When it comes to formal communications, a well-crafted letter acknowledging a beneficiary guarantee can really make a difference. Whether you're representing an organization or writing on behalf of an individual, it's crucial to convey clarity, professionalism, and warmth. In this article, we'll explore a comprehensive template that you can customize to suit your needs, ensuring your acknowledgment is both effective and respectful. So, if you're ready to learn how to create the perfect letter, let's dive in!

Clear identification of parties involved

In a beneficiary guarantee acknowledgment, the document should clearly identify the parties involved to ensure legal clarity and accountability. The first party is the guarantor, often referred to as the "Guarantor" (Company Name/Individual Name, including address and contact details). The second party is the beneficiary, known as the "Beneficiary" (Company Name/Individual Name, including address and contact details). Specific details must include the nature of the guarantee, such as a financial obligation, loan agreement, or service contract. Each party's obligations and rights should be outlined succinctly, along with essential data points such as the date of the agreement, the guarantee's validity period, and any relevant identification numbers like tax ID or registration numbers. Clear definitions of terms, especially related to payment conditions, default scenarios, and dispute resolution mechanisms should also be exemplified. Ultimately, precise identification fosters trust and mitigates risks associated with ambiguities in the acknowledgment process.

Accurate contract or agreement details

A beneficiary guarantee acknowledgment serves as a vital confirmation of the terms and details specified in a contract or agreement. Important elements include the parties involved, which typically consist of the guarantor and the beneficiary, outlining their respective responsibilities and rights. The agreement should specify the guarantee amount, often a numerical figure, which represents the financial assurance provided. Key dates such as the contract signing date, execution date, and any expiration or renewal information must be clearly indicated. Additionally, the contract should define the conditions under which the guarantee is effective and clarify any limitations or exclusions. Lastly, the governing law, which pertains to the jurisdiction applicable to the guarantee agreement, should be explicitly stated to avoid disputes.

Explicit acknowledgment statement

The beneficiary guarantee acknowledgment serves as a formal declaration confirming the understanding and acceptance of the terms outlined in a legally binding agreement. This statement explicitly denotes the awareness of specific obligations, rights, and the significance of the agreement in financial transactions, such as loans or insurance policies. For example, a mortgage beneficiary may confirm acknowledgment of the guarantee provided by the lender, detailing the implications of default and the recourse available to the lender in case of non-payment. This statement may also encompass crucial details regarding the duration of the obligation and any relevant legal clauses that protect both parties involved. Ensuring that all terms are clearly understood helps to prevent potential disputes in the future and promotes transparency in the fiduciary relationship.

Assurance of beneficiary rights fulfillment

A beneficiary guarantee acknowledgment serves as a formal document confirming an individual's or organization's commitment to fulfilling the rights and obligations owed to beneficiaries under a contractual agreement. This acknowledgment typically outlines key elements such as the beneficiary's name (e.g., John Doe), the associated policy number (e.g., Policy #123456), and the specific rights granted to the beneficiary, including entitlements to funds or assets after the occurrence of specified events like bereavement or policy maturity. Additionally, it highlights obligations legally mandated by governing laws, which may involve compliance with state regulations (such as the Uniform Transfers to Minors Act) to ensure the protection of the beneficiary's interests. Such documents are crucial in estates, trusts, and insurance claims, providing transparency and reassurance regarding the beneficiaries' rightful claims.

Contact information for further queries

Beneficiary guarantee acknowledgments play a crucial role in ensuring that all relevant parties understand their rights and responsibilities regarding financial transactions and entrustments. This document typically includes essential contact information for further queries, ensuring that beneficiaries and stakeholders can access assistance when needed. Important details to include may be the organization's official email address, phone numbers, office hours, and a dedicated support team's contact details for efficient query resolution. If there are specific individuals assigned to address vested inquiries, their names and roles can improve clarity and facilitate communication. Providing accurate contact information fosters transparency, builds trust, and enhances the overall effectiveness of the guarantee acknowledgment process.

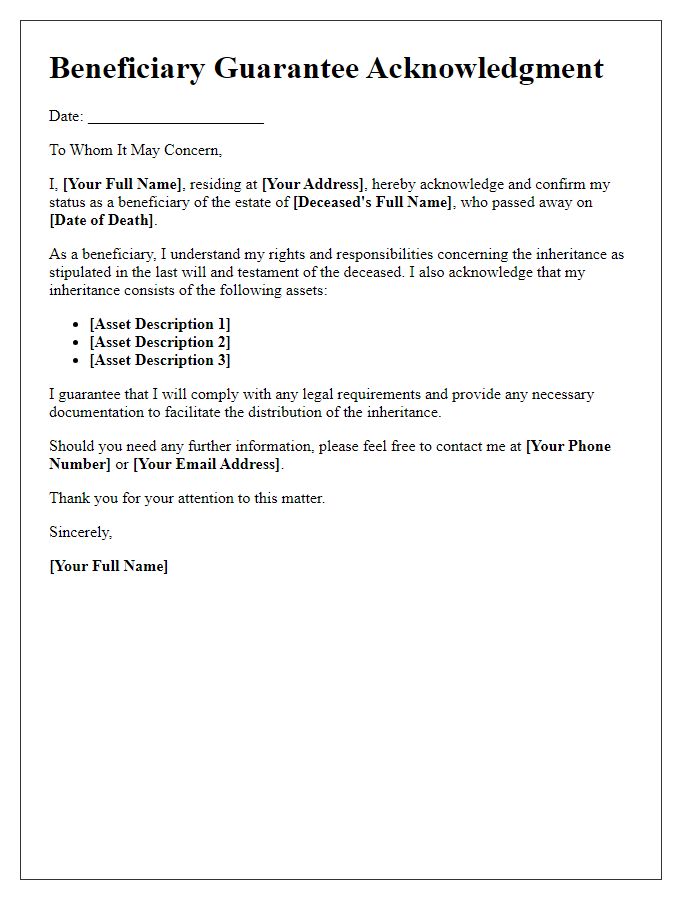

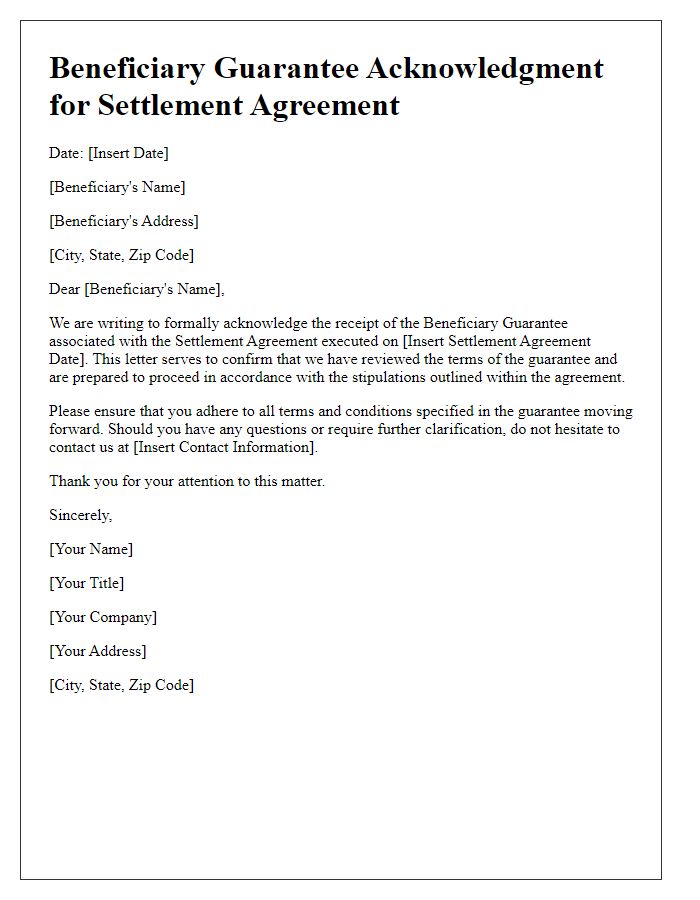

Letter Template For Beneficiary Guarantee Acknowledgment Samples

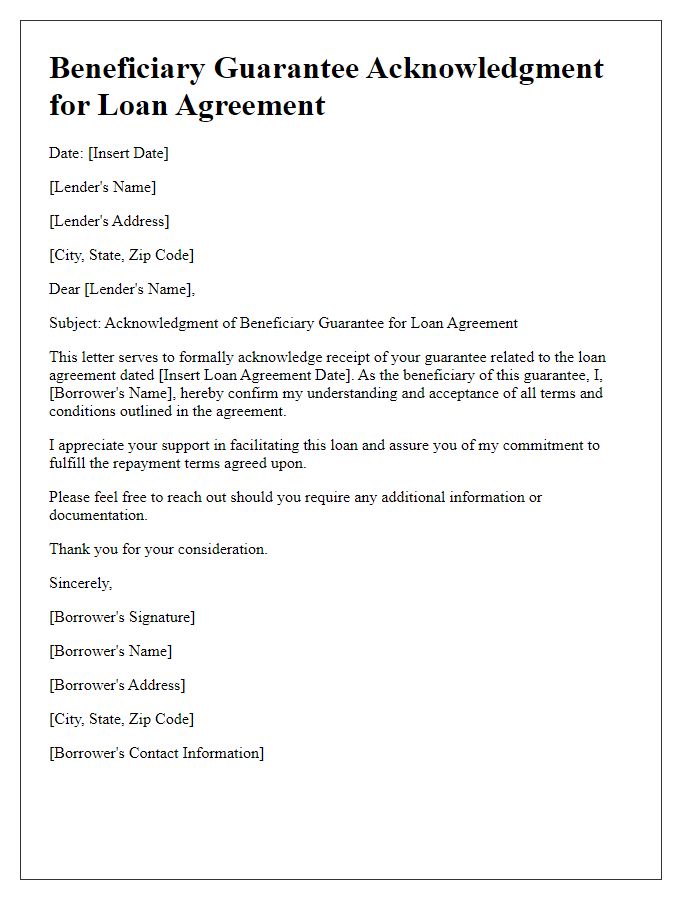

Letter template of Beneficiary Guarantee Acknowledgment for Loan Agreement

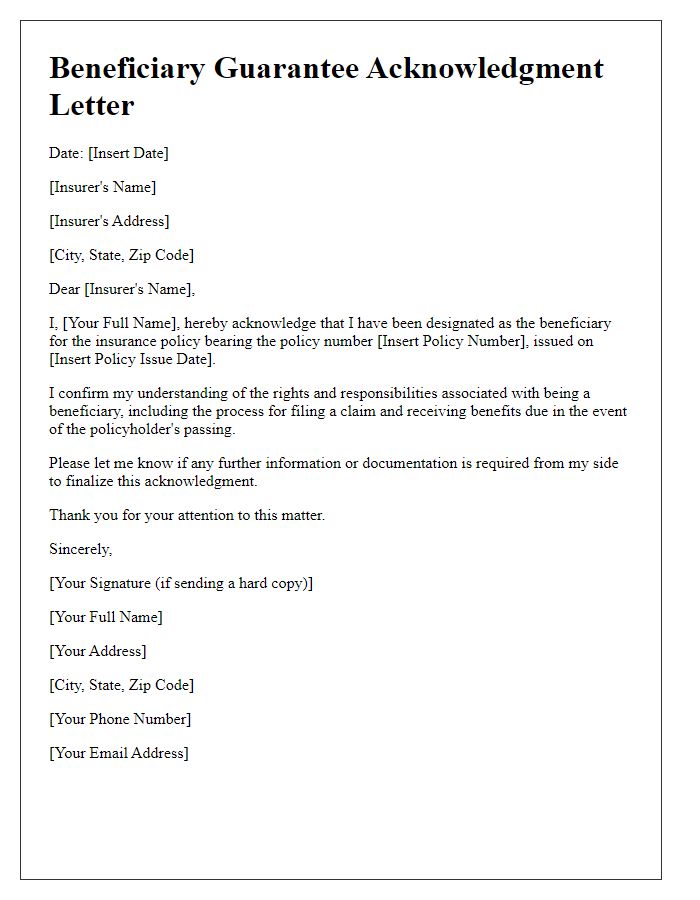

Letter template of Beneficiary Guarantee Acknowledgment for Insurance Policy

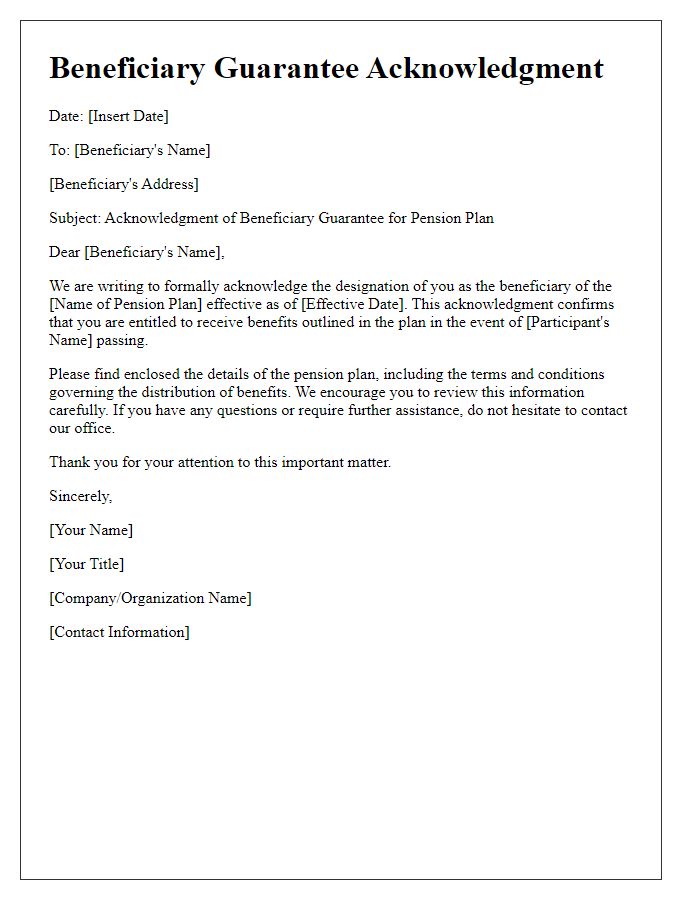

Letter template of Beneficiary Guarantee Acknowledgment for Pension Plan

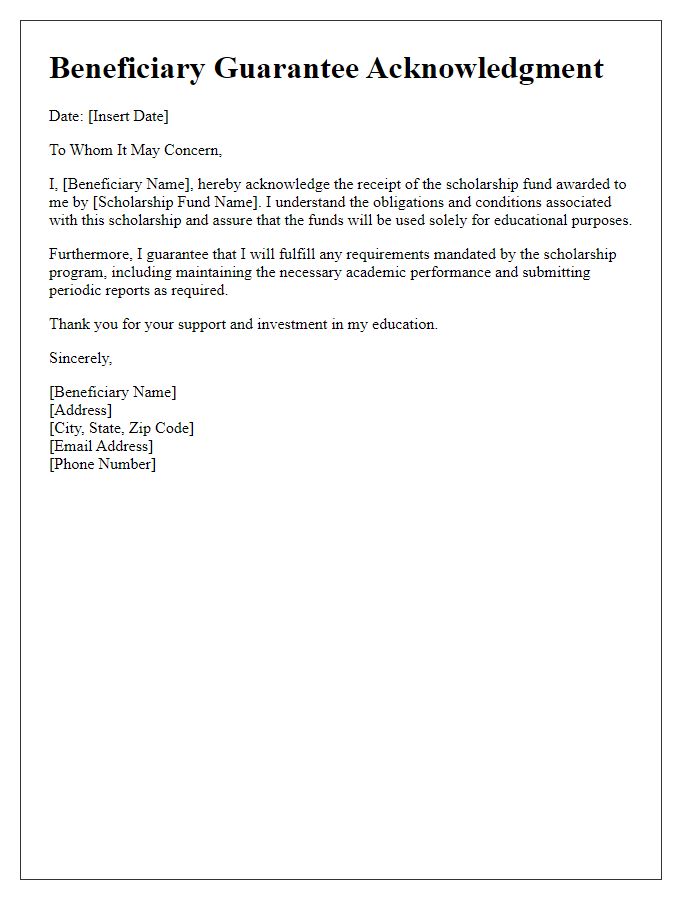

Letter template of Beneficiary Guarantee Acknowledgment for Scholarship Fund

Letter template of Beneficiary Guarantee Acknowledgment for Real Estate Transaction

Letter template of Beneficiary Guarantee Acknowledgment for Family Trust

Letter template of Beneficiary Guarantee Acknowledgment for Business Partnership

Comments