Are you feeling overwhelmed by your current loan terms? It's not uncommon to seek adjustments as our financial situations can change unexpectedly. In this article, we'll discuss how to effectively request a re-evaluation of your loan terms, empowering you to navigate your finances with confidence. Join us as we explore the essential steps you can take to secure a more favorable agreement!

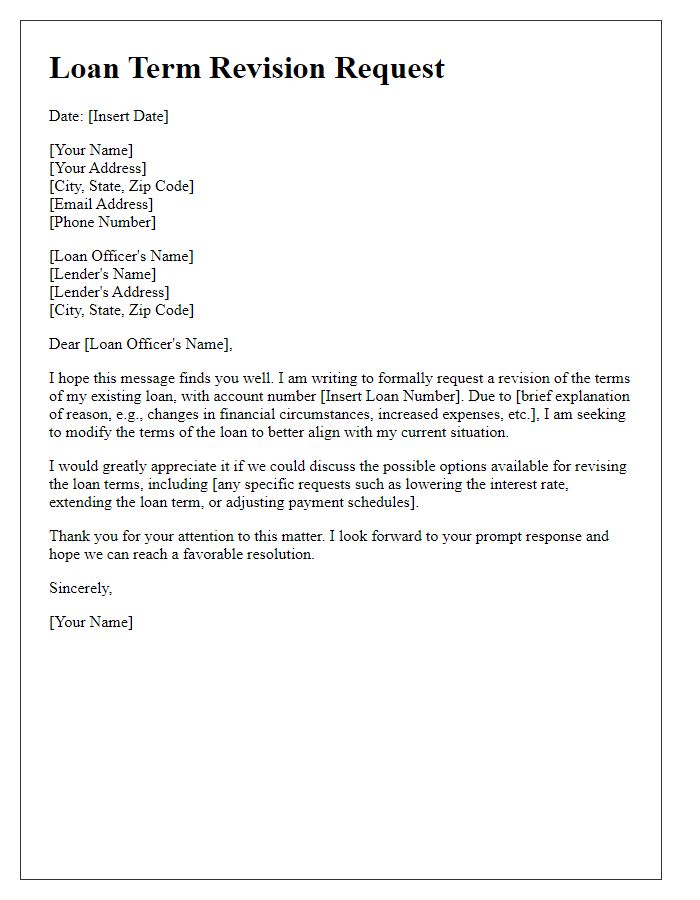

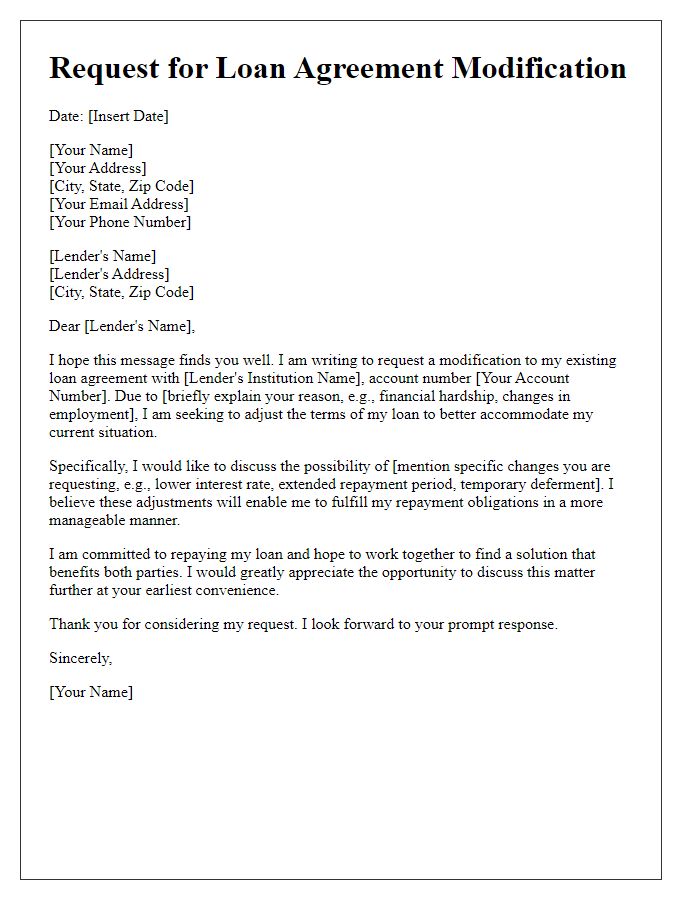

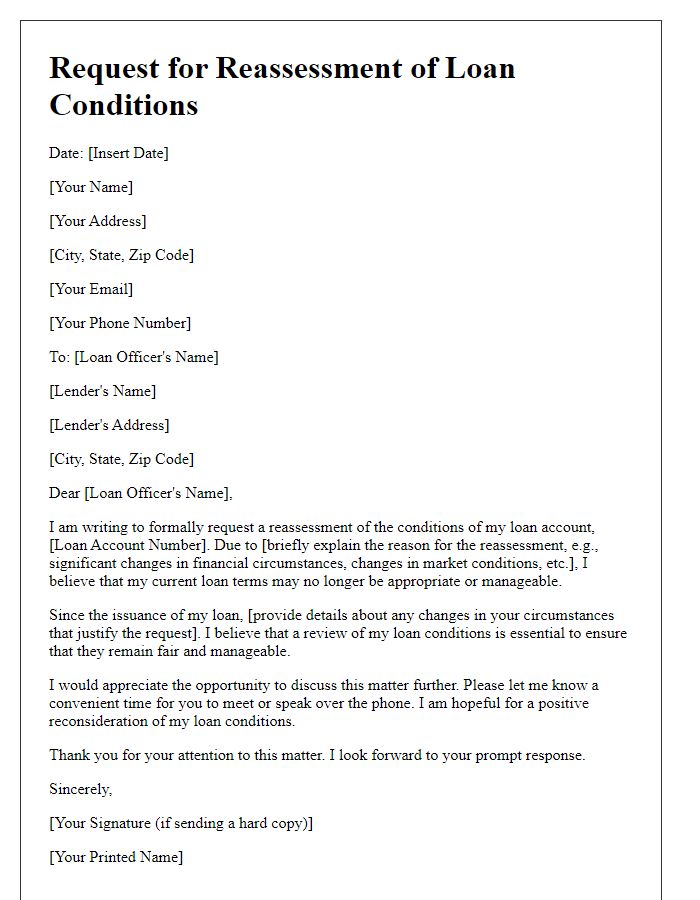

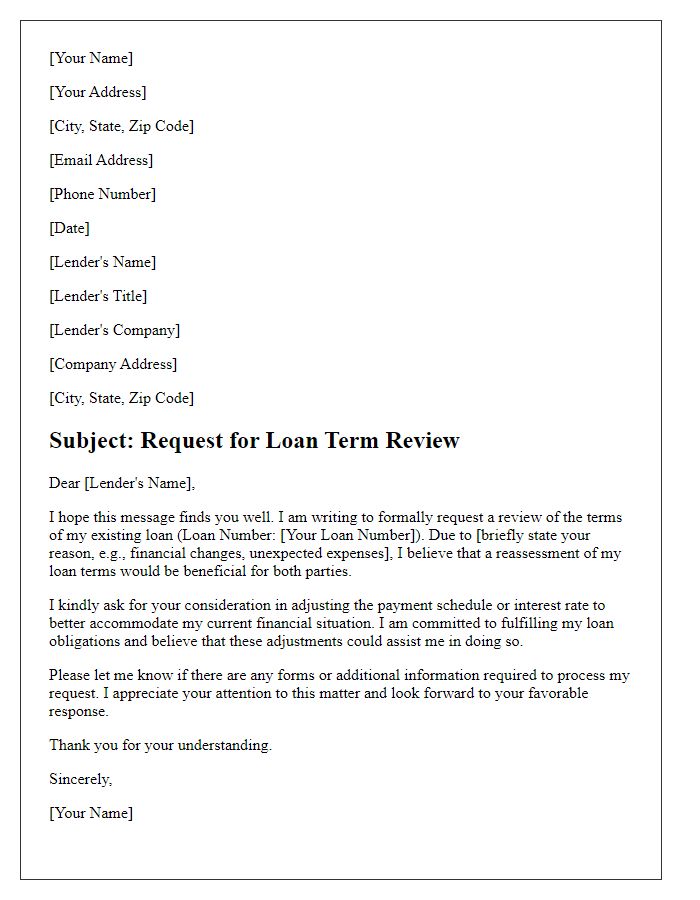

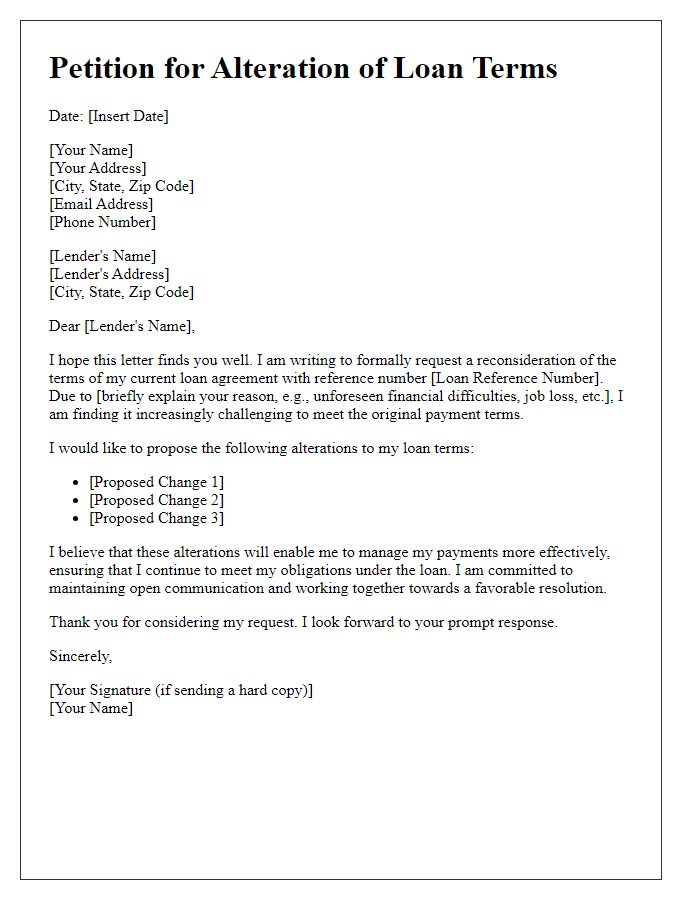

Personal Information and Loan Details

A loan term re-evaluation request requires specific personal information and loan details to effectively communicate with the financial institution. This includes your full name, contact information (phone number and email address), and mailing address for identification purposes. Additionally, details about the loan, such as the loan account number, original loan amount (often over $10,000), interest rate (for example, 5% fixed), monthly payment amount, and remaining balance as of the request date are crucial. Indicating the reason for the request--such as changes in financial circumstances, unexpected medical expenses, or job loss--provides context. Lastly, specifying desired changes to the loan terms, like extending the repayment period or modifying the interest rate, can facilitate a productive dialogue with the lender.

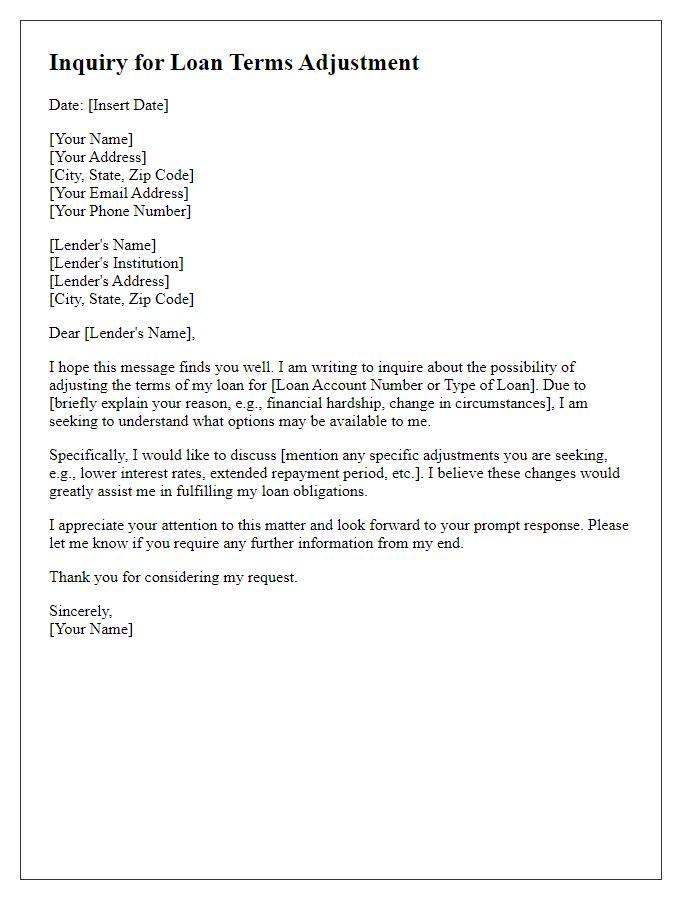

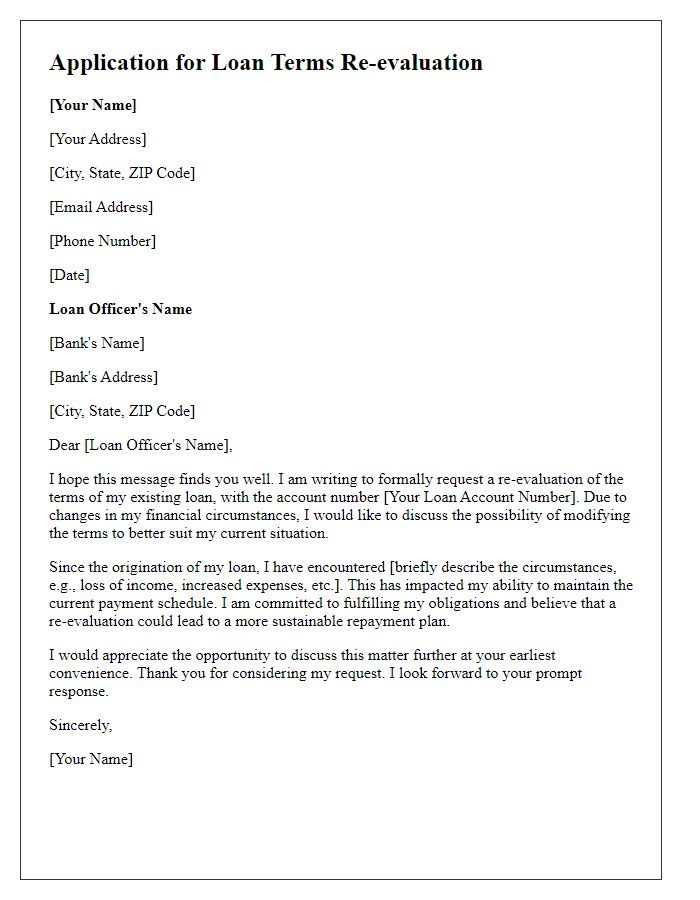

Reason for Re-Evaluation Request

The rising cost of living has significantly impacted personal finances throughout the United States. Many individuals, especially in metropolitan areas like New York City and San Francisco, are facing financial strain due to inflation rates that peaked at over 9% in mid-2022. Increased expenses related to housing, groceries, and healthcare add to this burden. Individuals from various economic backgrounds are seeking relief through reconsideration of their existing loans. The need for lower interest rates or extended repayment periods has become apparent, urging borrowers to reach out to lenders to request loan term re-evaluations. Such adjustments can provide much-needed financial flexibility and assist borrowers in maintaining timely payments without sacrificing essential living expenses.

Supporting Financial Documentation

A request for loan term re-evaluation may require comprehensive financial documentation to support the case. Essential documents typically include recent bank statements reflecting income trends, tax returns from the last two years evidencing fiscal stability, and a detailed personal budget outlining monthly expenses. Additionally, a credit report showcasing current credit scores and any outstanding debts can provide insight into the borrower's financial health. Documentation regarding any significant life changes, such as job loss or medical expenses, may also bolster the request. All these elements help present a clear picture of financial circumstances to lenders, illustrating the need for potentially adjusted repayment terms.

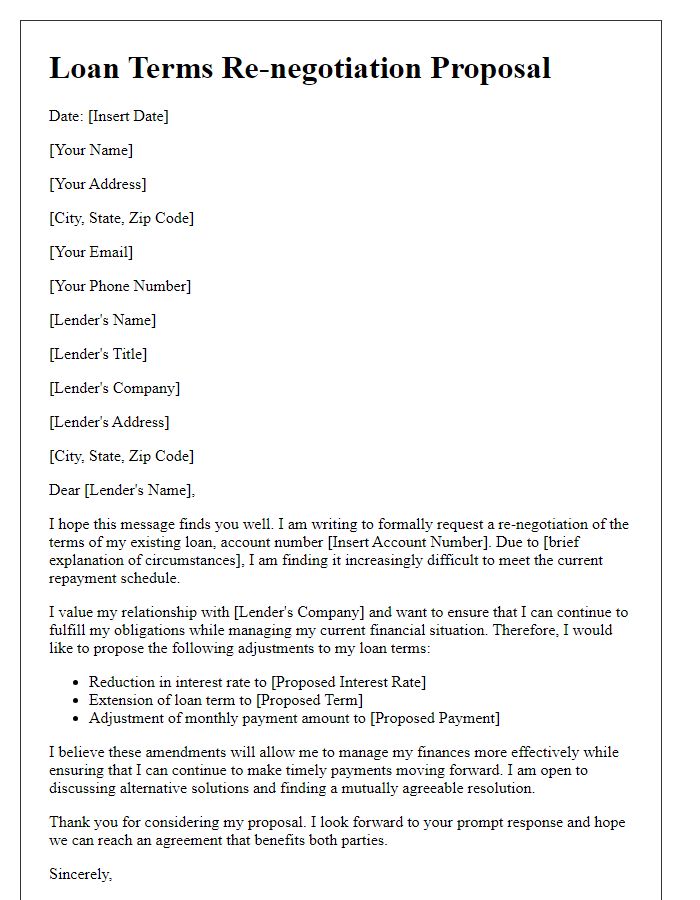

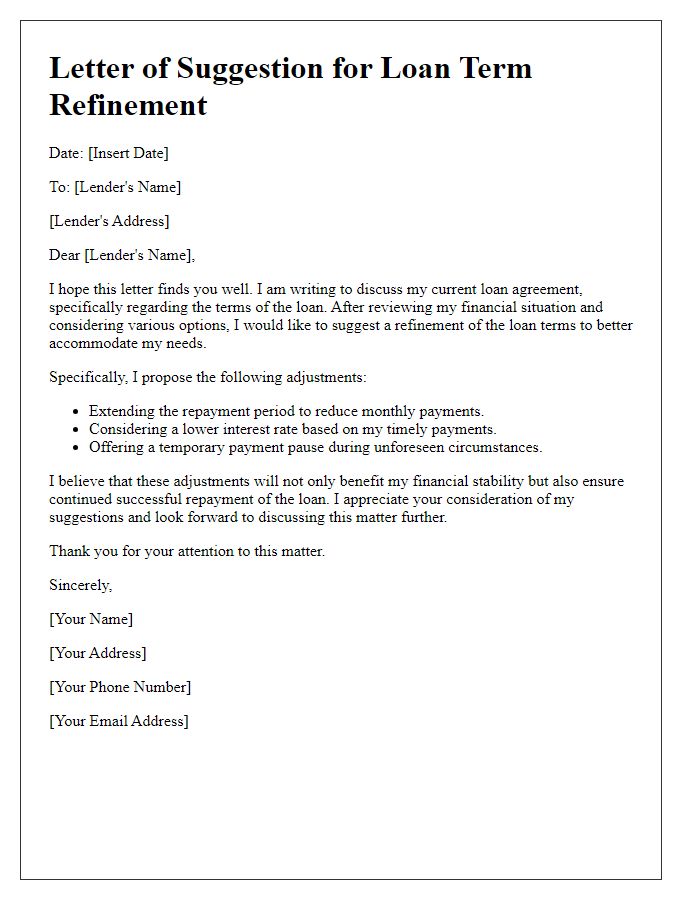

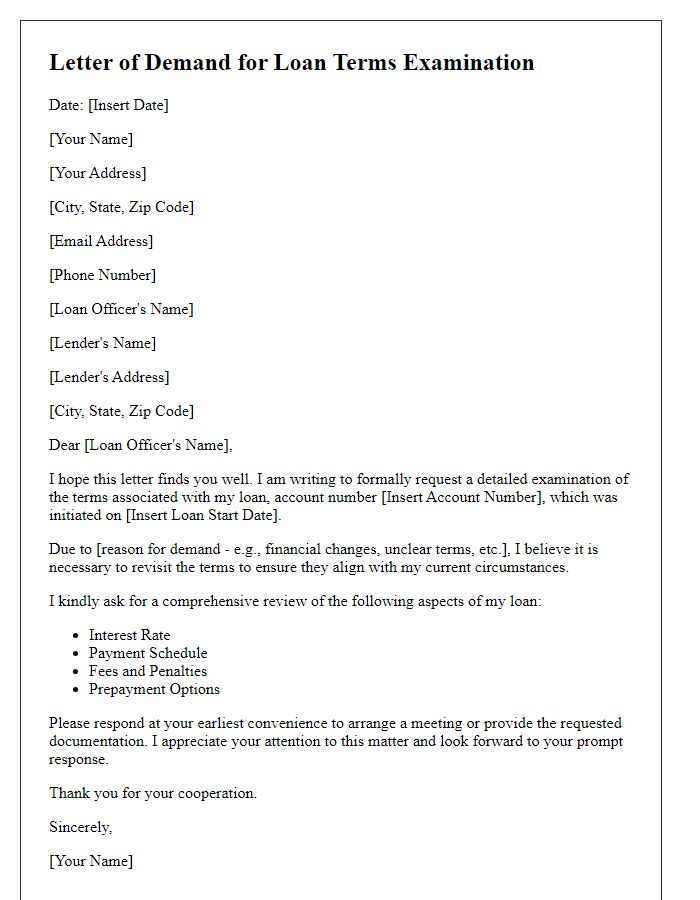

Proposal for New Terms

A loan term re-evaluation is essential for borrowers seeking to adjust their repayment conditions due to changing financial circumstances. This process involves submitting a formal request to the lending institution, detailing the need for modified loan terms such as extended repayment periods or reduced interest rates. Specific examples include a personal loan with an original term of five years and a fixed interest rate of 8%, where financial hardship has emerged due to unforeseen events like job loss or medical expenses. Providing evidence such as bank statements, income changes, and an explanation of challenges faced can strengthen the proposal. Institutions like Bank of America, Wells Fargo, or regional credit unions often offer options for borrowers to initiate this re-evaluation process, potentially leading to more manageable debt repayment strategies.

Contact Information and Request for Meeting

A loan term re-evaluation request typically seeks to adjust the conditions of financial support such as interest rates or repayment schedules. This process often requires documentation like credit history reports and current financial statements to provide a clearer picture of financial standing. Institutions like banks, credit unions, and online lenders may require specific forms filled for this re-evaluation process. Notably, community banks like First National Bank or regional credit unions often offer personalized service, which can aid in negotiating more favorable terms. Preparing for a meeting with a financial advisor or loan officer can lead to better outcomes in renegotiating loan terms, especially when backed by solid evidence of improved financial stability.

Comments