If you've ever found yourself puzzled over unexpected charges or discrepancies in your account, you're not alone! Many people encounter issues that require a closer look, and addressing these concerns promptly can save you both time and money. In this article, we'll guide you through the process of writing an effective letter for account review and correction, ensuring your inquiries are clear and compelling. So, let's dive in and equip you with the tools you need to take charge of your financial matters!

Account Information Accuracy

Account information accuracy is crucial for effective financial management and compliance with regulatory standards. Inaccurate data may lead to issues such as misallocated funds, incorrect credit scores, or delayed transactions. Regular audits (at least annually) can help identify discrepancies in personal identification details, account balances, and transaction history. Moreover, maintaining up-to-date contact information, including email addresses and phone numbers, enhances service communication from financial institutions such as banks or credit unions. Addressing these inaccuracies promptly ensures a smooth user experience and protects against identity theft or fraud risks that can arise from incorrect information.

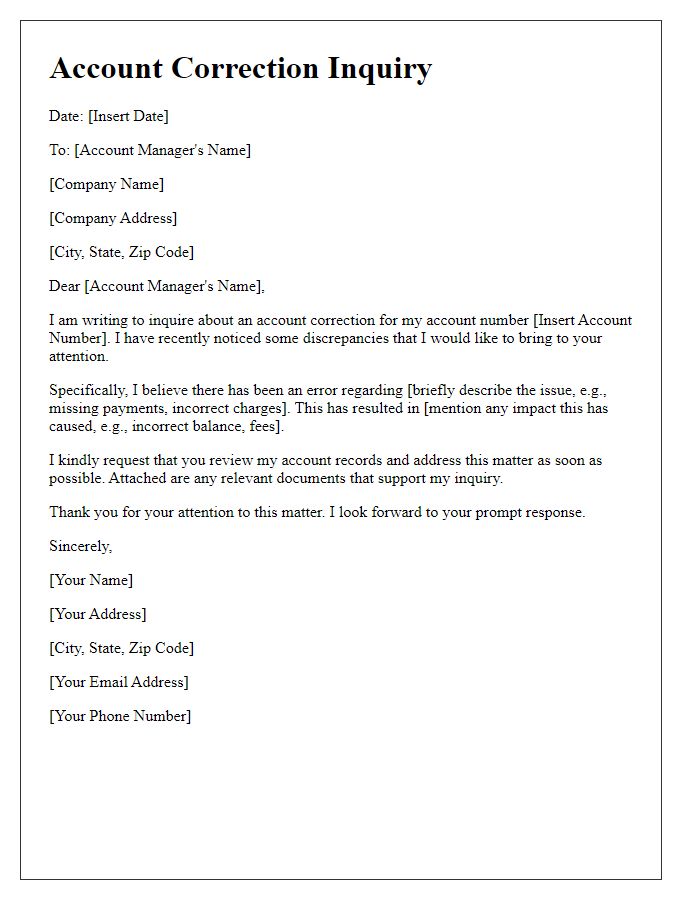

Error Identification and Documentation

During an account review process, accurate error identification is crucial to ensure proper documentation and resolution. Common errors include discrepancies in financial statements, such as mismatched transaction amounts or incorrect account balances that can lead to significant issues. For instance, an account statement from Bank of America may show a transaction of $500 instead of the actual $5,000, creating confusion. Documenting these errors involves capturing details like the transaction date, type, and any involved parties, such as vendors or customers, to provide clarity. Additionally, it is essential to reference supporting documents, such as invoices or receipts, which can validate claims and assist in executing necessary corrections with the accounting team or financial institution. Accurate record-keeping guarantees the integrity of financial data, fostering trust and reliability in organizational accounts.

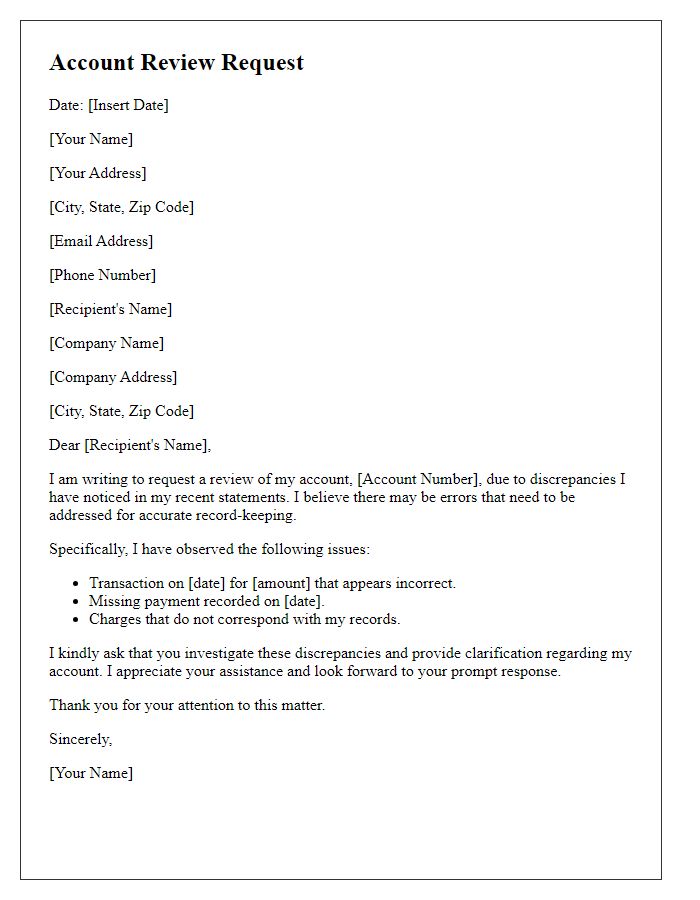

Request for Timely Correction

An account review and correction request is crucial for maintaining accurate financial records. Many financial institutions, such as banks or credit unions, often require detailed documentation including account numbers and transaction histories, especially when discrepancies arise. Clear identification of the specific errors, such as incorrect charges or missing deposits, is essential for a prompt resolution. Timeliness in submitting these requests can significantly impact the speed of corrections, ensuring that financial statements reflect the true account status. Accurate tracking of communications, including dates and responses, may also aid in achieving a satisfactory outcome.

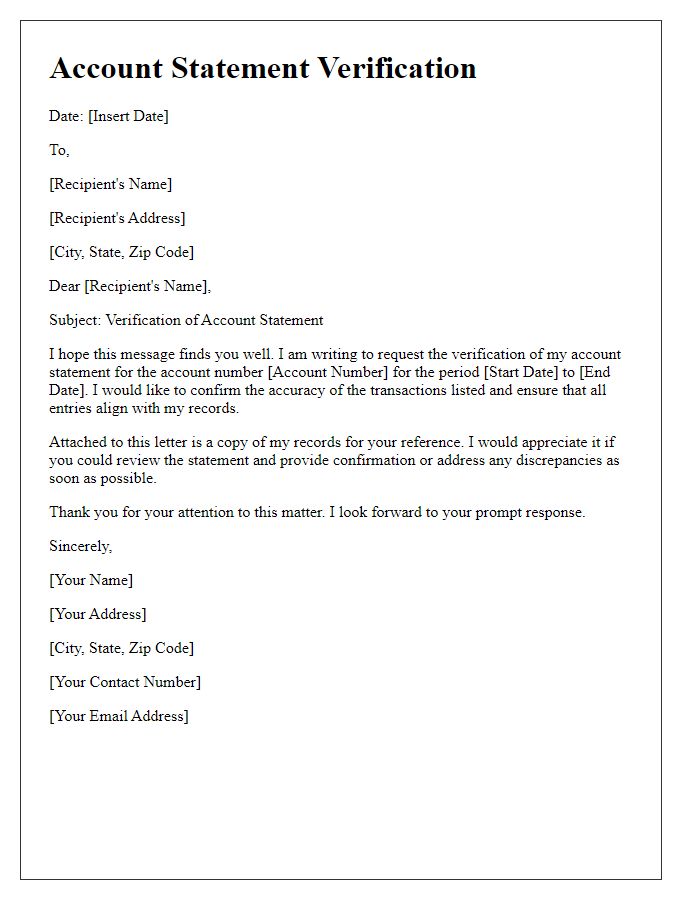

Contact Information for Follow-up

An account review and correction request can be initiated to ensure accurate and up-to-date information is reflected on financial profiles, such as bank accounts or credit reports. Providing complete contact information is essential for follow-up communication, which includes elements such as full name, phone number, email address, and mailing address. For instance, a full name might include both first and last names, with a phone number formatted for ease of communication, such as (555) 123-4567. An email address should be professional and clearly associated with the requester, while the mailing address must comply with postal standards to ensure timely correspondence. This information fosters clear communication, enabling swift resolution of account discrepancies.

Assurance of Data Confidentiality and Security

Ensuring data confidentiality and security is vital for maintaining trust in financial institutions such as banks and credit unions. Personal information, including Social Security numbers, addresses, and account details, must be protected against unauthorized access and breaches. Regulations like the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States set stringent guidelines for data handling and storage to ensure consumer rights are upheld. Encryption of sensitive data during transmission and storage helps safeguard against cyber threats, while regular security audits and employee training on data protection practices enhance the overall security posture of these institutions. Incident response plans are essential to manage any breaches, ensuring timely notifications to affected parties, compliance with legal requirements, and strategies to mitigate future risks.

Comments