Are you uncertain about how to request tax information as a beneficiary? Writing a letter to obtain the necessary details can feel daunting, but it doesn't have to be! With the right template in hand, you'll be able to communicate your needs effectively while ensuring compliance with any legal requirements. Curious about how to craft the perfect request? Read on to discover tips and a sample letter to guide you!

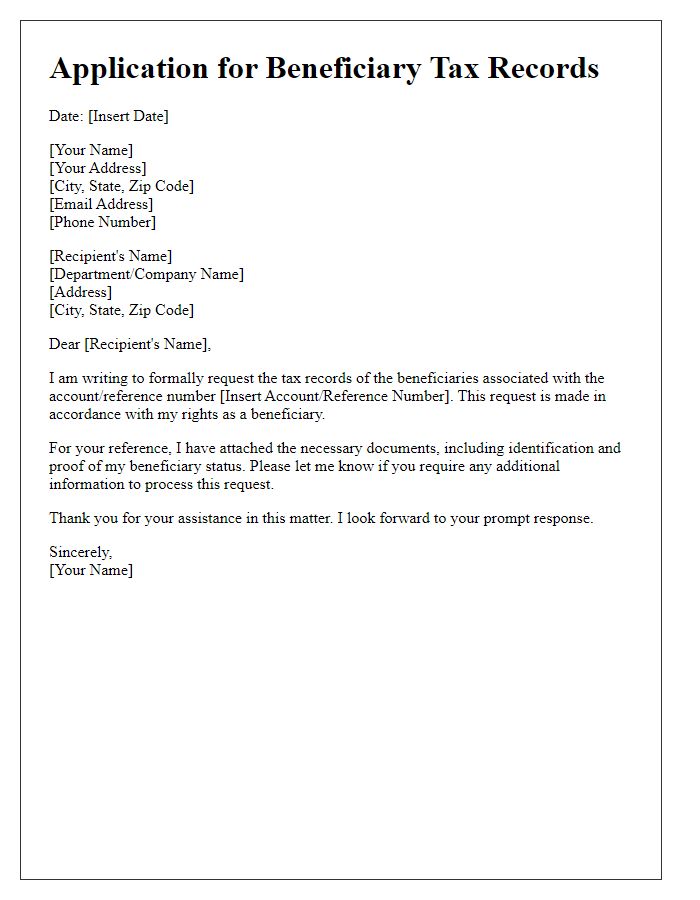

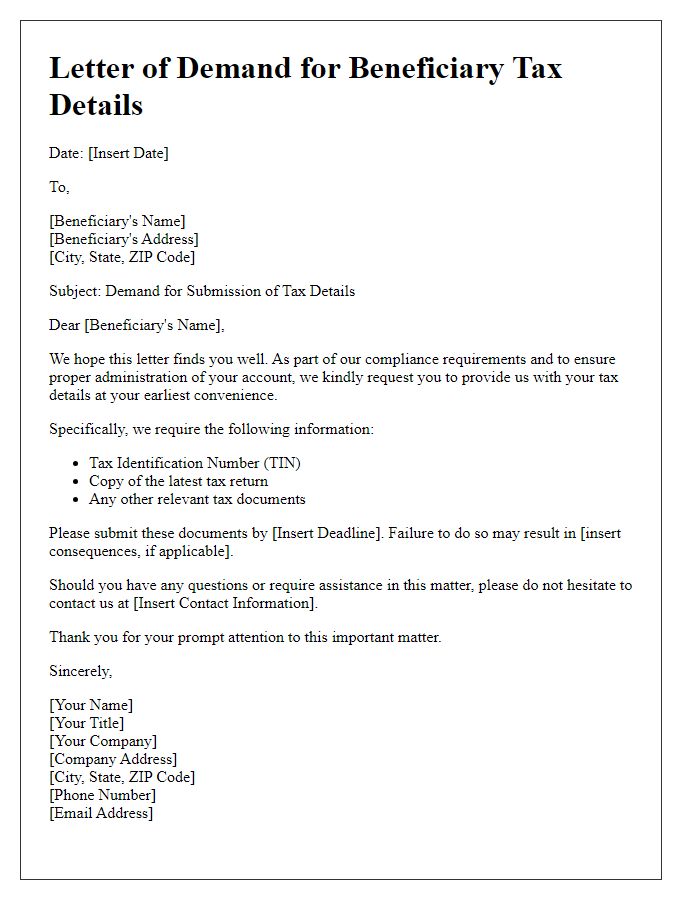

Proper salutation and recipient's name

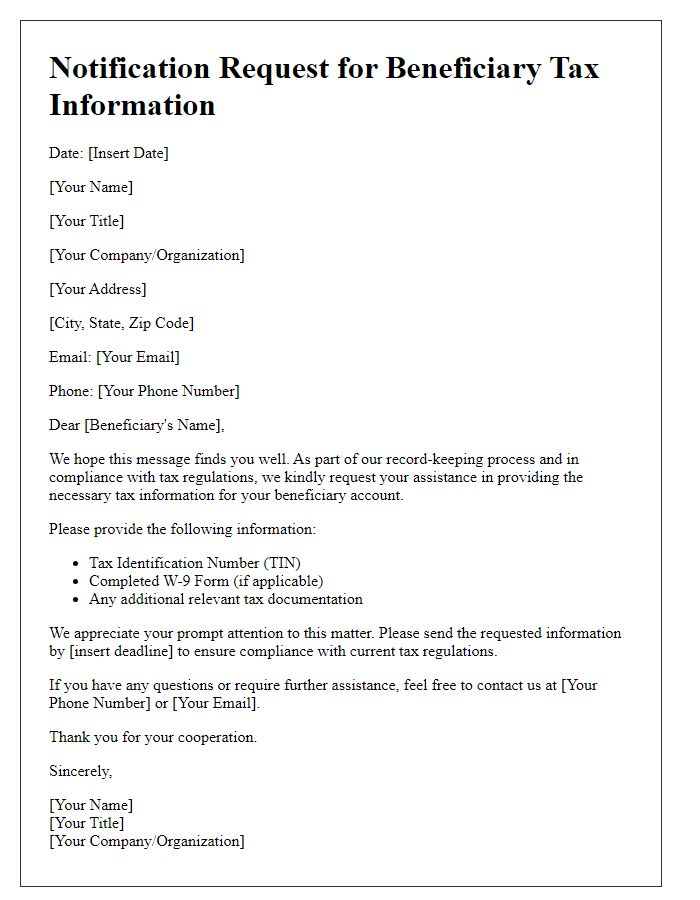

Beneficiary requests for tax information often require specific details to ensure proper processing. This includes the beneficiary's full name, identification number, and the account or reference number associated with the tax inquiry. Additionally, detailing the reason for the request, such as clarification on tax statements from the previous year or understanding specific deductions, is essential. It's also important to include the recipient's full name and title, as well as their organization or agency name, to ensure the request reaches the right individual. Finally, the date of the request and the beneficiary's contact information should be presented clearly for follow-up communication.

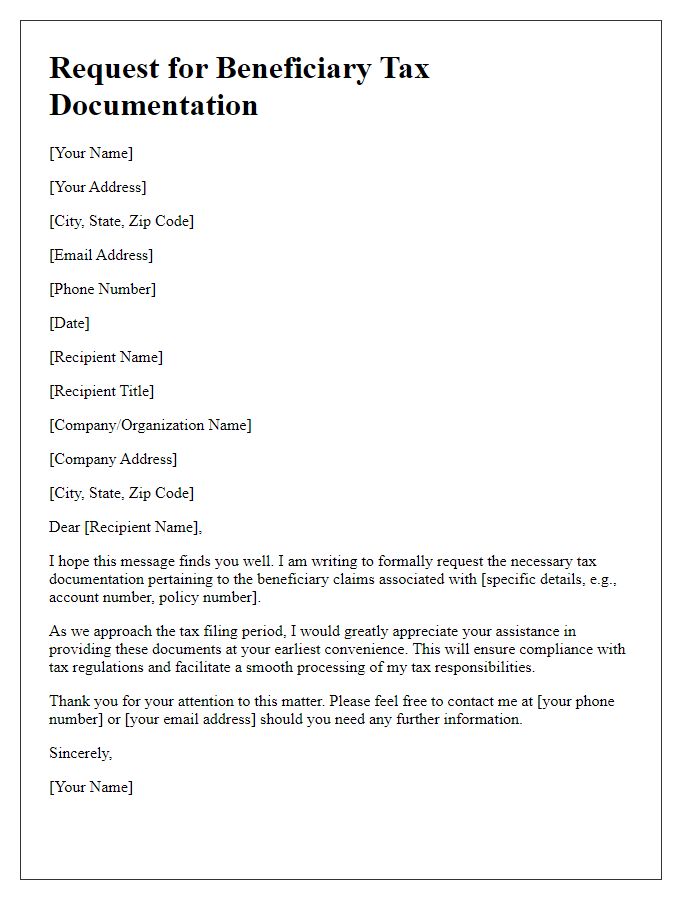

Clear subject line indicating purpose

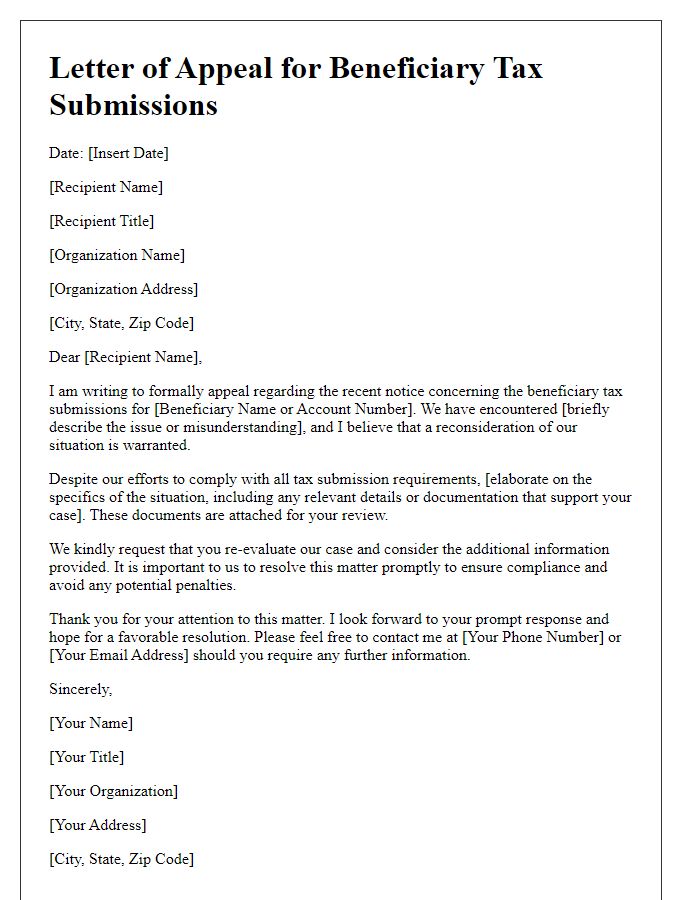

Submitting a request for tax information as a beneficiary is crucial in ensuring compliance and understanding tax obligations related to inheritance. Key details include specifying the type of tax information required, such as Form K-1 (an IRS tax document). It's essential to identify the estate or trust involved, mentioning names and dates for clarity. Providing personal identification details, like Social Security Number and address, helps in processing the request efficiently. Additionally, incorporating a deadline for the response can expedite obtaining the necessary information, especially during tax season, typically occurring from January 1 to April 15 each year in the United States. Clear communication can prevent misunderstandings and ensure a smooth review of tax responsibilities.

Detailed request for specific tax information

A beneficiary request for tax information is crucial for understanding financial responsibilities and obligations. Tax documents, such as IRS Form 1099 or K-1 statements, contain essential data regarding income distributions, total distributions, and potential tax liabilities. These forms must be accurate to ensure compliance with federal and state tax regulations. Additionally, the request should include specific years, like tax year 2022, to clarify the scope of the information needed. Addressing the request to the appropriate financial institution, such as a trust company or estate executor, ensures timely processing. Providing deadlines and preferred methods of receiving this information, such as via email or certified mail, enhances efficiency and clarity in communication.

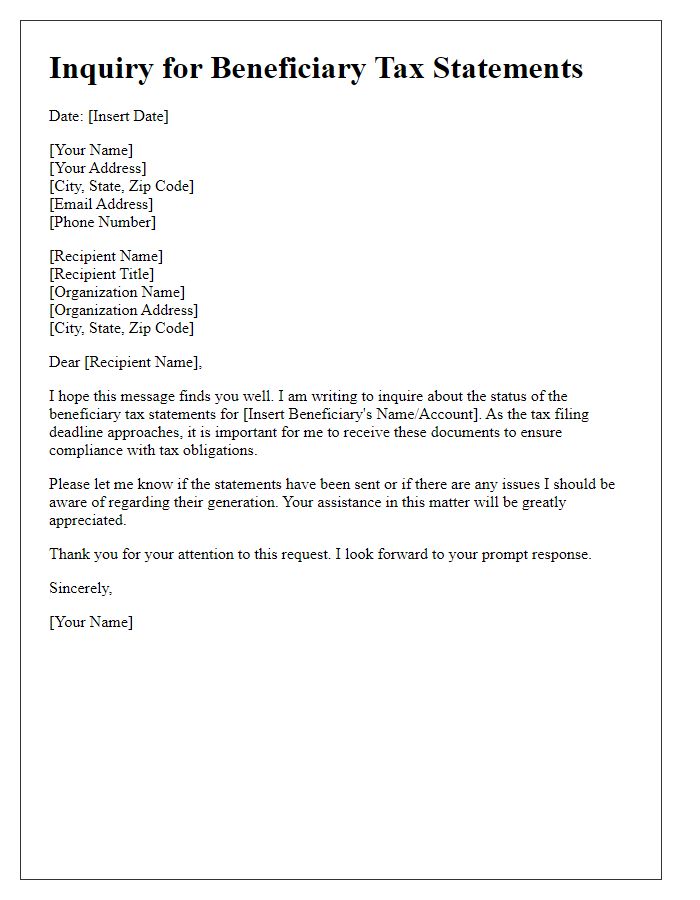

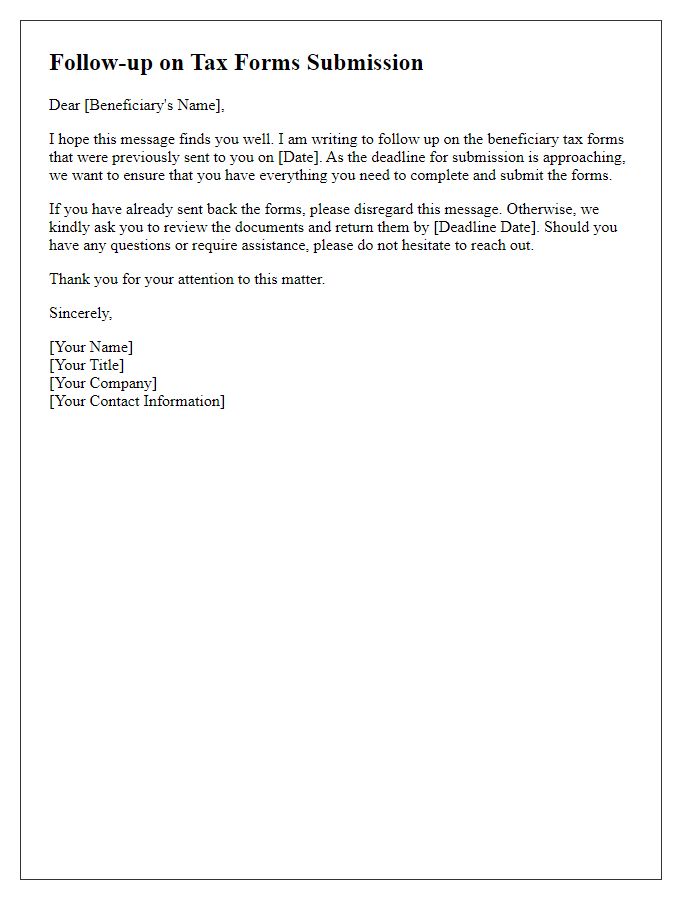

Deadline for response and urgency

Beneficiary requests for tax information typically involve a formal communication outlining specific details required for proper documentation and compliance. Such correspondence often emphasizes the deadline for response, which can vary significantly, commonly set within a few weeks of receipt. This urgency stems from the need to ensure accurate tax filings by the designated tax filing dates, often determined by local regulations, such as those outlined by the Internal Revenue Service (IRS) in the United States. Beneficiaries may need to provide critical information, including Social Security Numbers, income documentation, and previous tax returns, to facilitate seamless processing. It is vital for the beneficiary to understand the impact of delayed responses, which can result in penalties or delays in their financial transactions or benefits.

Contact information for follow-up and clarification

Beneficiaries often require specific tax information to ensure compliance with legal standards. Important details may include the name of the organization or individual responsible for tax documentation, such as a trust or estate, along with their Employer Identification Number (EIN). Additionally, the date of the tax year in question (e.g., 2022), along with the relevant forms (such as IRS Form 1041 for estates and trusts), should be explicitly stated to facilitate accurate processing. Providing a clear list of requested documents, like distribution summaries and Form K-1, is essential. For follow-up and clarification, include contact information, such as a dedicated email address or phone number, ensuring it is accessible during regular business hours to avoid delays in receiving the necessary tax information.

Letter Template For Beneficiary Request For Tax Information Samples

Letter template of notification for requesting beneficiary tax information

Comments