Are you considering an international transfer and feeling a bit overwhelmed by the approval process? Writing a clear and concise letter is your first step toward successfully securing your transfer. In this article, we'll explore essential elements to include in your letter, ensuring you make a strong case for your request. Want to dive deeper into crafting an effective letter template? Read on!

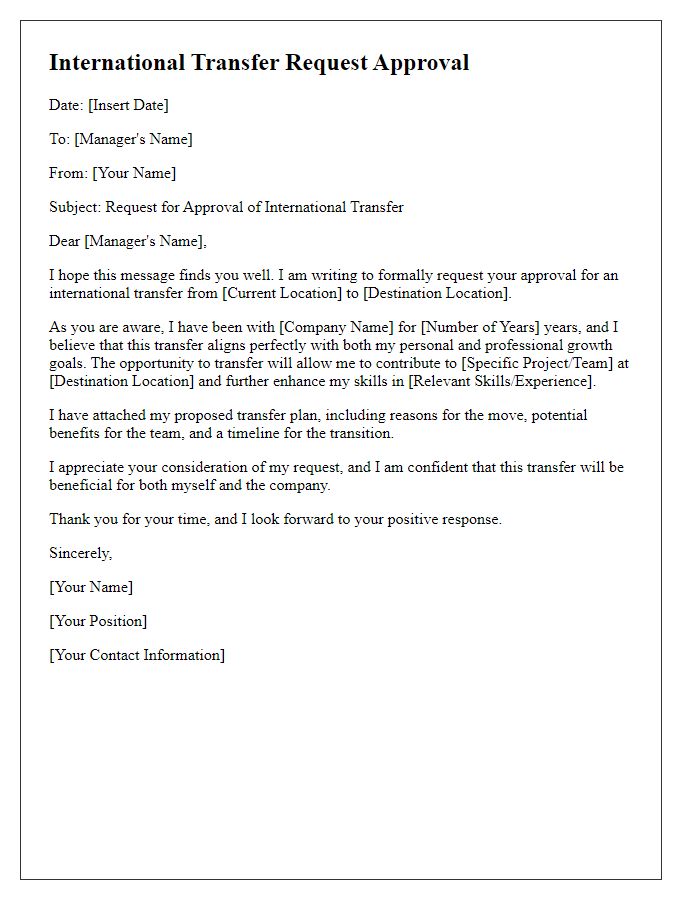

Recipient's Details

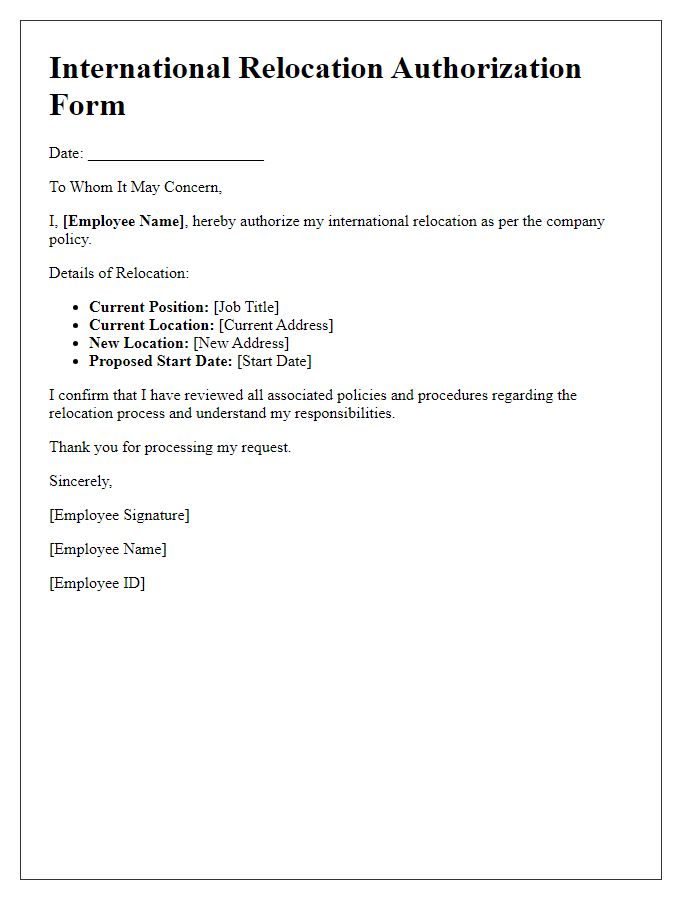

International transfer approvals often require specific recipient details to ensure proper processing and compliance with global banking regulations. Essential elements include recipient's full name, which should match official identification documents. Address information includes the recipient's current physical address, encompassing street name, building number, city, postal code, and country name. Bank account details must include the recipient's IBAN (International Bank Account Number) or account number, and the name of the recipient's bank, along with the bank's SWIFT/BIC code for international transactions. Accurate phone numbers, including country code, enable verification and communication regarding the transfer status. Finally, email addresses provide an additional channel for notifications related to the transaction.

Subject Line

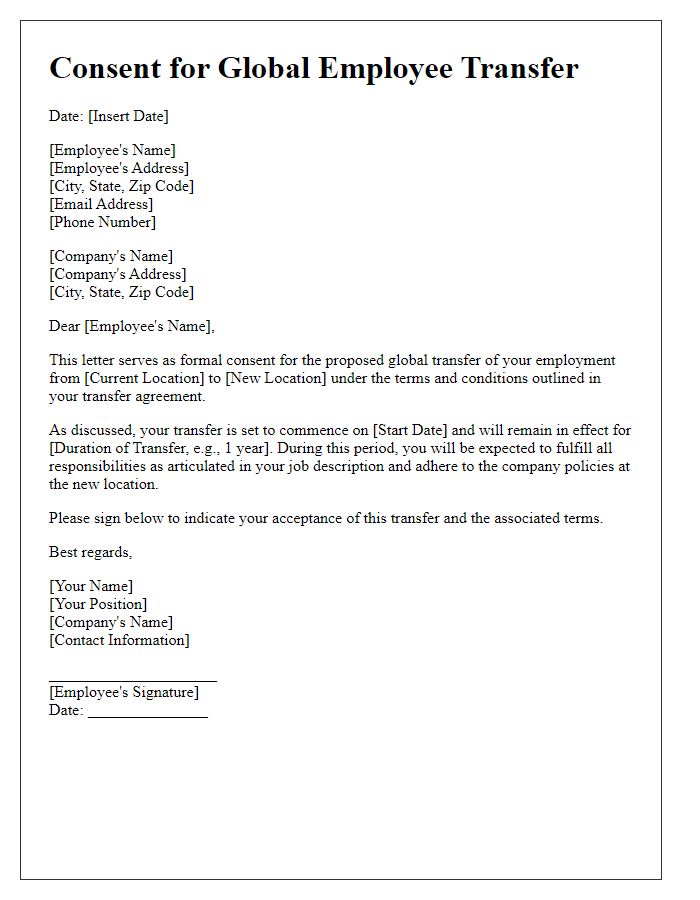

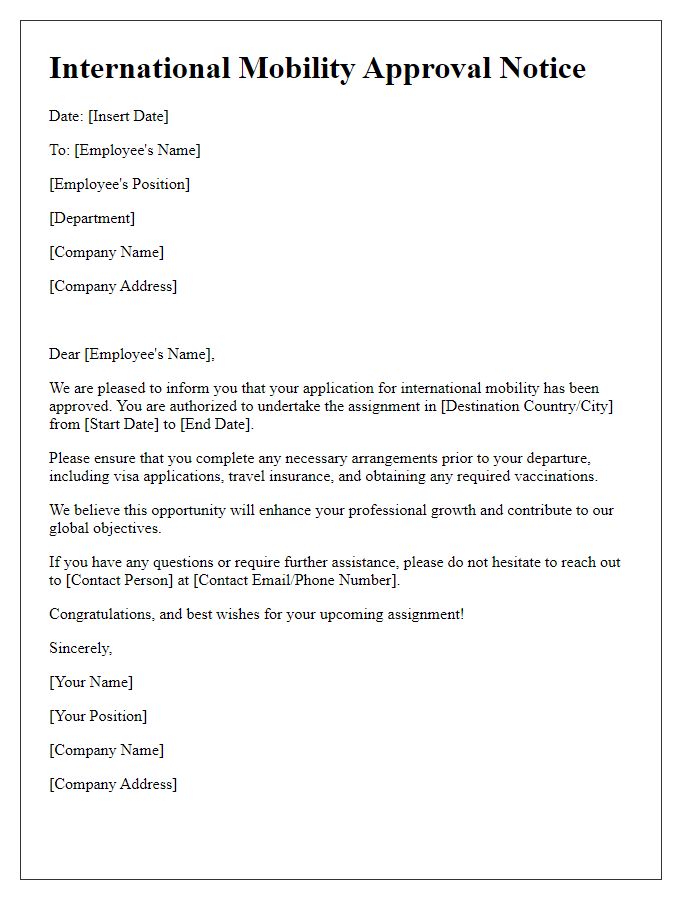

International transfer approvals require careful consideration of various factors. Documentation, such as the employee's current position and responsibilities at the company, often needs to be outlined clearly. Specific details, including the destination country and local laws regarding employment, are crucial. The proposed role in the foreign division must align with the company's strategic objectives. Consideration of timeframes for relocation, visa requirements, and logistical aspects should also be included. Additionally, the company's policy on expatriate support, including housing, schooling for dependents, and cross-cultural training, plays a critical role in ensuring a smooth transition.

Purpose of Transfer

International transfer approvals often involve critical financial documentation and regulatory adherence. Most organizations, like multinational corporations or educational institutions, require a clear purpose of transfer that aligns with international trade regulations. Common purposes usually include business expansion, relocation of employees, funding scholarships, or humanitarian aid. Documentation such as letters of credit, invoices, or scholarship contracts (often facilitated by agencies like SWIFT) is typically essential for successful processing. Compliance with local laws, such as anti-money laundering regulations or taxation obligations, also plays a crucial role in the approval of these transfers. Each transfer purpose must be meticulously outlined to ensure proper oversight and accountability.

Amount and Currency

International money transfers require careful consideration of amount and currency to ensure compliance with financial regulations and successful transactions. The specified amount can significantly impact transaction fees, with typical percentages ranging from 1-5% based on service providers like PayPal or Western Union. Currency choices affect exchange rates; for instance, transferring funds in US dollars (USD) or Euros (EUR) may yield different final amounts received due to fluctuating market rates. Additionally, destination countries can impose limits on transaction sizes, particularly in developing economies where thresholds might cap transfers at around $5,000 or less. Understanding these dynamics is crucial for optimizing transfer approvals and securing favorable conditions for all parties involved.

Compliance and Authorization

Compliance and authorization for international transfer are critical factors in the finance and banking sector, particularly regarding the regulation of money laundering and fraud. Various governing bodies like the Financial Action Task Force (FATF) establish rigorous guidelines and compliance requirements that financial institutions must follow during cross-border transactions. These transactions, which often exceed $10,000, require detailed documentation such as identification verification and purpose of transfer. The designated financial institutions must also ensure they possess the necessary approvals from their compliance departments, which involve comprehensive reviews of both the sender and recipient's credibility and intention. Additionally, adhering to the laws outlined by respective countries--such as the Office of Foreign Assets Control (OFAC) in the United States--facilitates the smooth processing of international funds while avoiding penalties.

Comments