Are you feeling overwhelmed by the ups and downs of your income and wondering how to manage your loan repayments accordingly? It's a common challenge many face, especially in today's unpredictable job market. Crafting a well-structured letter to your lender can be an effective way to negotiate adjustments that suit your financial situation. Join us as we explore how to align your loan repayments with your changing income to regain control over your finances!

Personalized borrower details

Individualized borrower profiles frequently include essential information such as job title, income level, loan type, and repayment history. Changes in financial circumstances, such as reduced working hours or increased medical expenses, can significantly impact monthly payments. For example, a lender may adjust the repayment schedule for a $20,000 personal loan over five years to accommodate a borrower's decreased income. Documentation typically required for this process includes pay stubs, tax returns from the last year, and an explanation of any changes in employment status. These adjustments aim to ensure that borrowers maintain manageable repayments while meeting financial obligations responsibly.

Clear statement of income change

A clear statement of income change typically describes alterations in one's financial situation, such as job loss or salary adjustment. For instance, an individual experiencing a significant reduction in monthly income due to a job termination might report a decrease from $5,000 to $3,000. This shift impacts overall financial stability and affects obligations like mortgage or personal loans, necessitating communication with lenders. Adjusted circumstances require updating repayment plans, ensuring manageable payment structures, reflecting the new financial reality. Engaging with financial advisors or using resources from reputable institutions can provide guidance through this transitional phase, aiming for just resolutions that align with revised financial capabilities.

Specific repayment adjustment request

Individuals facing financial pressure often seek adjustments to loan repayments when their income fluctuates. For example, a customer may request a modification for a personal loan of $10,000 following a job loss that resulted in a $1,500 monthly income reduction. The lender, possibly a bank like Chase or Bank of America, may offer options such as extending the loan term or reducing the monthly payment from $300 to $200 for a temporary period to ease financial strain. The impact of these changes could result in a total repayment duration extending from five years to six years, allowing the borrower to maintain timely payments and avoid defaulting on the loan. Such agreements often require documentation of current income, including pay stubs or unemployment benefits, to substantiate the request and facilitate the adjustment process.

Justification for request

Adjusting loan repayment schedules often becomes necessary in response to significant income changes, such as job loss or a reduction in work hours, which affects financial stability. For instance, individuals experiencing a decrease in income by 30% might struggle to meet current repayment obligations, leading to increased stress and potential default. A revised payment plan based on a longer term or reduced monthly amounts can prevent negative financial consequences, such as credit score deterioration and increased interest rates. Moreover, aligning repayment terms with new income levels facilitates better financial management, ensuring that borrowers can maintain essential expenses while fulfilling their loan obligations without jeopardizing their overall financial health.

Contact information for follow-up

Adjusting loan repayments according to income changes can significantly alleviate financial stress for borrowers. Income fluctuations, such as those caused by job changes or economic downturns, can impact monthly budgets. A streamlined communication process with lenders is essential, including maintaining up-to-date contact information (such as email addresses and phone numbers) for prompt follow-up discussions regarding repayment terms. Borrowers should provide accurate financial documentation, such as recent pay stubs or tax returns, to support their requests for adjustments. Utilizing online banking platforms can also aid in monitoring repayment schedules and initiating conversations with financial institutions. Clear communication about payment timelines and potential restructuring options can lead to a more manageable loan repayment plan.

Letter Template For Aligning Loan Repayments With Income Changes Samples

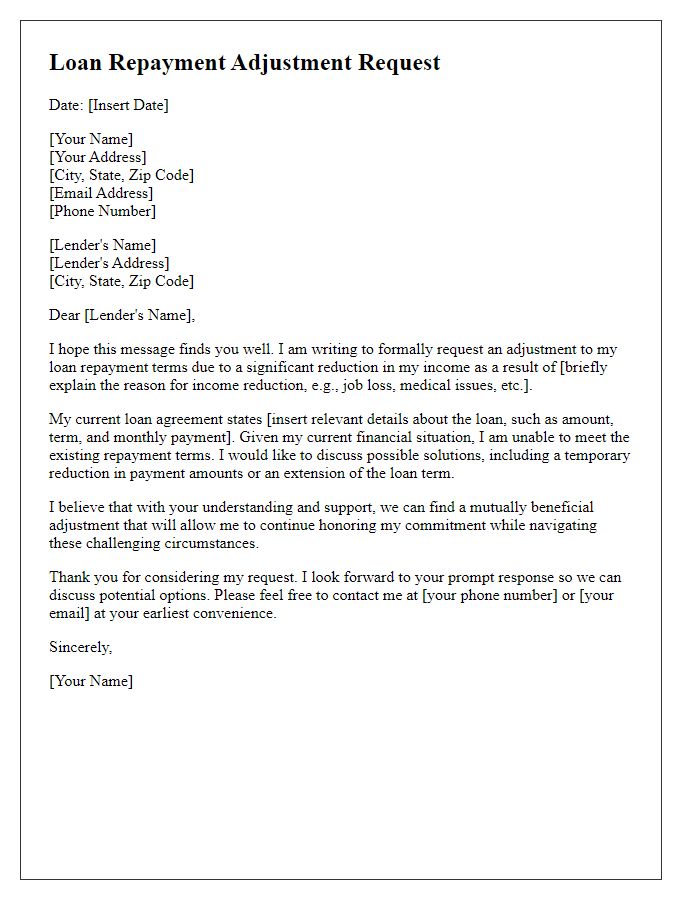

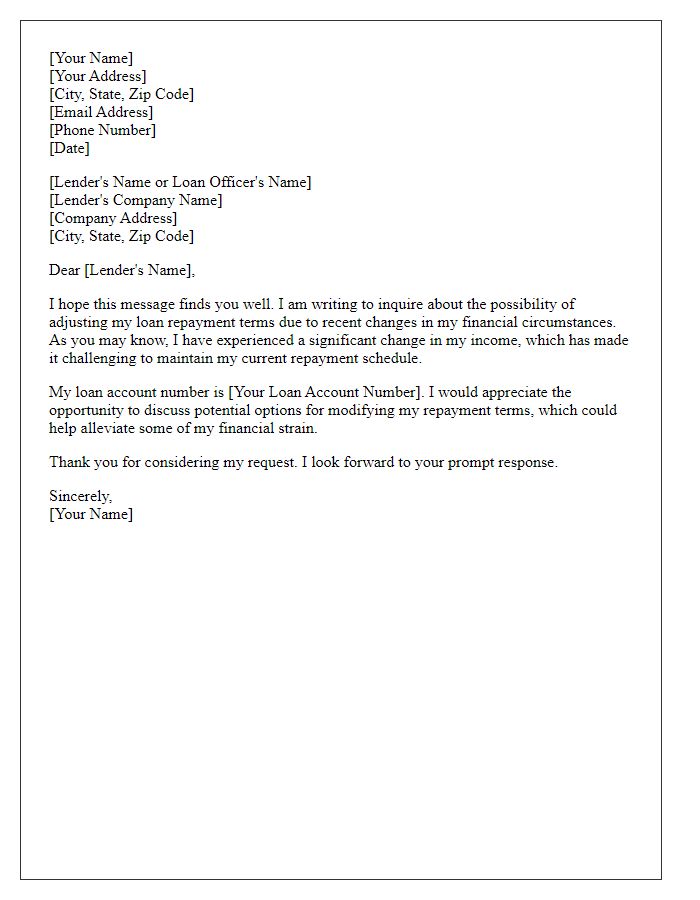

Letter template of request for loan repayment adjustment due to income reduction.

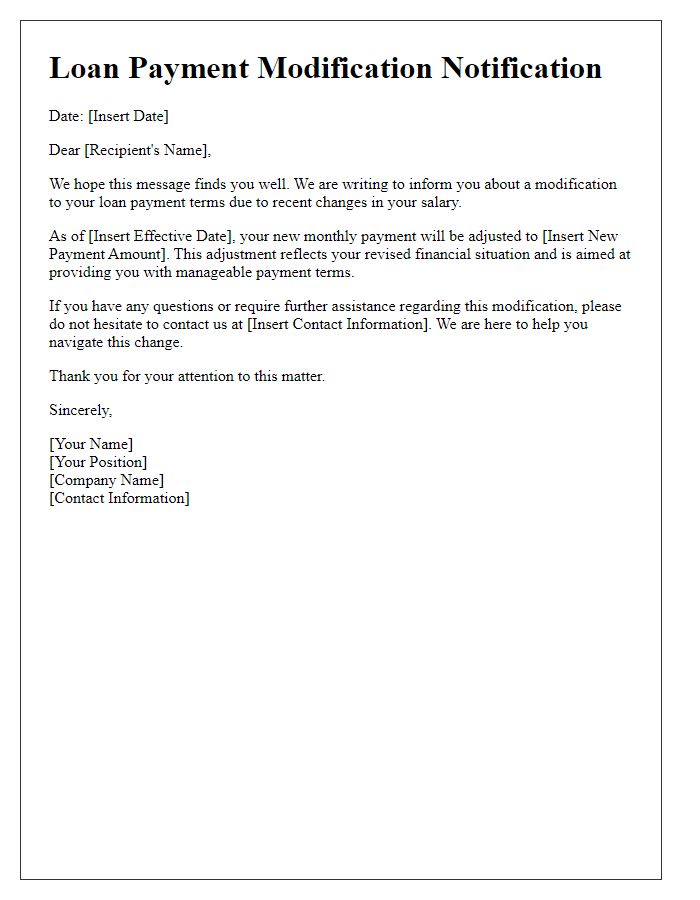

Letter template of notification for loan payment modification following salary changes.

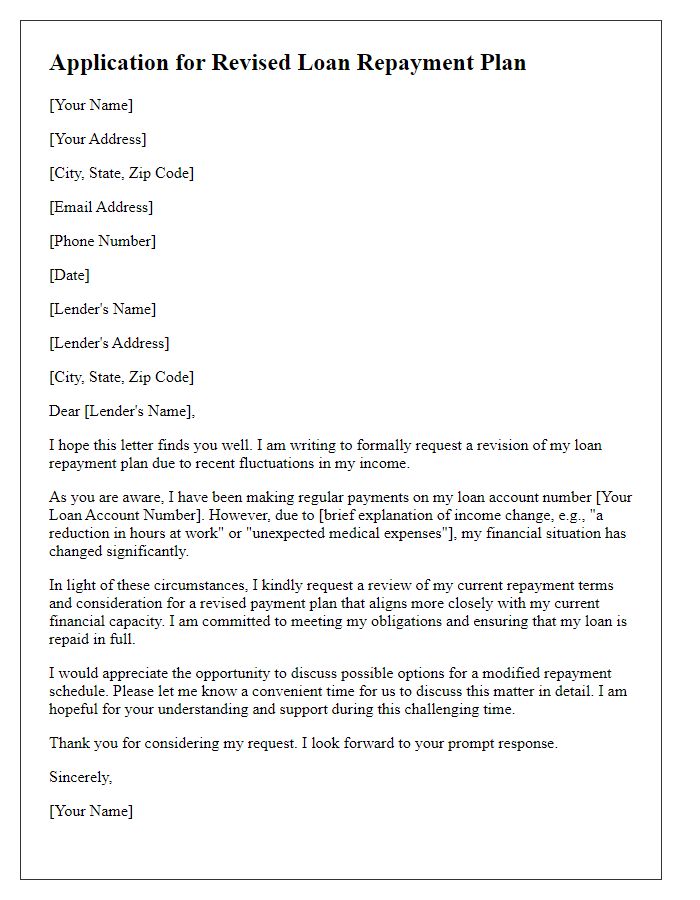

Letter template of application for revised loan repayment plan in light of income fluctuations.

Letter template of inquiry regarding loan repayment terms adjustment based on recent income changes.

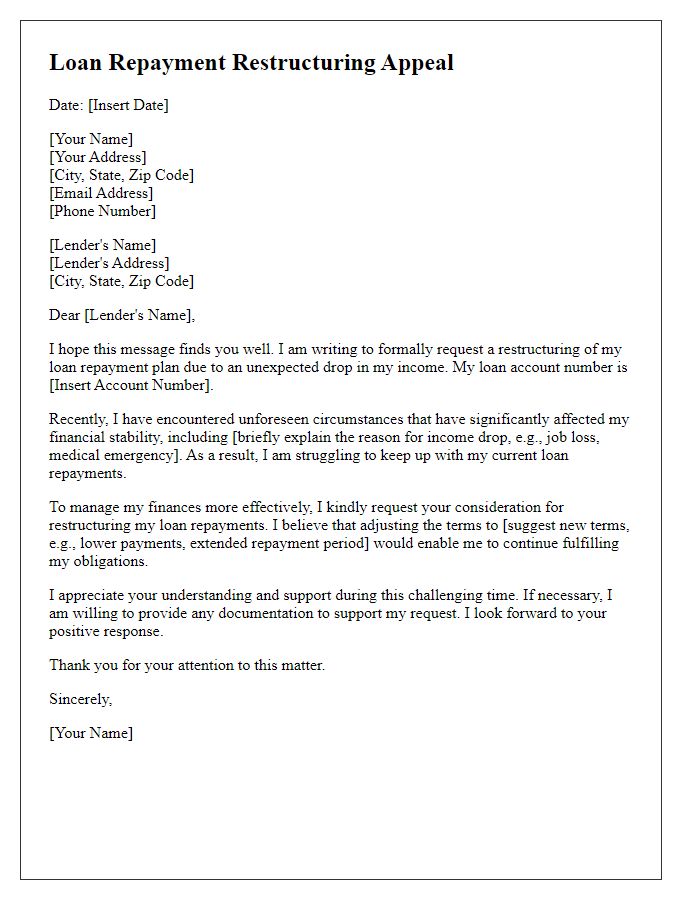

Letter template of appeal for loan repayment restructuring due to unexpected income drop.

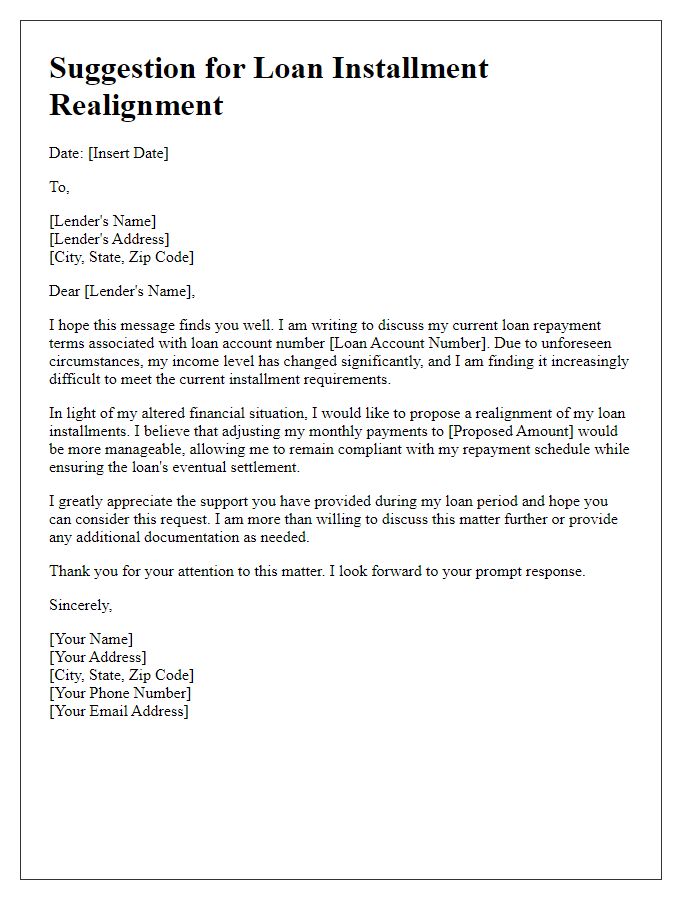

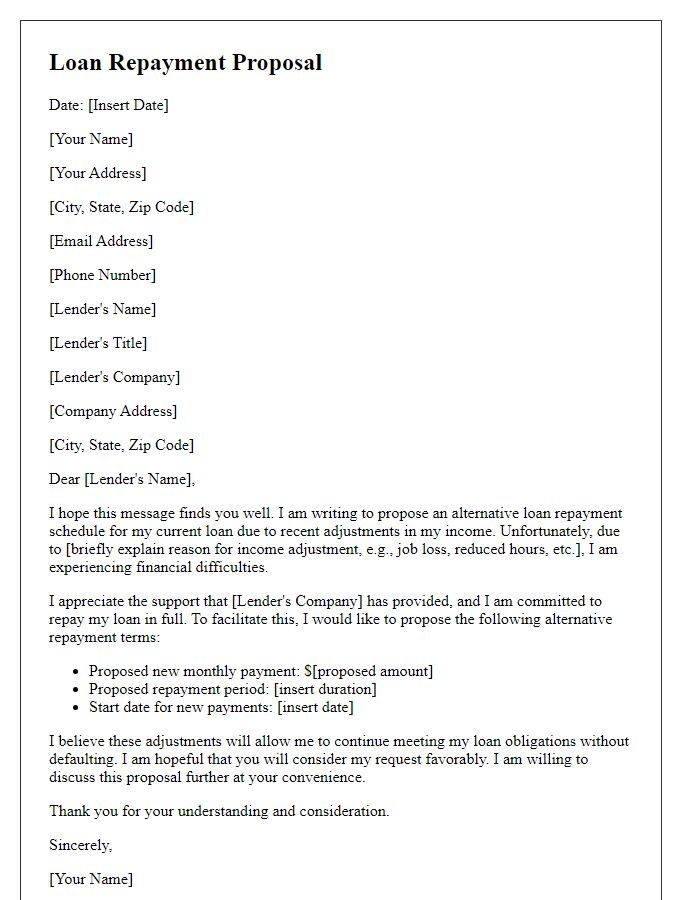

Letter template of suggestion for loan installment realignment with altered income levels.

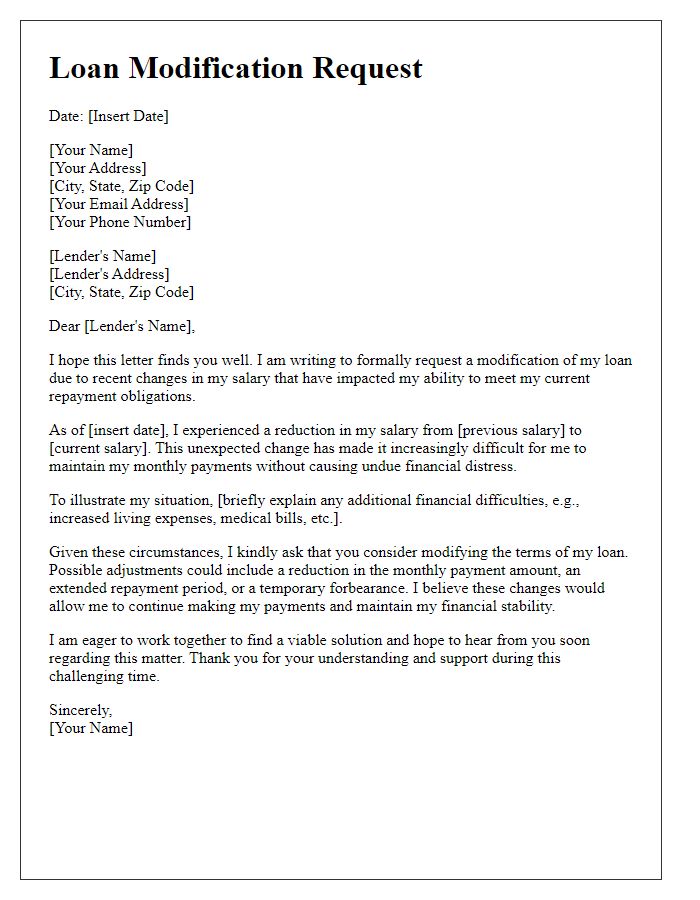

Letter template of explanation for seeking loan modification linked to salary changes.

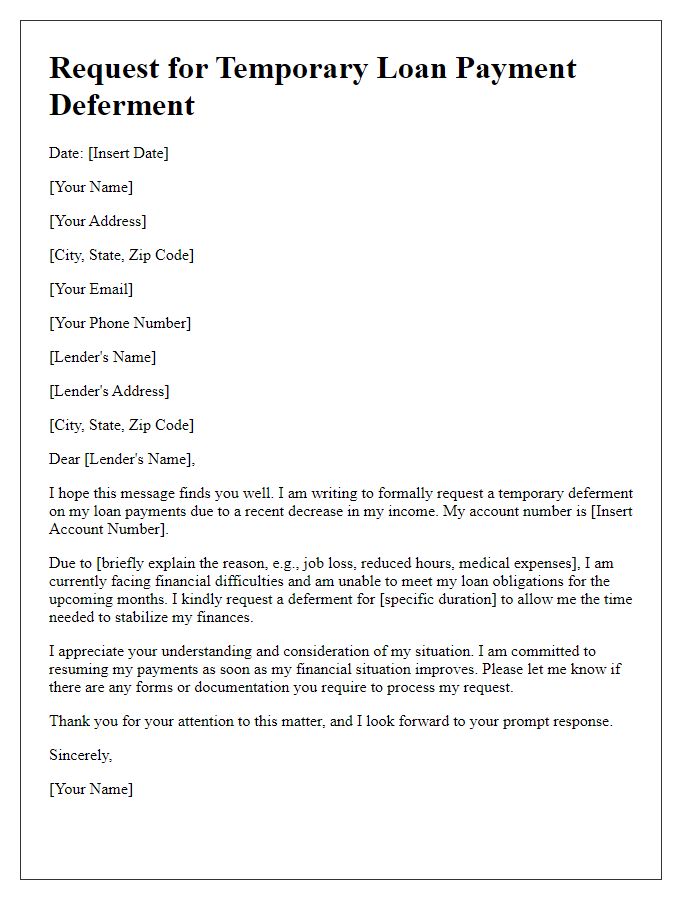

Letter template of formal request for a temporary loan payment deferment due to income decrease.

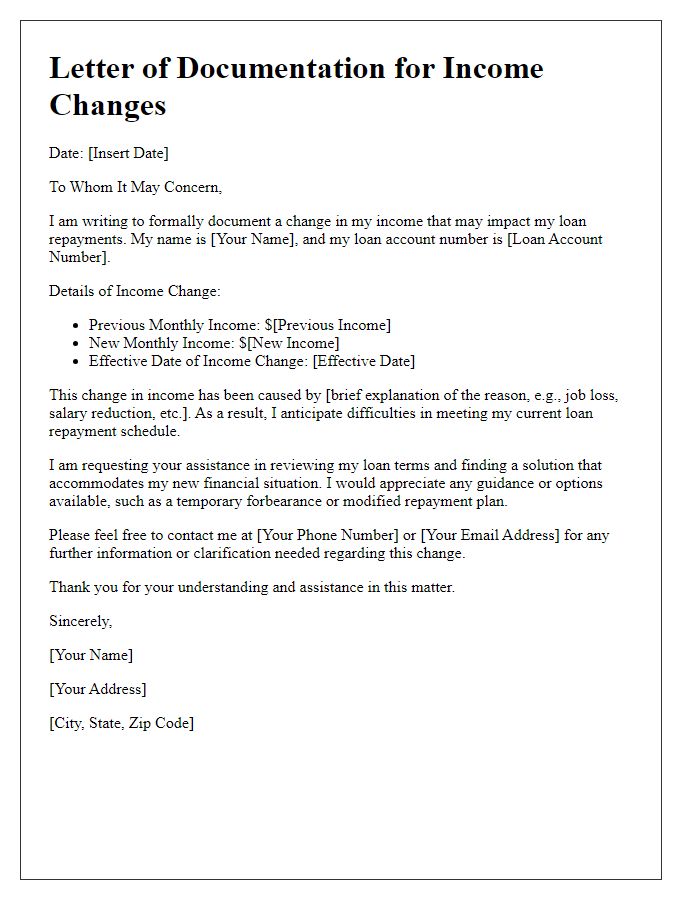

Letter template of documentation for income changes impacting loan repayments.

Comments