Are you looking to streamline your processes for requesting donation receipts? Crafting a well-structured letter is key to ensuring your beneficiaries receive their contributions with ease. In this article, we'll walk you through essential components and tips for creating a clear and effective donation receipt request letter. So grab a cup of coffee and let's dive in to explore how you can enhance your donation management today!

Donor Information

Beneficiary organizations rely on donor contributions to support various community initiatives and outreach programs. Accurate documentation of donor information, such as names, addresses, and contributions, is crucial for maintaining transparency and trust. For instance, a local charity organization might receive significant donations from individuals or businesses, reflecting their commitment to social causes. Additionally, these organizations must ensure that donation receipts comply with tax regulations enforced by the IRS. Proper receipt requests should emphasize the donation's purpose, date, and amount, aiding donors in tax deductions and record-keeping. Organizations can enhance their donor relationships by promptly acknowledging donations and providing necessary documentation.

Reference to Donation Details

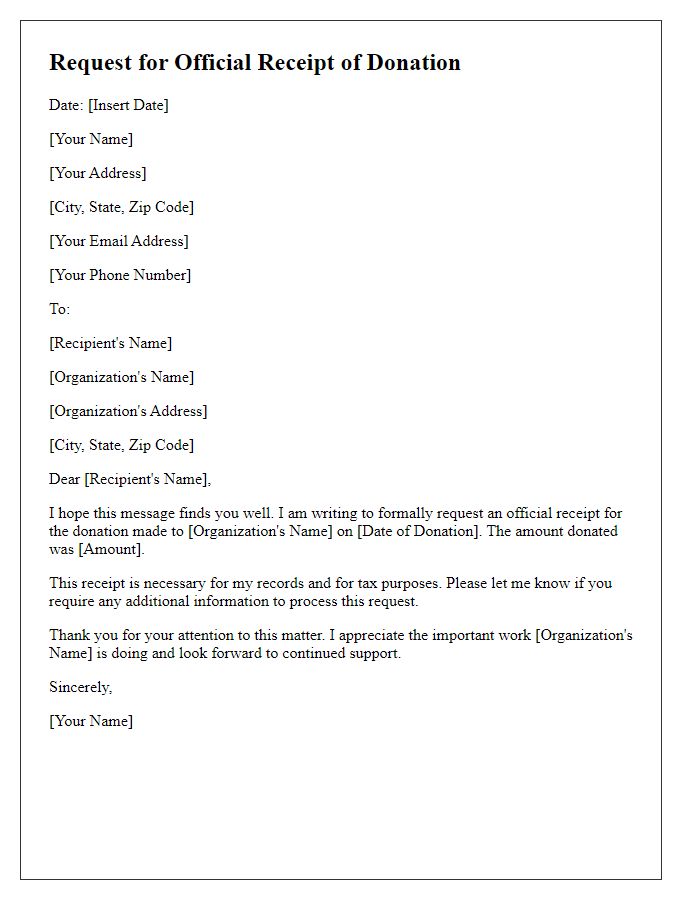

Charitable donations play a crucial role in supporting nonprofit organizations, enhancing community projects, and funding various social initiatives. Donors often seek receipts for their contributions to ensure tax deductions and to keep accurate financial records. These receipts, which typically include essential details such as the donor's name, date of the donation, amount donated, and the nonprofit's tax identification number, serve as important documentation. Requests for donation receipts can be made via formal letters or emails, emphasizing the donation's specifics and the desire for proper acknowledgment of generosity. Keeping records of donations helps maintain transparency and encourages recurring support for vital causes within the community.

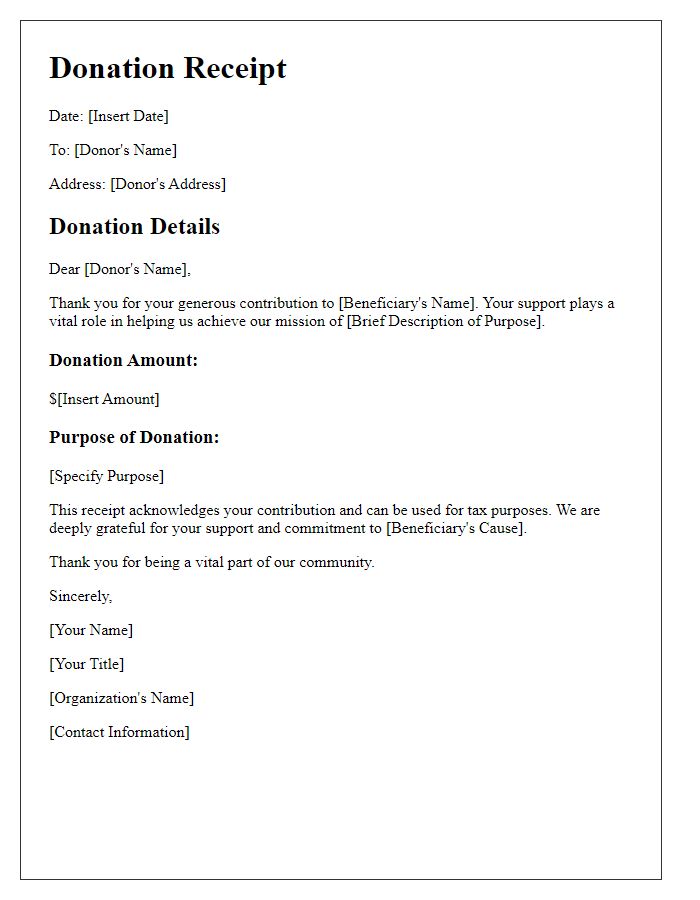

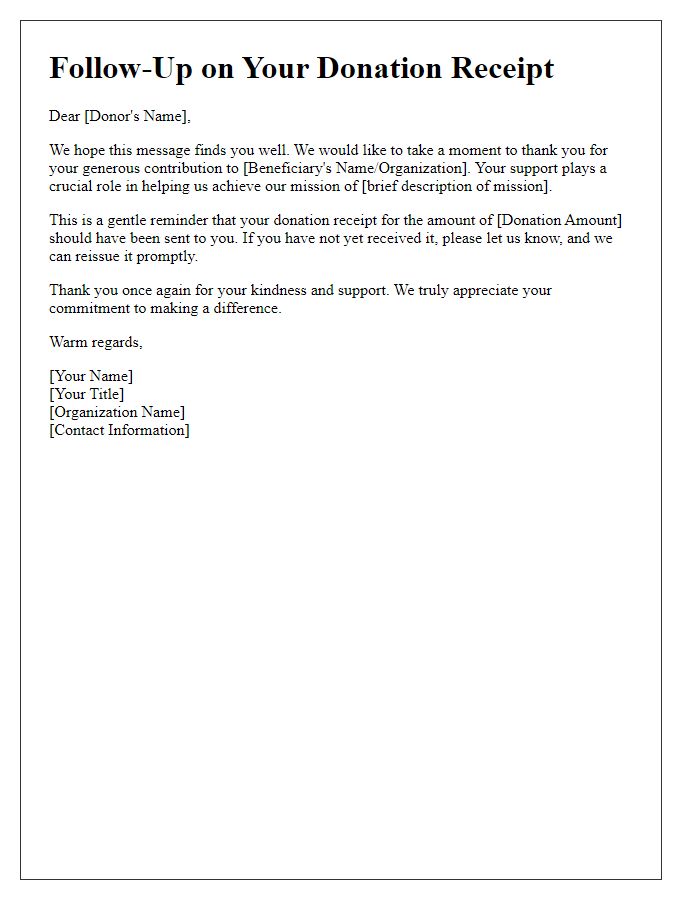

Request for Donation Receipt

A donation receipt serves as a vital document for tax purposes, confirming contributions made to non-profit organizations or charitable causes. Accurate records of donations, particularly during tax season, can assist donors in maximizing their deductions. When requesting a donation receipt, individuals should include essential details such as the donation amount, date of the contribution, and the organization's name. Specific organizations, like the American Red Cross or Habitat for Humanity, may have distinct guidelines for receipt requests. Precise documentation ensures that both the donor and the recipient organization maintain clear financial records, essential for transparency and accountability.

Contact Information

Beneficiaries of charitable donations often require formal receipts for contributions received. These receipts serve as proof for tax purposes and ensure transparency in charitable transactions. Important details typically included in the receipt are donor's name, donation amount, date of contribution, as well as the name of the charitable organization alongside its tax identification number (EIN). Additionally, information regarding the type of donation, whether monetary or in-kind, should be clearly stated. Ensuring compliance with IRS guidelines is essential for both organizations and donors engaged in charitable giving.

Gratitude and Acknowledgment

Generous donations play a crucial role in supporting non-profit organizations, such as community food banks that provide meals for families in need. Acknowledgment of contributions ensures transparency and builds trust between donors and recipients. For instance, recognizing a $50 contribution helps organizations demonstrate the impact of individual gifts, allowing them to serve over 100 meals to local families facing food insecurity. Crafting a formal receipt, detailing the donation amount, date, and purpose, fosters a culture of gratitude and may also serve as a tax deduction for the donor. Engaging in this practice not only highlights accountability but also encourages sustained donor support, fostering stronger community ties.

Letter Template For Beneficiary Donation Receipt Request Samples

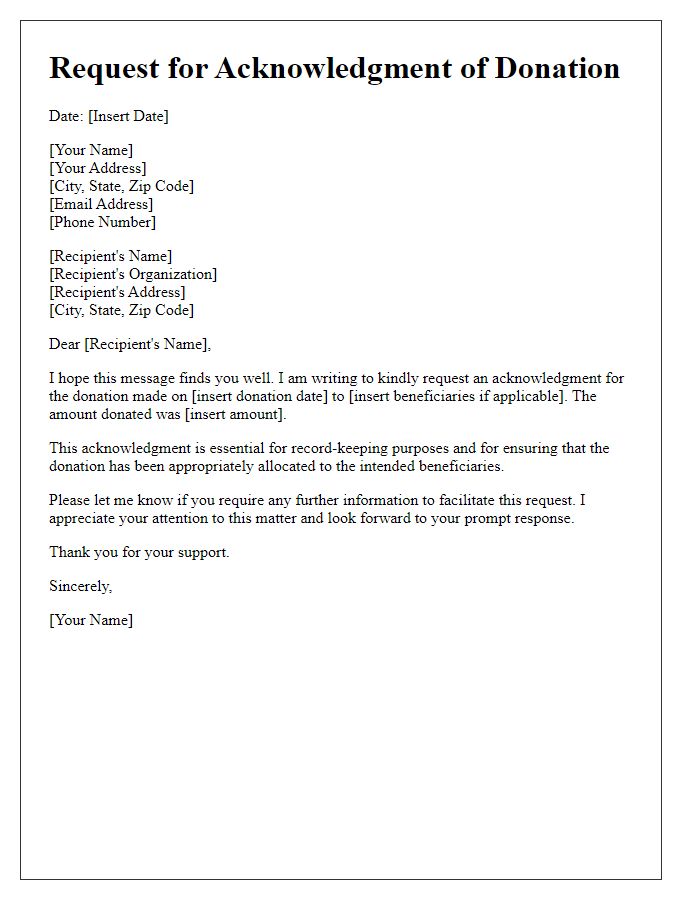

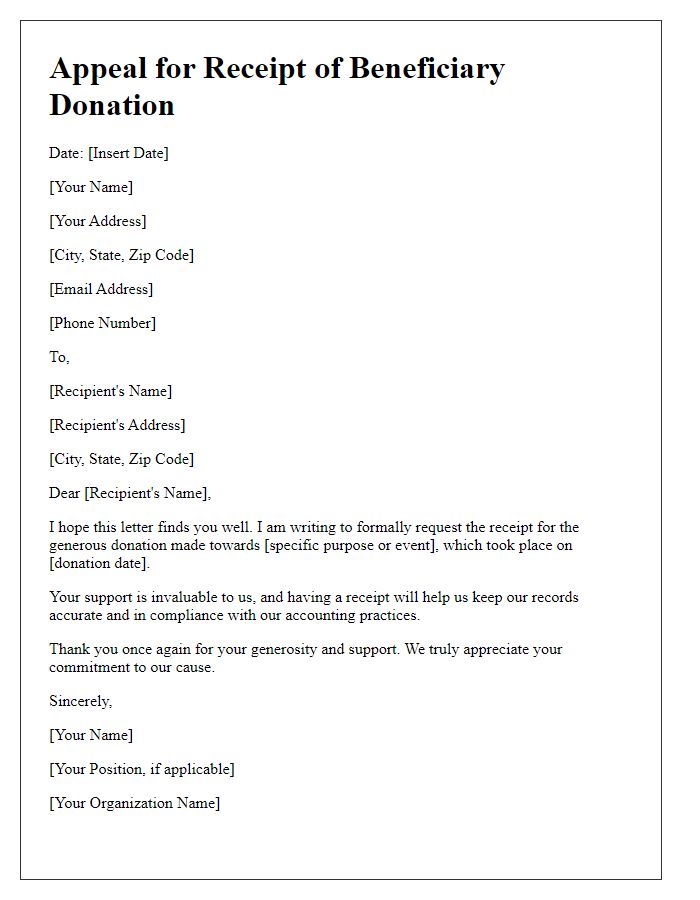

Letter template of request for acknowledgment of donation to beneficiaries

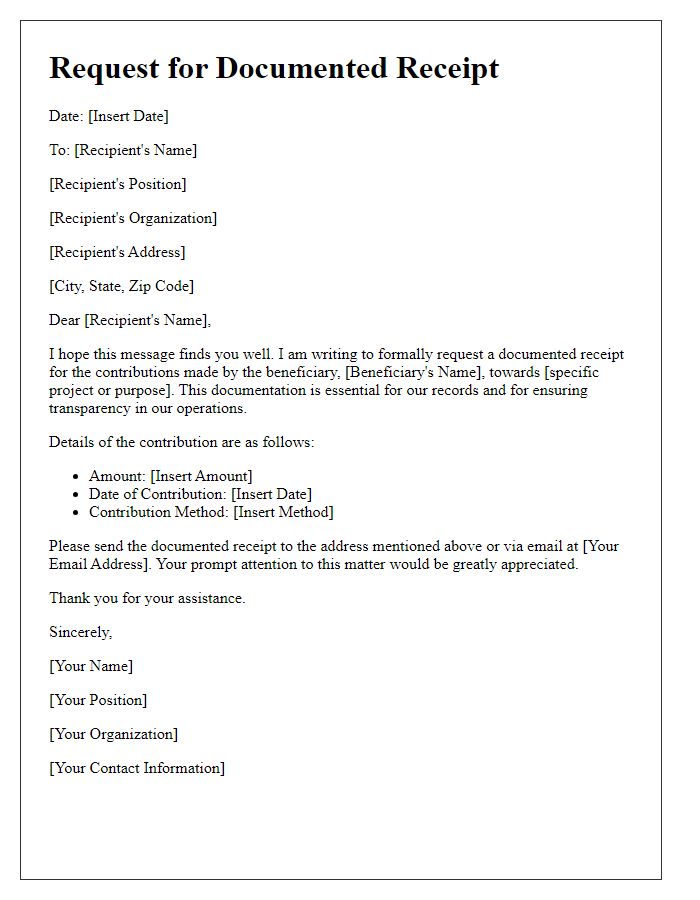

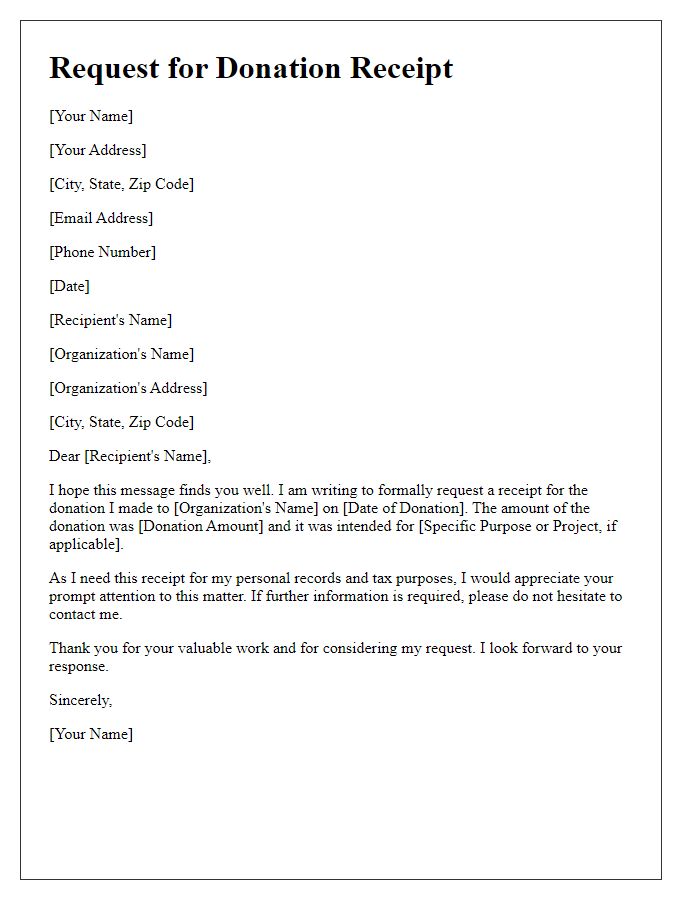

Letter template of request for documented receipt for beneficiary contribution

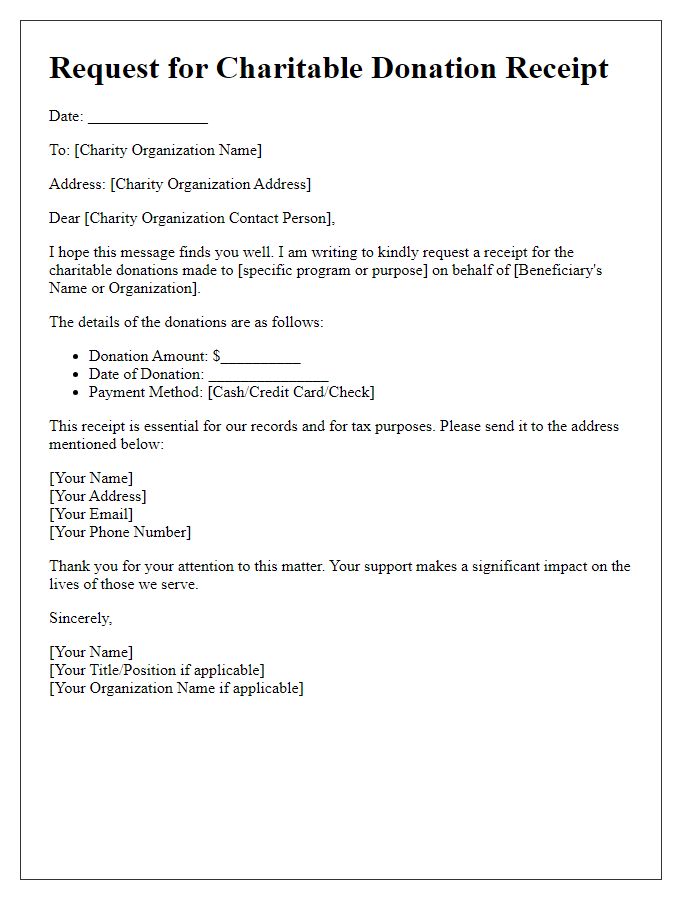

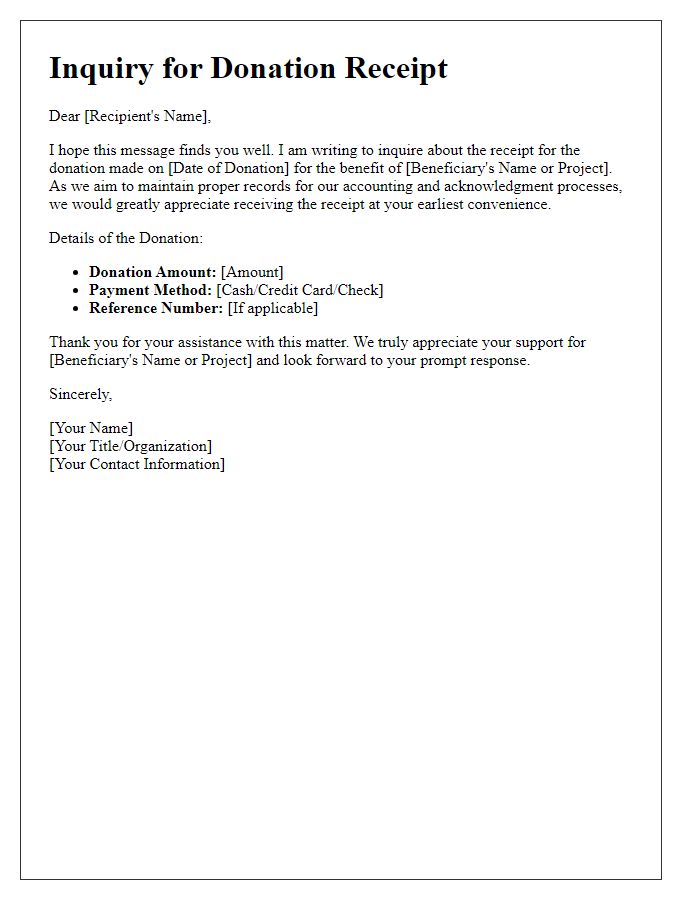

Letter template of request for charitable donation receipt for beneficiaries

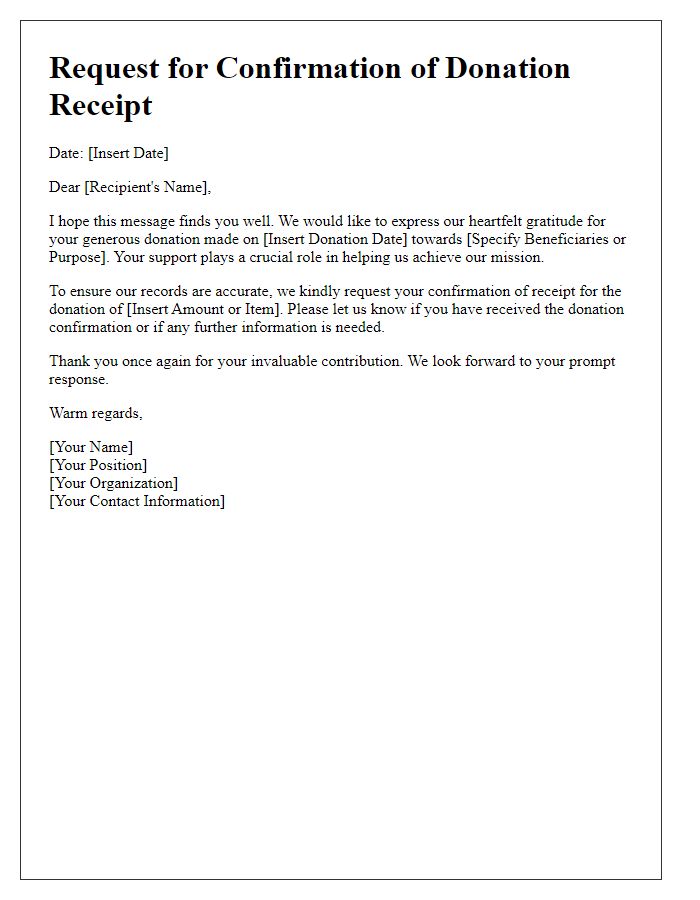

Letter template of seeking confirmation of donation receipt for beneficiaries

Comments