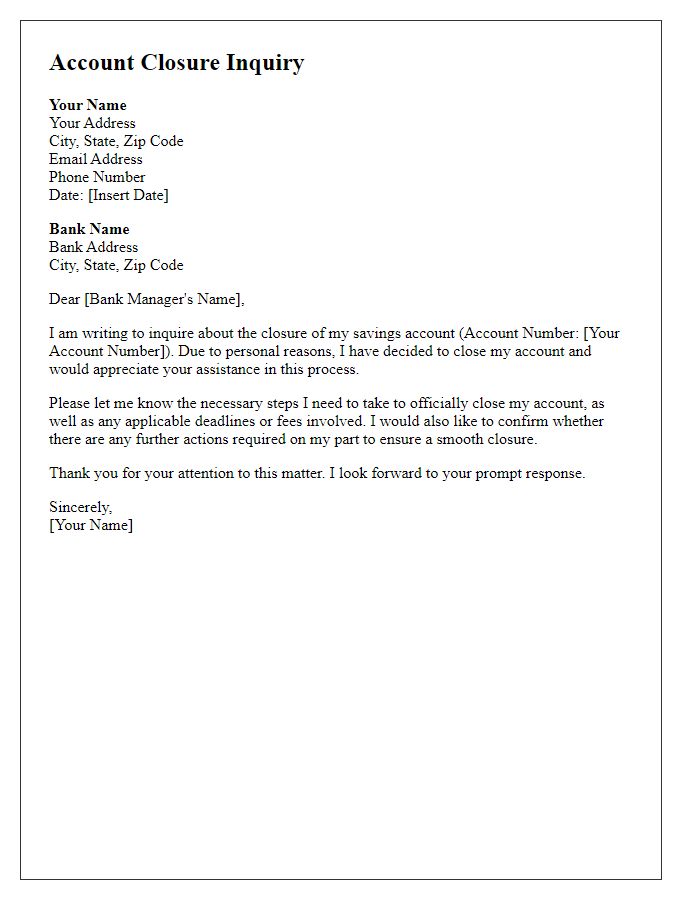

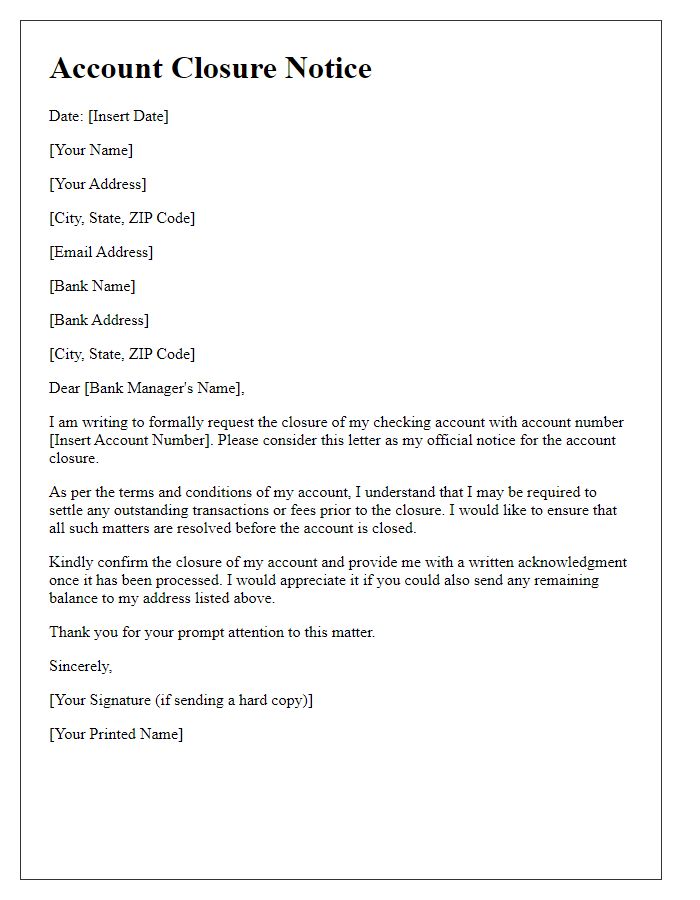

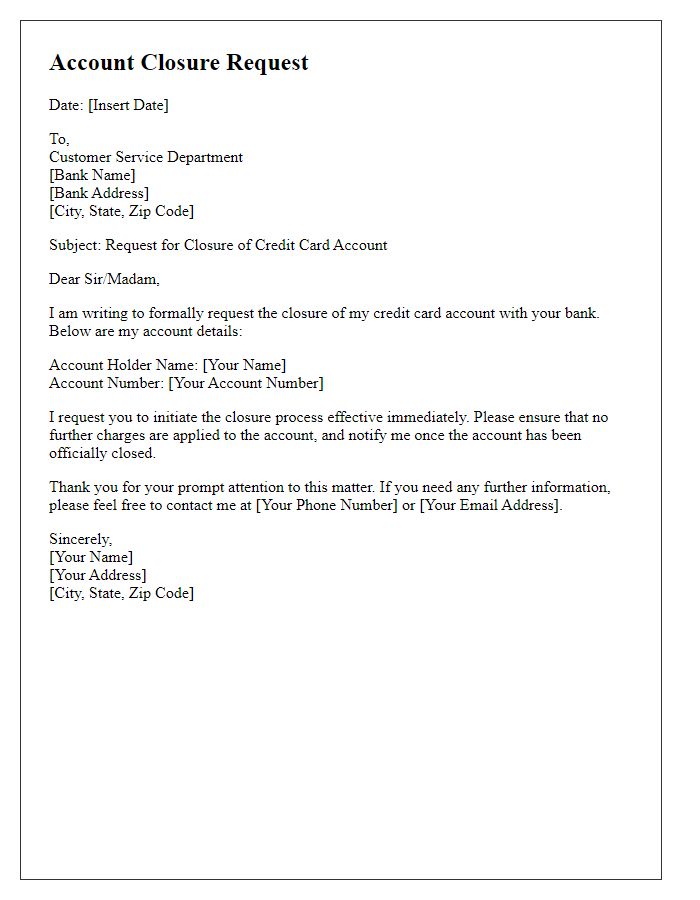

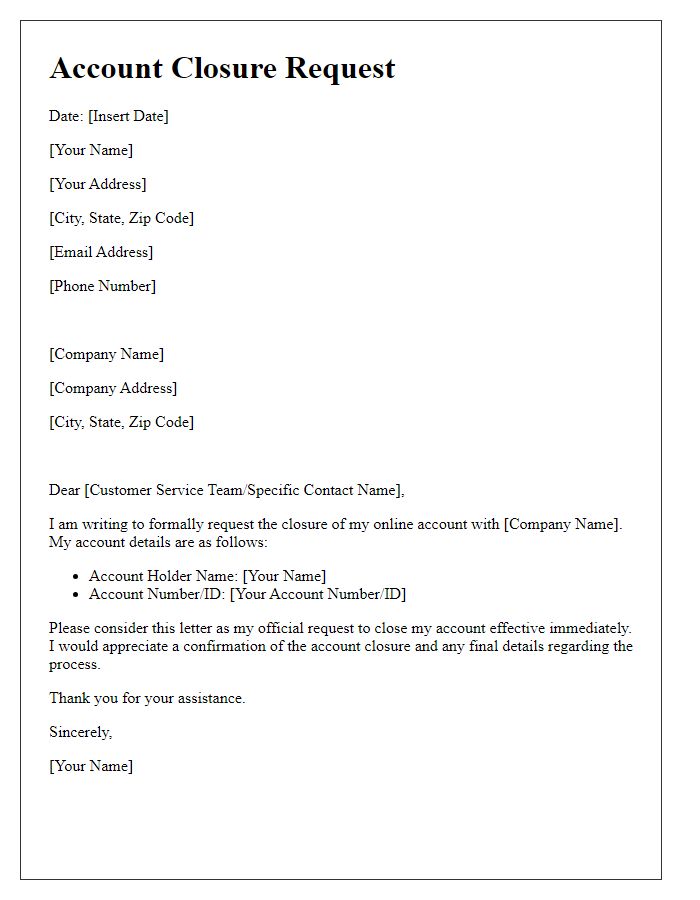

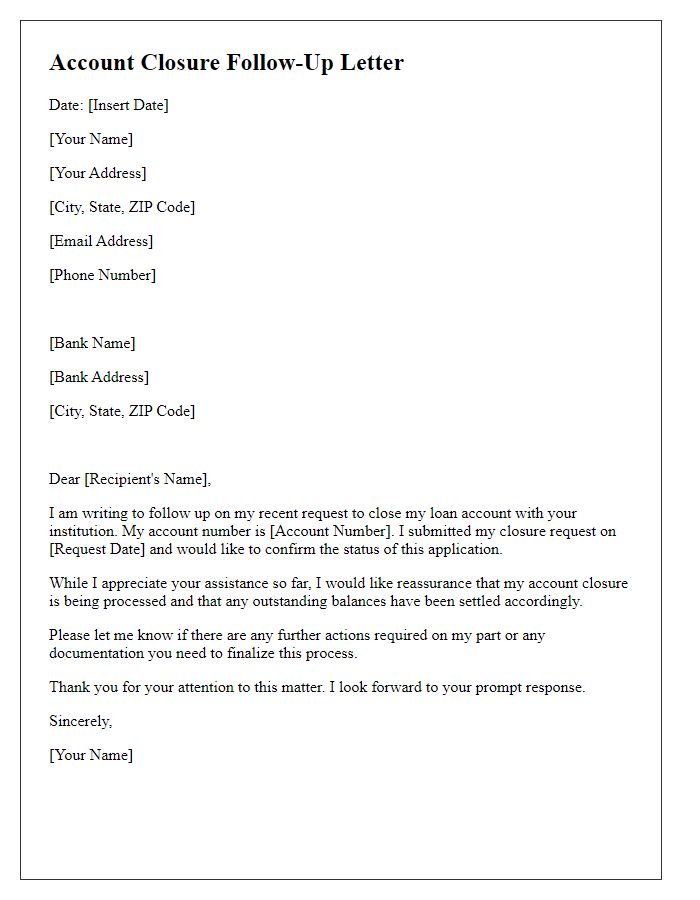

Letter Template For Account Closure Notification Samples

Letter template of account closure submission for an investment account.

Letter template of account closure announcement for a retirement account.

Comments