Hey there! If you're looking for a reliable way to confirm the receipt of an official loan document, you've come to the right place. Understanding the ins and outs of loan paperwork can be a bit daunting, but having the right template can make it much easier. So, stick around as we dive into how to craft the perfect confirmation letter that covers all your bases!

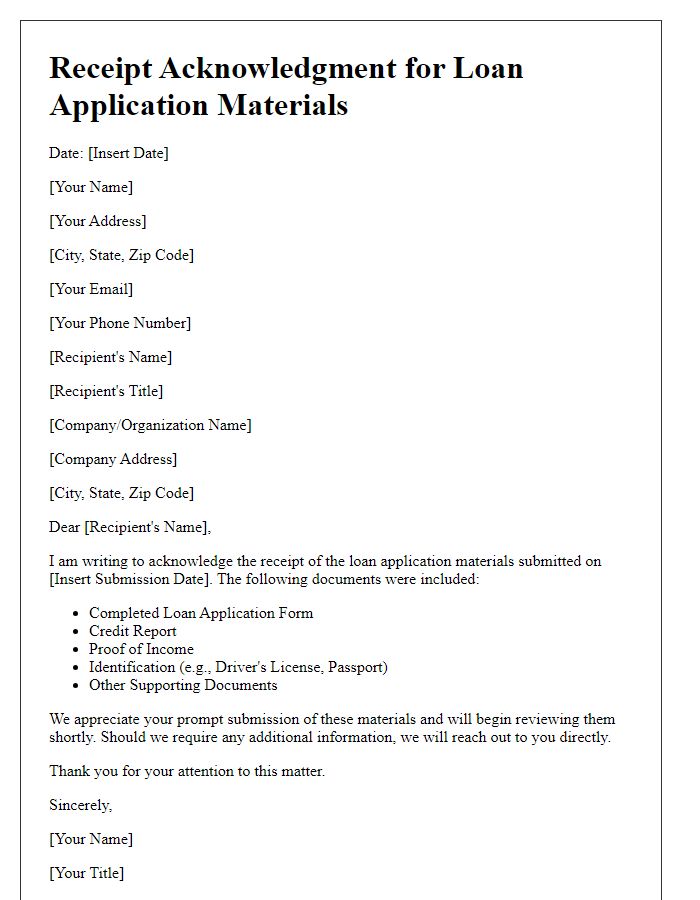

Date and recipient information

Confirmation of official loan document receipt is essential in financial transactions. For instance, on October 10, 2023, a confirmation letter may be sent to John Smith at his address, 456 Oak Street, Springfield, USA. The letter should clearly state the receipt of the official loan documents, specifically detailing the loan agreement dated September 30, 2023, for a sum of $50,000, which is intended for home improvement. Including a summary of the key points such as the interest rate of 4.5% and the repayment term of 15 years ensures clarity and transparency in the communication. This documentation not only acknowledges the receipt but also serves as a reference for future correspondence related to the loan process.

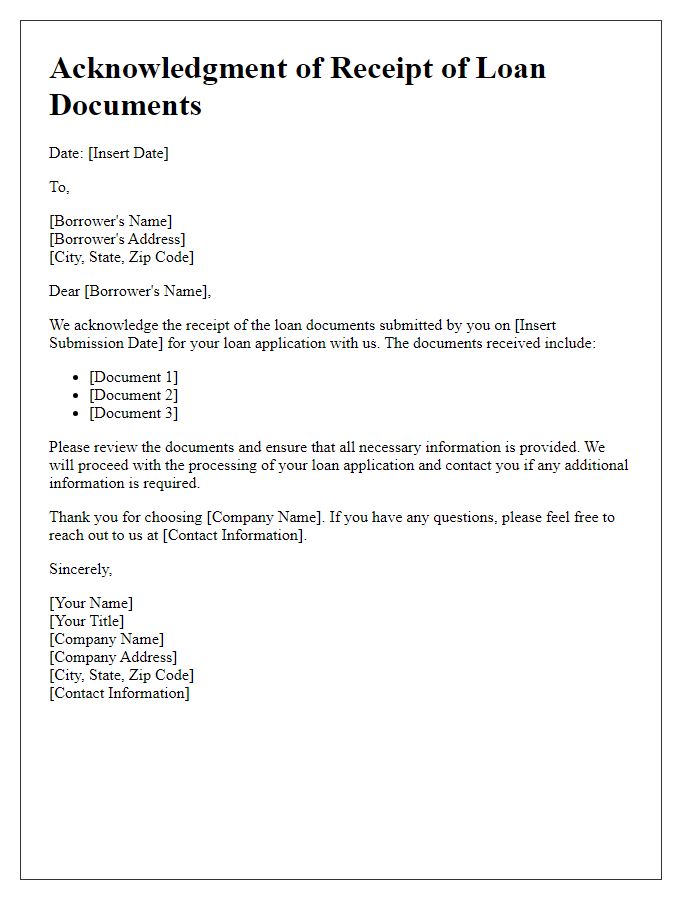

Acknowledgment of receipt

Acknowledgment of receipt is a critical process in loan documentation, ensuring both parties are aware of the official transaction. When a financial institution issues a loan document, such as a mortgage agreement or personal loan contract, confirmation of receipt is typically communicated via a formal notice. This acknowledgment includes pertinent details like the loan amount (often thousands or millions of dollars), interest rate (usually between 3% and 7% for personal loans), and the date of receipt (noting the specific day and time). Additionally, it may reference the loan agreement number, borrower's name, and relevant terms of repayment. Such acknowledgment safeguards the interests of both the lender and borrower, promoting transparency in the lending process and enabling record-keeping for future reference.

Summary of key loan terms

Receipt of official loan documents signifies agreement on critical loan terms. Loan amount typically ranges from $5,000 to $500,000, depending on the lender's assessment of the borrower's creditworthiness and financial history. Interest rates may vary between 3% to 10%, influencing the total repayment over the loan duration, which often spans 5 to 30 years. Monthly payment schedules, including principal and interest, determine the borrower's budgetary obligations, while any origination fees, usually around 1% to 3% of the loan amount, impact the upfront costs. Prepayment penalties may apply if the borrower intends to pay off the loan earlier than the agreed term, complicating potential savings on interest. Understanding these components is crucial for informed financial decision-making.

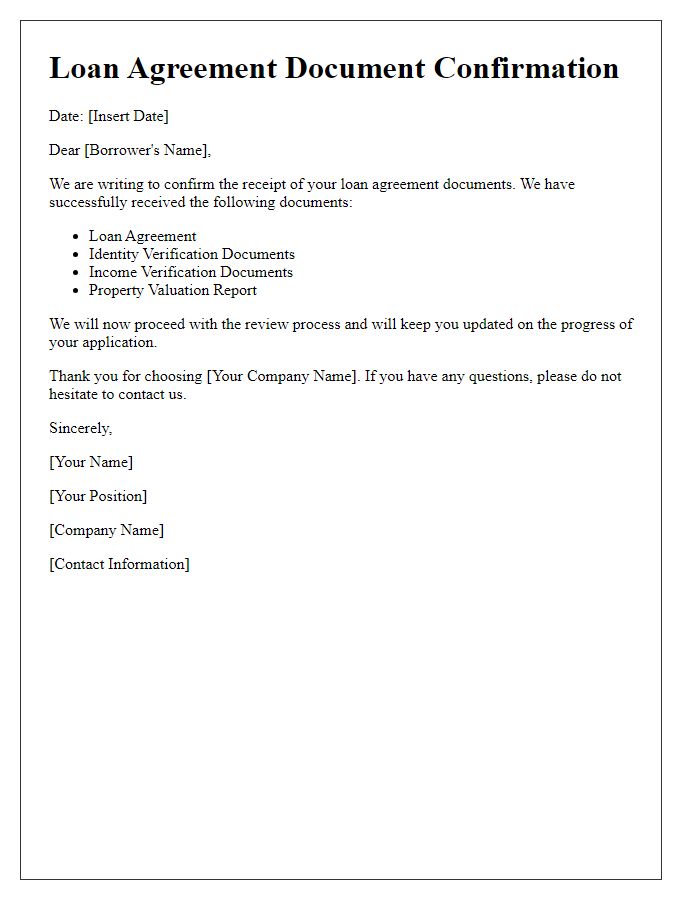

Contact information for further inquiries

The receipt of official loan documents serves as a critical milestone in the financing process. Acknowledgment of such documents, typically executed by loan officers or financial institutions, ensures that vital information such as loan amounts, interest rates, and repayment terms are correctly noted. Confirmation usually includes the borrower's name, loan reference number, and the date of document receipt. For further inquiries, contact details such as direct phone numbers (e.g., +1-800-555-0199) and email addresses (e.g., support@financingcorp.com) are essential, providing clients with immediate channels for assistance. Regular monitoring of document status may necessitate follow-up communications, reinforcing the importance of secure transmission methods (like encrypted emails) to protect sensitive personal information.

Signature and sender's information

The official loan document signifies a financial agreement between a lender and a borrower, outlining the terms, conditions, and repayment schedule. This document often includes critical information such as the loan amount (often ranging from hundreds to millions of dollars), interest rates (fixed or variable), and due dates (monthly, quarterly, or annually). Receivers typically sign the document as a formal acknowledgment of its contents, ensuring both parties understand their obligations. The sender's information, including name, address, and contact details, provides a reliable point of reference should any discrepancies arise in the future. Accurate documentation plays a vital role in maintaining transparent communication and accountability within financial transactions.

Letter Template For Confirming Official Loan Document Receipt Samples

Letter template of receipt acknowledgment for loan application materials

Comments