Are you looking for the perfect way to communicate important financial information to your loved ones? A letter template for beneficiary final expense coverage can make this process smoother and more thoughtful. This simple guide ensures that your family understands the details of your coverage, alleviating any potential confusion during a challenging time. Curious to learn more about crafting a compassionate and clear letter?

Personalization and Recipient Details

Final expense coverage offers financial assistance for end-of-life expenses, such as funerals or medical bills. This insurance typically covers amounts ranging from $5,000 to $50,000. Beneficiaries receive these funds directly upon the policyholder's passing. Without proper planning, families can face unexpected costs, which can place significant emotional and financial strain in difficult times. Planning ahead by securing final expense coverage can ensure that loved ones are not burdened with these costs, making it an essential part of financial and estate planning. Many policies allow for straightforward application processes, often with no medical exams required, allowing individuals to secure peace of mind efficiently.

Purpose and Coverage Summary

Final expense coverage serves as an essential financial safeguard designed to alleviate the burden of funeral and burial costs for beneficiaries. This insurance policy typically provides a death benefit ranging from $5,000 to $25,000, ensuring that families are not left with unexpected expenses during a difficult time. Coverage is specifically structured to address costs associated with funerals, cemetery plots, cremation services, and any outstanding medical bills. Beneficiaries can utilize these funds without the constraints of lengthy claims processes, offering immediate financial relief. Policies often require no medical exams, making them accessible for individuals aged 50 and older, regardless of health conditions. In essence, final expense coverage provides peace of mind and financial support during life's most challenging moments.

Policy Information and Benefits

Final expense insurance policies, designed specifically to cover end-of-life costs, offer beneficiaries substantial financial relief. Typical policy amounts range from $5,000 to $50,000, depending on the insurance provider and individual circumstances. Coverage often includes expenses such as funeral costs, burial fees, and outstanding medical bills. Notable providers in the market include Mutual of Omaha and AARP, known for their straightforward claim processes. Beneficiaries should be aware of the policy's terms, including possible waiting periods (often two years) before full benefits are payable. Additionally, the premium amounts vary based on factors such as the insured's age and health status at the time of application, affecting overall coverage affordability.

Contact Information for Assistance

Final expense coverage serves as a financial safety net for beneficiaries during challenging times. This type of insurance policy, often designed to cover funeral costs (averaging between $7,000 and $12,000 in the United States), can alleviate the financial burden on loved ones. Beneficiaries seeking assistance or clarification about their coverage can reach out to insurance providers through dedicated customer service lines (typically available 24/7) or online portals for policy management. Essential documents, such as policy numbers and identification, should be readily accessible to expedite the assistance process. Understanding the specific terms and conditions of the final expense policy can ensure that beneficiaries utilize benefits effectively during moments of grief, providing peace of mind in managing end-of-life expenses.

Call to Action and Closing Signature

Beneficiary final expense coverage provides important financial protection for families, addressing costs associated with funeral services and burial expenses. This coverage can minimize financial stress during a difficult time, often ranging from $5,000 to $30,000, depending on the policy. Common expenses include caskets, burial plots, and memorial services. Taking action now ensures that loved ones are not burdened with these costs, promoting peace of mind and security. Contact your insurance provider today to discuss options tailored to your needs. Your proactive steps can safeguard your family's financial future and facilitate plans in accordance with your wishes.

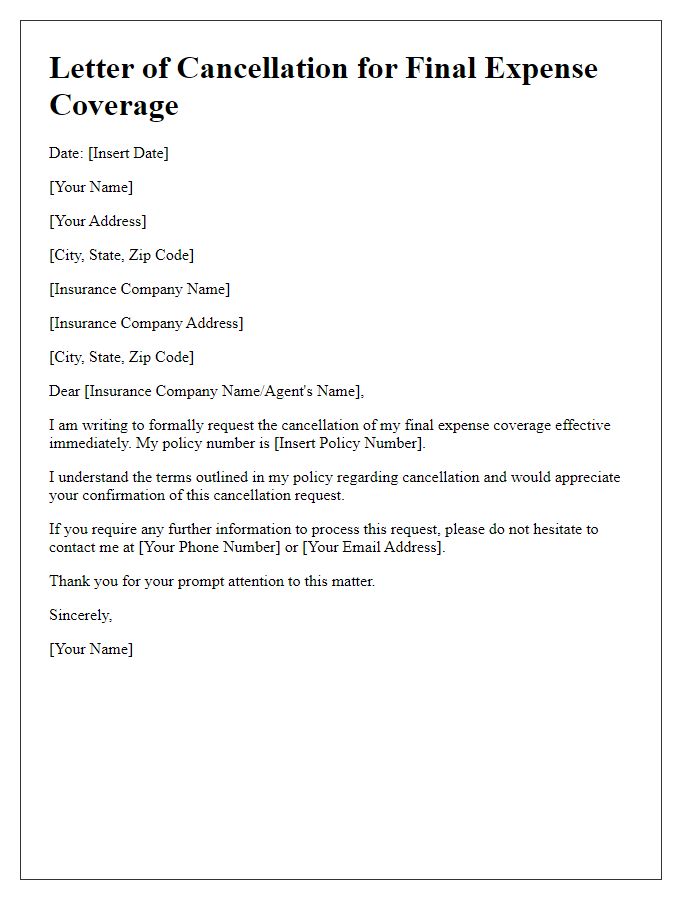

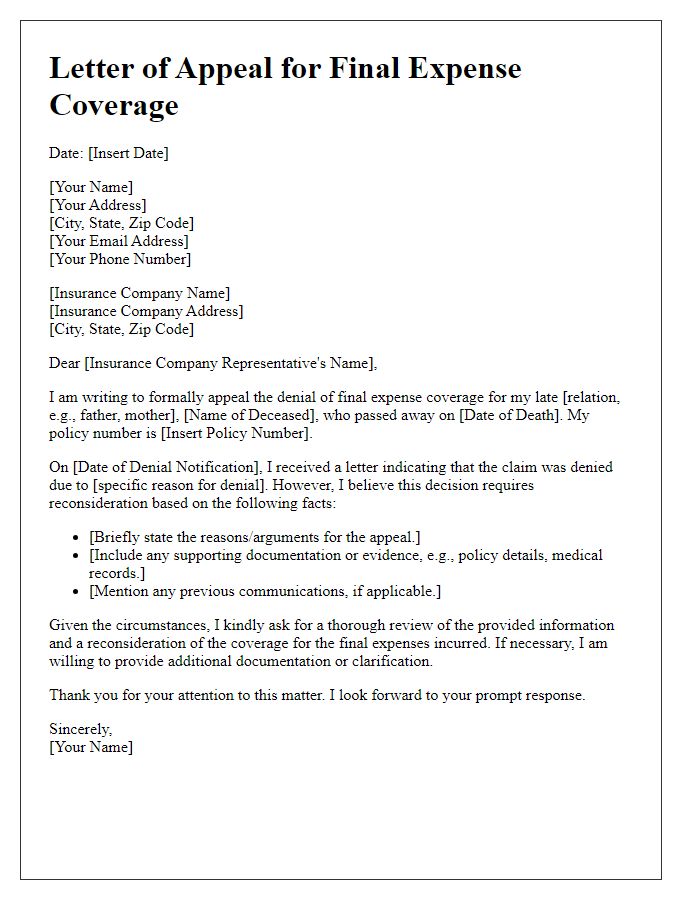

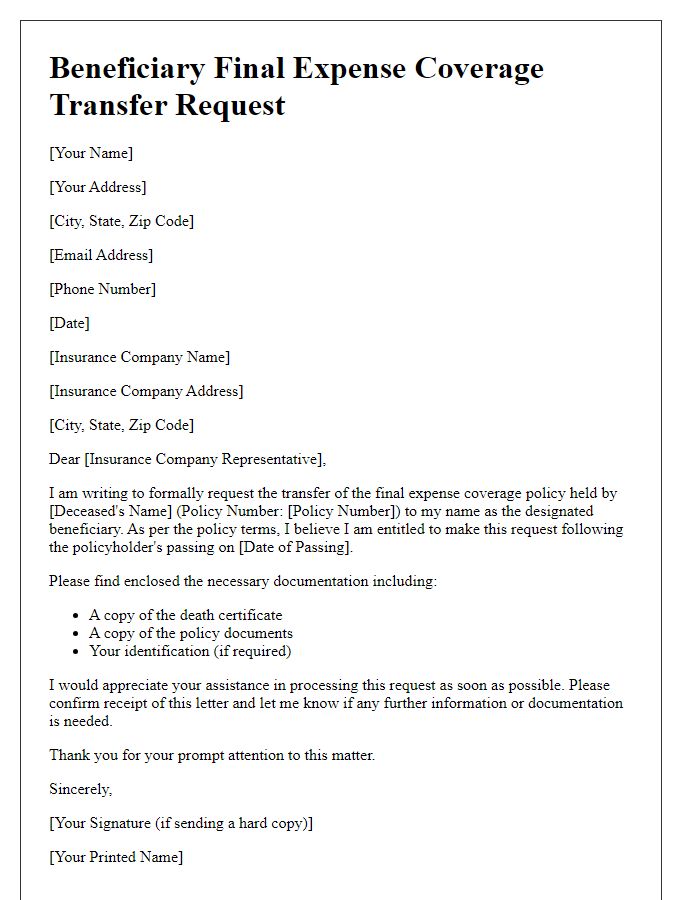

Letter Template For Beneficiary Final Expense Coverage Samples

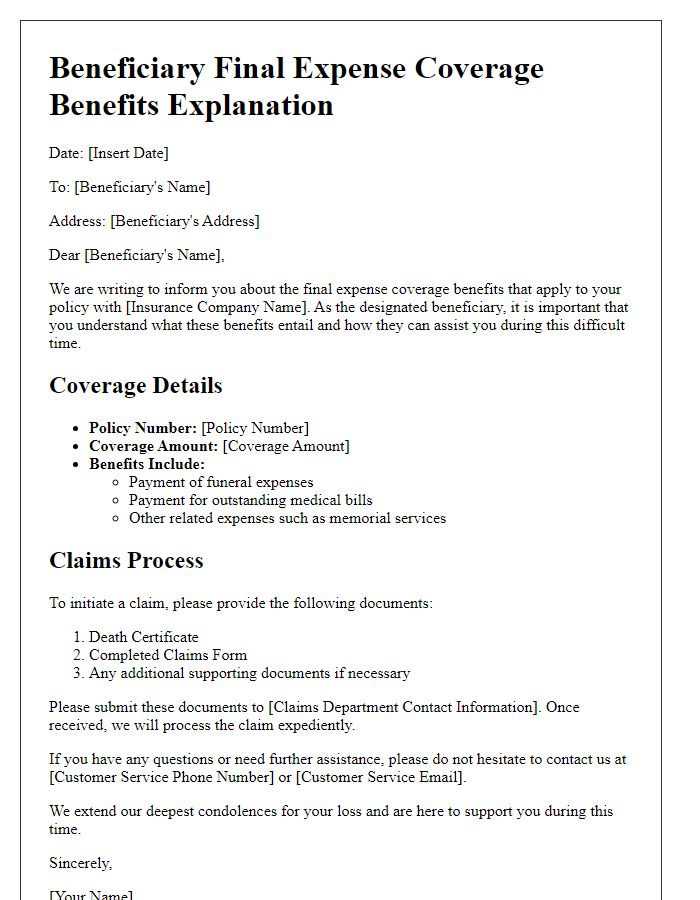

Letter template of beneficiary final expense coverage benefits explanation

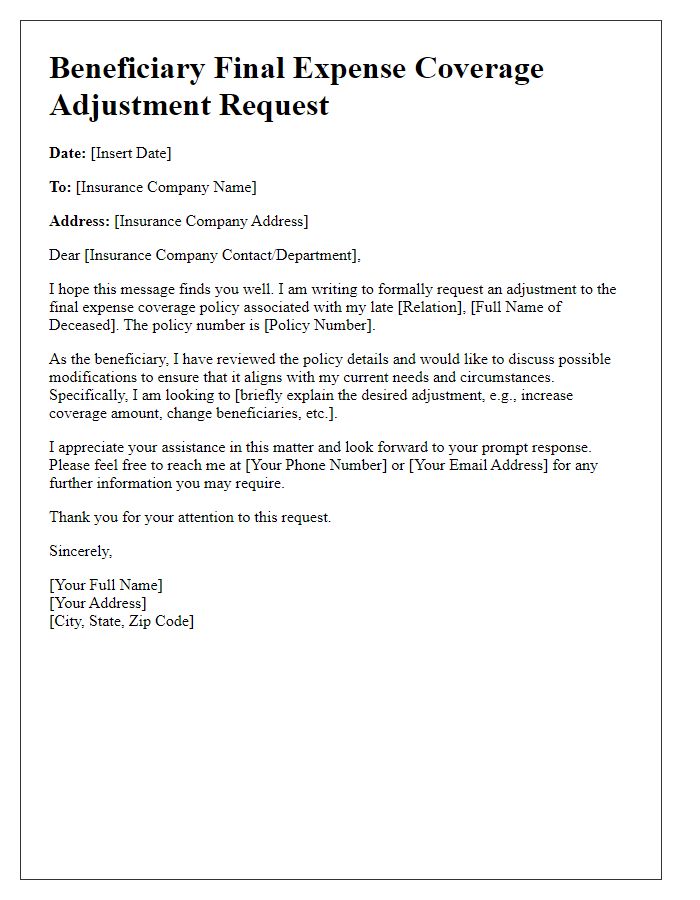

Letter template of beneficiary final expense coverage adjustment request

Comments