Hey there! If you've ever wondered how to ensure your loved ones are taken care of after you're gone, you're in the right place. In this article, we'll explore the important aspects of confirming beneficiary legacy allocations, making sure that your intentions are crystal clear for your family. So, grab a cup of coffee and let's dive deeper into the details!

Clear Identification of Parties

Beneficiary legacy allocation confirmations often encompass specific information to ensure clarity and legality. The involved parties typically include the primary legatee (the individual receiving the legacy), the executor (the person responsible for administering the estate), and the estate (the totality of assets and liabilities left by the deceased). In formal documents, full legal names, addresses, and contact information of all parties should be meticulously detailed. This ensures clear identification and minimizes any potential disputes regarding the distribution of assets. Additionally, the specific legacy being allocated, including its value and nature (e.g., real estate, monetary funds, or tangible personal property), must be explicitly stated to avoid ambiguity.

Detailed Description of Assets

Benefits of legacy allocation provide clarity and security for heirs during asset distribution. A comprehensive list of assets, such as real estate properties (including their market values assessed in 2023), financial investments (stocks valued at current market price), and personal belongings (artwork or vehicles appraised recently) serves as an essential document in estate planning. Life insurance policies (with beneficiaries specified) must also be included, alongside any retirement accounts that may impact beneficiaries. Including the locations of these assets, like addresses for real estate and custodian details for financial accounts, ensures proper management and allocation for beneficiaries according to the established legacy. Proper documentation streamlines the estate settlement process, preventing potential disputes among heirs.

Distribution and Percentage Allocation

A legacy allocation confirmation document outlines the distribution and percentage allocation of assets to designated beneficiaries. This important document typically specifies the total value of the estate, such as $500,000, alongside precise percentages assigned to each beneficiary. For instance, a beloved child may receive 40%, equating to $200,000, while a charitable organization might be allocated 10%, resulting in a $50,000 contribution. It includes detailed descriptions of each asset, such as real estate located in San Francisco, valued at $1.2 million, or investment accounts totaling $250,000. The confirmation ensures clarity on the distribution process, reducing potential disputes among beneficiaries, while following legal requirements established in the last will and testament. This document acts as a formal record, outlining specific terms and conditions related to the asset distribution process to ensure beneficiaries are informed.

Contact Information for Questions

Beneficiary legacy allocation confirmation provides essential information regarding the distribution of assets to designated individuals upon the passing of the benefactor. Key details include the names of beneficiaries, specific assets allocated, and instructions for distribution. Important organizations involved may include estate planning attorneys, financial advisors, or trust companies responsible for the execution of the will. Confirmation should include contact information for questions, typically listing both phone numbers and email addresses of representatives from estate management firms or legal counsel, ensuring beneficiaries can seek clarification on the allocation process and address any concerns regarding their inheritance.

Legal and Financial Disclosures

Beneficiary legacy allocation confirmation involves detailing the distribution of assets to heirs or beneficiaries as specified in a will or estate plan. Legal documents, such as wills and trusts, outline the specific shares of assets, including real estate, investments, and personal property, designated to each beneficiary. Financial disclosures offer transparency regarding the estate's value, including appraised properties and liquid assets, clarifying potential liabilities such as debts or taxes. This confirmation process ensures that all beneficiaries understand their entitlements and the legal obligations surrounding the distribution of the decedent's estate. Handling this with precision avoids future disputes, ensuring a smooth transition of wealth under legal guidelines.

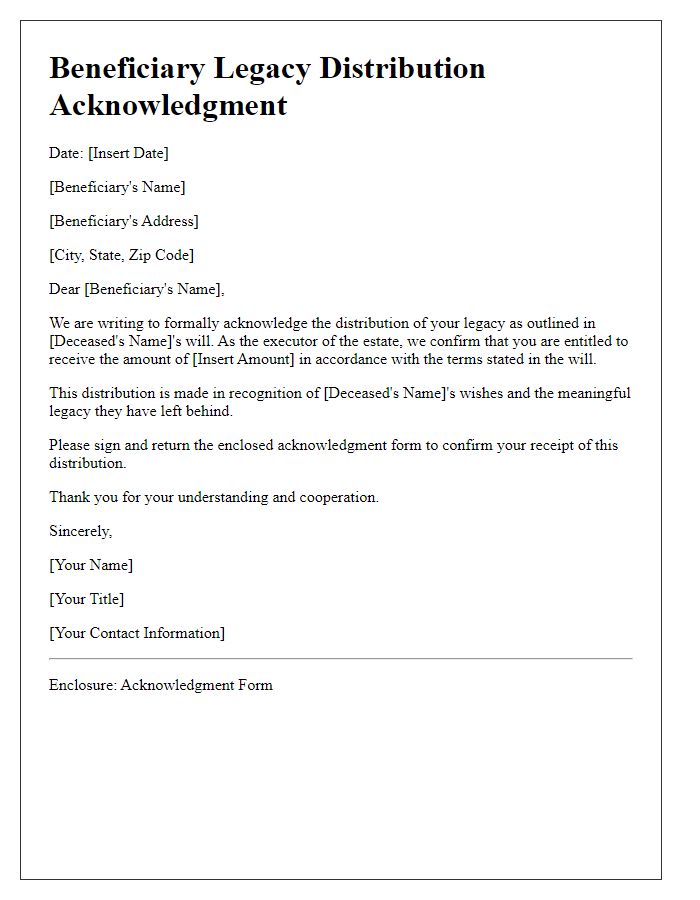

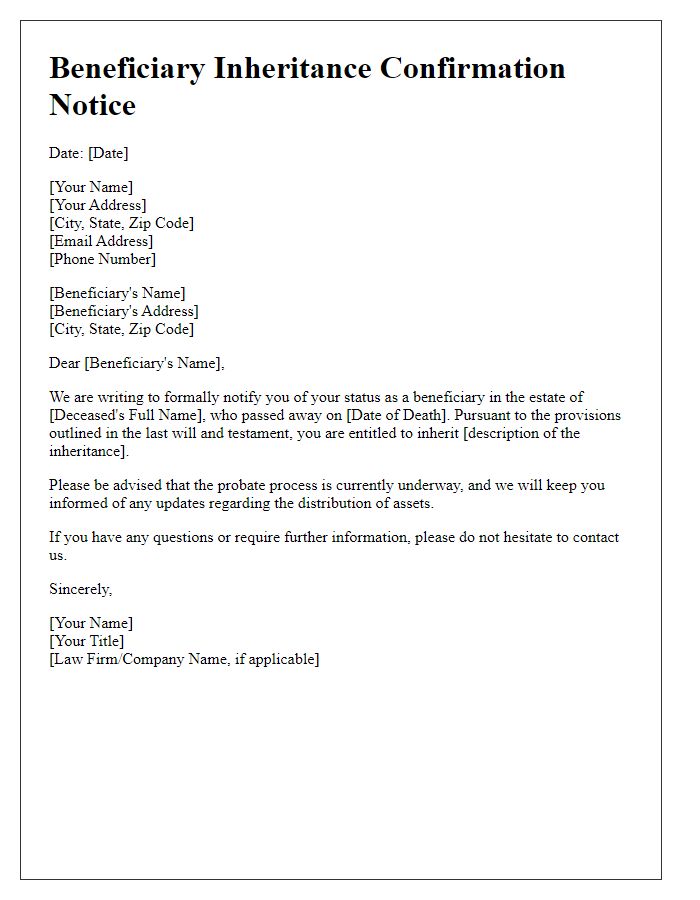

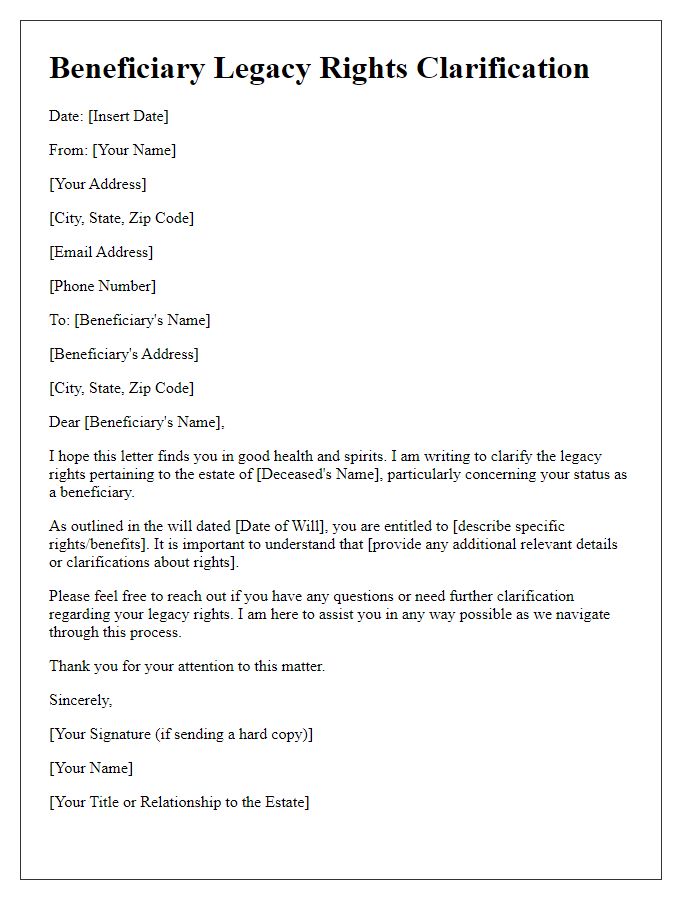

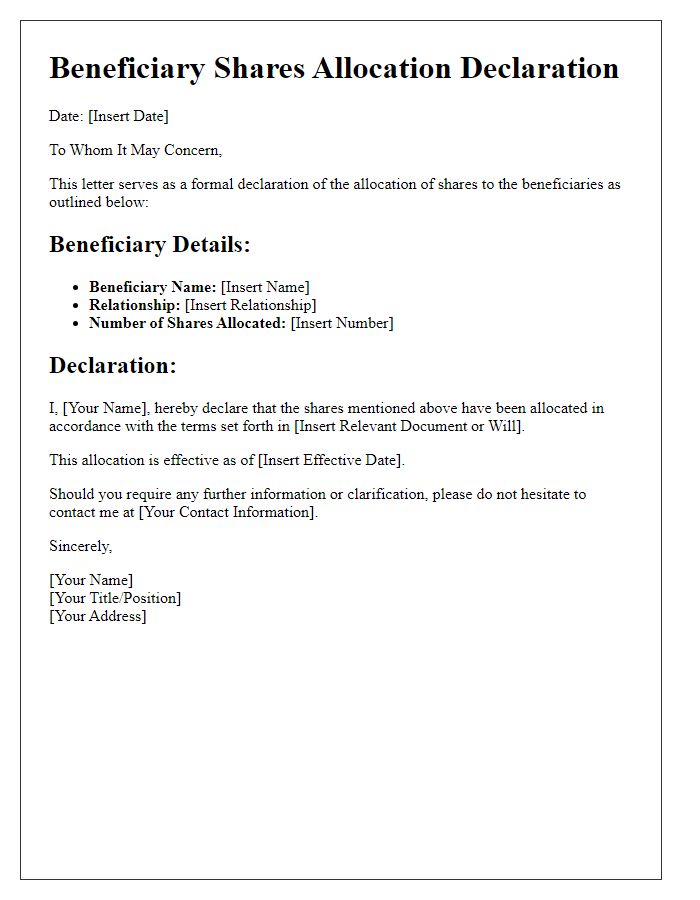

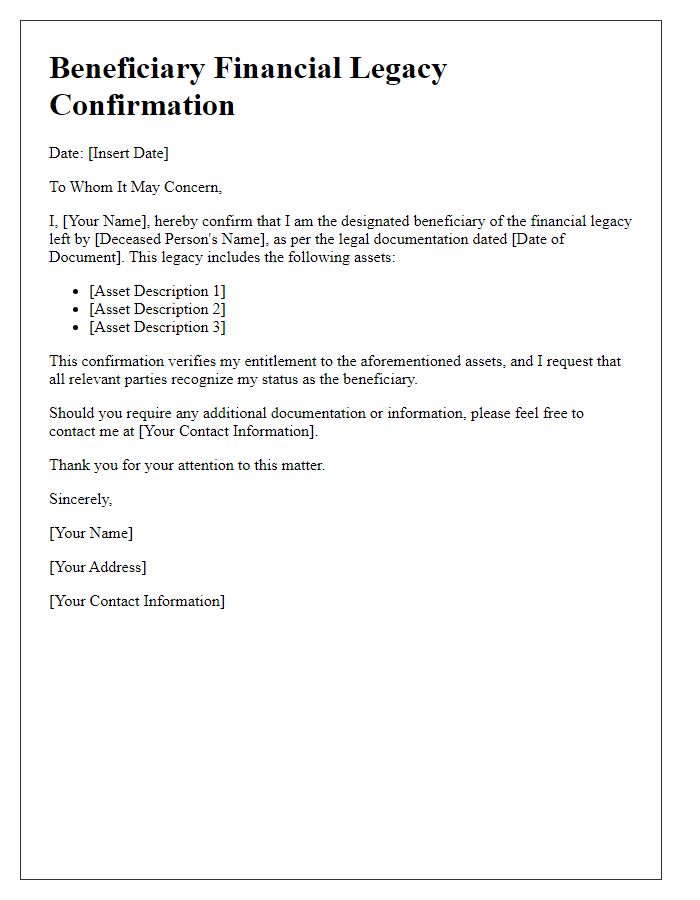

Letter Template For Beneficiary Legacy Allocation Confirmation Samples

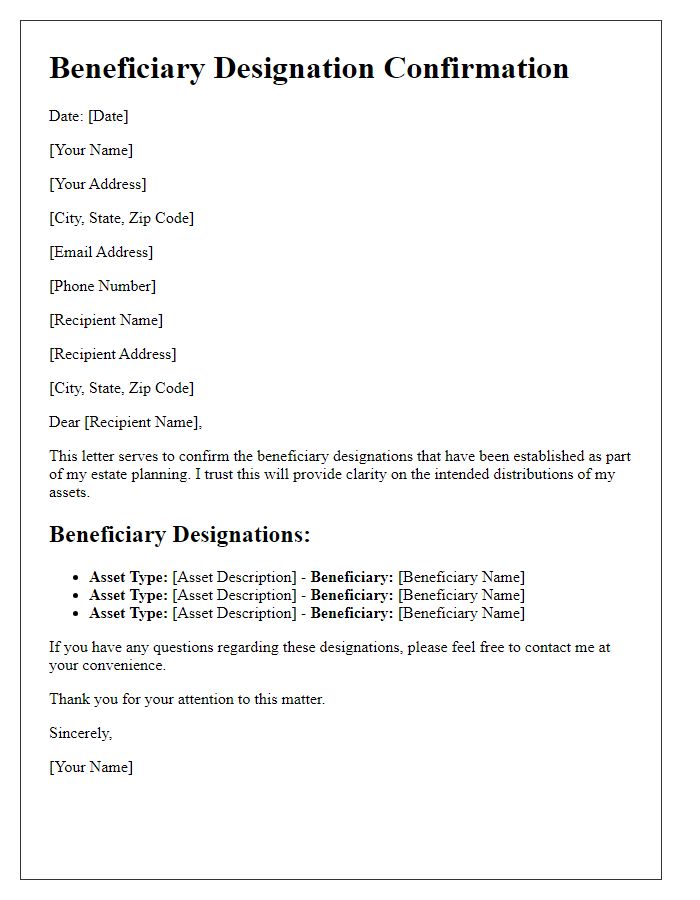

Letter template of beneficiary designation confirmation for estate planning.

Comments