Are you looking to enhance your account transaction limits? Many individuals and businesses find themselves needing a little extra flexibility when it comes to managing their finances. Whether you're planning a significant purchase or simply want a smoother experience with your banking transactions, increasing your limits can make a big difference. Join us as we explore the steps and considerations involved in requesting a transaction limit enhancement!

Customer Identification

Enhancing account transaction limits allows customers to complete higher-value transactions without interruption. Major banks, such as JPMorgan Chase and Bank of America, often require robust customer identification processes for this purpose. Verification methods include government-issued identification (e.g., passports, driver's licenses), social security numbers, and biometric data. In 2021, the Financial Action Task Force (FATF) emphasized the importance of Know Your Customer (KYC) regulations, which ensure financial institutions assess risk and prevent fraud. Failure to comply with these requirements may result in transaction delays and decreased customer trust, highlighting the critical nature of secure identification methods in banking transactions.

Account Details

Requesting an enhancement for account transaction limits can facilitate smoother financial operations. For instance, regular banking accounts may have standard withdrawal limits (ranging from $300 to $1,000 daily), while premium accounts often have higher thresholds (like $5,000 or more). This adjustment becomes essential for business accounts, which sometimes incur large transactions (over $10,000) during busy periods, such as fiscal year-end or holiday seasons. Furthermore, banks might set up comprehensive verification processes (including two-factor authentication) to prevent fraudulent activity when such limits are increased.

Justification for Increase

A significant increase in account transaction limits is essential for effectively managing business operations, particularly in sectors such as e-commerce, where daily transactions can exceed thousands of dollars. In May 2023, our company experienced a 40% rise in online sales, primarily attributed to a successful marketing campaign that doubled our customer base. As a result, the current transaction limit of $5,000 may lead to payment processing delays, impacting customer satisfaction and potentially resulting in revenue loss. Additionally, consistent order fulfillment through platforms like Shopify requires seamless payment solutions to maintain efficiency. An enhanced limit of $25,000 would not only accommodate our expanding transaction volume but also ensure stability in cash flow management, enabling us to reinvest in growth initiatives and improve overall operational effectiveness.

Requested Limit

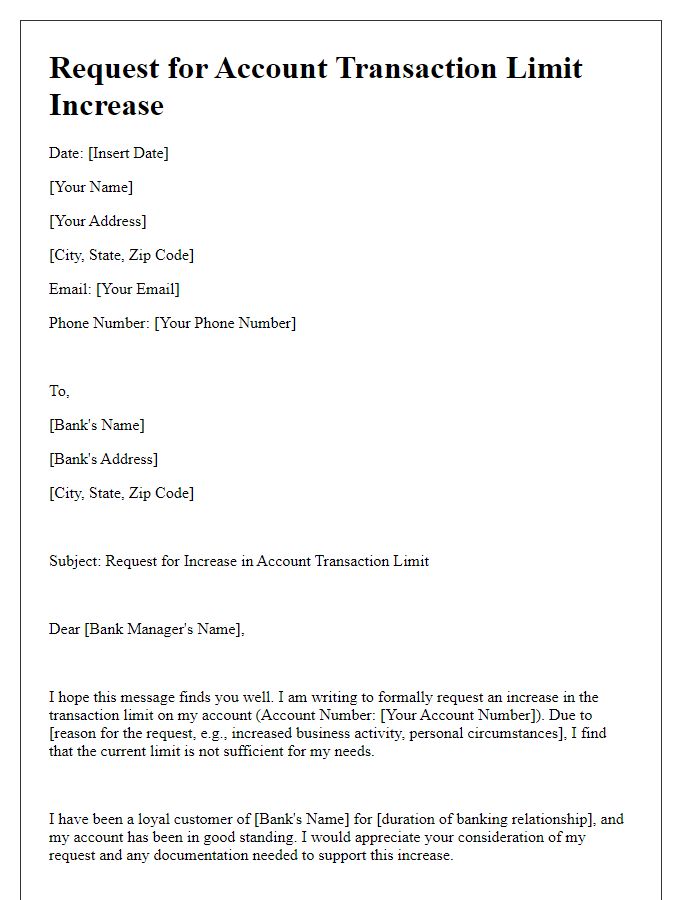

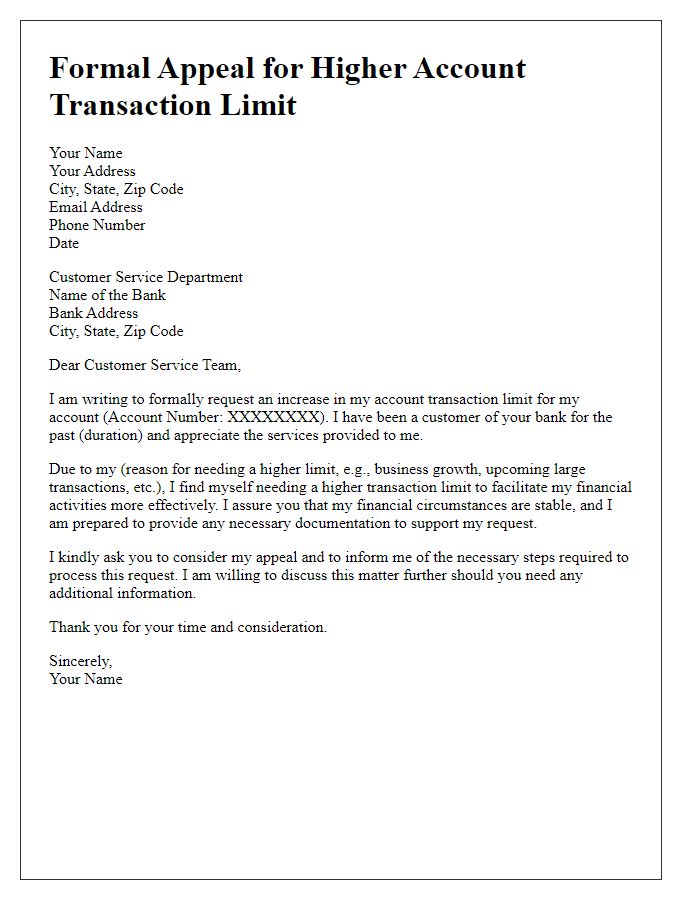

Account transaction limits can significantly impact financial operations for individuals and businesses. Banks typically impose maximum transaction limits, often set at $10,000 for personal accounts and varying for business accounts depending on account type and customer history. Requests for account limit enhancements should include details such as current transaction limits, the desired limit amount (e.g., $25,000), and the rationale behind the request, such as increased business activity or urgent payment requirements. Banks also consider the account holder's relationship duration and previous transaction history, which highlights the importance of maintaining a good banking relationship while making such requests.

Contact Information

Enhancing account transaction limits can be essential for frequent users of banking services, such as small businesses or high-frequency investors. Banks like Chase or Bank of America often set standard transaction limits (e.g., $10,000 daily for withdrawals) that may not suffice for larger transactions. Requesting an increase usually involves reaching out to customer service through various contact channels such as phone lines, web chat, or secure email specific to account management. Timing is crucial; requests made during regular business hours often receive quicker responses. Essential documents like recent bank statements or verification of income might be necessary to support the request. Following up ensures that the application for the enhanced limit moves forward in a timely fashion.

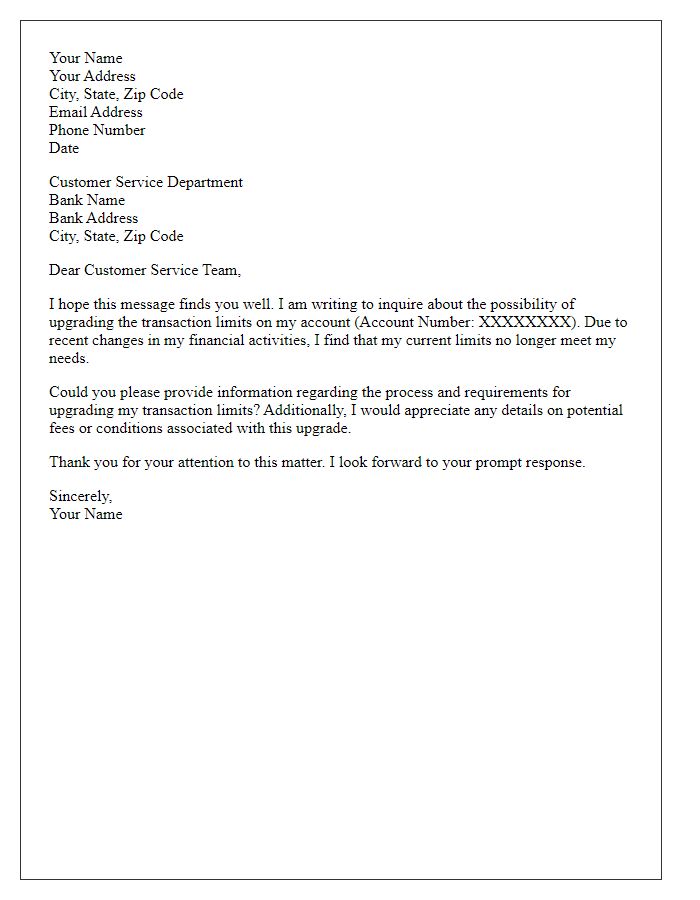

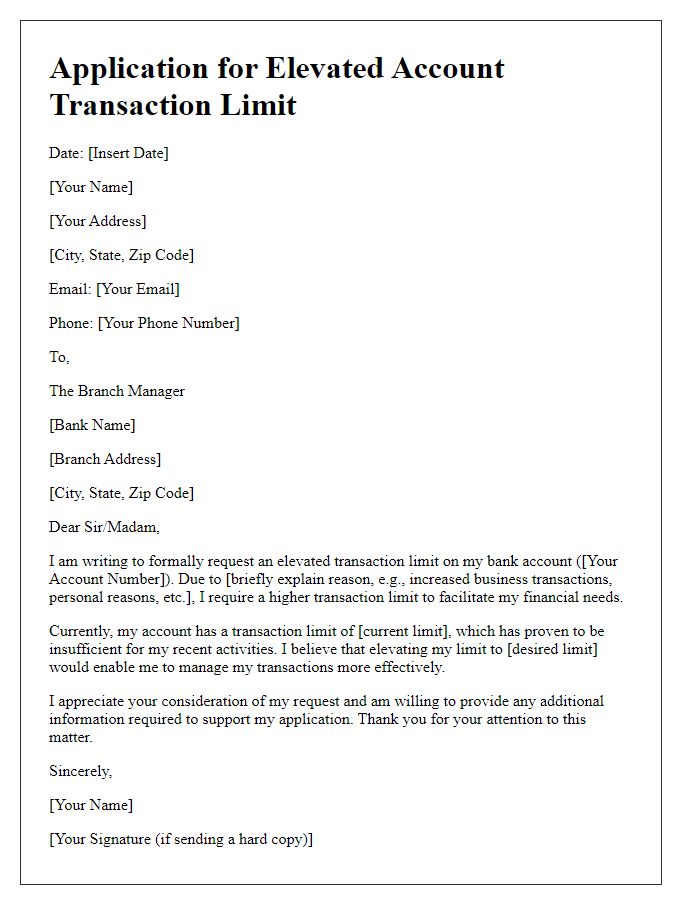

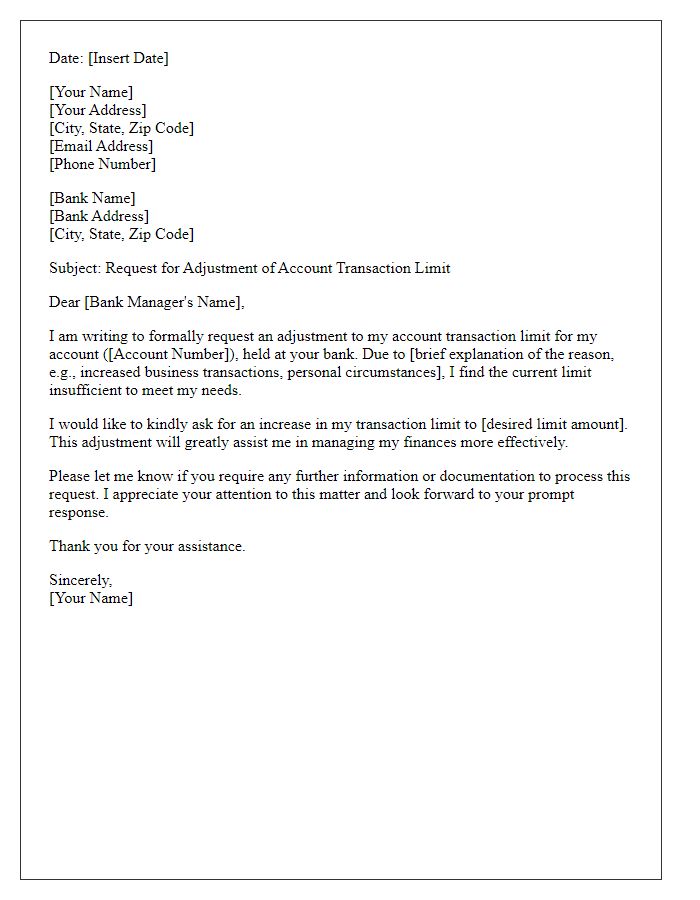

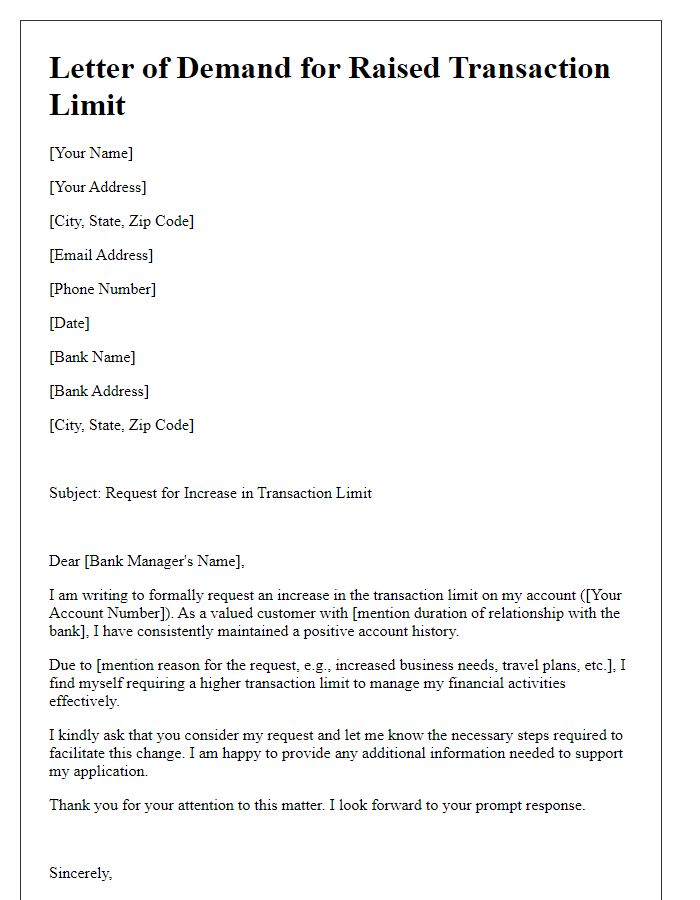

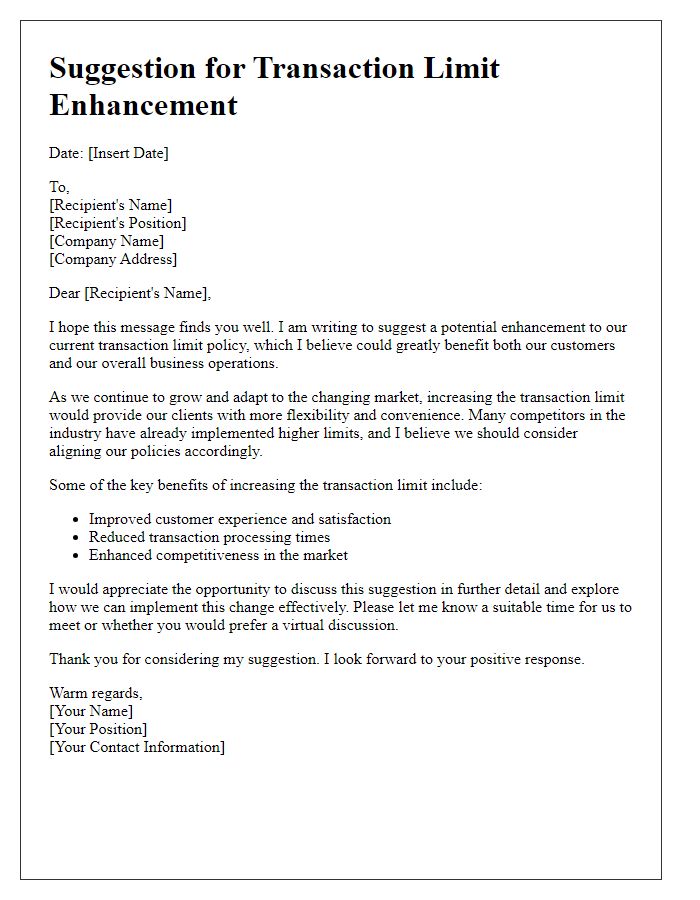

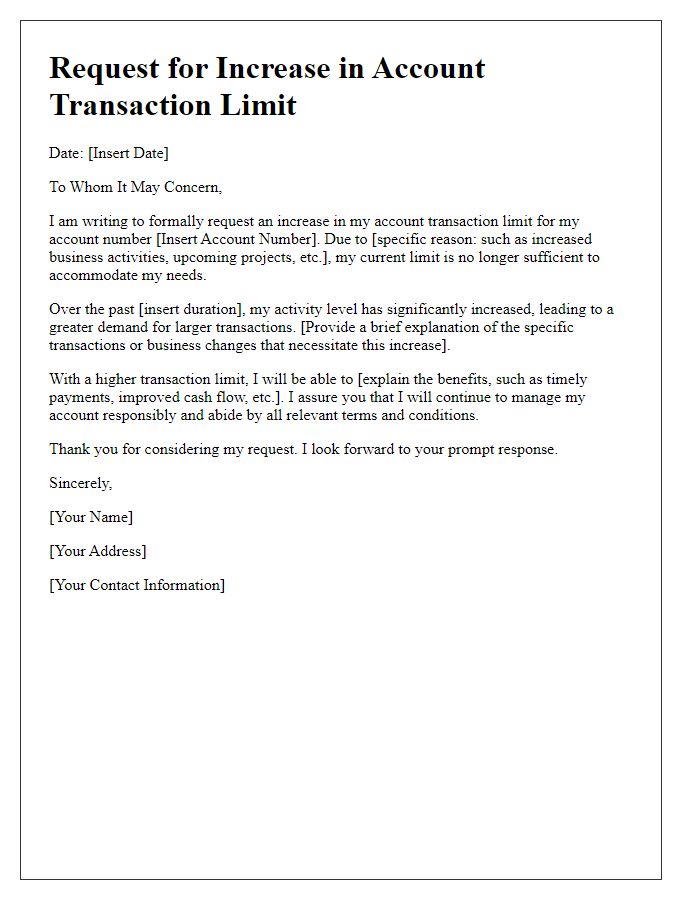

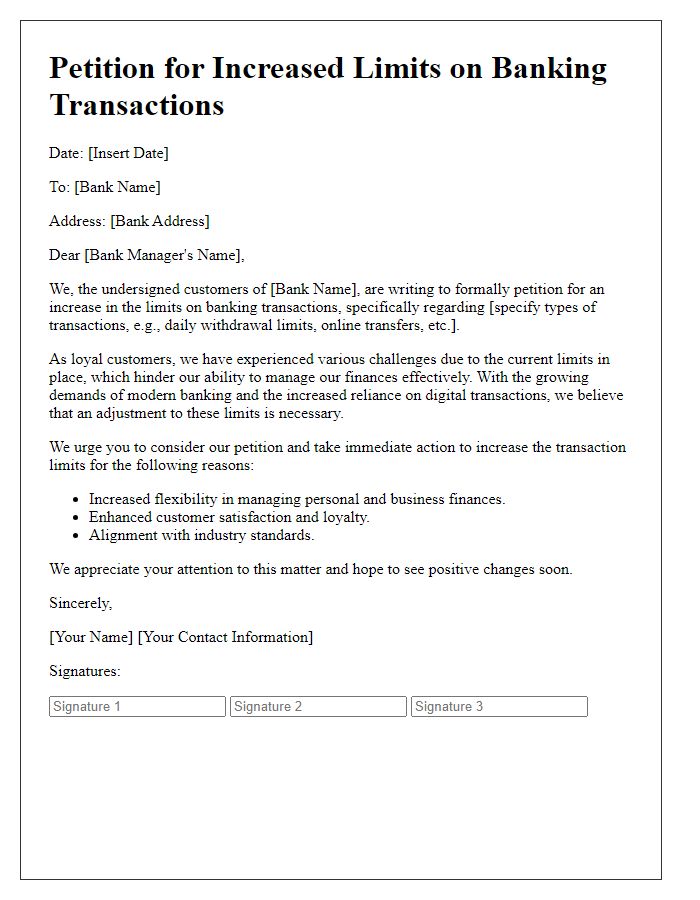

Letter Template For Account Transaction Limit Enhancement Samples

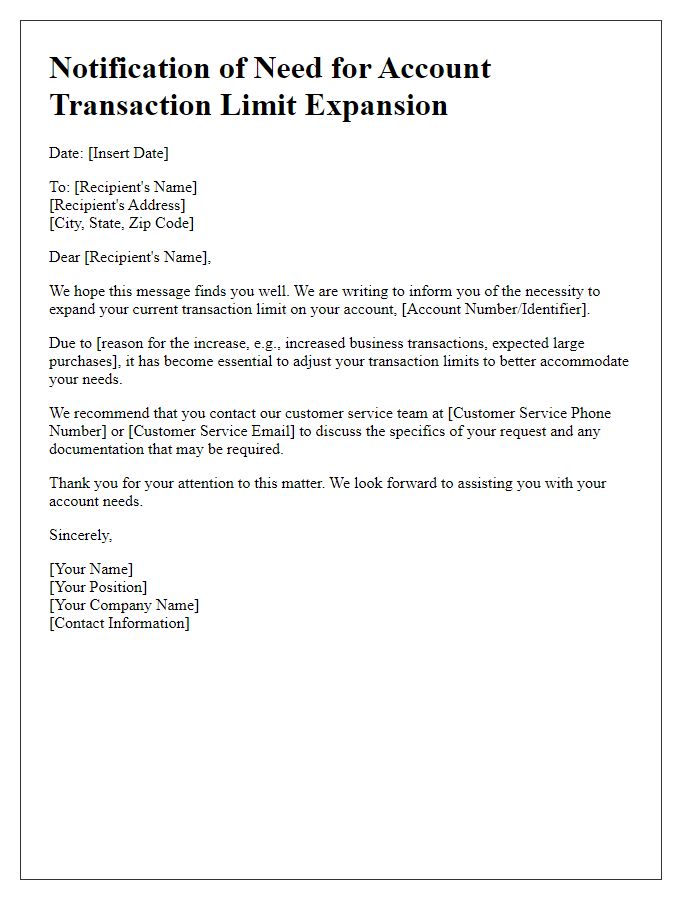

Letter template of notification of need for account transaction limit expansion

Comments