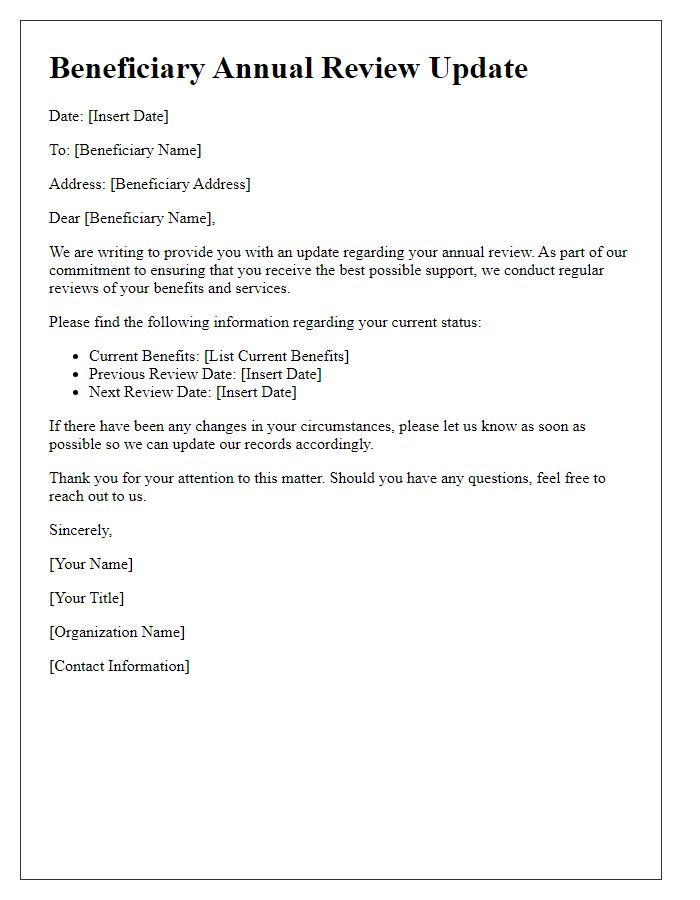

Are you looking for a straightforward and effective way to communicate with beneficiaries during their annual review? Crafting a clear and informative letter can strengthen relationships and ensure everyone is on the same page regarding updates and expectations. In this article, we'll explore a customizable letter template that highlights key information while maintaining a warm, conversational tone. Ready to enhance your communication? Let's dive in!

Personalization

Beneficiary annual review letters provide important financial information and personalized insights regarding investment portfolios. These letters typically include a summary of account performance over the past year, details on changes in asset allocation, and updates on any significant market events affecting investments. The content often highlights how individual risks and goals have been managed, with tailored recommendations for future strategies that align with the beneficiary's financial objectives. Personalization can extend to referencing specific beneficiaries' life events, such as retirement milestones, educational plans for children, or home purchase goals, creating a more meaningful connection and encouraging ongoing engagement with financial advisors.

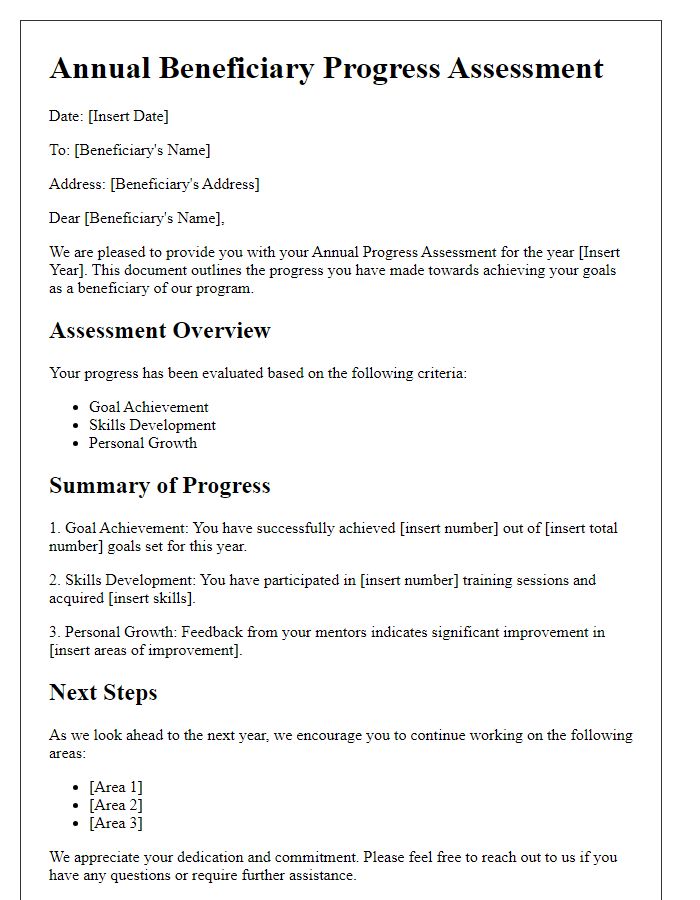

Clear Objectives

The beneficiary annual review letter provides an overview of the key objectives set for the year, such as enhancing skill development and increasing employment opportunities. Clear objectives include measurable targets, like achieving a minimum of 60 hours of vocational training, which aligns with community support programs in urban areas. Additionally, engagement with local businesses aims to secure internships for beneficiaries, emphasizing partnerships within the nonprofit sector. Regular assessment meetings will monitor progress, fostering accountability, while encouraging beneficiary feedback on program effectiveness remains crucial for improvement initiatives. This structured approach aims to empower beneficiaries through enhanced resources and opportunities, ultimately contributing to their independence and success.

Financial Overview

Beneficiary annual review letters provide crucial insights into financial performance and future projections. The summary will typically include key financial metrics such as total assets (for example, $250,000) and liabilities (approximately $50,000), highlighting net worth (around $200,000). A detailed analysis of revenue sources, including investment income (a significant 5% growth) and distributions from trust funds, offers a comprehensive overview of financial health. Additionally, the letter may address changes in market conditions, such as interest rates (currently at 3.5%) and their impact on growth strategy. Future considerations, including potential tax implications and upcoming legislative changes (such as the recent tax reform in 2023), will also be discussed to prepare beneficiaries for informed decision-making. Ultimately, this financial overview serves as a transparent communication tool, helping beneficiaries understand their financial standing while planning for forthcoming opportunities or challenges.

Future Projections

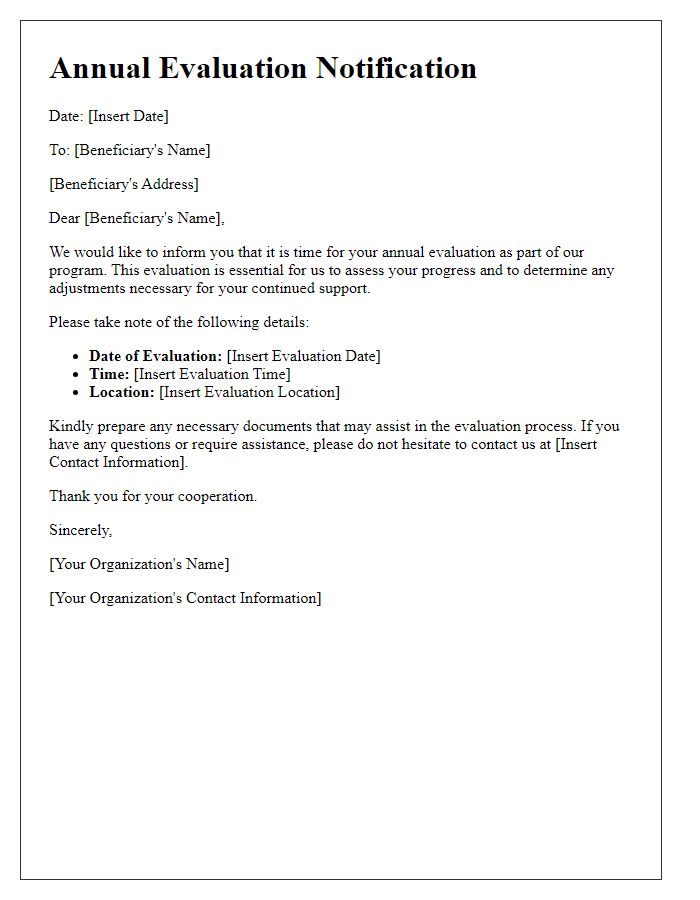

Annual beneficiary reviews are essential for monitoring progress and future projections in plans, such as financial assistance programs or trust distributions. These reviews assess individual performance against established goals, identifying trends and potential challenges. Beneficiary participation often includes meetings held annually in locations like community centers or virtually through secure online platforms. Data gathered during the review process, including income figures and expenditure reports, assists in forecasting future needs and adjustments in support levels. Continuous assessment allows for informed decision-making, ensuring the beneficiary's long-term sustainability and success in various aspects of their lives.

Contact Information

Contact Information serves as the essential details for communication between parties in the context of a beneficiary annual review. This typically includes the beneficiary's full name, address (street, city, state, zip code), phone number, and email address. Accurate and up-to-date contact information is vital for ensuring effective correspondence and timely updates regarding benefits. Consider including relevant identification numbers such as Social Security Number or policy number to facilitate easier access to records and provide a streamlined process for inquiries. In certain instances, reference to a point of contact within the organization managing the review can enhance clarity and foster a more productive dialogue. Proper formatting of this section enhances professionalism and ensures no critical detail is overlooked.

Comments