Are you feeling overwhelmed by the thought of retrieving your tax documents? You're not alone! Many folks find themselves in a bind when it comes to organizing their financial paperwork, especially during tax season. If you're looking for some guidance and handy tips on how to streamline the process, keep reading for helpful insights that can simplify your document retrieval journey.

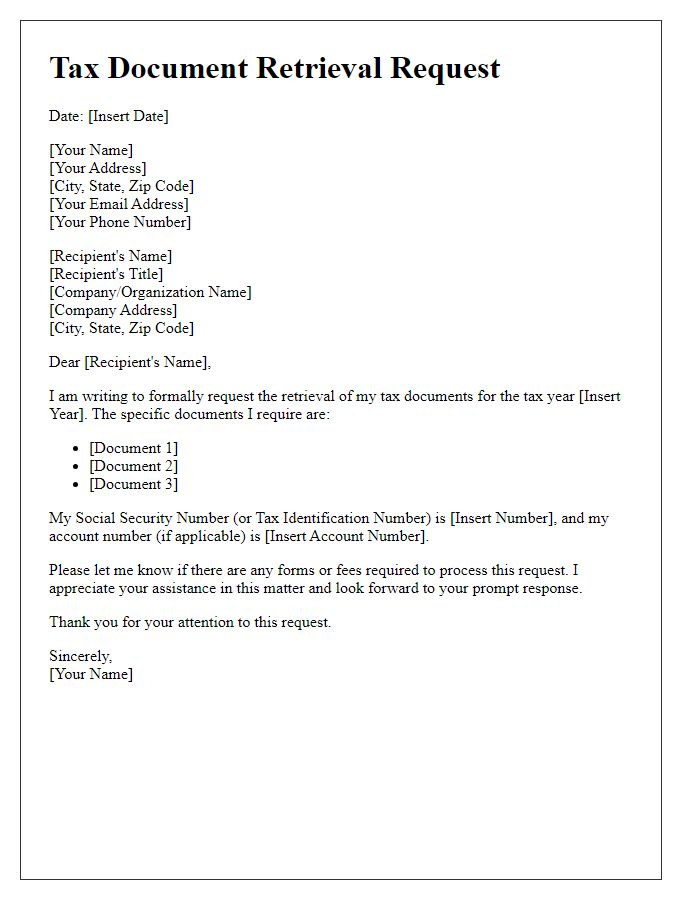

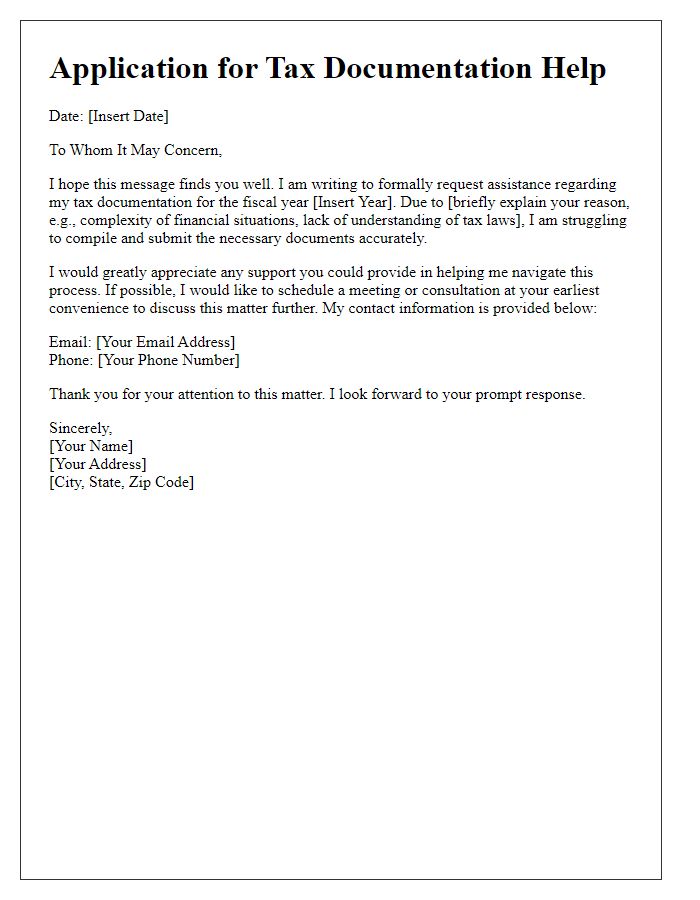

Contact Information

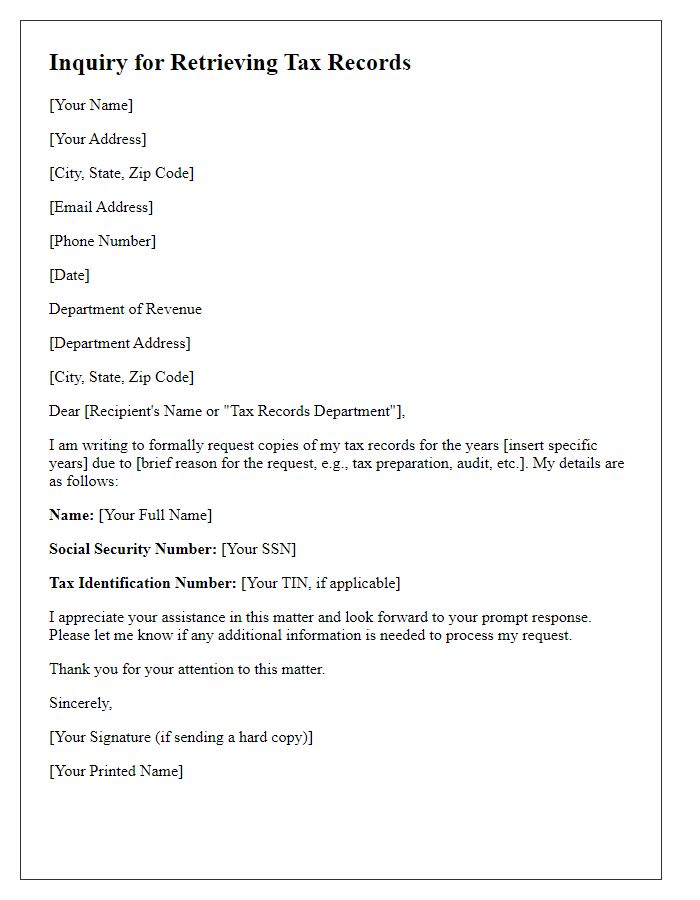

Retrieving tax documents can be a complex process, often requiring detailed personal information. For example, when requesting documents like IRS Form 1040 (Individual Income Tax Return) or Form W-2 (Wage and Tax Statement), individuals need to provide their Social Security number (SSN) for verification purposes. The tax year in question also needs specification, as documents are organized by year, such as 2022 or 2023. Additionally, an accurate address, including city, state, and ZIP code, ensures the delivery of physical copies, while an email address may aid in expedited electronic communication. Contacting the appropriate agency, such as the Internal Revenue Service (IRS) in the United States or local tax offices, is crucial for retrieving essential tax documents efficiently.

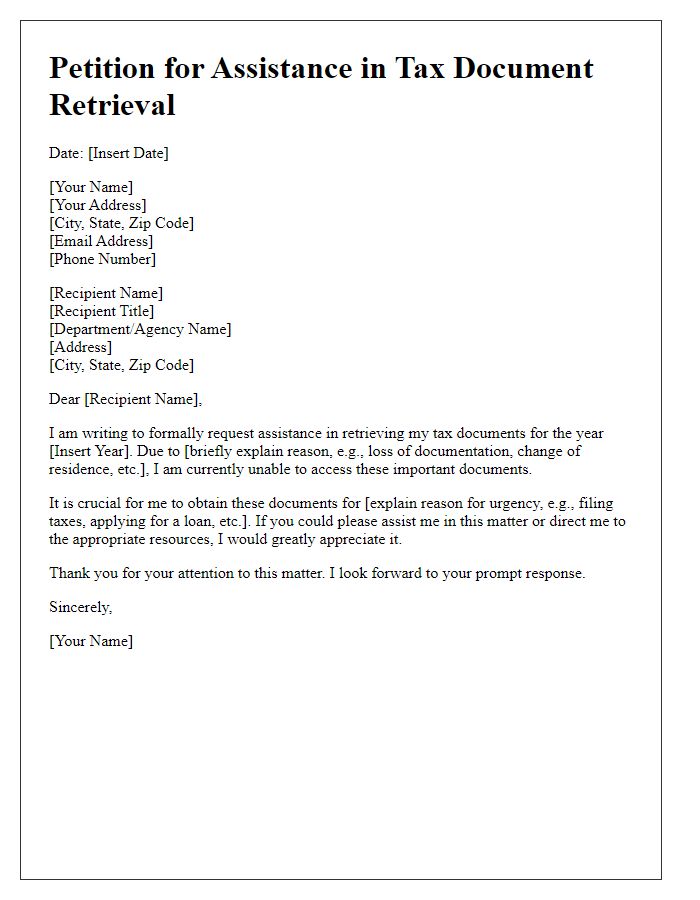

Reference Number

Incorporating a reference number in tax document retrieval processes enhances traceability and efficiency. A reference number, often composed of alphanumeric characters, uniquely identifies a specific tax file or inquiry. This number aids tax professionals in accessing pertinent documents, such as W-2 forms or 1099 statements, efficiently. Accurate retrieval ensures compliance with tax obligations and facilitates smooth interactions with tax authorities like the Internal Revenue Service (IRS) in the United States. Utilizing a reference number in correspondence expedites resolution of requests and minimizes miscommunication, crucial during busy tax filing seasons.

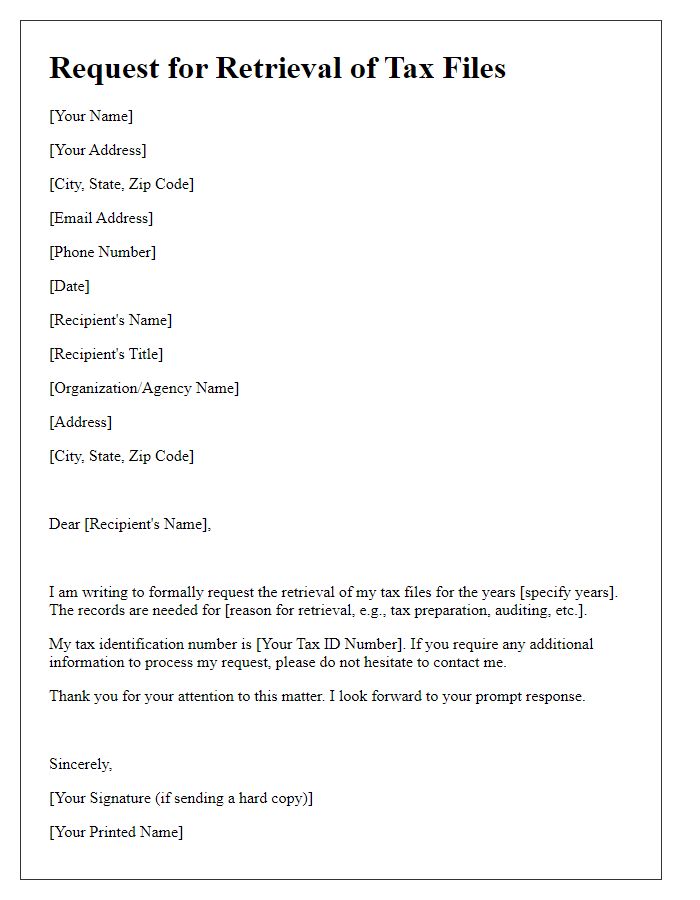

Details of Requested Documents

Navigating the process of tax document retrieval can be challenging, particularly when dealing with multiple forms such as W-2s (Wage and Tax Statements) and 1099s (Miscellaneous Income Statements). Taxpayers often require specific information from the Internal Revenue Service (IRS) when requesting copies of these documents. The retrieval process typically involves submitting Form 4506-T to the IRS, which necessitates details such as the taxpayer's name, Social Security Number (SSN), and the years for which documents are sought. Additional information may include the address associated with the tax return, as discrepancies can result in delays. The IRS aims to provide copies of tax documents within 10 to 75 business days, depending on the method of submission and processing volume. Understanding these nuances can simplify the retrieval process and ensure timely access to essential tax information.

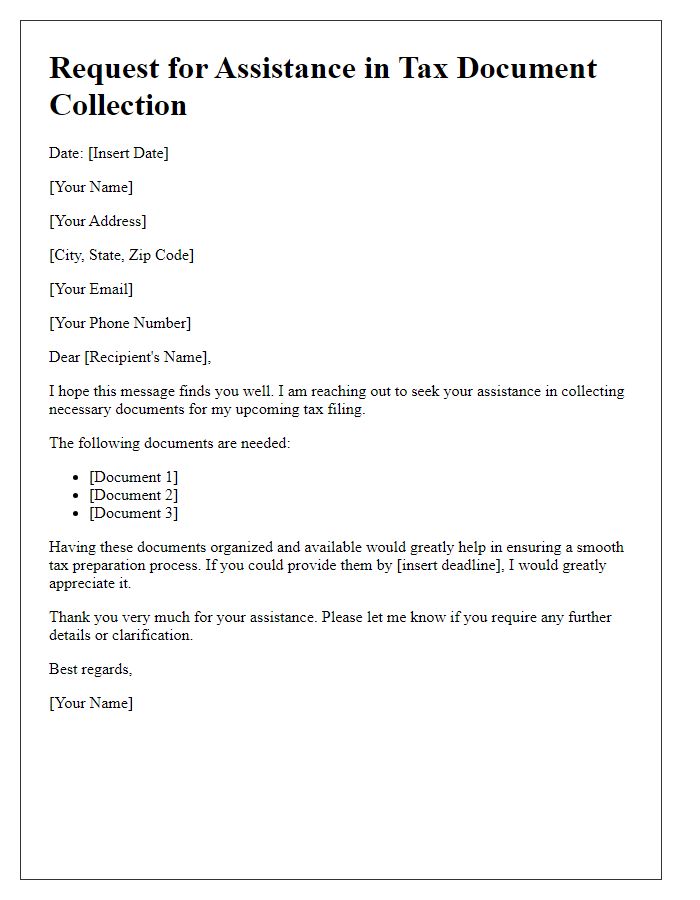

Specific Tax Period

Tax document retrieval for specific periods, particularly for the year 2022, can be essential for individuals preparing their annual tax filings. Forms such as the IRS Form 1040 or W-2 from employers provide valuable information for accurately reporting income. The deadlines, typically around April 15th, necessitate timely access to these documents. Utilizing services like the IRS's online portal, taxpayers can request copies of past tax returns or receive statements of account to verify their tax history. Additionally, contacting prior employers or financial institutions may help recover lost or missing tax documents for timely submission and compliance with federal tax regulations.

Deadline for Response

Individuals need assistance retrieving essential tax documents, specifically Form 1040, which influences annual tax returns in the United States. Such documents become crucial during the tax filing season, generally occurring between January and April each year. The Internal Revenue Service (IRS) mandates that taxpayers submit these forms for accurate financial reporting. Timely document retrieval is vital due to upcoming deadlines, typically April 15, when late penalties could accrue. Additionally, individuals may require this information for mortgage applications, student loans, or financial aid assessments, emphasizing the need for prompt assistance to avoid complications with obligations.

Comments