When it comes to assessing risks at the board level, clear communication is essential. A well-structured letter template can streamline the process, ensuring that all vital information is conveyed efficiently. In this article, we'll explore how to craft a comprehensive letter that not only identifies potential risks but also outlines strategies for mitigation. So, let's dive in and discover the key elements that make a risk assessment letter truly effective!

Introduction and Purpose

The board risk assessment process plays a crucial role in corporate governance, allowing organizations to identify potential risks that could impact operational stability and financial health. This systematic approach aligns with regulatory standards, such as the Sarbanes-Oxley Act of 2002, ensuring transparency in risk management practices. The primary purpose of the assessment is to evaluate risks related to strategic objectives, operational processes, compliance obligations, and financial reporting accuracy. By employing methodologies such as SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis and risk matrices, the assessment provides a framework for decision-making, enabling the board to allocate resources effectively and prioritize risk mitigation strategies. Ultimately, a thorough risk assessment enhances the organization's resilience against unforeseen events and fosters a culture of proactive risk management throughout the enterprise.

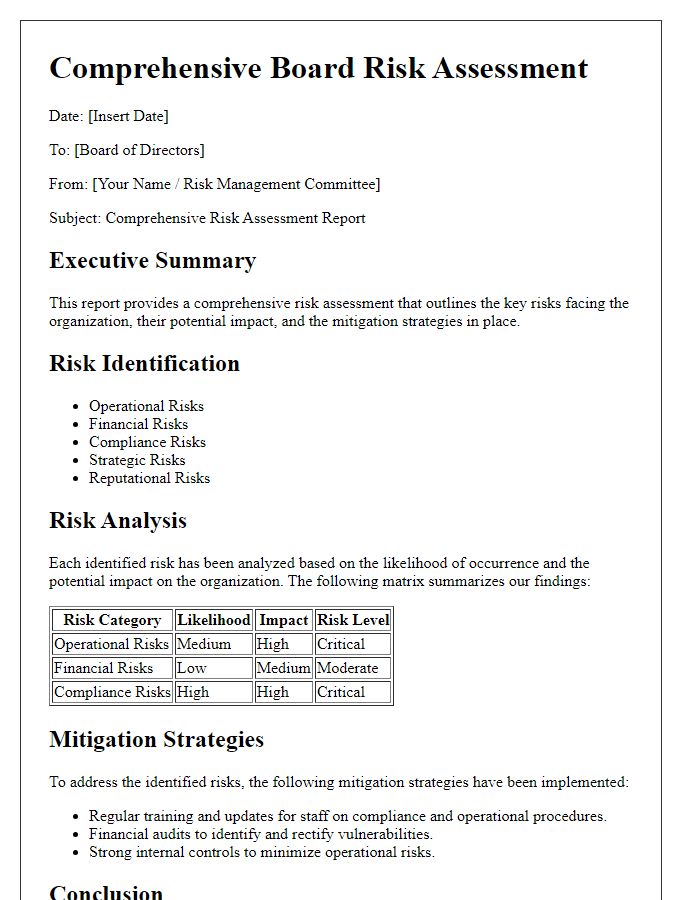

Risk Identification and Analysis

In the realm of corporate governance, comprehensive risk identification and analysis are crucial for organizations striving to achieve strategic objectives. Risk management frameworks like ISO 31000 outline methodologies for systematically identifying risks, which can range from financial uncertainties to operational inefficiencies. The board must assess various risk categories, including market risks arising from economic fluctuations (such as shifts in interest rates or inflation) and regulatory risks tied to compliance (pertaining to laws like GDPR or SOX). Additionally, reputational risks emerge from public perception, often amplified by social media channels, impacting stakeholder trust. Tools such as SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis and risk matrices facilitate this process, allowing stakeholders to prioritize risks based on likelihood and impact. Furthermore, trends in cyber threats, highlighted by increasing incidents of data breaches (with nearly 4,000 reported in 2020 alone), require attention as organizations increasingly depend on digital infrastructure. Implementing proactive measures enables companies to mitigate these risks effectively, ensuring long-term sustainability and resilience.

Assessment of Impact and Likelihood

A thorough risk assessment involves evaluating the potential impact and likelihood of identified risks facing an organization. First, impact assesses how severely a risk event could affect organizational objectives, often classified as low, medium, high, or critical. For instance, financial risks (such as loss of revenue exceeding 20% during a market downturn) can significantly impact overall profitability and investor confidence. Second, likelihood estimates the probability of risk occurrence, categorized similarly, with high likelihood indicating a greater than 70% chance of happening. An example would be operational risks associated with technology failures, posing substantial disruptions if internal servers (such as those located in data centers in California) encounter cybersecurity breaches due to inadequate protection protocols. This assessment informs strategic decision-making, resource allocation, and development of mitigation plans focused on prioritized threats, ultimately safeguarding organizational integrity and stakeholder trust.

Mitigation Strategies and Action Plans

A comprehensive board risk assessment requires clear mitigation strategies and actionable plans to address potential vulnerabilities within an organization. Identifying critical risks, such as financial instability, operational inefficiencies, or compliance failures, is essential for safeguarding the institution's integrity. Detailed action plans should incorporate specific timelines, responsible teams, and measurable outcomes to ensure accountability. For instance, cybersecurity risks may necessitate the implementation of robust software solutions, employee training (scheduled quarterly), and regular audits. Furthermore, contingency plans (like emergency financial reserves) are vital for navigating unexpected events, ensuring resilience in uncertain environments, and maintaining stakeholder trust through transparent reporting and communication.

Monitoring and Reporting Procedures

Monitoring and reporting procedures are critical components in the board risk assessment framework, essential for maintaining organizational integrity and compliance. Regular audits (quarterly), aligned with industry standards, ensure early detection of potential risks, including financial misreporting and cybersecurity threats. Reporting mechanisms, such as monthly dashboards, provide key metrics like risk exposure levels, incidents, and response effectiveness. Designated roles, including a Chief Risk Officer (CRO), oversee these processes, ensuring accountability and alignment with business objectives. Additionally, external assessments (conducted by third-party firms) can validate internal findings, enhancing transparency and stakeholder confidence. Consistent documentation and efficient communication channels support timely response to identified risks, fostering a proactive risk management culture within the organization.

Comments