If you've recently faced a loan denial, you're not aloneâmany people find themselves in the same frustrating situation. Understanding the reasons behind the lender's decision can be the first step toward a successful appeal. With the right approach, crafting a compelling letter can make a significant difference in your chances of securing the funding you need. Grab a cup of coffee and join us as we explore effective strategies for writing an appeal letter that can turn your loan denial into a loan approval!

Clearly state the purpose of the appeal.

An appeal regarding the recent denial of a loan application is being submitted. The loan, administered through a financial institution in accordance with federal guidelines, was applied for on October 1, 2023. The requested amount, $15,000, aimed to finance home renovations in Springfield, Illinois, enhancing property value and ensuring safety standards. Additional supporting documents highlighting steady income reported for years, including pay stubs and tax returns, are provided to demonstrate financial stability. The appeal seeks a reconsideration of the eligibility criteria since the primary reasons cited for denial, which include credit score issues, do not adequately reflect recent improvements and responsible credit behavior following past setbacks. Therefore, a review of this decision is requested to facilitate the loan approval process.

Provide additional relevant financial information.

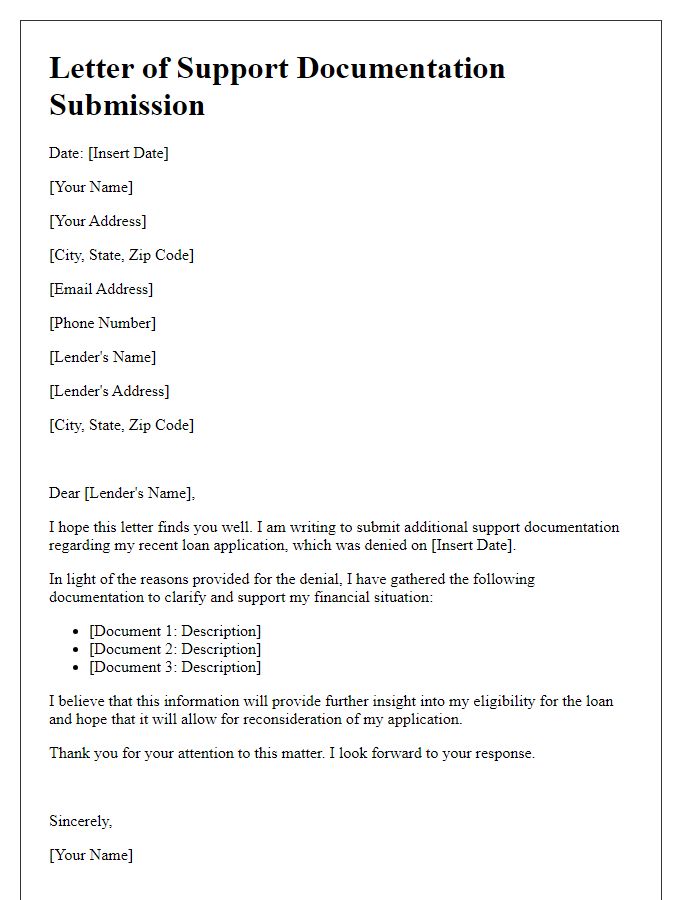

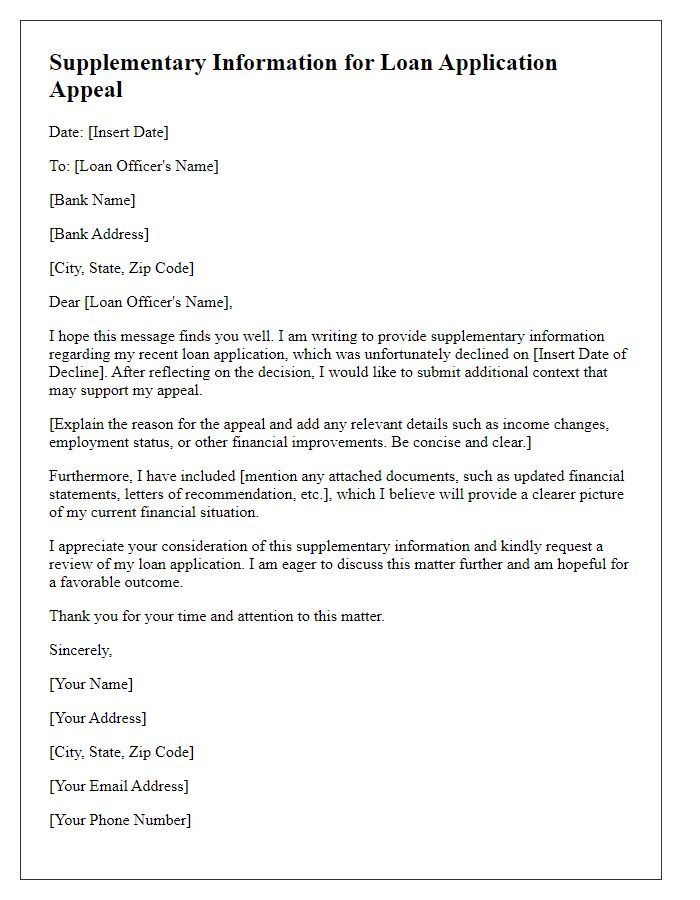

Loan denial appeals can be bolstered by presenting additional financial information that underscores the applicant's eligibility. Documents such as updated credit reports reflecting recent improvements in credit scores, tax returns from the past two years showing steady income, and bank statements revealing a consistent savings habit can fortify an appeal. Employment verification letters from current employers can demonstrate job stability, while proof of additional sources of income like side jobs or investments can also enhance financial standing. Furthermore, outlining a budget that showcases financial management skills and plans for repayment can provide lenders with a clearer picture of fiscal responsibility and the ability to meet loan obligations. Incorporating these elements into the appeal package can significantly improve the chances of overturning a loan denial.

Highlight any recent changes in circumstances.

Recent changes in financial circumstances can significantly influence loan application outcomes. For instance, a newly secured employment position at a reputable company, such as Tech Innovations Inc. with an annual salary increase of 20%, strengthens the applicant's ability to repay the loan. Acquiring additional assets, including a valuable real estate investment worth $250,000, also enhances financial stability. Moreover, a recent reduction in monthly expenses, such as a decrease in rent due to a move to a more affordable apartment, illustrates an improved financial situation. Providing documentation of these changes, such as pay stubs, budget plans, or asset appraisals, can further support the appeal for a loan reconsideration, emphasizing the improved ability to meet payment obligations.

Offer potential collateral or security.

A loan denial decision can significantly impact financial planning and aspirations. Applicants often face hurdles such as insufficient credit scores (typically below 650 for conventional loans) or high debt-to-income ratios (above 43%, which lenders often consider risky). In appealing for reconsideration, potential collateral (such as real estate, vehicles, or savings accounts) can provide security for lenders, demonstrating commitment and lowering risk. A well-structured appeal may include recent improvements in credit scores or consistent income verification to reinforce the application's reliability. Highlighting specific financial circumstances, like temporary employment changes or unexpected medical expenses, may offer a compelling narrative to secure a favorable outcome.

Maintain a polite and professional tone.

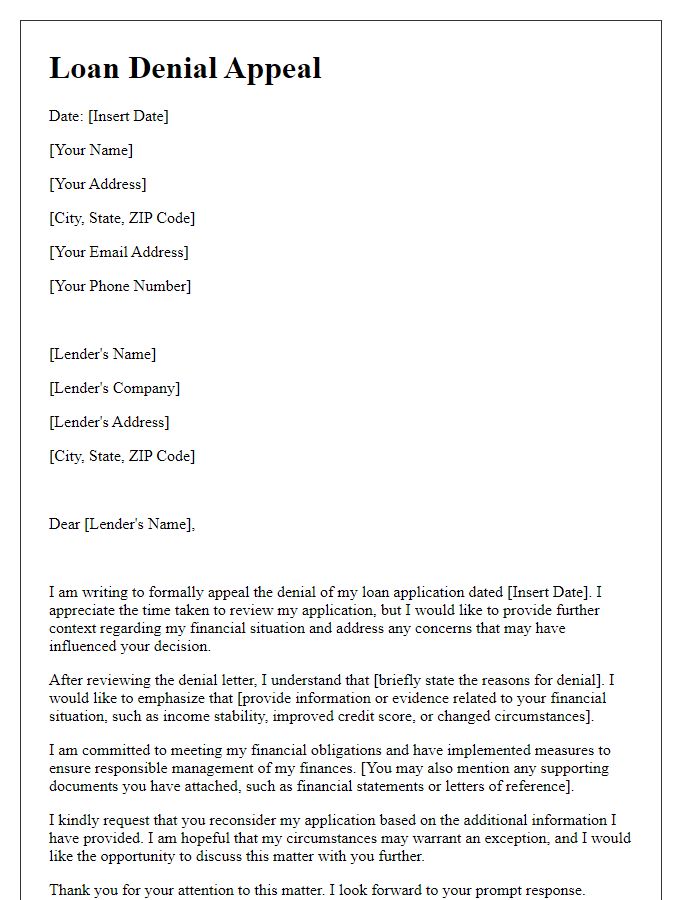

Loan denials can significantly impact financial plans, often leaving applicants feeling confused and uncertain. When requesting a reconsideration of a loan denial from a financial institution, it's essential to clearly state the reason for the appeal while maintaining a courteous and respectful tone. Begin by acknowledging the bank's assessment of the loan application, emphasizing appreciation for their review process. Provide additional context or documentation that addresses any concerns highlighted in the denial letter. For instance, if the denial was due to a low credit score, include recent reports indicating efforts to improve it. Relevant figures, such as current income or debt levels, can bolster the appeal by illustrating a stronger financial position than previously presented. Also, highlighting a solid repayment history with other creditors can demonstrate reliability. Conclude by expressing hope for a reevaluation of the application, reinforcing commitment to fulfilling loan obligations responsibly. Emphasizing an intention for a long-term relationship with the institution can also enhance the appeal's impact.

Letter Template For Appealing Loan Denial Decision Samples

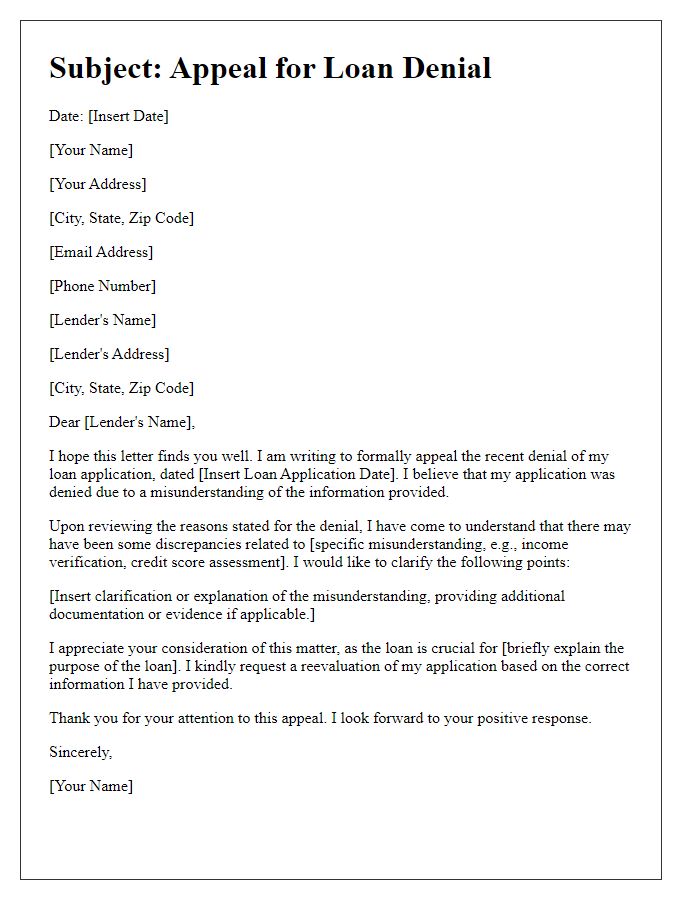

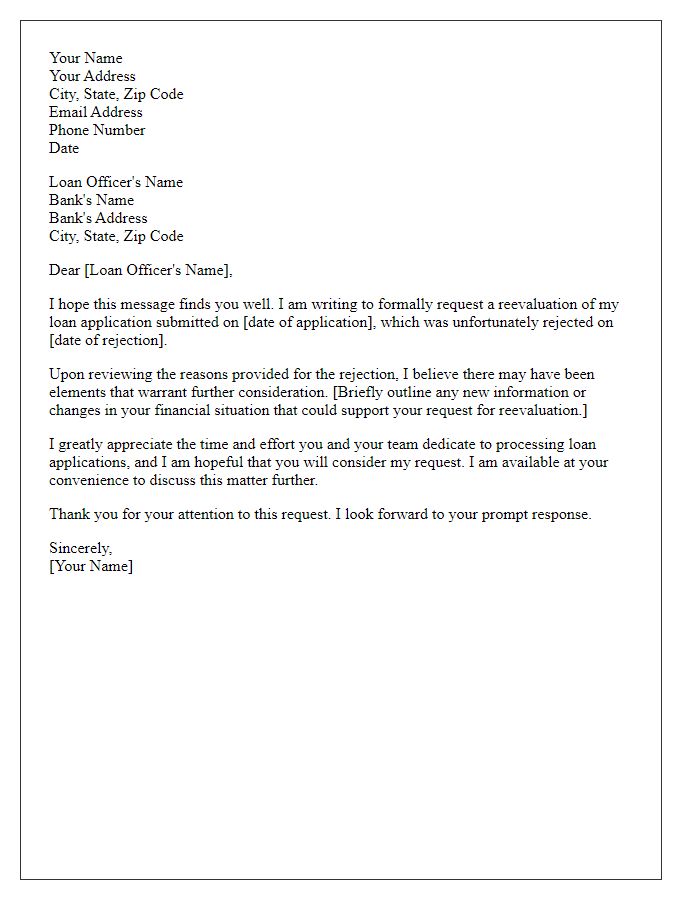

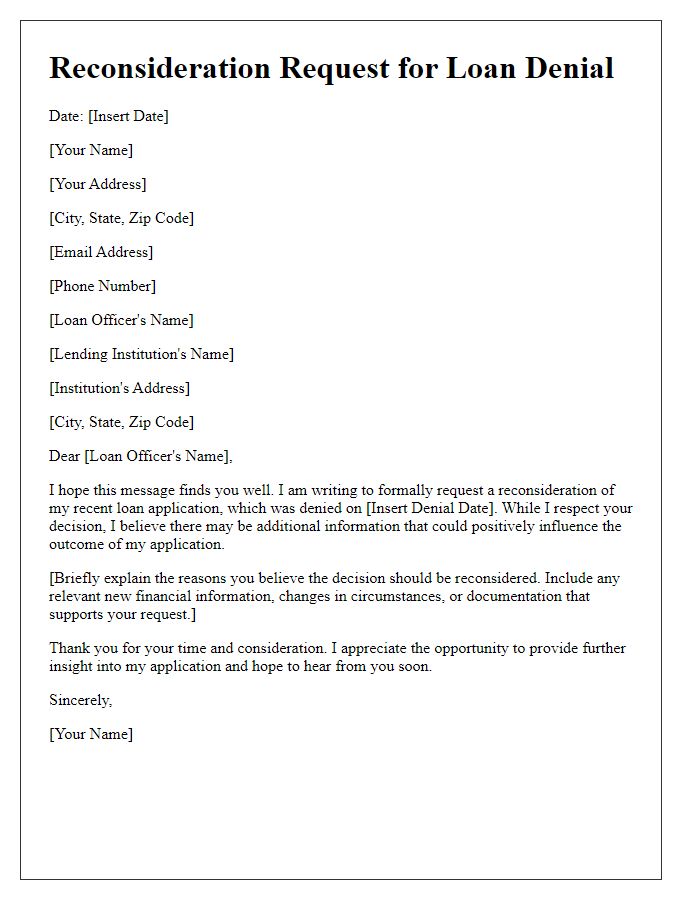

Letter template of appeal for loan denial due to misunderstanding of information.

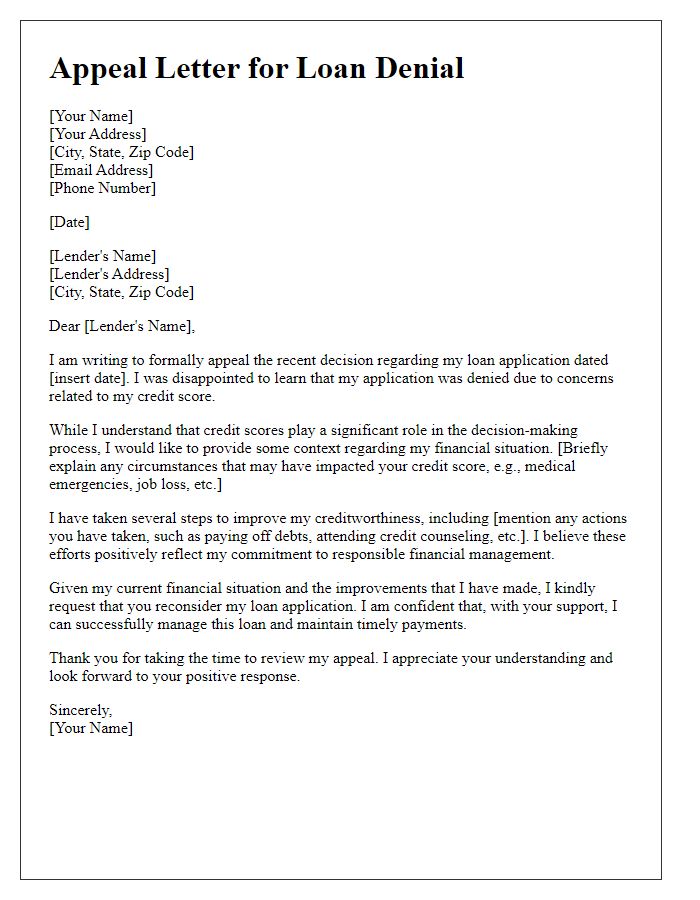

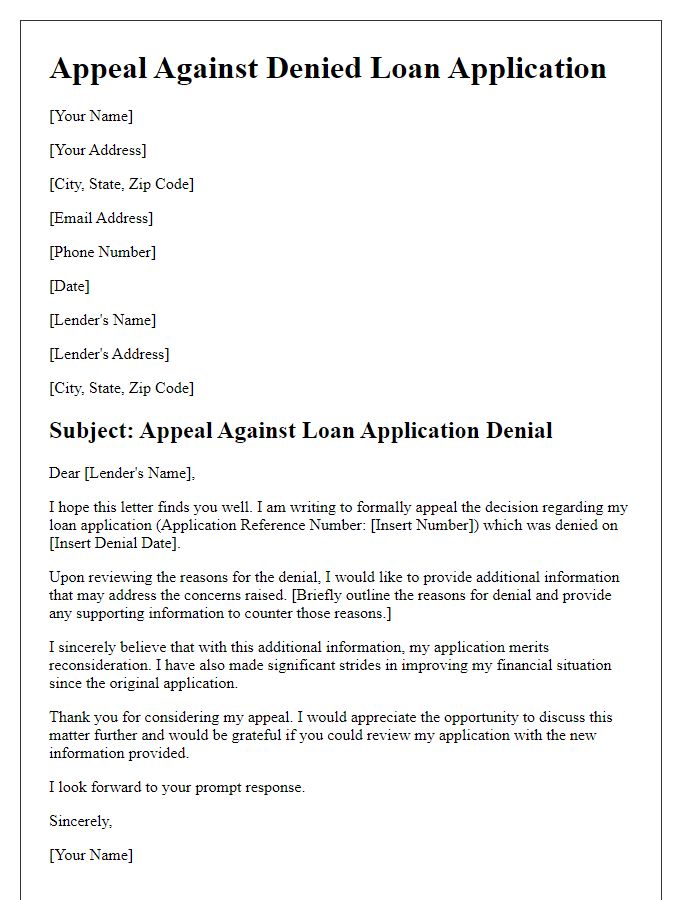

Letter template of appeal addressing credit score concerns in loan denial.

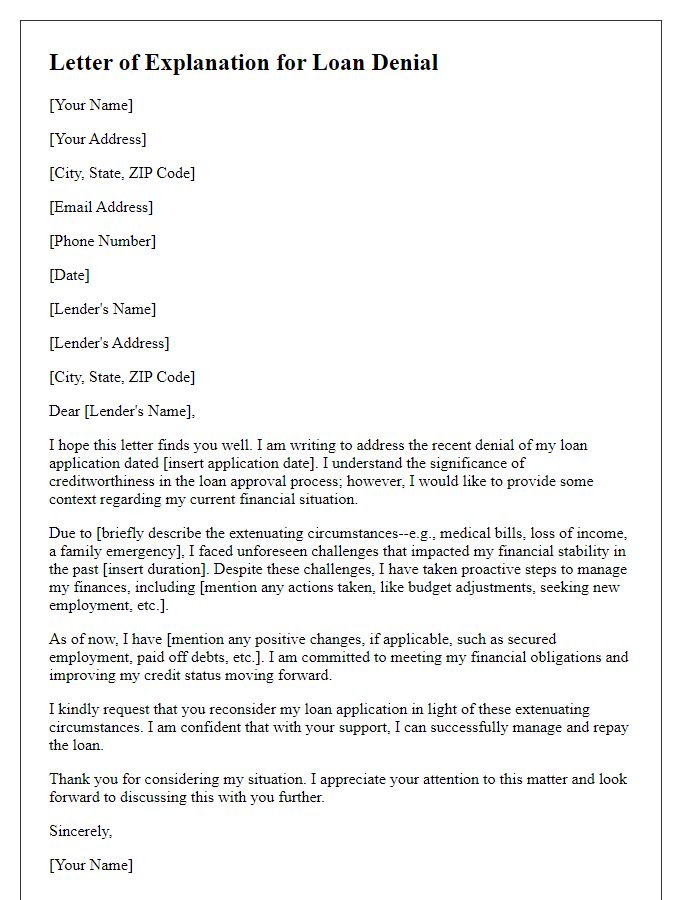

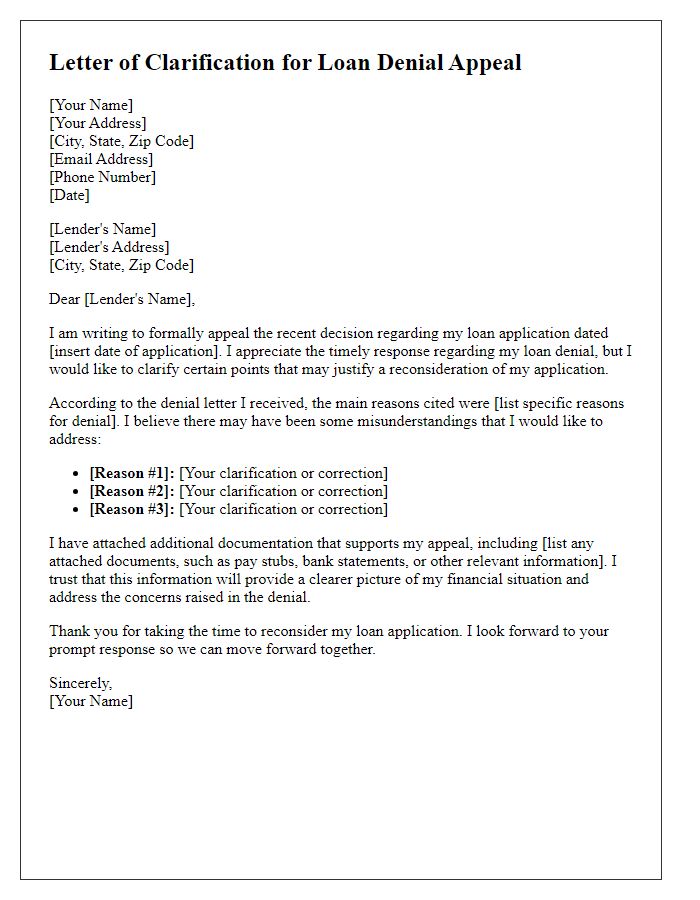

Letter template of extenuating circumstances explanation for loan denial.

Comments