Are you curious about how to navigate the complexities of real estate assets as a beneficiary? Understanding your rights and responsibilities can feel overwhelming, especially when it comes to property inheritance. This article aims to simplify the process, providing you with essential insights and practical tips to ensure you make informed decisions. So, let's delve into the world of real estate asset inquiries togetherâread on to discover more!

Personal Information and Identification

Beneficiary inquiries related to real estate assets necessitate comprehensive personal information and identification verification to ensure legal compliance. Key details required include full name (matching government-issued ID), current residential address (to verify residency), date of birth (to confirm age and eligibility), and Social Security Number (for tax identification purposes). Additional identification may include copies of a driver's license or passport, which serve to authenticate identity. Property details, such as address, parcel number, or title deed information, aid in locating the specific real estate assets in question. Collecting these elements establishes clarity regarding beneficiary rights, aiding in the proper administration of estate assets under state probate laws.

Detailed Asset Description

Inquiring about real estate assets, such as residential properties, requires detailed information to ascertain value and condition. Property specifics should include location, typically outlined by city, neighborhood, or ZIP code, plus square footage (for example, 2,500 square feet), number of bedrooms (such as 4), and bathrooms (like 3). Essential details encompass property age (e.g., built in 1995) indicating potential renovation status, as well as lot features such as size (e.g., 0.25 acres) and landscaping. Additional aspects to consider are amenities (e.g., swimming pool, garage), market data including comparable sales within the last six months, and zoning classifications affecting land use. Include any existing liens or mortgages that may impact ownership rights. Documenting this information accurately provides a comprehensive view of the asset under review.

Legal Ownership and Documentation

Beneficiary inquiries regarding real estate assets necessitate an examination of legal ownership and associated documentation. This process involves identifying the primary legal documents such as titles, deeds, and conveyance papers that outline the ownership structure. For instance, the Title Deed, usually issued by government authorities, verifies ownership rights and should include pertinent details such as the plat number, legal description, and any encumbrances like mortgages or liens. Additionally, beneficiaries must access property tax records, which provide evidence of tax obligations tied to the asset, including historical tax payment records available through local tax assessor offices. Documentation such as the Last Will and Testament can also be scrutinized to clarify beneficiary entitlements, ensuring compliance with the estate settlement process. Understanding these elements ensures a thorough grasp of legal standing and accountability regarding the real estate asset in question.

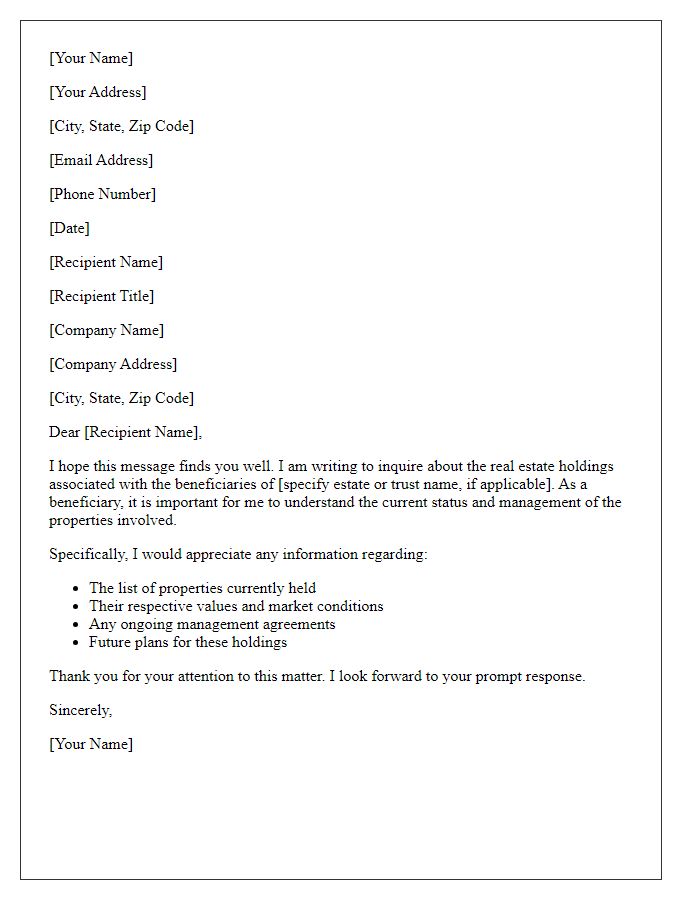

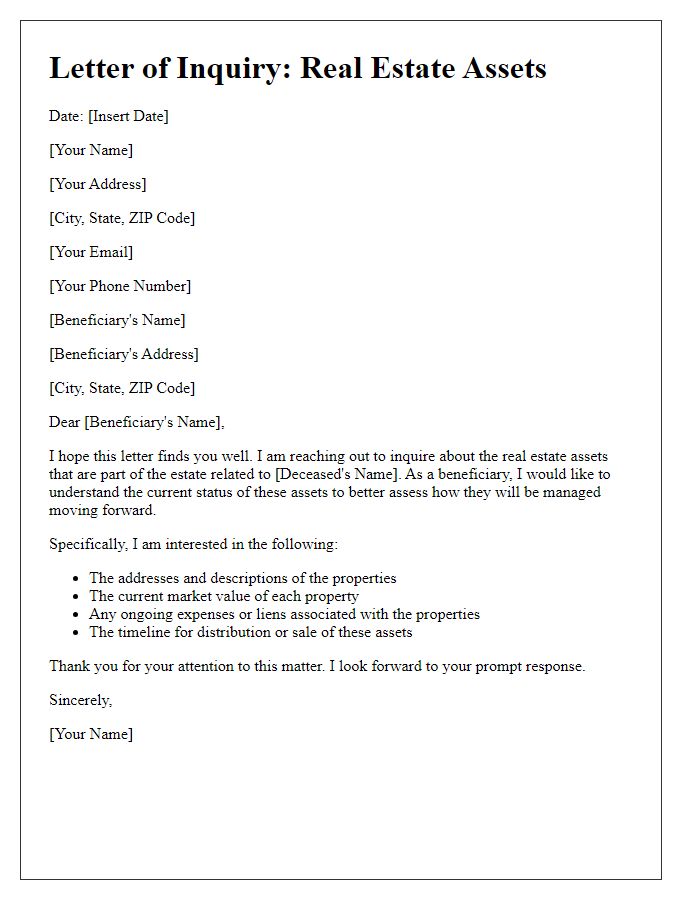

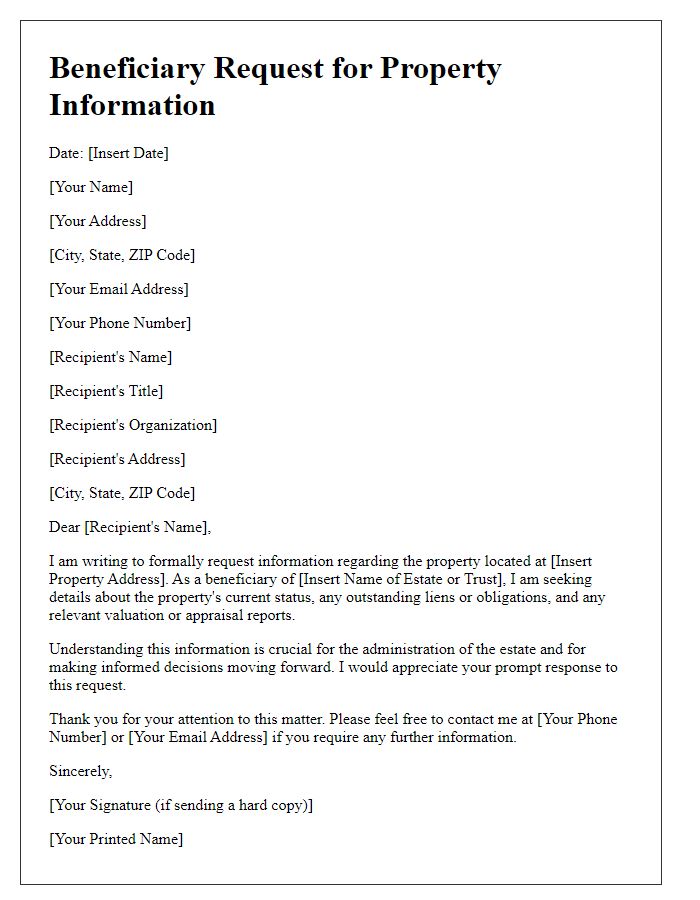

Contact Information for Inquiries

For inquiries regarding beneficiary real estate assets, including property valuation, legal ownership documentation, and estate management details, individuals should gather pertinent information such as property address, tax identification number, and details of the beneficiary. Contact the estate attorney or the property management company directly via their official email or phone number for swift assistance. Alternatively, reaching out to local real estate agencies can provide insights into property market trends and valuation assessments. It's advisable to have documentation ready, such as the will or trust agreement, to facilitate the inquiry process.

Privacy and Data Security Assurance

Beneficiary inquiries regarding real estate assets often require sensitive data handling, underscoring the importance of privacy and data security measures. Best practices involve using encryption protocols like AES-256 to protect personal information during transmission. Additionally, implementing access controls, such as multi-factor authentication, can limit data exposure to authorized personnel only. Safeguarding records in compliance with regulations like GDPR or CCPA mandates that organizations maintain transparency with beneficiaries about their data usage. Continuous monitoring for unauthorized access attempts further reinforces data integrity and trust in the asset inquiry process. Regular staff training on data security protocols remains crucial to preventing breaches and ensuring responsible information handling.

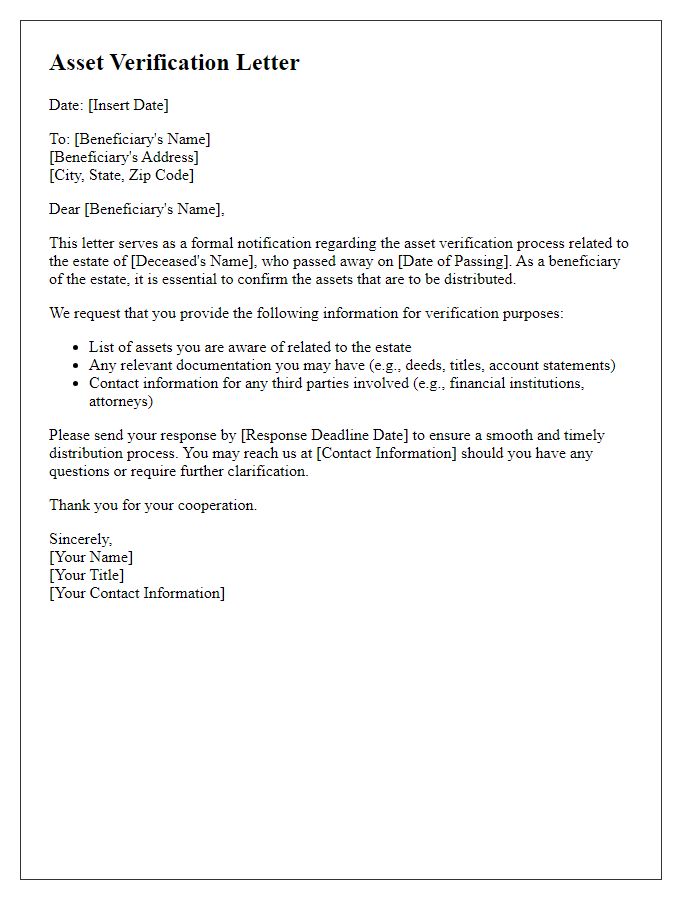

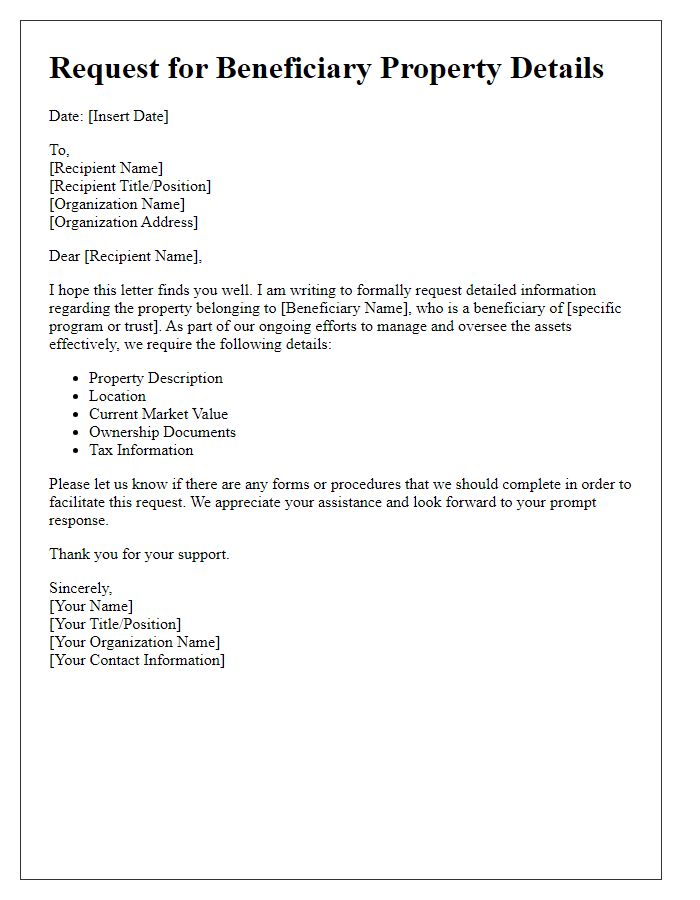

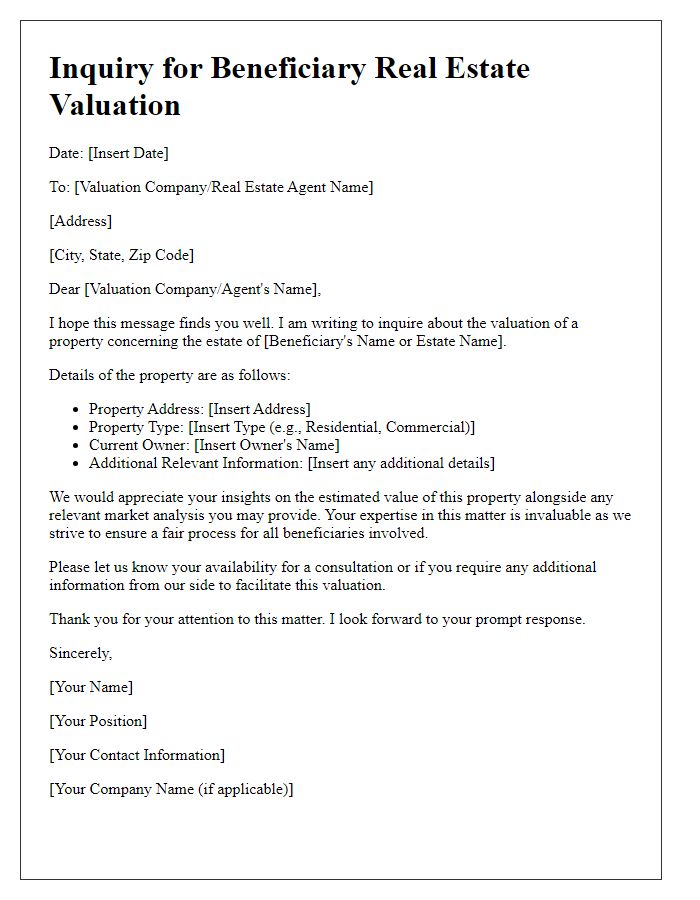

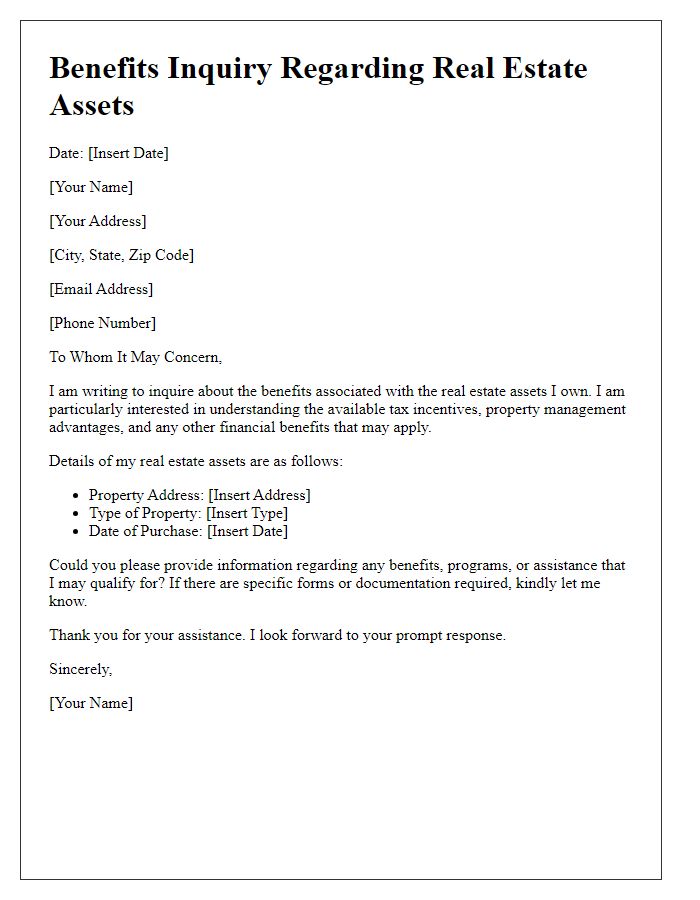

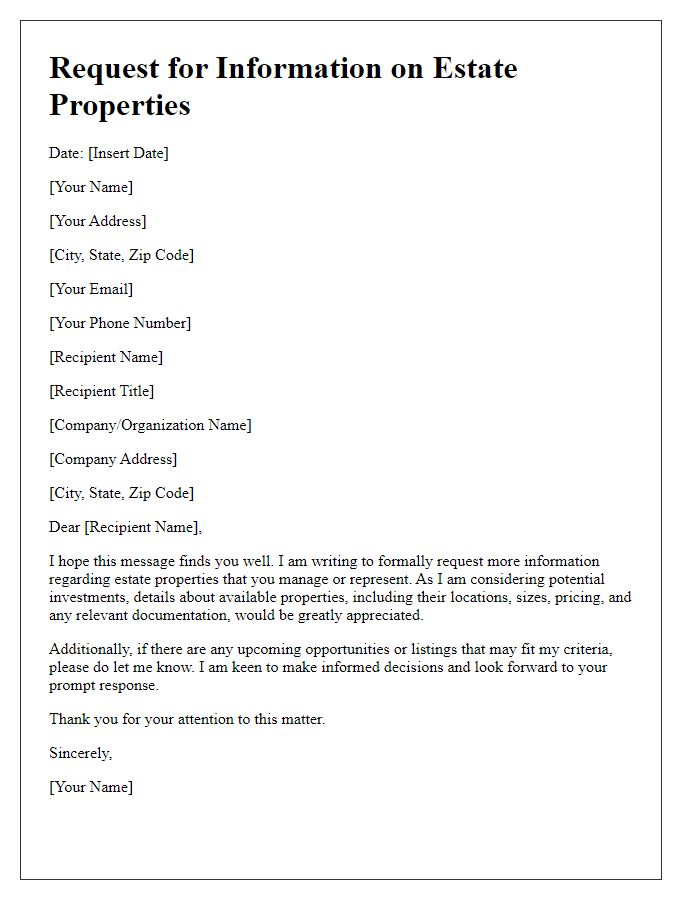

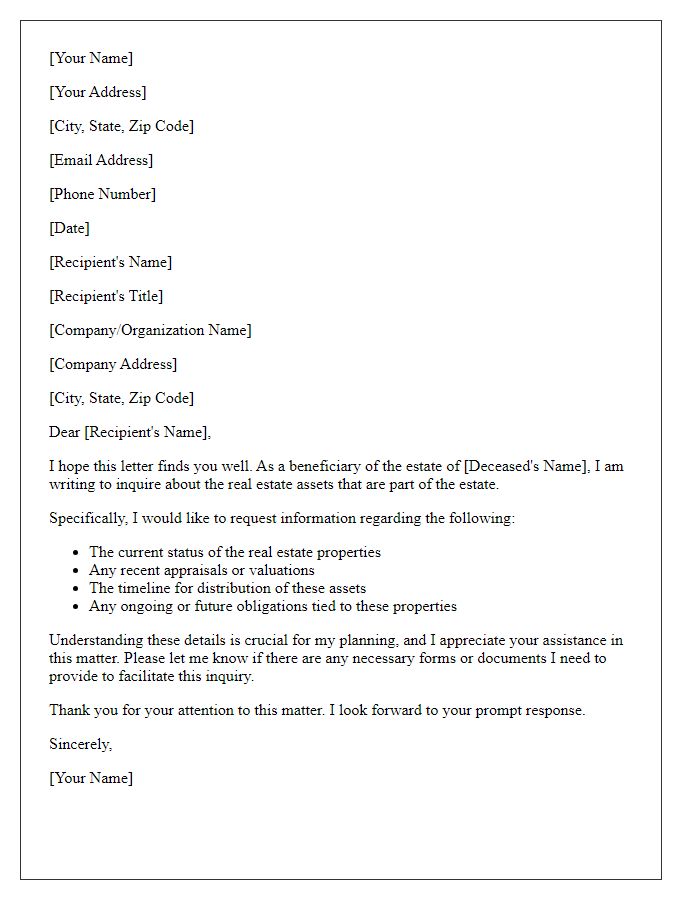

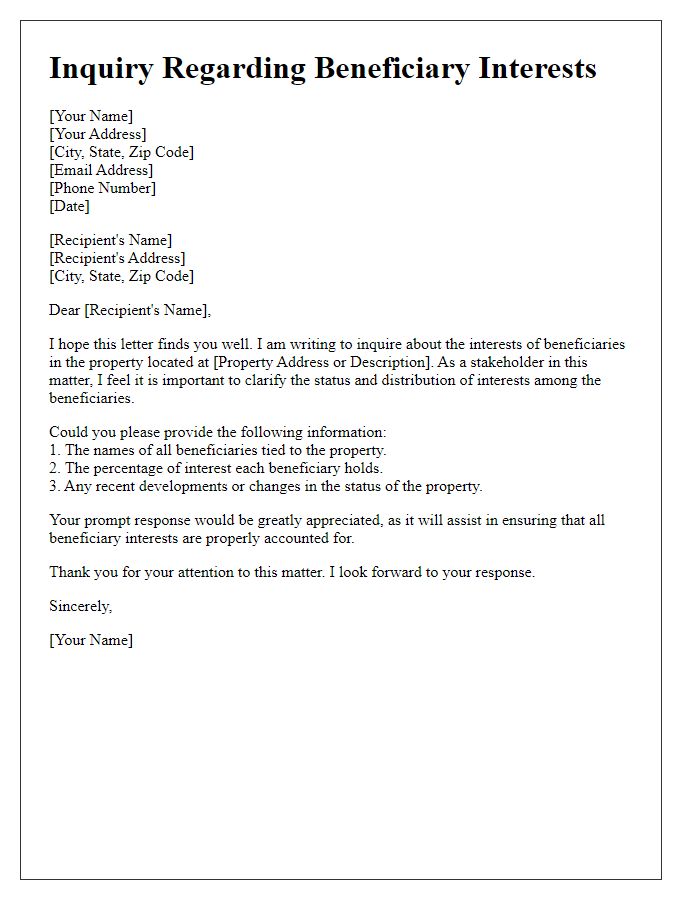

Letter Template For Beneficiary Real Estate Asset Inquiry Samples

Letter template of inquiry regarding real estate holdings for beneficiaries

Comments