Are you considering a change in your loan conditions but unsure how to approach your lender? Crafting a well-structured request letter can make all the difference in your negotiations. Whether it's a reduction in interest rates, an extension of repayment terms, or any other adjustments, clarity and professionalism in your communication are key. Dive into our comprehensive guide to learn how to effectively articulate your needs and increase your chances for a favorable response!

Clarity and Precision

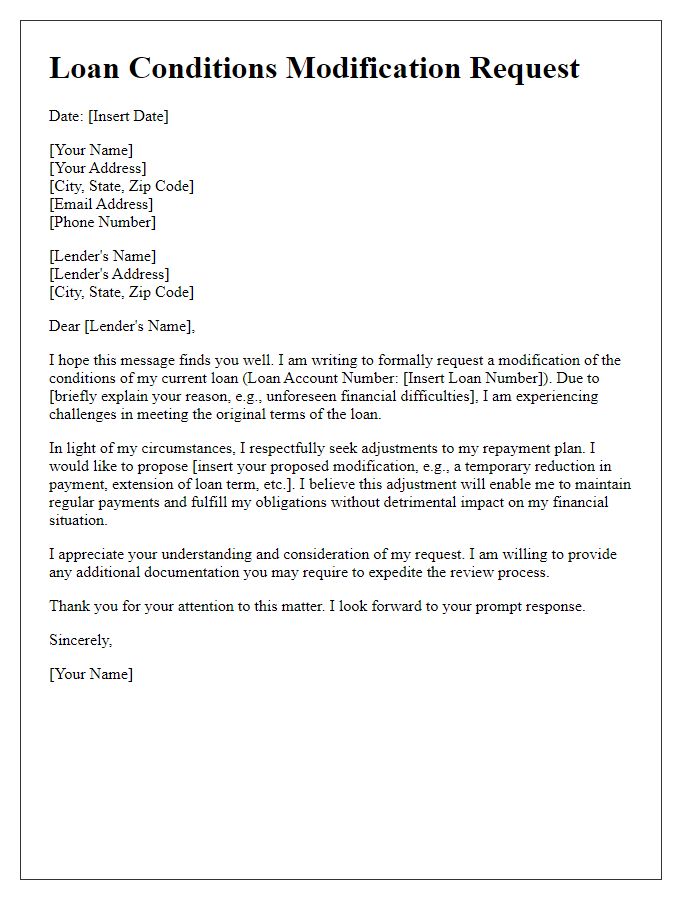

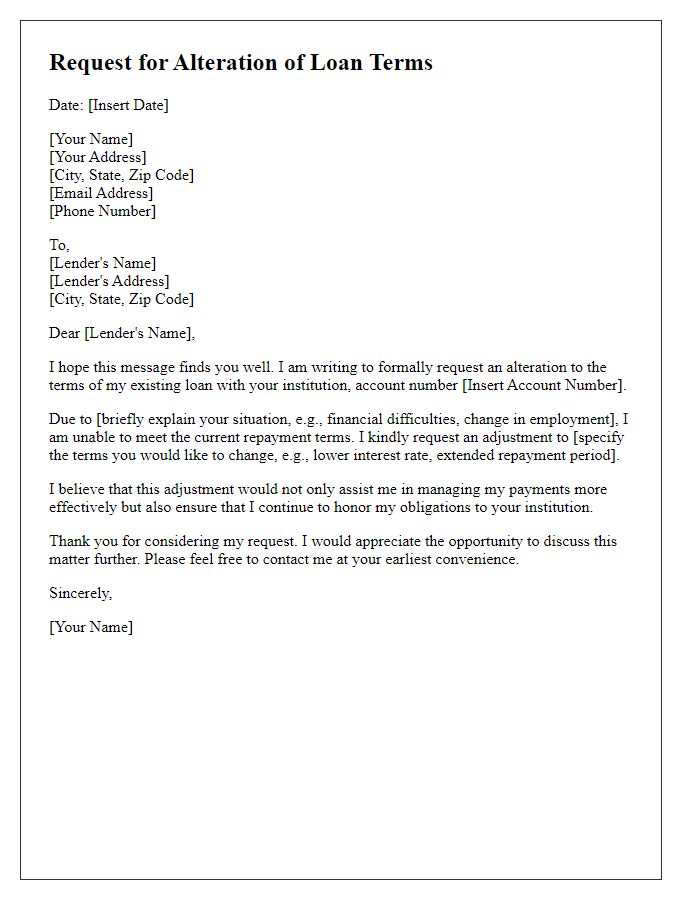

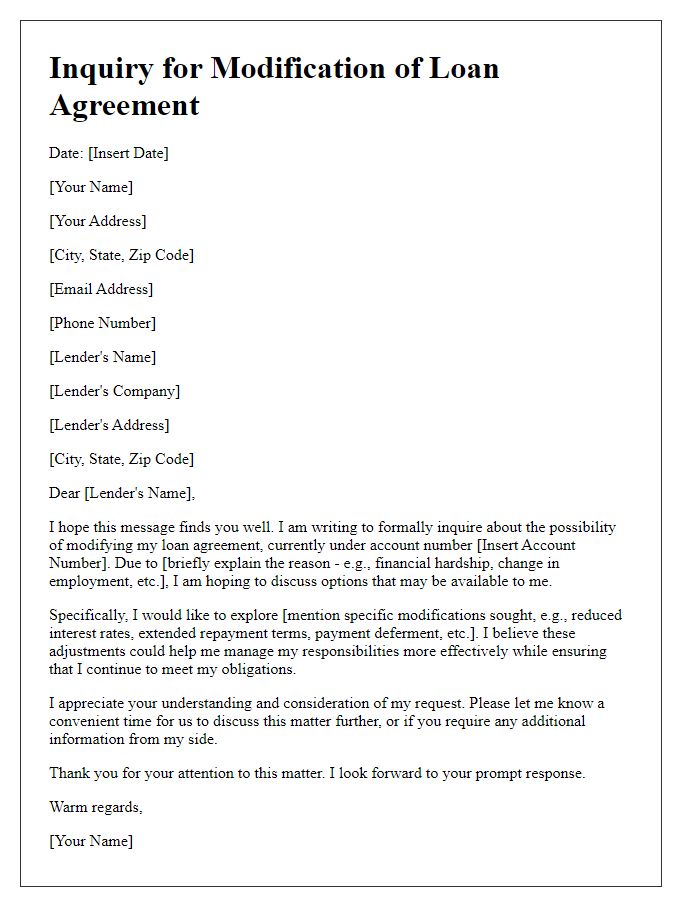

A loan modification request can lead to adjustments in payment terms. This may include lower interest rates, extended repayment periods, or changed monthly payment amounts. Financial institutions, such as banks (like Wells Fargo or JPMorgan Chase), typically require specific documentation for processing requests, including income verification, current financial statements, and a written explanation of the need for change. For borrowers facing hardships, such as job loss or medical emergencies, demonstrating financial strain is crucial. The timeline for modifications can vary, often taking several weeks to months, impacting overall budgeting. Clear communication with the lender enhances the likelihood of a favorable adjustment to the terms of the loan.

Loan Account Details

A loan account with specific details such as the 12-digit account number, original loan amount of $50,000, and current interest rate of 5% per annum may require a reevaluation of conditions due to changes in financial circumstances. Monthly payments may be burdensome, and a modification request could include alternatives such as a reduced interest rate or extended repayment period, aiming to enhance affordability and improve financial stability. In addition, recent market trends showing declining interest rates could justify a request for better terms. Proper documentation and a clear rationale can support the case for a favorable reconsideration of loan conditions.

Reason for Request

Loan modification requests often arise from financial distress stemming from unexpected life events such as job loss or medical emergencies. For instance, an individual may face difficulties in meeting monthly mortgage payments due to a sudden layoff from a position at a large corporation, affecting household income significantly. The request for more favorable loan conditions, such as extending the loan term or reducing the interest rate, can help alleviate the financial burden and provide a manageable path back to stability. Furthermore, providing evidence of current financial challenges, like bank statements showing decreased income or medical bills totaling thousands of dollars, may strengthen the petition for modification.

Desired Changes

Clients often seek adjustments to their loan conditions, defined by financial institutions such as banks or credit unions. Specific desired changes might include reducing the interest rate, extending the repayment term, consolidating multiple loans, or changing the repayment schedule. For instance, a borrower might request a lower interest rate from 5% to 3% to decrease monthly payments and overall repayment burden. Additionally, extending the repayment term from 10 years to 15 years can significantly lower monthly obligations while enhancing cash flow for other expenses. Consolidation, which combines several loans into one, can simplify management and potentially lower interest rates. Moreover, modifying repayment schedules from monthly to bi-weekly payments can accelerate repayment and reduce interest paid over the life of the loan, benefiting financial stability.

Supporting Documentation

When requesting a change in loan conditions, essential supporting documentation can help substantiate the request. Key documents include the loan agreement (original contract outlining terms), income statements (recent pay stubs or tax returns demonstrating financial stability), and a personal statement (detailing reasons for the request and desired changes). Additionally, credit reports (showing the current credit score and history) can provide insight into financial responsibility. Bank statements (reflecting current financial status) also serve as vital evidence, while any relevant circumstances, such as job loss or medical emergencies, should be documented thoroughly to support the case for modified loan terms.

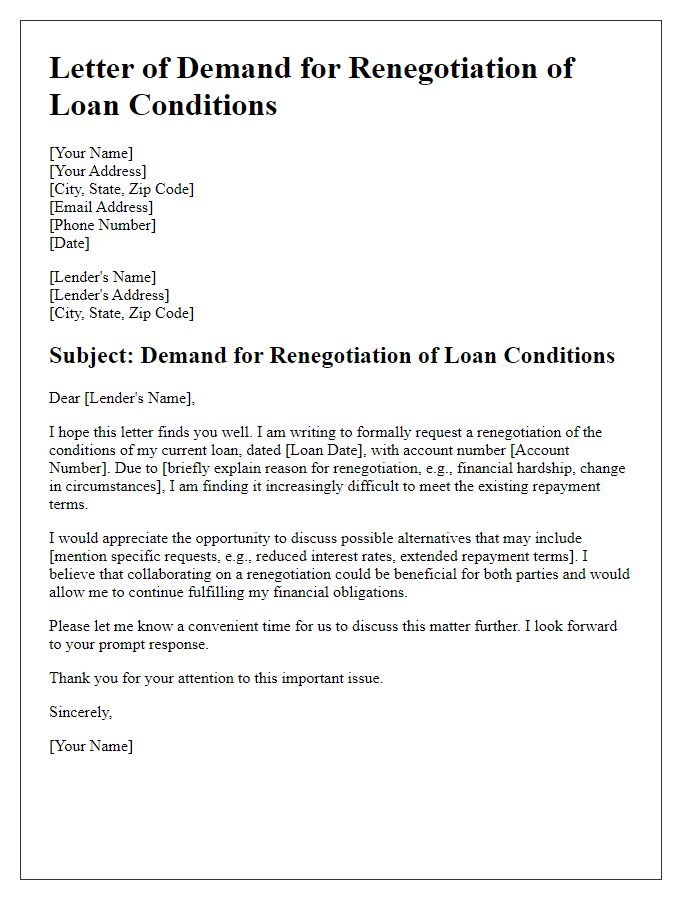

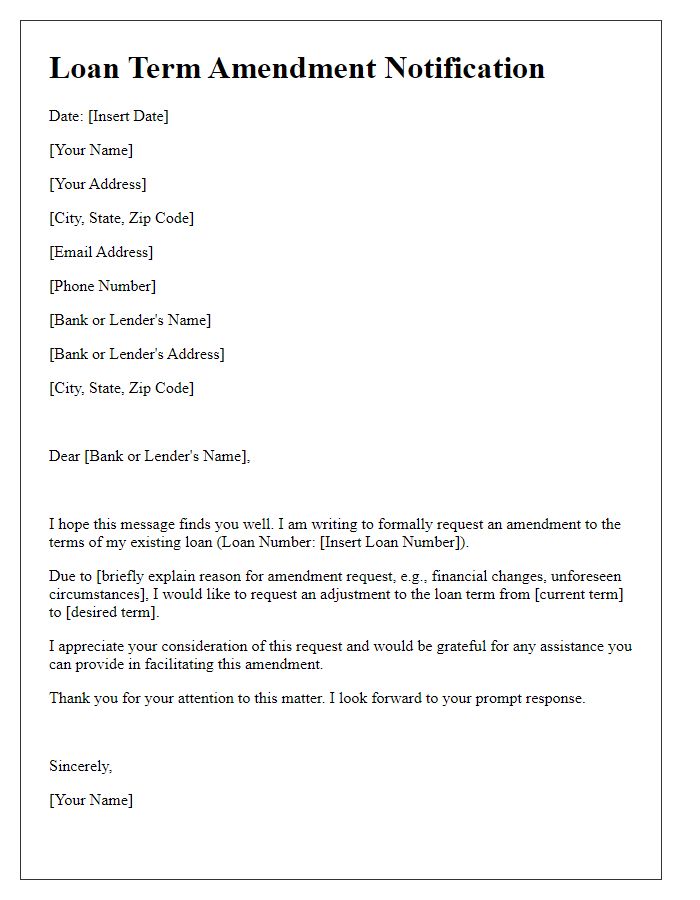

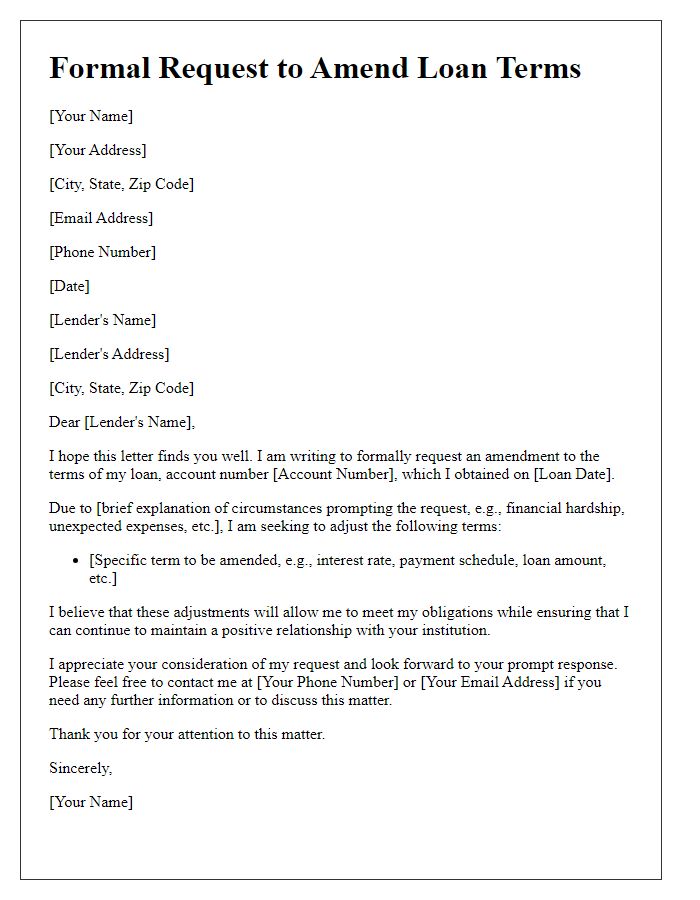

Letter Template For Requesting Change In Loan Conditions Samples

Letter template of correspondence regarding loan conditions modification

Comments