Are you facing financial hardships and struggling to keep up with your loan payments? You're not alone! Many individuals find themselves in similar situations where they need a little extra time to get back on their feet. In this article, we'll provide guidance on how to effectively draft a letter for loan deferment due to hardshipâyour first step towards financial relief. Read on to discover tips that can help ease your burden!

Personal Identification Details

Loan deferment requests due to financial hardship often involve providing personal identification details to substantiate the claim. Essential information includes the full name of the borrower, which identifies the individual legally responsible for the debt. The Social Security number (SSN) serves as a unique identifier, ensuring accurate account linking and verification. Address details, including the street address, city, state, and zip code, establish residency and facilitate communication. The loan account number is critical, as it ensures that the specific loan being discussed is identified in correspondence. Recent income documentation or pay stubs may also be included, evidencing the financial situation that necessitates deferment.

Clear Explanation of Hardship

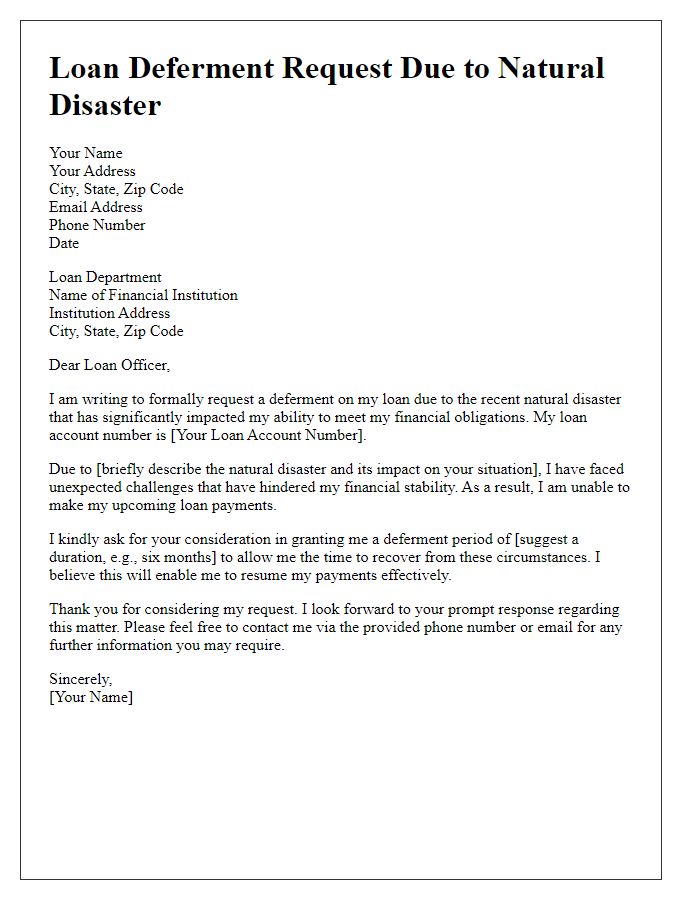

Experiencing unexpected financial hardships can severely impact a borrower's ability to meet loan obligations. Factors such as job loss (with unemployment rates soaring to 14.8% during the COVID-19 pandemic), medical emergencies resulting in high bills, or natural disasters like hurricanes (Hurricane Maria in Puerto Rico left thousands without income) can create urgent financial distress. Homeowners may struggle to keep up with mortgage payments as monthly expenses for necessities such as food (USDA reported a 4.7% increase in grocery prices) and utilities skyrocket. Additionally, personal circumstances, including the loss of a primary wage earner in the family or divorce, can significantly alter financial stability. Seeking loan deferment during these trying times is crucial to regain footing without jeopardizing credit scores or facing foreclosure (which saw a 2% increase in filings during economic downturns).

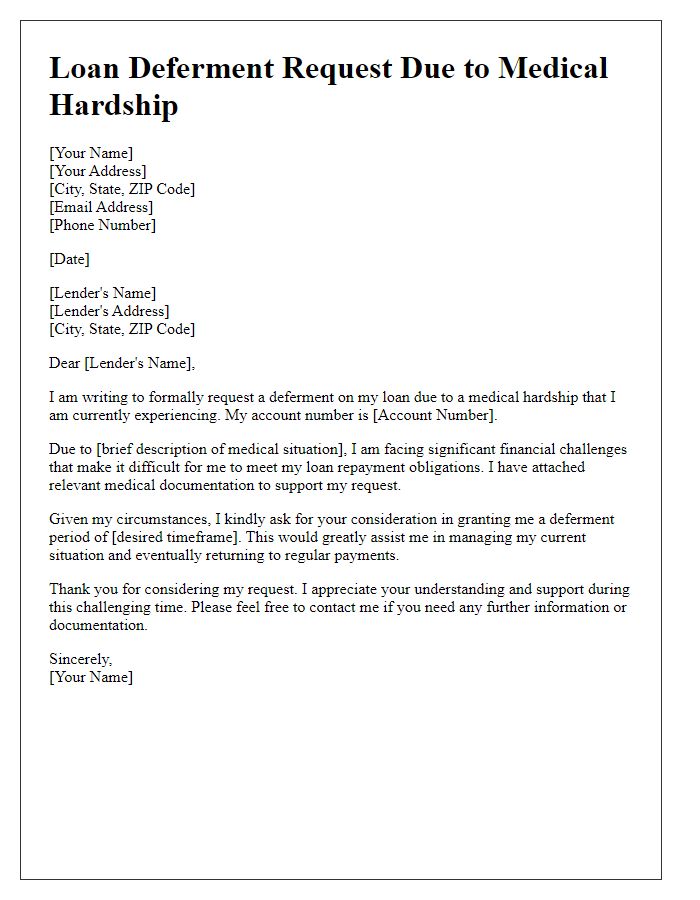

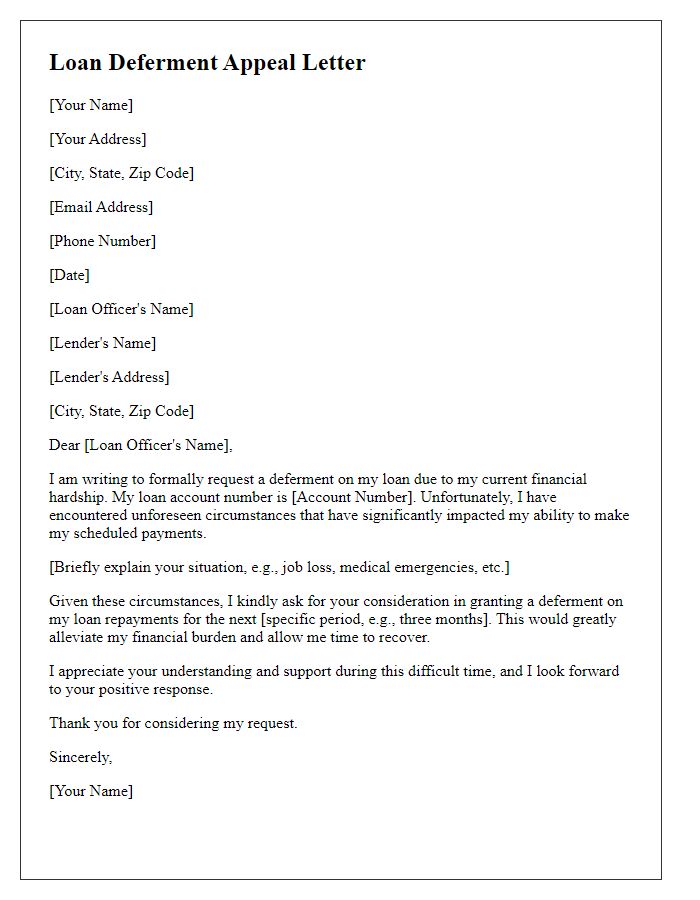

Request for Deferment

Financial hardships can significantly impact individuals and families, often leading to requests for loan deferment. Economic challenges, such as sudden job loss, medical expenses, or unexpected repairs (which can amount to thousands of dollars), often require immediate financial attention. Deferment allows borrowers to temporarily suspend repayment, providing crucial relief during difficult times. For example, federal student loans can offer deferment periods up to three years based on unemployment status or economic hardship. Documentation, such as income statements or medical bills, is typically required to support the request, ensuring that lenders understand the borrower's situation. Addressing this need promptly can help borrowers avoid late fees and maintain credit scores during stressful periods.

Supporting Documentation

Individuals experiencing financial hardship often seek loan deferment options to manage their repayment obligations, particularly during unforeseen circumstances like job loss or medical emergencies. Supporting documentation plays a crucial role in validating a request for deferment. Common documents include recent pay stubs, indicating income levels; bank statements, reflecting current financial status; and unemployment letters from the state's labor department, confirming job loss. Additional evidence, such as medical bills from hospitals or clinics and tax returns from the previous year, can also strengthen the application. By providing a comprehensive array of documentation, borrowers can demonstrate their financial struggles and increase their chances of receiving loan deferment approval.

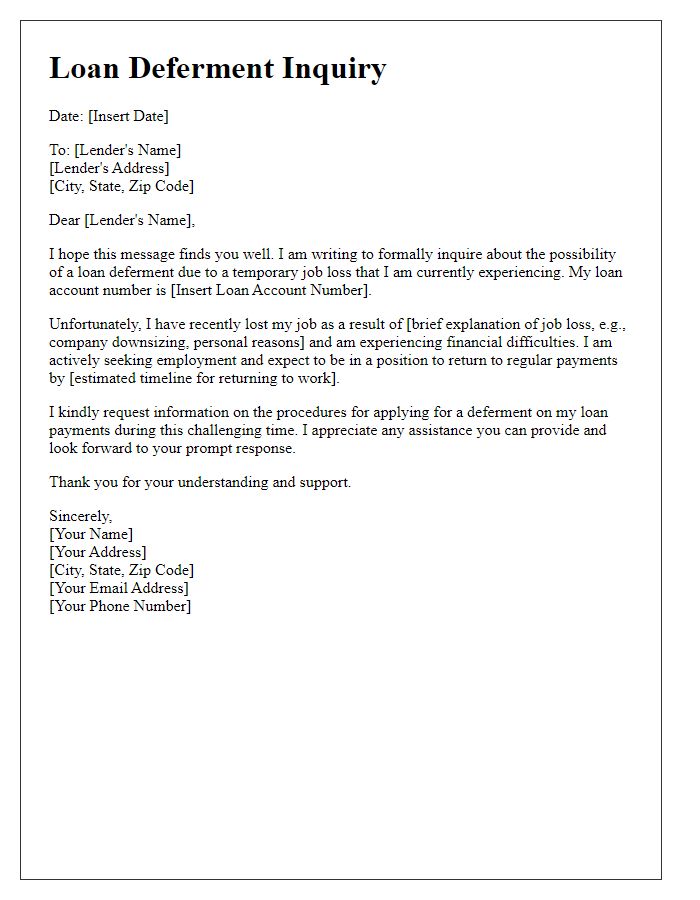

Contact Information for Follow-up

Loan deferment requests often arise due to unforeseen financial hardships impacting borrowers. Essential details include the borrower's full name, account number, and contact information, such as an active phone number and email address. Loan servicers may request supporting documentation, like recent pay stubs or proof of income loss, to assess eligibility for a deferment. Clear communication channels are indispensable, ensuring efficient processing of the request and timely follow-ups regarding the loan status. Understanding specific guidelines provided by institutions, such as the Federal Student Aid office or private lenders, can significantly influence the outcome of deferment applications.

Letter Template For Loan Deferment Due To Hardship Samples

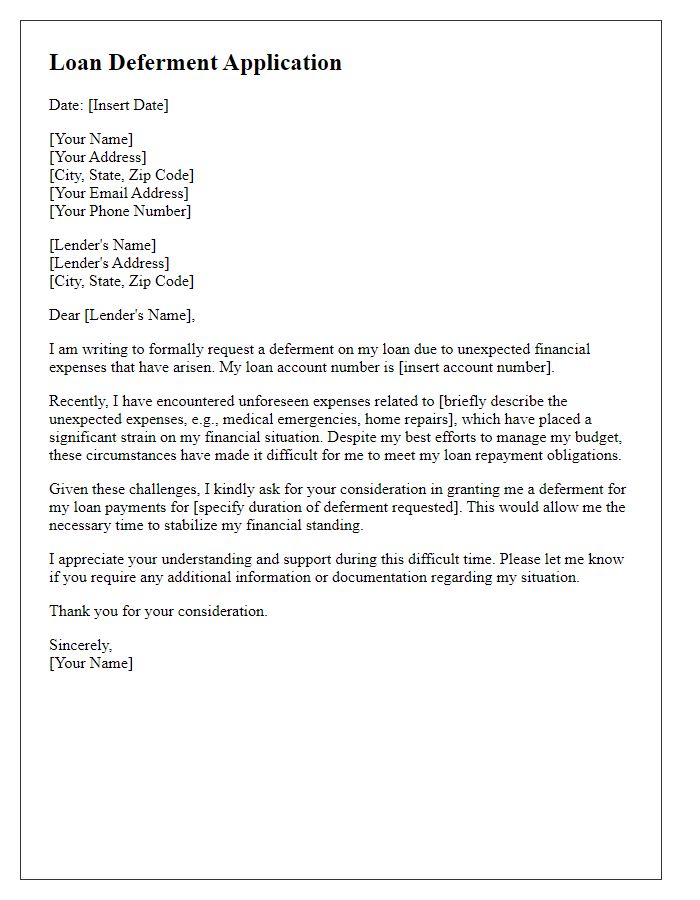

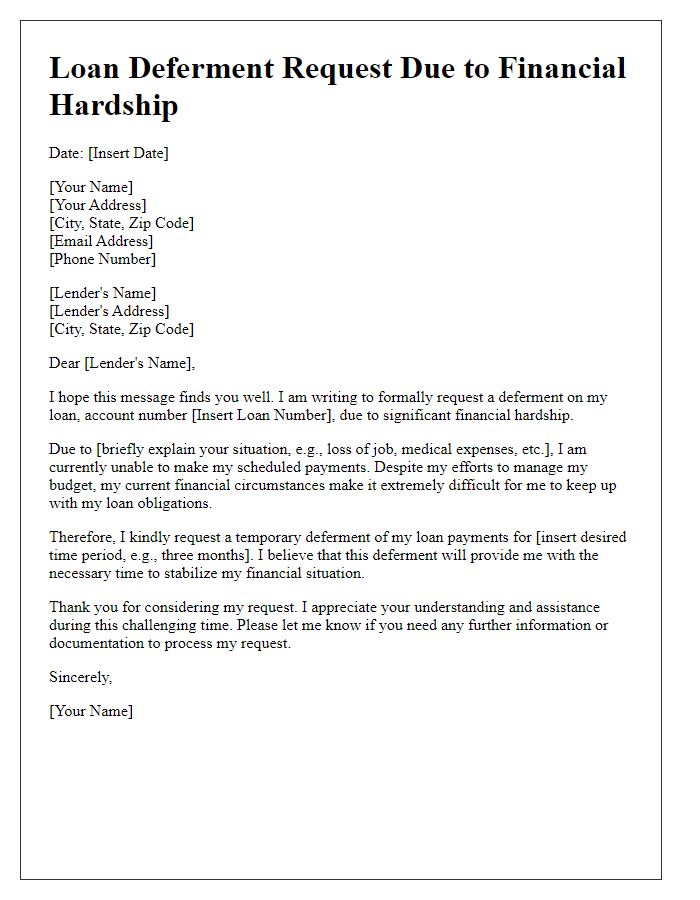

Letter template of loan deferment application due to unexpected expenses.

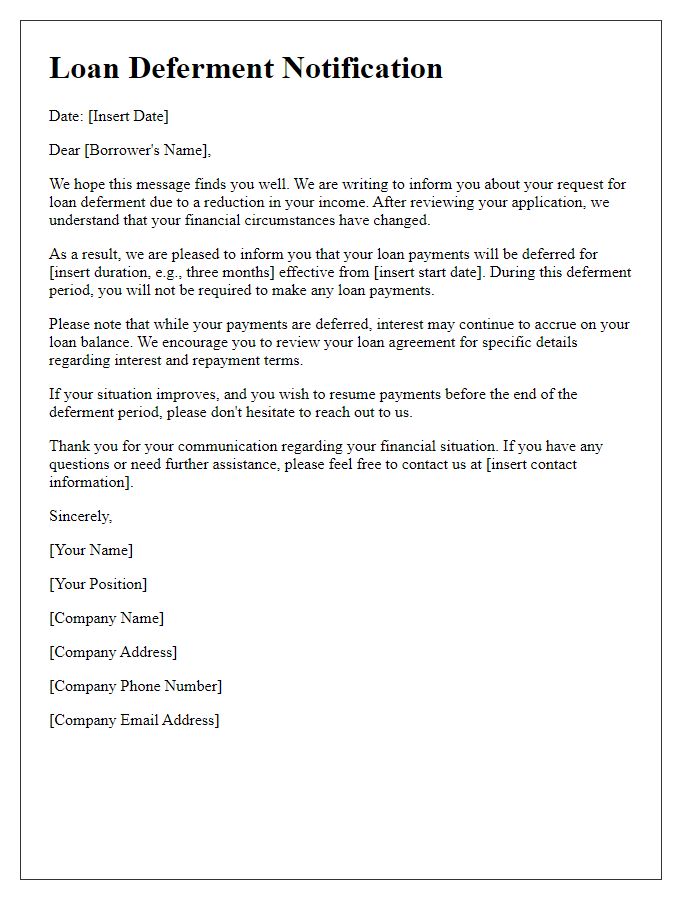

Letter template of loan deferment notification following income reduction.

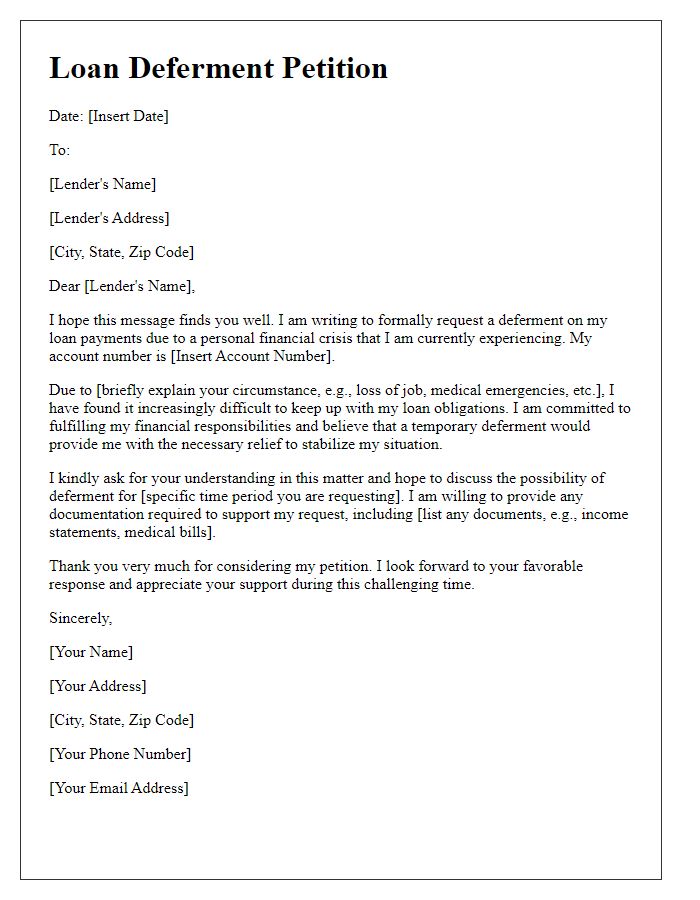

Letter template of loan deferment petition during personal financial crisis.

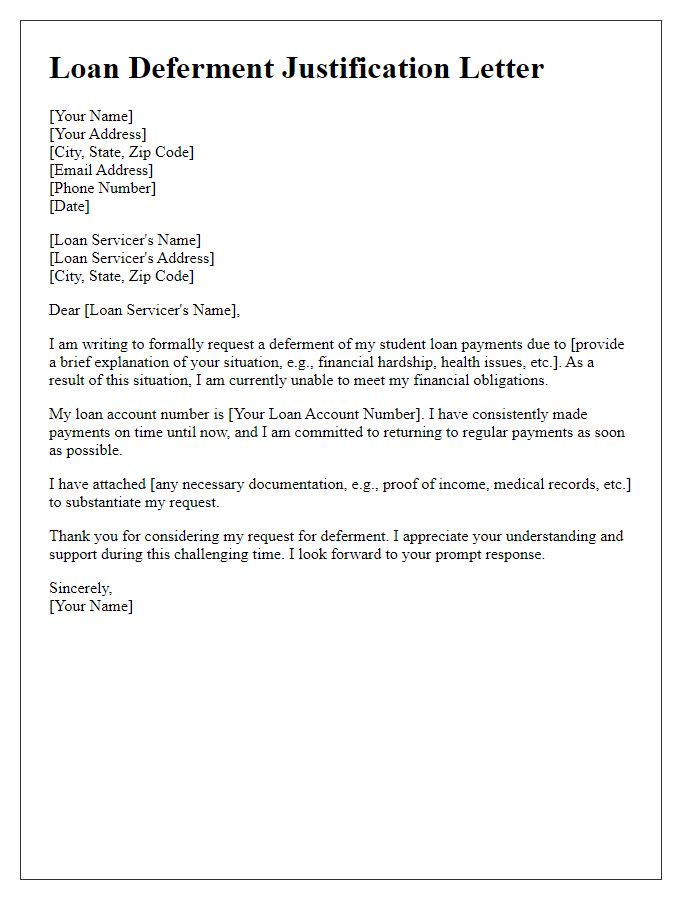

Letter template of loan deferment justification for student loan relief.

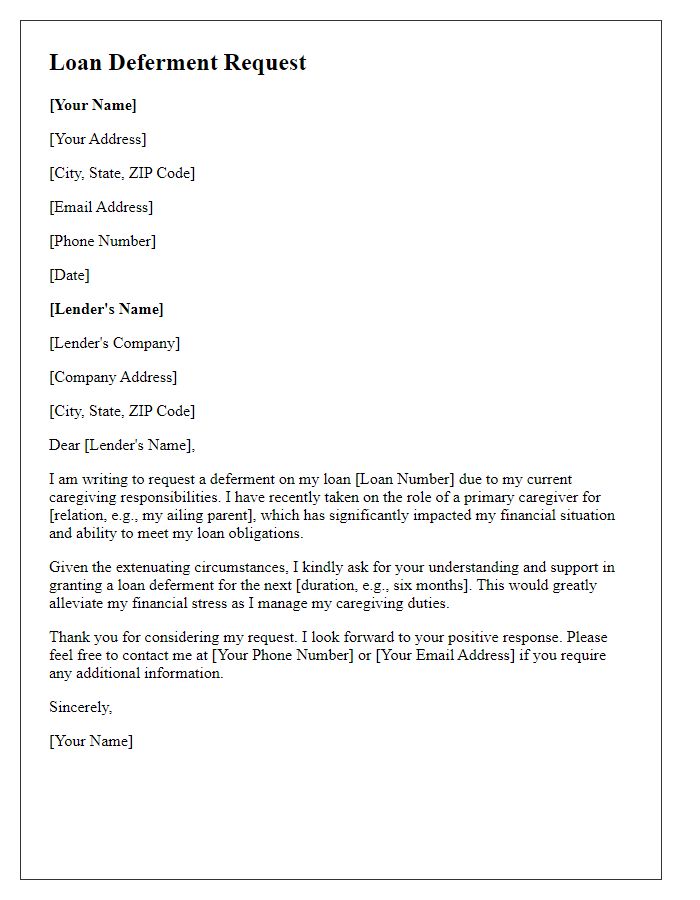

Letter template of loan deferment request linked to caregiving responsibilities.

Comments