Are you curious about how beneficiary fund allocation works? In this article, we'll break down the essential elements of the process, making it easy to understand how these funds are distributed and the factors that influence allocation decisions. Whether you're a beneficiary, a financial advisor, or simply interested in the topic, you'll find valuable insights that can help clarify any uncertainties you might have. So, grab a cup of coffee and dive in to learn more about this important subject!

Clarity and Transparency

Beneficiary fund allocation requires clarity and transparency to ensure proper understanding of resource distribution. Detailed documentation, including allocation percentages, specific beneficiary needs, and funding sources, enhances trust in the process. For instance, if a charity allocates $100,000 to educational initiatives across five schools in New York City, each school might receive varying amounts based on student population or specific program needs. Transparency regarding how funds are utilized, such as salaries, materials, or facility upgrades, fosters accountability. Regular reports must outline expenditure and impact metrics, informing stakeholders of progress and challenges. Open communication channels enable beneficiaries and donors to ask questions, ensuring an ongoing dialogue regarding financial stewardship.

Specific Beneficiary Details

Beneficiary fund allocation aims to provide financial support to individuals or groups in need, often linked to specific causes such as education, healthcare, or disaster recovery. For instance, a scholarship fund may target students from underprivileged backgrounds, providing grants ranging from $500 to $5,000 per recipient to cover tuition and learning materials. Alternatively, a disaster relief fund might allocate resources to affected families, with distributions averaging $1,000 per household for immediate recovery efforts. These funds are typically managed by nonprofit organizations or foundations based in specific regions, enabling targeted assistance that addresses local needs effectively. Documentation requirements include proof of eligibility, such as income statements or medical records, ensuring support reaches those who need it most.

Fund Allocation Breakdown

Beneficiary funds, designated for specific allocations within charitable organizations or community projects, often require a detailed breakdown to ensure transparency and accountability. Each fund may be allocated toward distinct categories such as administrative expenses (typically 10-15% of the total budget), program costs (which can comprise 70-80% depending on the project), and reserves for future initiatives (around 5-10%). For instance, if a nonprofit organization received a total grant of $100,000, allocating $15,000 for administration, $75,000 for direct program services, and $10,000 for future project reserves effectively outlines the intended use of funds. Detailed reporting on each allocated portion enhances trust among donors and stakeholders, fostering a better understanding of financial management and project impact.

Compliance with Legal Requirements

Beneficiaries involved in fund allocation must adhere to comprehensive legal requirements established by regulatory authorities. These regulations, often dictated by specific legislation (such as the Financial Act of 1988 or the Nonprofit Organizations Act of 1990, depending on jurisdiction), mandate transparent reporting procedures and ethical management of allocated funds. Documentation, including detailed expenditure reports and audits, must be maintained to ensure compliance, fostering accountability and trust among stakeholders. Regulatory bodies often require annual filings, disclosures of conflict of interest, and adherence to guidelines on fund usage, particularly in public benefit cases. Failing to comply with these requirements can result in penalties, loss of non-profit status, or legal action from donors or governmental entities.

Contact Information for Queries

Beneficiary fund allocation involves the distribution process of financial resources to designated recipients, ensuring transparency and efficiency in managing assets for various purposes such as charitable causes, educational grants, or community development projects. Allocation criteria may include eligibility requirements, fund utilization guidelines, and documentation needed (such as proof of need or project proposals). Beneficiary names and contact information, along with designated amounts, must be clearly outlined to facilitate communication and address any queries. For further assistance, stakeholders can reach out to the fund management team, typically available via provided email addresses and telephone lines, ensuring responsive support throughout the allocation process.

Letter Template For Beneficiary Fund Allocation Explanation Samples

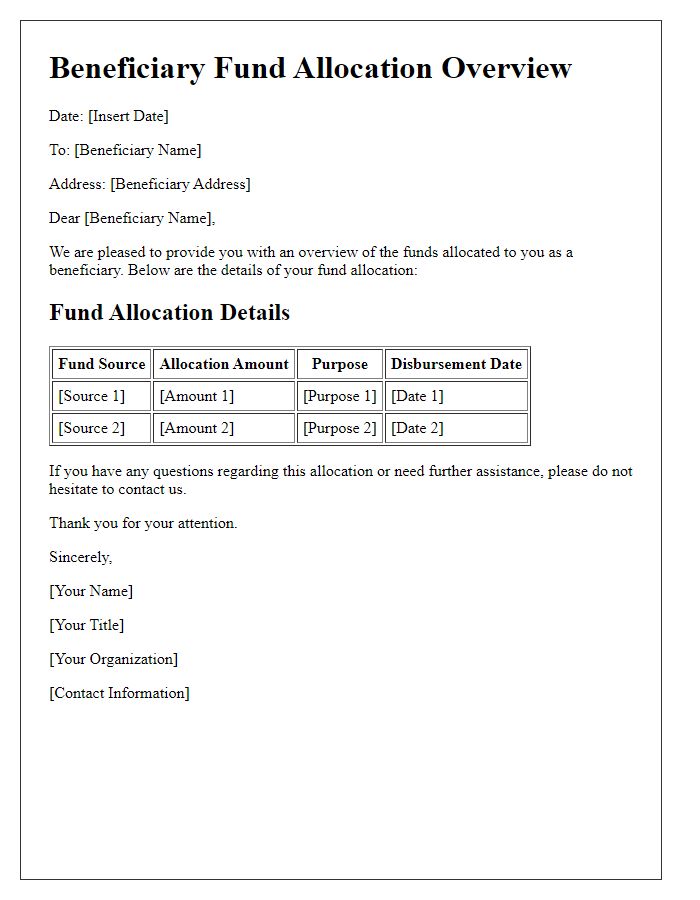

Letter template of beneficiary fund allocation overview for beneficiaries.

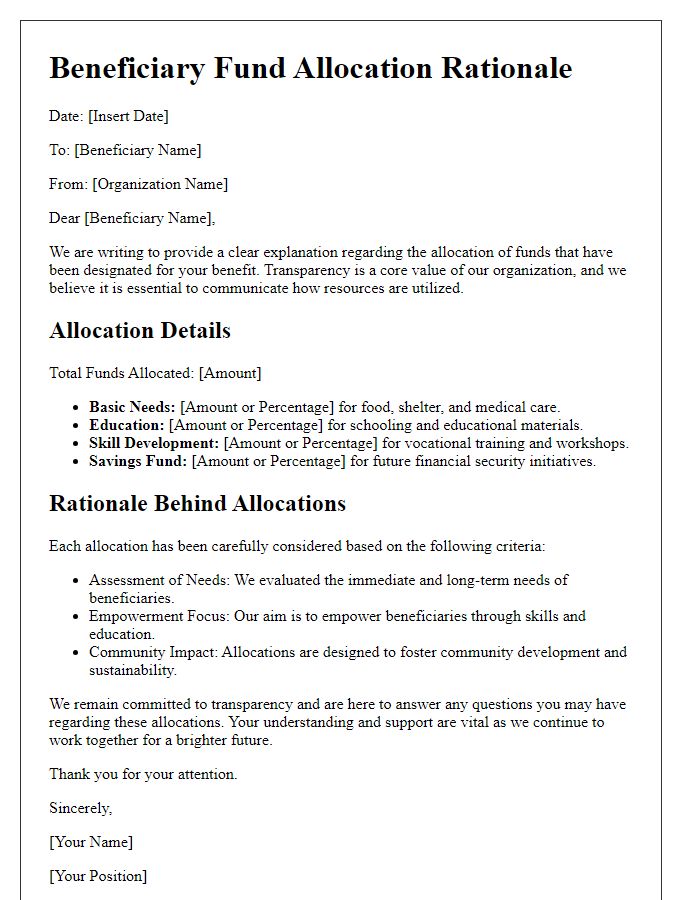

Letter template of beneficiary fund allocation rationale for transparency.

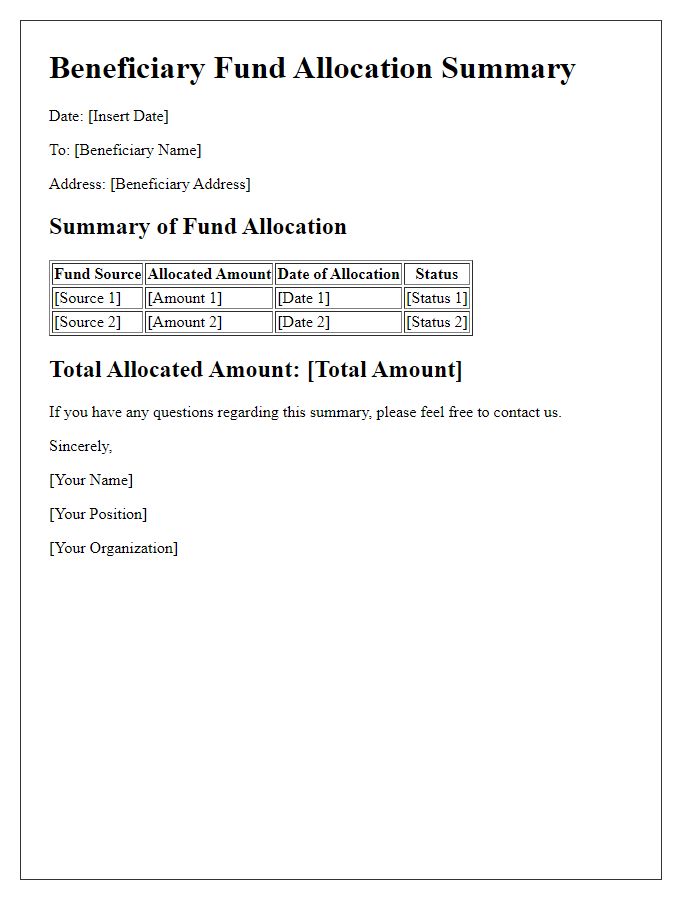

Letter template of beneficiary fund management update for beneficiaries.

Letter template of beneficiary fund allocation guidelines for compliance.

Comments