Hey there! If you've recently come across a letter template for a beneficiary estate windup notice, you're likely navigating some complex emotions and legalities. It's crucial to understand what this notice entails, as it outlines the final steps in settling an estate and informs beneficiaries about their rights and responsibilities. Let's dive deeper into the nuances of estate windup processes and what you should know moving forward. For more insights and detailed guidance, keep reading!

Legal compliance and regulations

Beneficiary estate windup notices are critical legal documents in the context of estate management, ensuring that heirs understand their rights and obligations during the estate settlement process. In compliance with the relevant jurisdiction's estate laws, such as those outlined in the Uniform Probate Code, these notices must detail the decedent's (the deceased person's) name, date of death, and the case number associated with the probate proceedings. The notice should specify the timeline for filing claims against the estate, often dictated by state regulations which can range from 30 to 90 days. Additionally, it should inform beneficiaries about their rights to contest the will or inherit property. Accurate documentation is essential to navigate complex legal frameworks and avoid potential disputes among beneficiaries, facilitating a smooth windup process in accordance with the law.

Beneficiary contact information

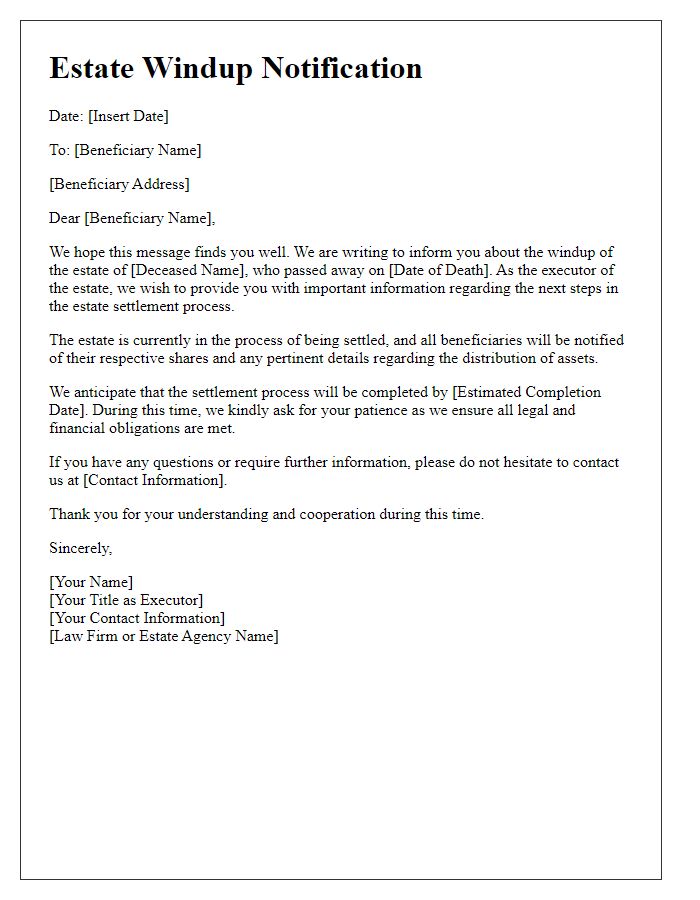

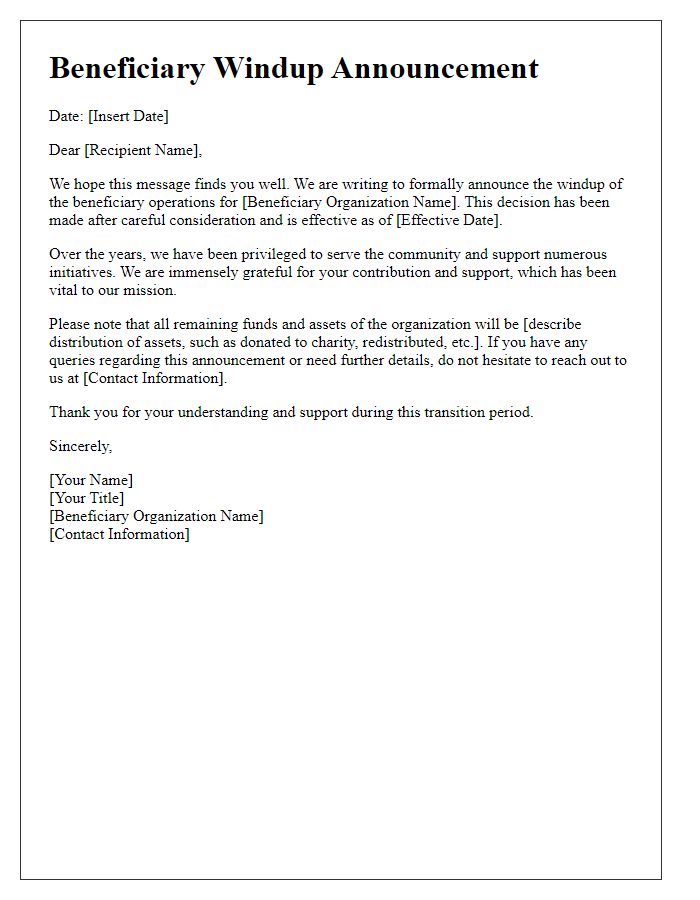

A beneficiary estate windup notice serves to inform individuals designated to inherit assets from a deceased's estate about important details and next steps. This notice typically includes the full name of the deceased individual (often referred to as the decedent) along with the date of their passing, providing context for the communication. Beneficiary contact information is crucial, encompassing names, mailing addresses, phone numbers, and email addresses to ensure clear communication. The notice may also reference the probate court handling the estate, located in a specific jurisdiction like Los Angeles County or Cook County, along with the case number for tracking purposes. Additionally, significant dates related to the estate administration process, such as deadlines for claims or distributions, are often included to keep beneficiaries informed and engaged throughout the windup process.

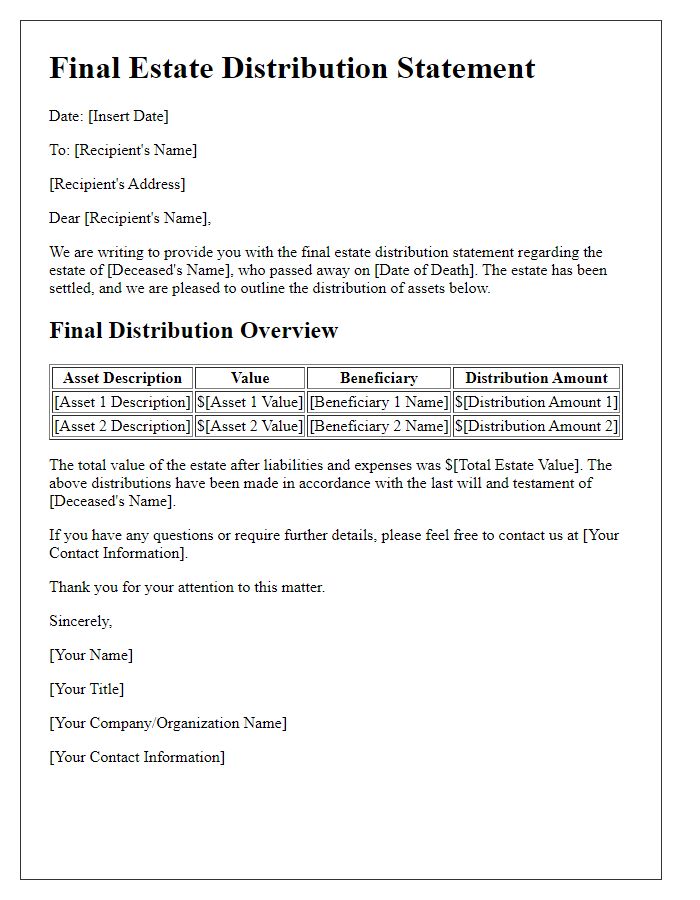

Estate details and value

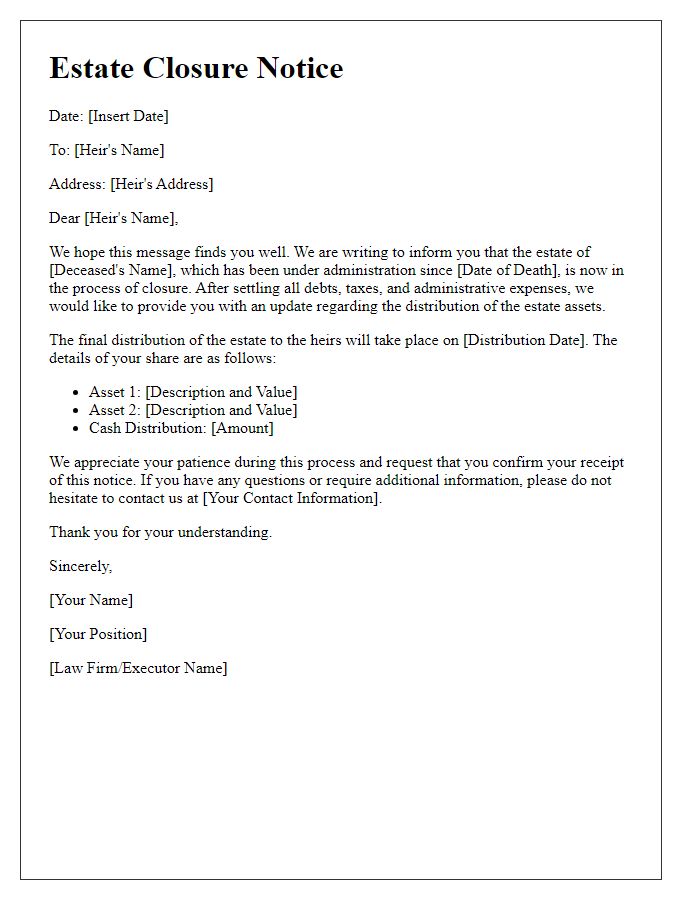

The estate of John Doe, located at 123 Maple Street, Springfield, is currently undergoing a windup process as per the final wishes stipulated in his Last Will and Testament dated June 15, 2020. The total estimated value of the estate is approximately $500,000, which includes real estate, personal belongings, and financial assets. The primary asset in this estate consists of a residential property valued at $350,000, alongside a savings account with a balance of $100,000 and various collectibles approximating $50,000. Beneficiaries are advised to review the estate documentation, including the asset inventory and liabilities statement, provided by the executor for the distribution process scheduled to commence on January 15, 2024. Personal representatives and beneficiaries must ensure that all claims against the estate are submitted by February 15, 2024, in order to facilitate a timely settlement of all outstanding debts and equitable distribution of assets.

Instructions for claims and objections

When a decedent's estate is being administered after their passing, beneficiaries must be notified about the windup process. This notice typically outlines the necessary steps for filing claims against the estate or objections to the proposed distribution of assets. Beneficiaries should be informed about pertinent dates, such as the deadline for submitting claims, often 30 to 90 days from the notice date, depending on local probate laws. The notice should also include the estate's location, often identified as the specific county court where the probate proceedings are occurring, as well as contact information for the executor or personal representative managing the estate. Additionally, it is crucial to include any required documentation that beneficiaries must submit, such as proof of relationship or legal entitlement. The objective is to ensure transparency, allowing any interested party adequate opportunity to assert their rights regarding the estate's distribution and any potential disputes.

Closing date and timelines

The estate windup process for beneficiaries typically involves several key timelines and deadlines. Notification letters regarding the estate of the deceased, which may include specific details about the closing date, are crucial for beneficiaries. Generally, the estate executor has to provide a notice within a specific timeframe, often within 60 days from the date of death. The closing date for the estate could be set anywhere from six months to one year after the notification, depending on the complexity of the estate and any potential disputes among beneficiaries. Beneficiaries should be informed about the timelines for filing claims against the estate, which can range from a few weeks up to several months after the initial notification letter is sent. These timeframes ensure that all beneficiaries are aware of their rights and responsibilities during the windup of the estate, allowing for an orderly and legal compliance with state probate laws, often subject to the jurisdiction in which the estate is processed.

Comments