Are you considering a long-term business loan but unsure how to approach the negotiations? Navigating the world of financing can feel daunting, but with the right letter template, you can effectively communicate your needs and build a strong case for your request. This guide will walk you through the essential components that will help you articulate your vision and financial goals clearly. So, let's dive in and unlock the keys to successful loan negotiations!

Loan Amount and Purpose

When seeking a long-term business loan, it is essential to clearly outline the loan amount and its intended purpose to demonstrate a well-thought-out financial strategy. For example, a business might request a loan amount of $500,000 aimed at expanding operations, specifically for the purchase of new machinery and equipment to enhance production efficiency in a facility located in Dallas, Texas. The funds could also be allocated towards marketing initiatives to increase brand awareness in the competitive market of the tech industry. Providing detailed projections of how this investment will lead to increased revenue and job creation can further strengthen the loan application, making it appealing to lenders.

Interest Rate and Repayment Terms

Negotiating favorable interest rates and repayment terms is crucial for long-term business loans, enabling companies to manage cash flow effectively while investing in growth. Interest rates, typically ranging between 3% to 10% based on creditworthiness and market conditions, significantly influence overall loan costs. Flexible repayment terms, such as 5 to 20 years, allow businesses to align payments with revenue cycles. Additionally, incorporating grace periods or interest-only payments initially can ease financial strain, fostering sustainable growth. Understanding lenders' specific criteria, including debt-to-income ratio and current economic indicators, is essential for achieving the most beneficial terms. Engaging in these negotiations thoughtfully can lead to a tailored financing solution that supports long-term success.

Collateral and Financial Statements

Long-term business loans require a comprehensive understanding of collateral and financial statements, impacting approval processes. Collateral, such as real estate, inventory, or equipment, serves as security for lenders during negotiations, often valued through assessments or appraisals. Financial statements, including balance sheets, income statements, and cash flow statements, provide insight into business performance, with key metrics like revenue growth rates, profitability margins, and debt-to-equity ratios influencing lender decisions. Accurate and detailed financial records from the past three to five years help establish creditworthiness, showcasing the ability to manage debt effectively and sustain operations. A solid financial footing is crucial, especially for businesses located in competitive markets such as technology hubs or manufacturing districts, where funding can drive growth and innovation.

Business Plan and Projected Growth

A well-structured business plan serves as a roadmap for securing long-term business loans, essential for expansion and operational improvement. This plan outlines the vision for growth over the next five years, detailing projected financial metrics such as revenue, profit margins, and cash flow to demonstrate the potential return on investment. Specific strategies include market analysis targeting key demographics in urban areas, expansion into online platforms, and enhanced customer engagement through tailored marketing campaigns. Milestones such as achieving a 20% increase in market share and launching two new product lines by Year 3 underscore the ambitious yet attainable goals that can attract potential lenders. Comprehensive financial projections confirm the sustainable growth trajectory, with anticipated annual revenues reaching $1.5 million by Year 5, providing lenders confidence in the viability and profitability of the investment.

Legal and Regulatory Compliance

In the realm of long-term business loan negotiations, adherence to legal and regulatory compliance is paramount for fostering trust and ensuring sustainability in financial agreements. Financial institutions, such as banks and credit unions, must enforce guidelines set by agencies like the Federal Reserve and the Consumer Financial Protection Bureau, which govern lending practices and protect consumer rights. Documentation such as the Uniform Commercial Code (UCC) filings and detailed credit reports of borrowers must be meticulously reviewed to ensure compliance with local, state, and federal regulations. Furthermore, understanding the implications of the Dodd-Frank Wall Street Reform and Consumer Protection Act is crucial for lenders to mitigate risks associated with predatory lending and maintain transparency throughout the loan process. By prioritizing these compliance aspects, both parties can cultivate a secure environment for negotiations leading to mutually beneficial long-term financing solutions.

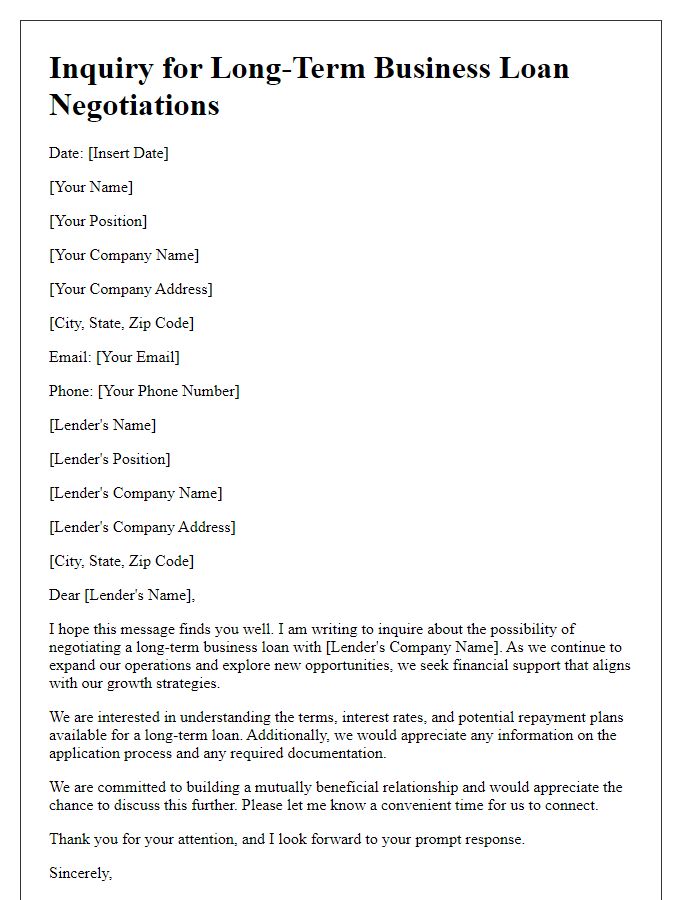

Letter Template For Long-Term Business Loan Negotiations Samples

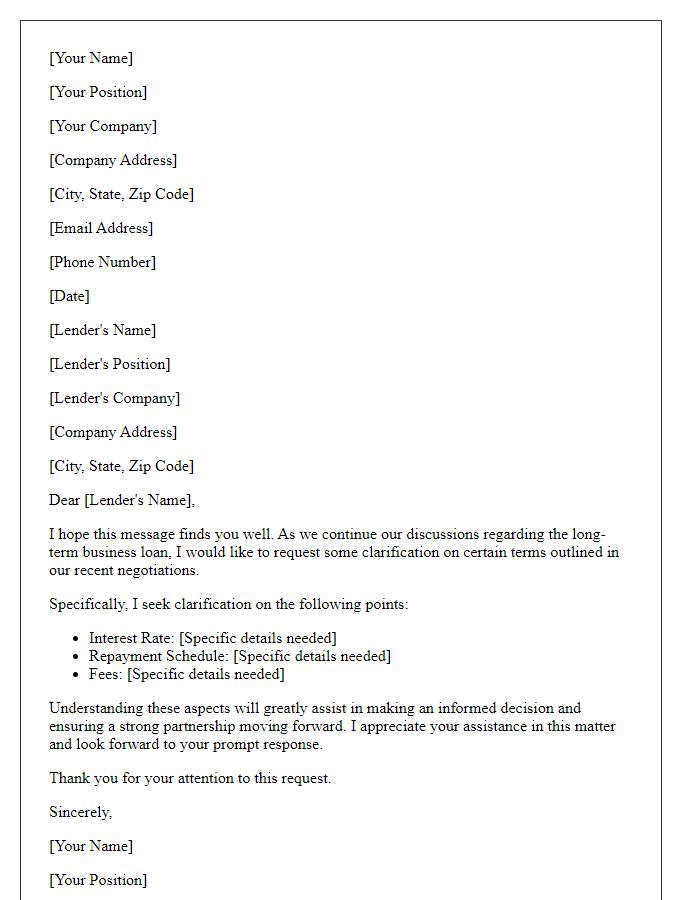

Letter template of request for terms clarification in long-term business loan negotiations

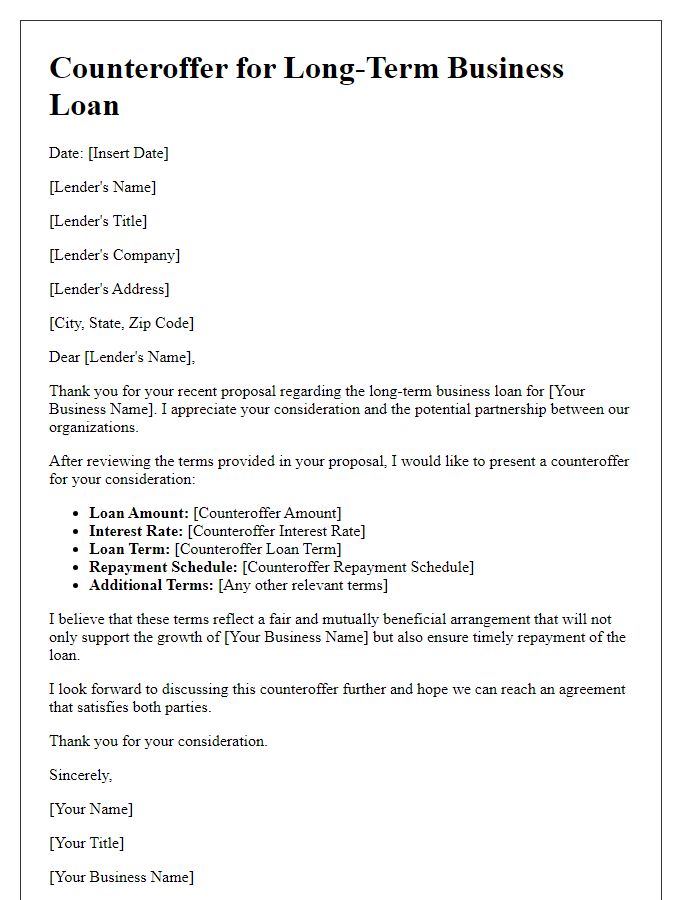

Letter template of counteroffer for long-term business loan negotiations

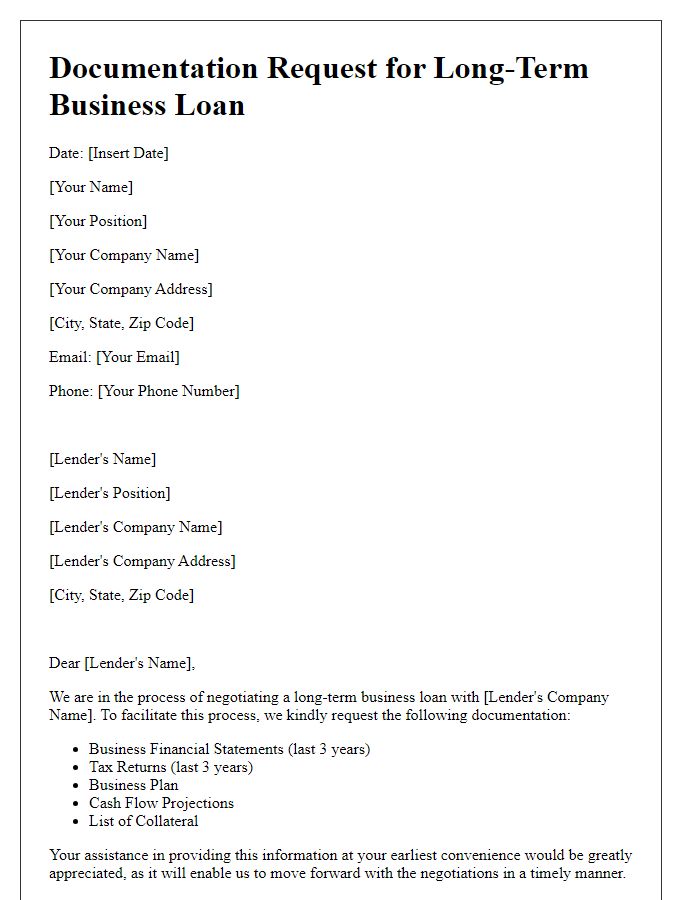

Letter template of documentation request for long-term business loan negotiations

Comments