Life can throw us unexpected challenges, and one of the most difficult situations is dealing with an unexpected loan default. Many people experience unforeseen circumstances like job loss or medical emergencies that can disrupt their financial stability. If you find yourself in this predicament, it's important to communicate your situation clearly and honestly with your lender. Read on to discover a helpful template for writing a letter that explains your loan default and sets the stage for a constructive dialogue.

Clear and concise explanation of circumstances.

Unexpected loan defaults can occur due to unforeseen financial hardships, such as sudden job loss, medical emergencies, or significant economic downturns affecting income stability. For instance, individuals may encounter job loss due to company layoffs in industries like retail or hospitality, which have seen fluctuations during economic challenges. Major medical expenses from surgeries or long-term treatments can deplete savings rapidly, hindering timely loan payment. Additionally, external factors such as natural disasters (hurricanes, floods) can result in loss of property and increased expenses, straining personal finances further. These circumstances often create a ripple effect, making it difficult for borrowers to meet their financial obligations, leading to defaults on loans, which can affect credit scores and overall financial health.

Evidence of communication and documentation.

Unexpected loan defaults often stem from unforeseen circumstances such as job loss or medical emergencies, impacting repayment ability. Effective communication with lenders, documenting efforts to discuss hardship, is essential. For instance, emails and recorded phone calls provide evidence of timely notification of financial struggles. Lenders, like banks or credit unions, typically require documentation, including pay stubs, medical bills, or unemployment letters, to substantiate claims of hardship. These records illustrate a borrower's willingness to resolve the issue and may lead to options like loan modification or deferment. Proactive engagement can potentially mitigate negative repercussions on credit scores and lead to more manageable repayment solutions.

Demonstration of intent to repay.

Unexpected loan defaults can stem from various factors impacting borrowers' financial circumstances, such as job loss or medical emergencies. The documentation illustrating borrowers' intent to repay includes structured payment plans and commitment letters. Financial records, such as bank statements, highlight borrowers' efforts to secure necessary funds. Communication with lenders showcasing consistent dialogue underscores borrowers' dedication to rectifying defaults. Additionally, evidence of temporary financial relief efforts, like seeking government assistance programs, reflects a proactive approach. Commitment to repaying the loan remains strong, with detailed plans for future repayments indicating accountability and responsibility towards fulfilling obligations.

Proposed solution or repayment plan.

Unexpected loan default can result from various factors including job loss, medical emergencies, or economic downturns. Affected individuals must communicate openly with the lender, providing documentation of the circumstances. A repayment plan may include restructuring the loan, allowing for lower monthly payments or extending the loan term up to five years. Additionally, requesting a temporary deferment could provide relief, enabling borrowers to stabilize their financial situation. Establishing a detailed budget can help prioritize loan repayment while meeting other essential living expenses. Engaging financial counseling services may also offer tailored strategies for managing debt effectively.

Assurance of preventive measures for future defaults.

Unexpected loan defaults can create significant financial strain for both borrowers and lenders. Economic fluctuations, like the recent recession in 2023, contributed to increased unemployment rates leading to reduced income for many individuals. In response, institutions are implementing strategic preventive measures such as enhanced borrower education programs, financial counseling sessions, and regular assessments of loan repayment capabilities. Additionally, adopting technology-driven solutions, like AI-based predictive analytics, can help identify potential default risks earlier in the loan lifecycle, allowing for timely intervention. Furthermore, dedicated support teams focus on restructuring loan agreements to accommodate changing financial situations, ensuring future defaults are minimized effectively.

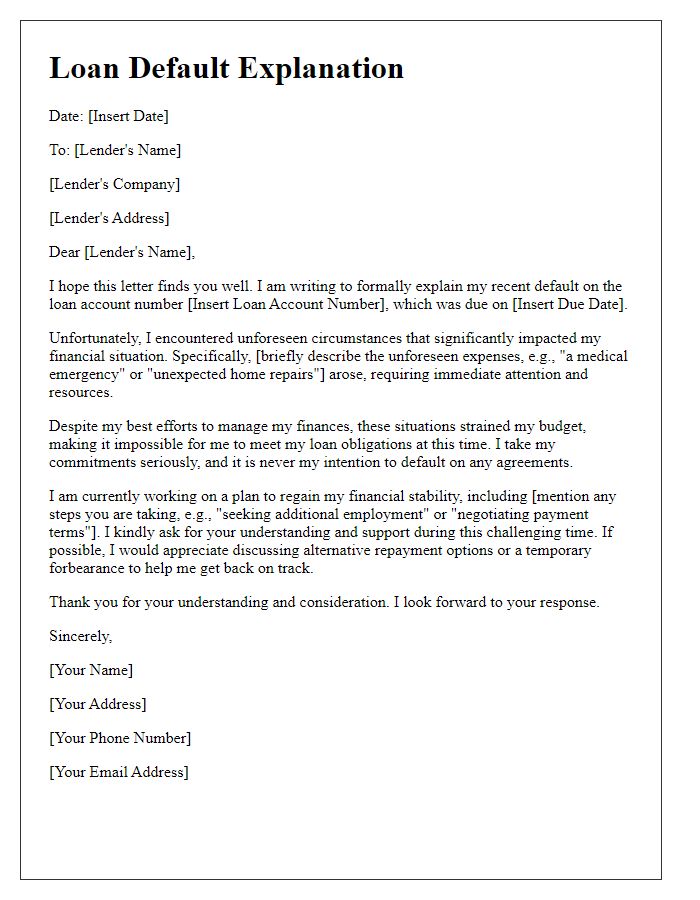

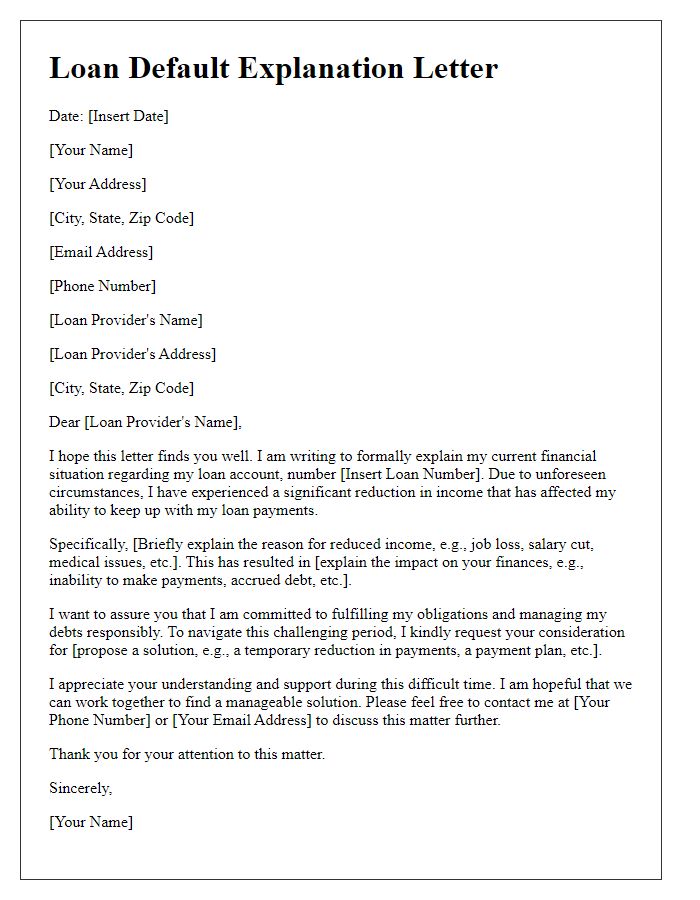

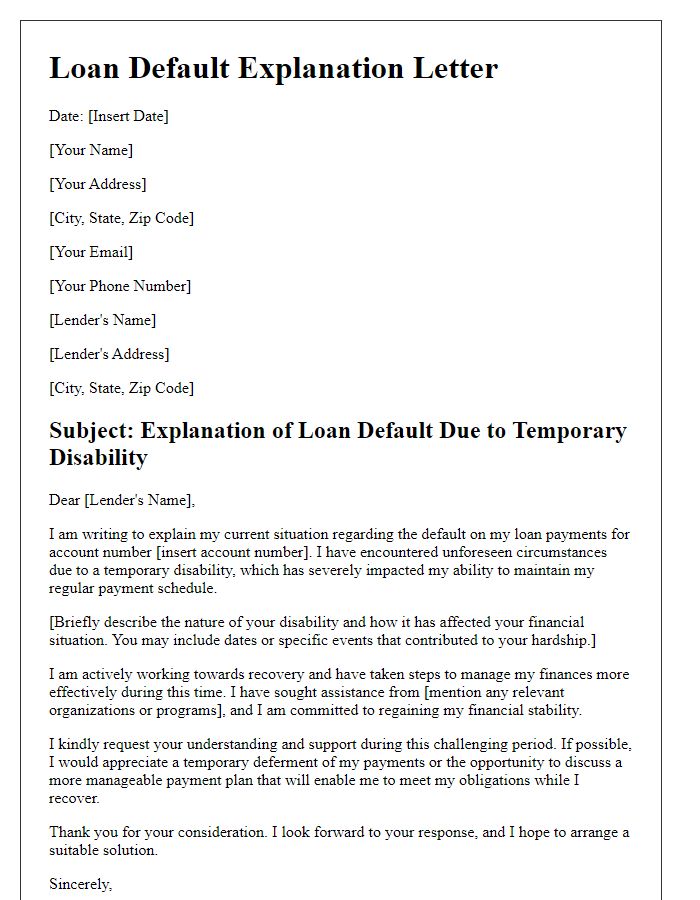

Letter Template For Explaining Unexpected Loan Default Samples

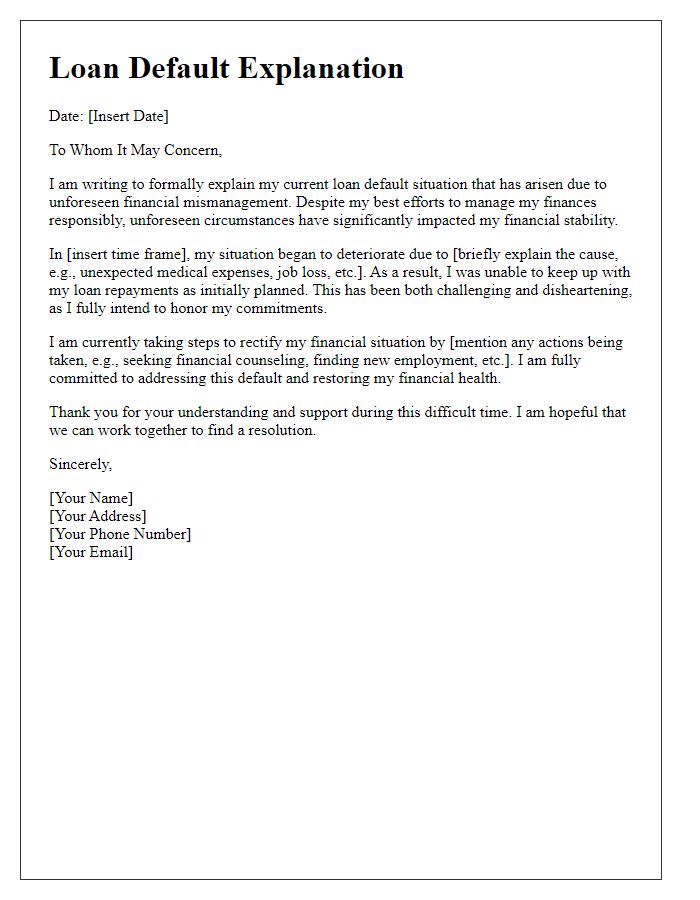

Letter template of loan default explanation for financial mismanagement.

Comments