Are you looking to navigate the often tricky waters of transferring stock inheritance to beneficiaries? Understanding the necessary steps and legal nuances can feel overwhelming, but it doesn't have to be. In this article, we'll break down the essential components of a letter template designed specifically for stock inheritance transfers, ensuring you have a clear path to follow. So, let's dive in and simplify the process together â keep reading to discover the details!

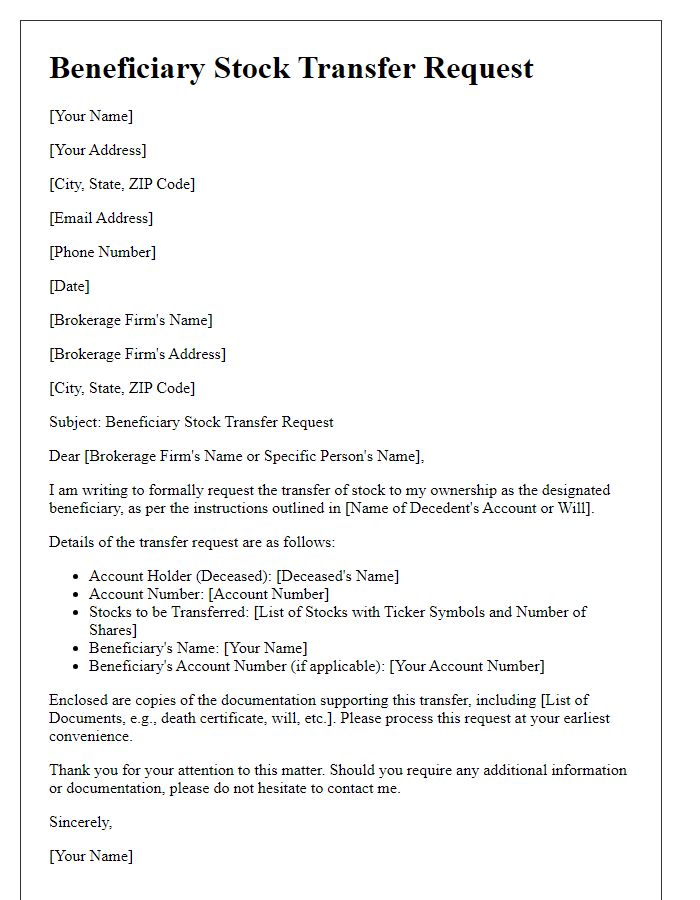

Beneficiary Information

The process of transferring stock inheritance to a beneficiary requires careful consideration of specific details. Beneficiary information must include full name, address, and Social Security number (or Tax Identification Number for non-U.S. citizens) to ensure accurate identification. Often necessary is the completion of the Transfer on Death (TOD) form, specifying the stock type and quantity inherited, accompanied by a certified copy of the death certificate of the original shareholder. Depending on the brokerage firm, additional documentation may be needed, such as an Affidavit of Heirship or Letters Testamentary issued by a probate court, especially if assets surpass the threshold in value, which varies by state. Clear communication with the brokerage is essential to expedite the transfer process while maintaining compliance with any tax obligations associated with inheritance.

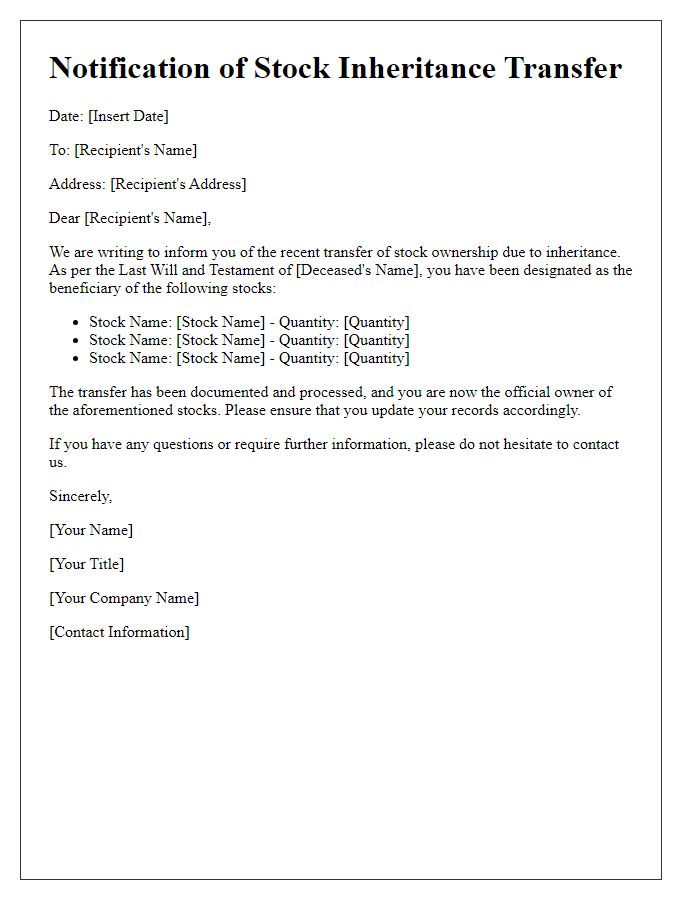

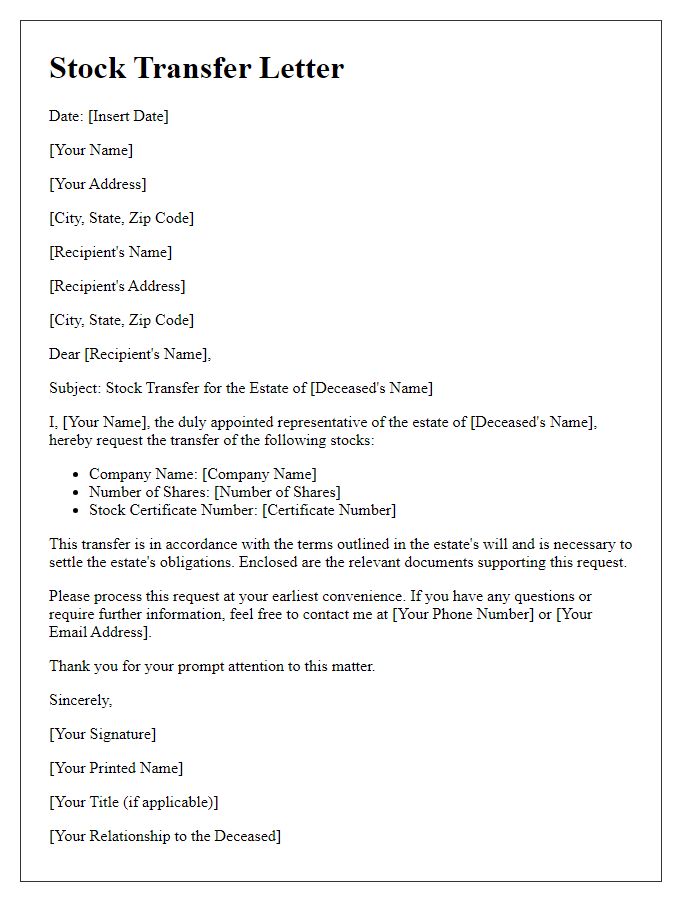

Stock Details

The transfer of inherited stocks involves essential details such as stock company name, number of shares owned, and stock ticker symbol. For example, if the stocks belong to Apple Inc., known for its high market capitalization exceeding $2 trillion, the precise number of shares, say 50, must be indicated. Additional documentation may include the deceased's will, estate information, and any applicable probate court details. The transfer process often mandates consultation with a financial advisor to understand tax implications such as capital gains taxes, which can arise from stock appreciation. Beneficiary identification is critical, requiring full legal names, Social Security numbers, and proof of relationship to the deceased, ensuring compliance with inheritance laws.

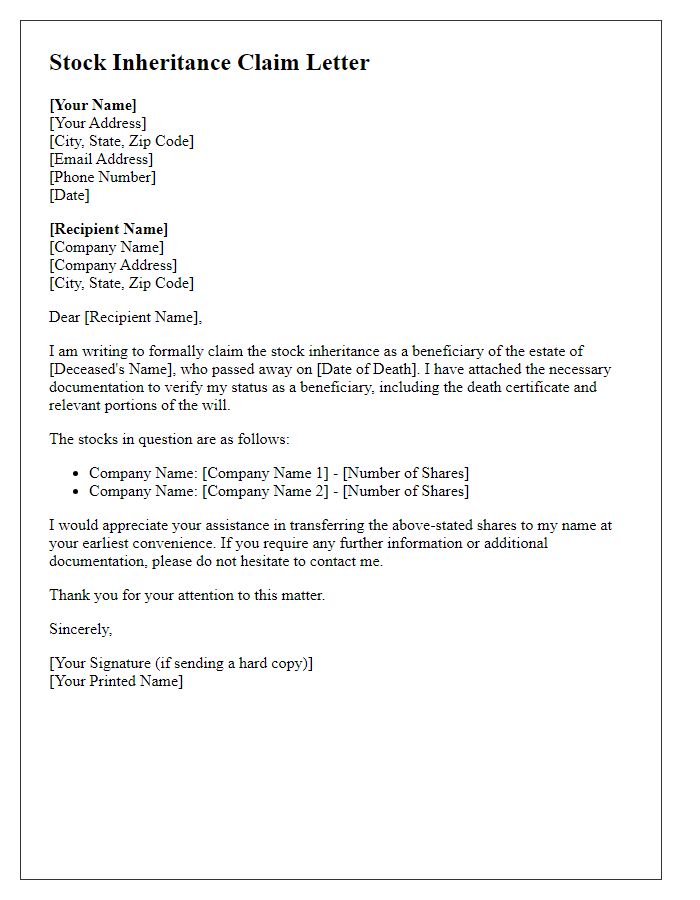

Inheritance Documentation

The inheritance documentation process for transferring beneficiary stock, such as shares from publicly traded companies like Apple Inc. or Microsoft Corp., requires meticulous attention to detail. Accurate completion of forms, including the Stock Transfer Form or Affidavit of Heirship, is vital to ensure compliance with state laws. Key information, such as the decedent's name, date of death (often leading to significant tax implications), and the stock certificate numbers, must be provided. Additionally, the estate executor may need to obtain a tax identification number (TIN) for the estate to facilitate the transfer. Documentation such as the Last Will and Testament or a Trust Agreement can verify beneficiary entitlement, while a death certificate may confirm the passing of the original owner. Timely submission of these documents to the brokerage firm or transfer agent, like Charles Schwab or Fidelity, is crucial to finalize the transfer of stock to designated beneficiaries.

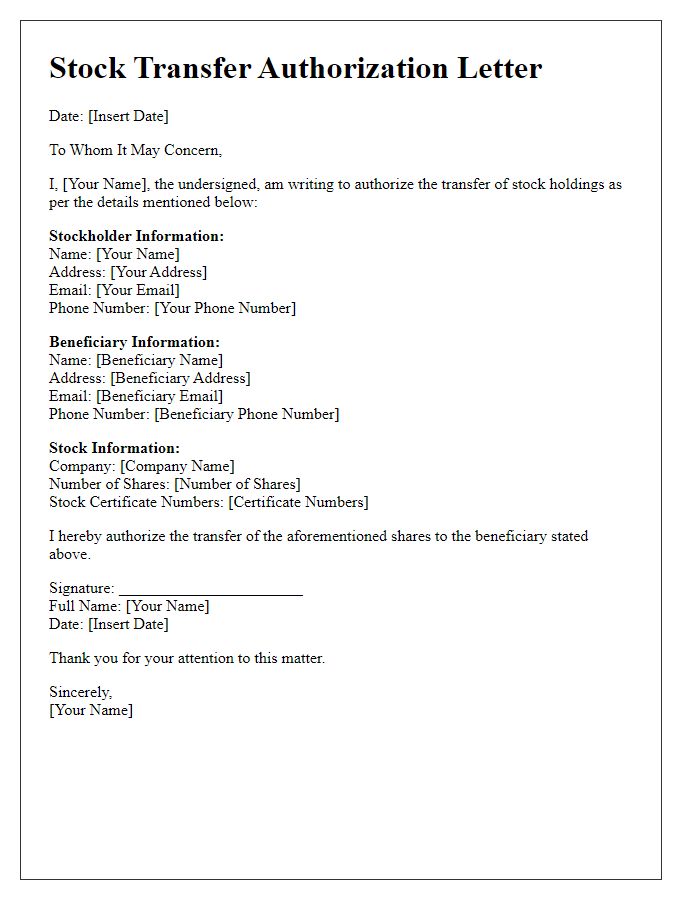

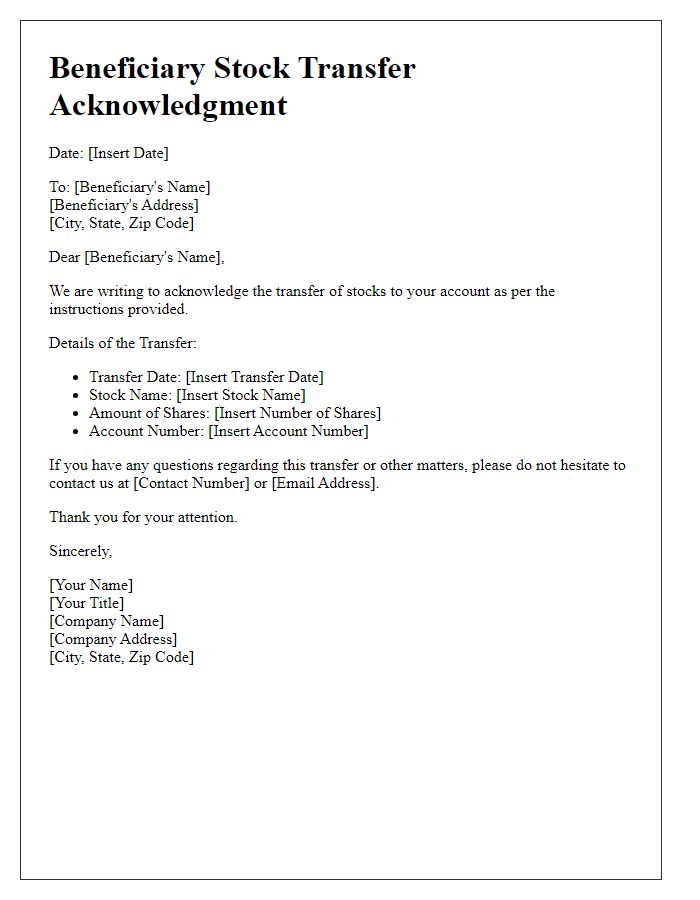

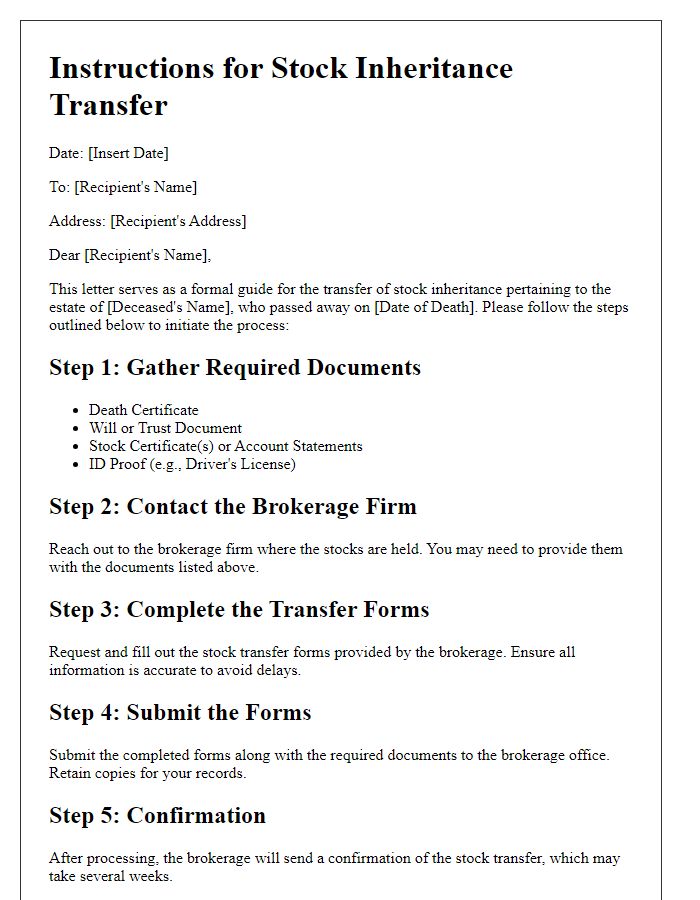

Transfer Instructions

Beneficiary stock inheritance involves transferring ownership of equities (stocks) to an heir or designated individual after the original owner's passing. This process typically requires several vital steps. Documents such as the death certificate and the will or trust agreement must be gathered to validate the beneficiary's claim. The financial institution or brokerage where the stocks are held, like Charles Schwab or Fidelity Investments, requires the completion of specific forms for the transfer. Important information includes the original owner's account details, the beneficiary's personal identification, and the specific stocks being transferred, which may involve large quantities or high-value assets. Processing times can vary, lasting anywhere from a few days to several weeks, depending on the institution's policies and the completeness of the submitted documentation. Taxes related to capital gains may apply when selling inherited stocks, so consulting a financial advisor is advisable for understanding implications.

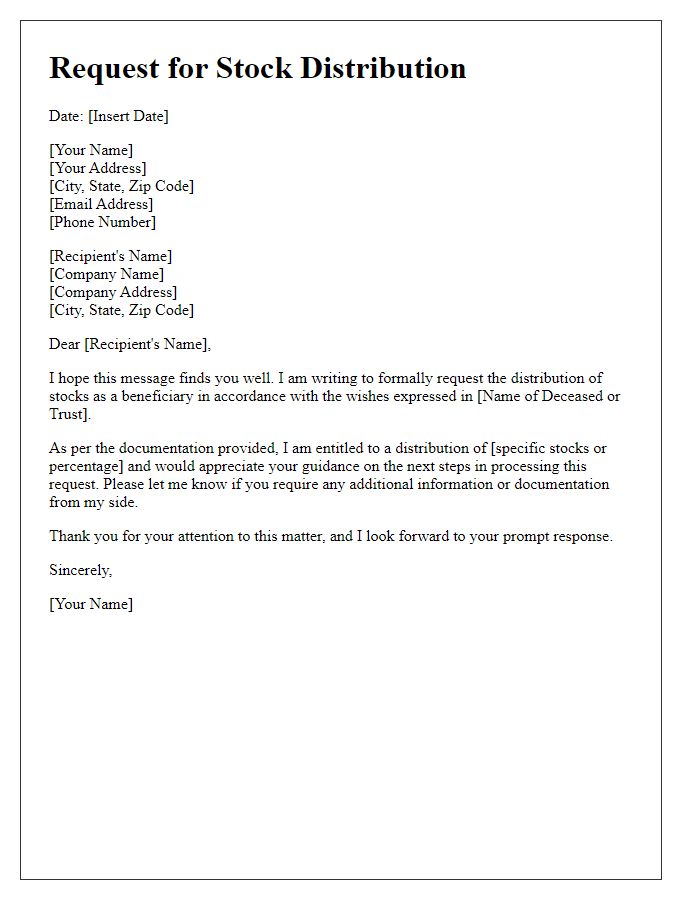

Contact Information

Beneficiary stock inheritance transfer involves specific details that ensure smooth processing. Information includes full name (beneficiary), address (including city, state, zip code), contact number, and email (for electronic communication). Additional elements encompass the name of the deceased (stockholder), date of death (necessary for legal documentation), stock brokerage firm name (where stocks are held), and account number. Legal documents such as a death certificate (official proof of death) and will (if applicable) may also be required for verification purposes. Clarity in providing these details can significantly aid in expediting the transfer process.

Comments