Are you excited about taking the next step toward homeownership? Getting your mortgage approval is a significant milestone in your journey, and knowing what to expect can make it easier. In this article, we'll break down the essential elements of a mortgage approval notification letter, ensuring you understand what the lender's communication means for you. So, let's dive in and explore this important topic together!

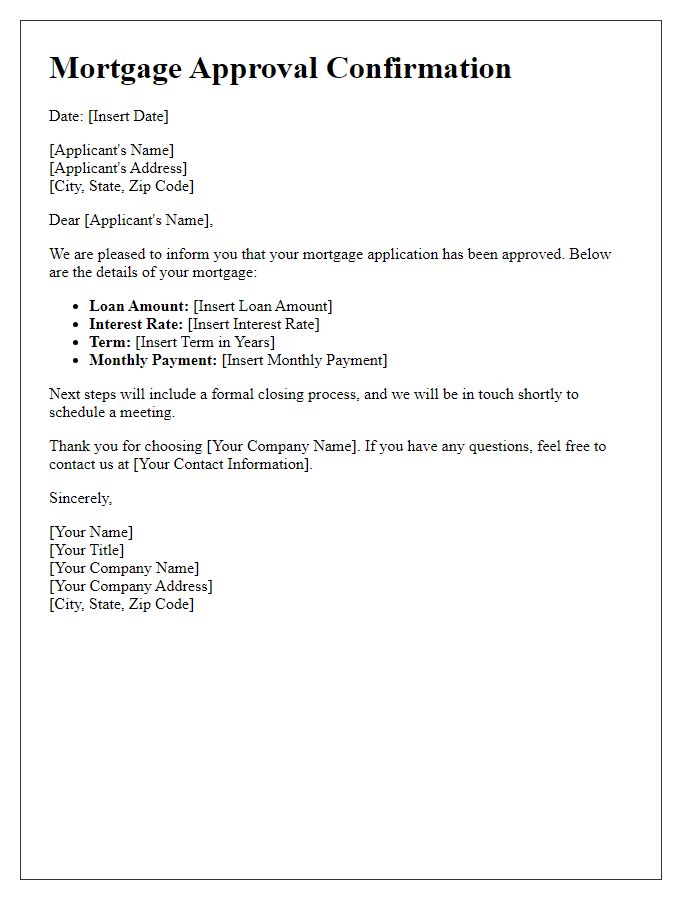

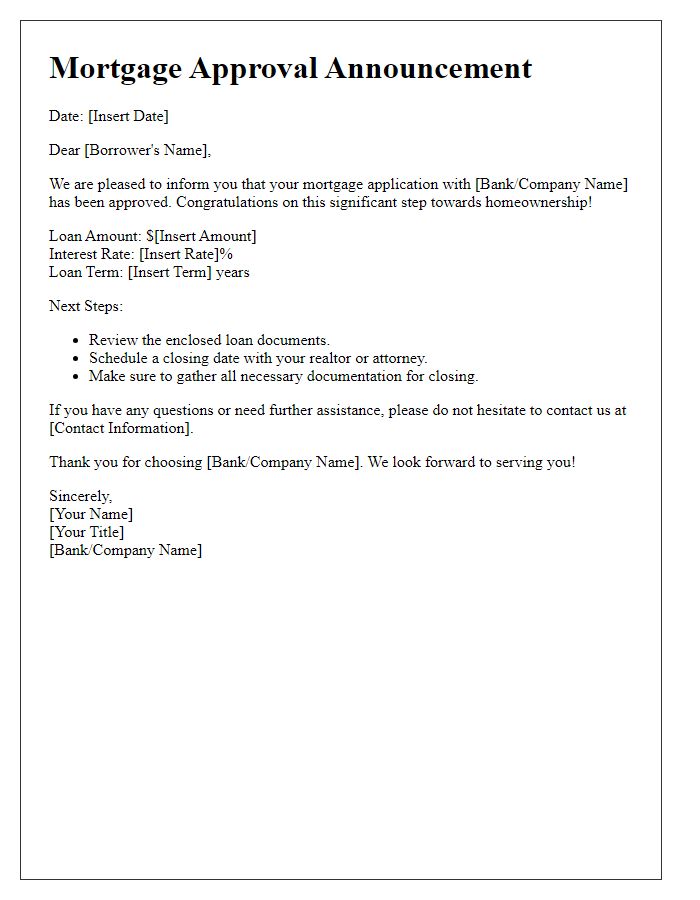

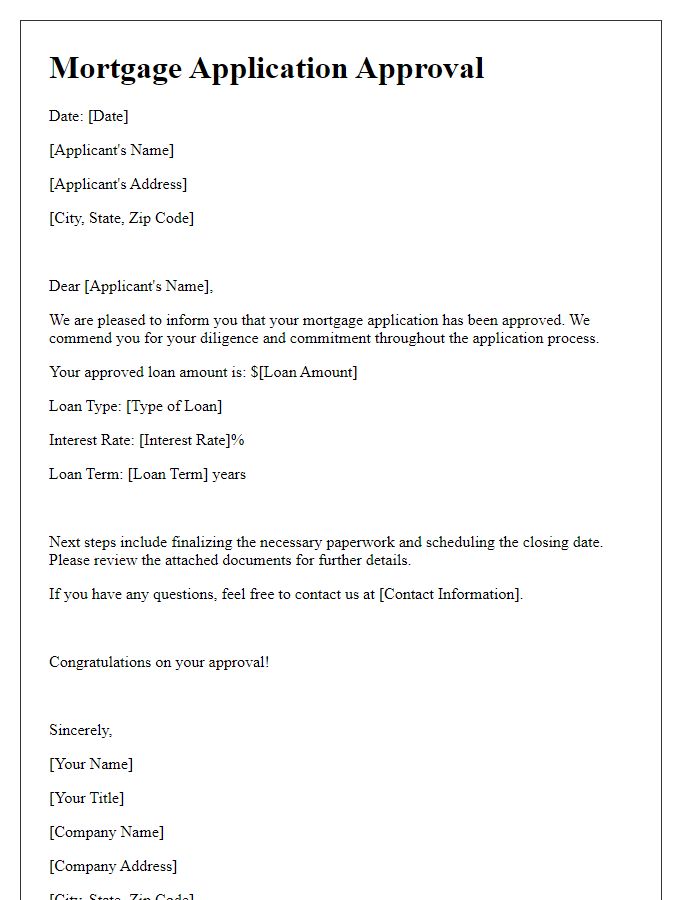

Applicant's full name and address

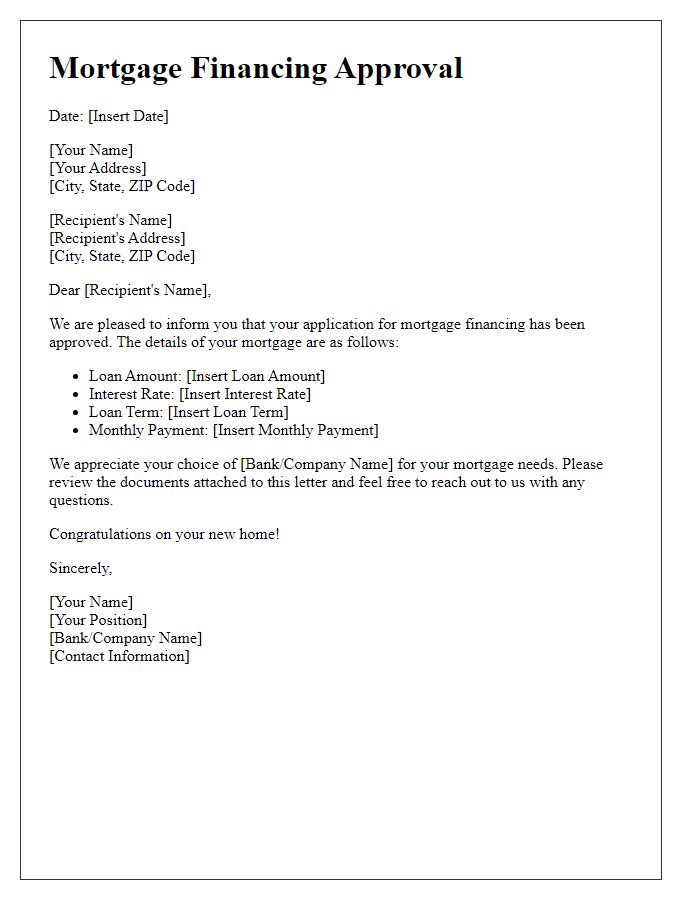

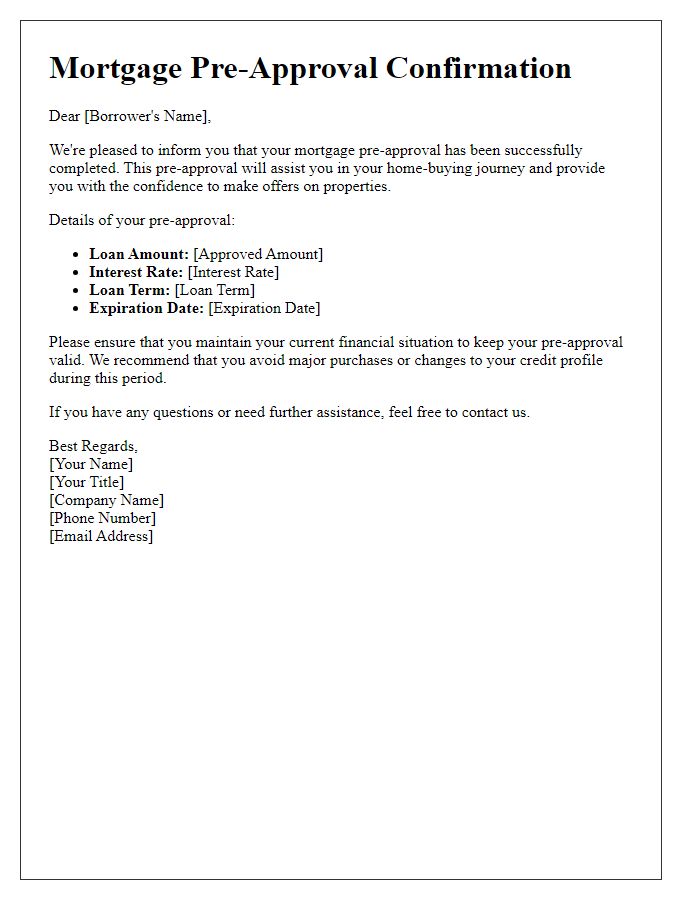

The mortgage approval notification serves as a vital communication regarding an applicant's financial request for a property loan. This document typically includes the name of the applicant, such as John Smith, and their residential address, such as 123 Elm Street, Springfield, IL 62704. It informs the applicant of the loan amount approved, the interest rate, and terms, including repayment duration, which often spans 15 to 30 years. Other critical elements might involve details about the closing process, required documents, and contact information for the loan officer, ensuring that the applicant is fully aware of the subsequent steps to secure funding for their property purchase.

Loan amount and terms

The mortgage approval notification outlines the affirmation of a loan amount dedicated to prospective homeowners. The approved loan amount, typically ranging between $150,000 and $500,000, is critical for determining purchasing power in the real estate market. Terms of the mortgage often include an interest rate, which can fluctuate between 3% and 7%, depending on market conditions and creditworthiness. The loan period typically spans 15 to 30 years, impacting monthly payments and overall interest paid over the life of the loan. Timely mortgage approval is essential for facilitating property transactions, often influenced by factors such as credit score, income verification, and property appraisal values, which are vital in identifying the financial viability of applicants in securing homeownership.

Interest rate and type

Mortgage approval notifications inform applicants about their loan status. The notification includes interest rates, typically represented as a percentage, and the loan type, such as fixed-rate or adjustable-rate mortgage. Fixed-rate mortgages secure the same interest rate throughout the loan term, offering payment stability. Adjustable-rate mortgages start with a lower initial interest rate, adjusting after a specified period based on market conditions. Understanding terms such as Annual Percentage Rate (APR) and loan-to-value (LTV) ratio is crucial for borrowers. Timely communication of these details, usually via email or mailed letter, can enhance applicant satisfaction and clarity.

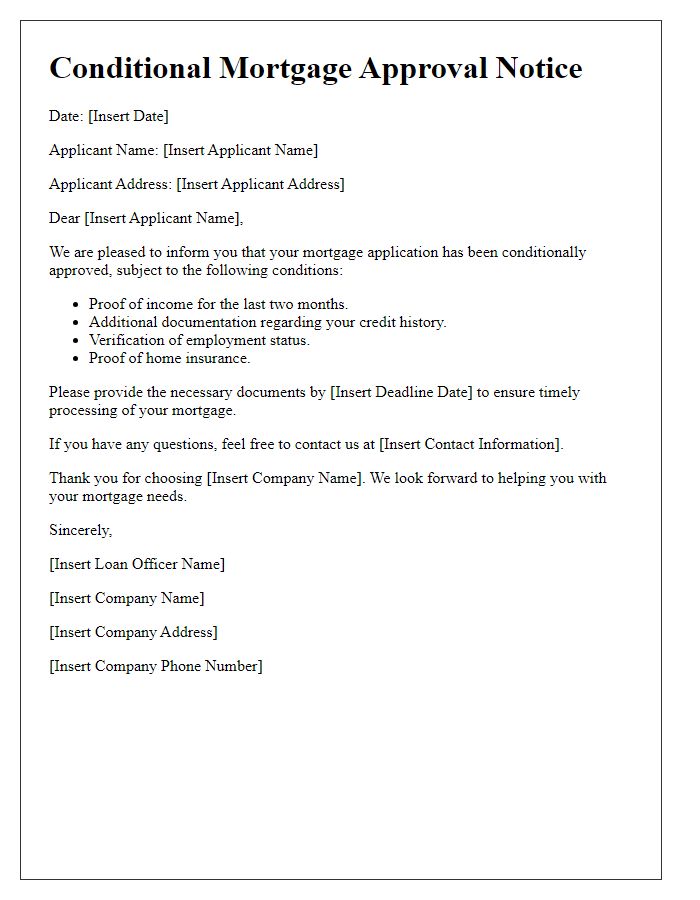

Conditions for funding

The mortgage approval notification outlines essential funding conditions that borrowers must meet to secure their loan successfully. Conditions may include verified income documentation, such as recent pay stubs or tax returns, proving financial stability. Additionally, a satisfactory credit report from agencies like Experian or TransUnion is crucial, ensuring a credit score above the minimum threshold set by lenders (often around 620 for conventional loans). Property appraisal is necessary to confirm the home's value aligns with the loan amount, preventing over-financing. Homeowner's insurance must be in place, covering potential hazards, with lenders often requiring a minimum coverage amount. Lastly, a debt-to-income ratio (DTI) lower than 43% is typically mandated, indicating borrowers' ability to manage monthly payments effectively without financial strain. Meeting these conditions expedites the funding process, facilitating a smooth transition to homeownership.

Contact information for questions

The mortgage approval notification typically includes contact information for any inquiries related to the approval process. Key entities within this notification include the institution name, such as First National Bank, which is responsible for the mortgage, and the specific department, like the Mortgage Processing Department, that handles applications. Essential contact details consist of a direct phone number, possibly (555) 123-4567, ensuring applicants can easily reach representatives. Additionally, an email address, for example, mortgage.support@firstnationalbank.com, offers a convenient method for communication. The notification may also highlight the availability of online customer service chat options, available 24/7, providing swift assistance for questions or concerns.

Comments