Are you facing the hassle of a lost passbook and need to request a replacement? It's a common yet frustrating situation, but fortunately, there are simple steps you can take to get back on track. In this article, we'll guide you through the essential elements of writing a clear and effective letter for your request. So, grab your pen and paper, and let's dive into the details to make this process as smooth as possible!

Account Holder Information

Lost passbooks create significant challenges for account holders managing their bank accounts. Essential details include the account number (unique identifier for personal banking accounts), account holder's name (indicating the individual responsible for the account), and branch location (specific bank branch where the account is maintained). The date of loss (critical for record-keeping) and any relevant identification documents, such as a government-issued ID (providing proof of identity), ensure swift processing of the replacement request. Additionally, recent transaction history (listing various financial operations) may be necessary for verification purposes to safeguard against unauthorized access.

Bank Details and Branch Information

Lost passbooks necessitate a formal replacement request at banks to maintain accurate financial records for customers. Affected individuals should provide key banking details: account number (typically a 10 to 15 digit identifier), customer name (as registered), and branch information (including branch name and code, which can vary between locations). Additionally, the branch's location, such as New York City or Los Angeles, may be relevant for identification purposes. A mention of the loss event--like theft or misplacement--can enhance the context of the request. Acknowledgment of the bank's policies regarding lost documents, which might include specific identification requirements, can expedite the renewal process.

Description of Lost Passbook

The lost passbook, issued by ABC Bank at their Main Branch in Springfield, contains vital account information including account number 1234567890, customer name John Doe, and transaction history spanning from January 2020 to September 2023. The passbook features a blue cover, with the bank's logo prominently displayed on the front. It was misplaced during a recent trip to the local library on Elm Street, where it last appeared in a book I borrowed. The missing passbook holds records of over 50 transactions, including deposits, withdrawals, and interest accruals, crucial for maintaining accurate financial tracking. Immediate replacement is essential to ensure continuity in managing my banking activities and access to funds.

Request for Passbook Replacement

A lost passbook can disrupt banking activities, especially for account holders of financial institutions like Commercial Bank or State Bank. Without this essential document, users face challenges in verifying transactions, maintaining accurate account statements, and accessing fund details. The replacement process, typically initiated by submitting a formal request to the bank's customer service department, may require additional identification documents such as a National ID or Passport. Banks often request a written declaration of loss, which includes account specifics like the account number and branch name, to streamline processing times. Delays in obtaining a replacement passbook can lead to inconvenience in managing personal finances, limiting access to banking services and potential funds.

Signature and Contact Information

Lost passbooks necessitate a formal replacement request to financial institutions, such as banks or credit unions. Customers must provide personal identification details, including full name, date of birth, and account number associated with the lost passbook. Essential contact information includes phone number for direct communication and email address for prompt digital correspondence. Signing the request serves as an affirmation of the information provided and consent to process the request. Additionally, the institution may require a valid identification, like a driver's license or passport, to verify the identity of the account holder.

Letter Template For Lost Passbook Replacement Request Samples

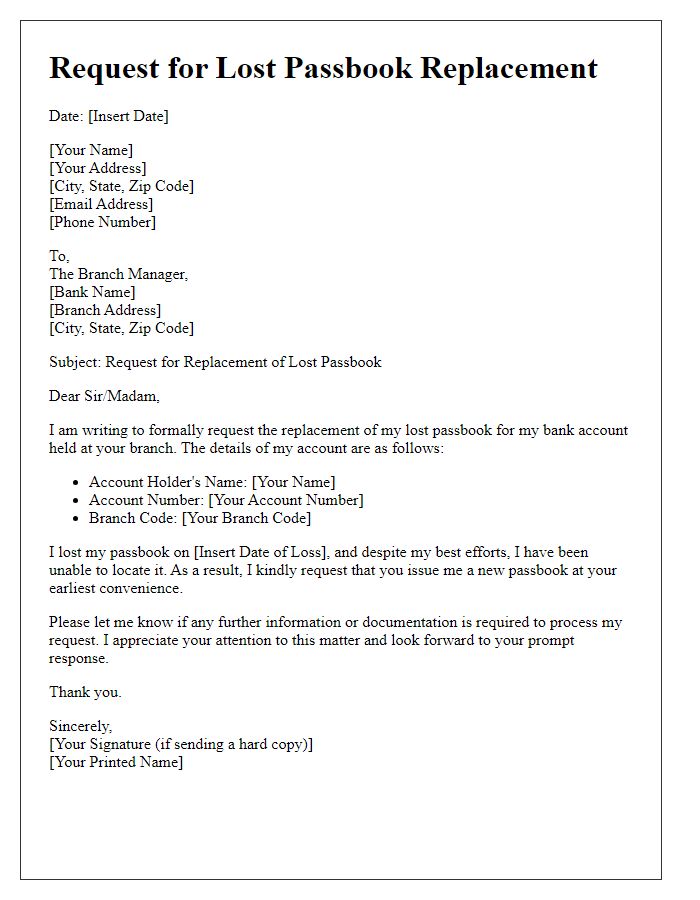

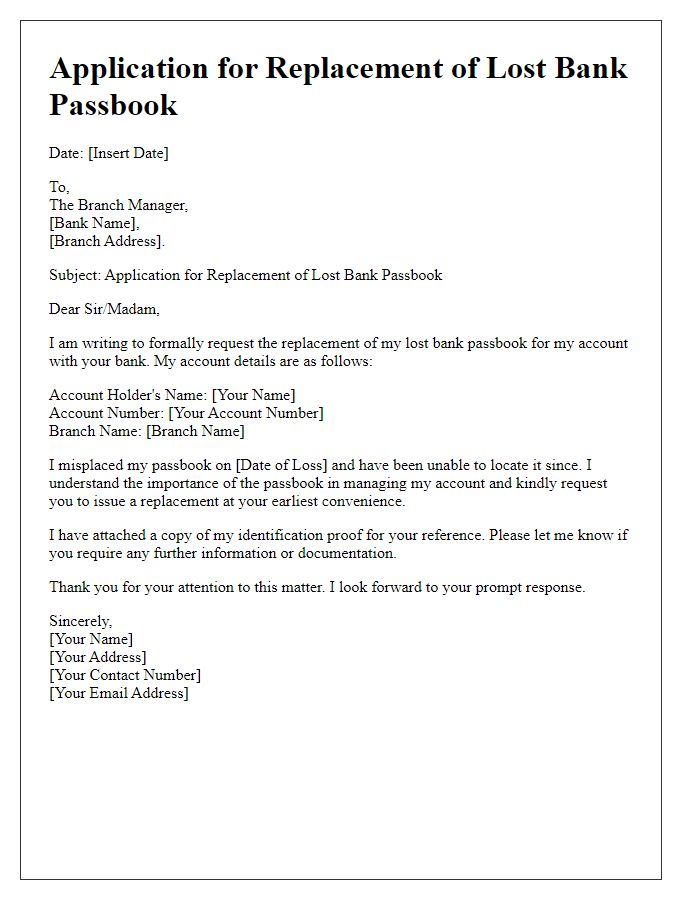

Letter template of request for lost passbook replacement for bank account holders.

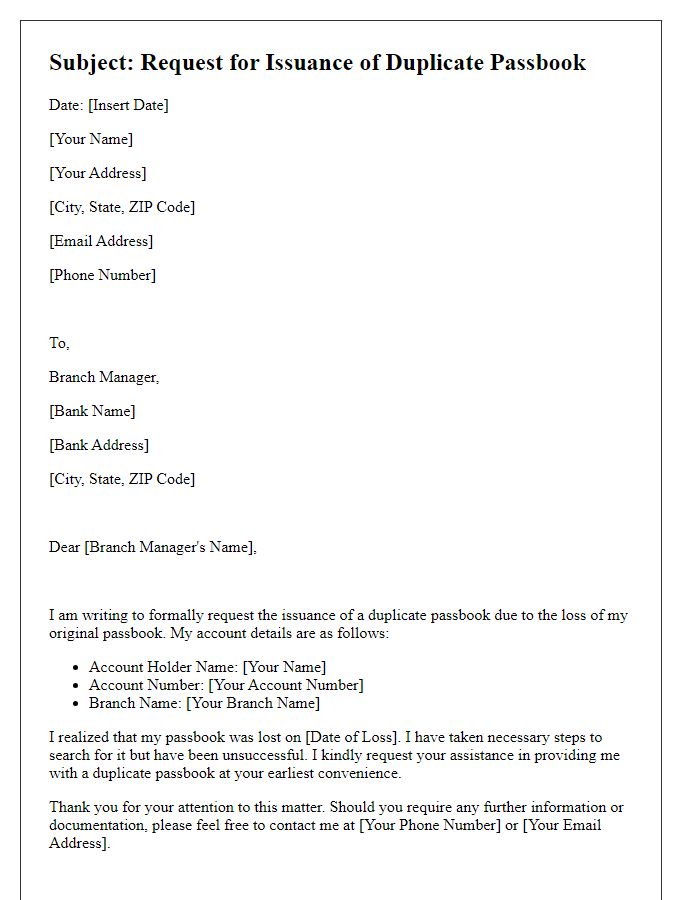

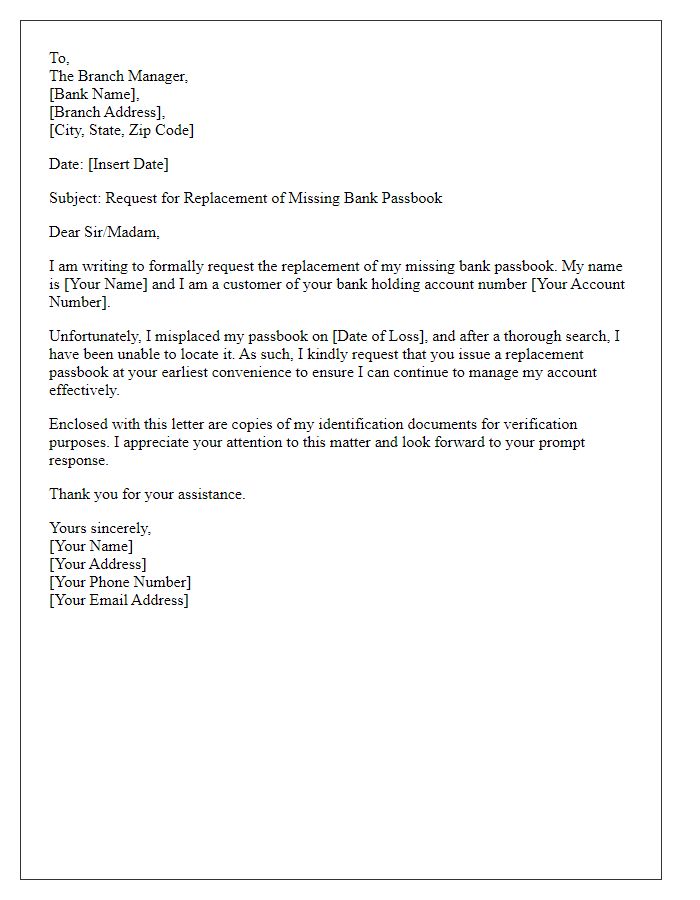

Letter template of formal request to obtain a duplicate passbook after loss.

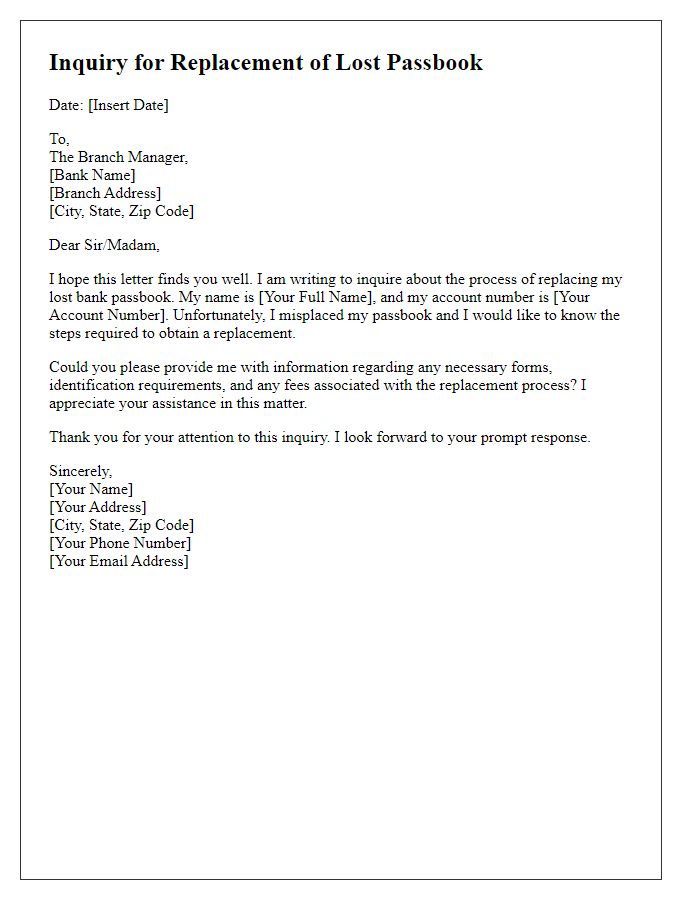

Letter template of inquiry for the process of lost passbook replacement.

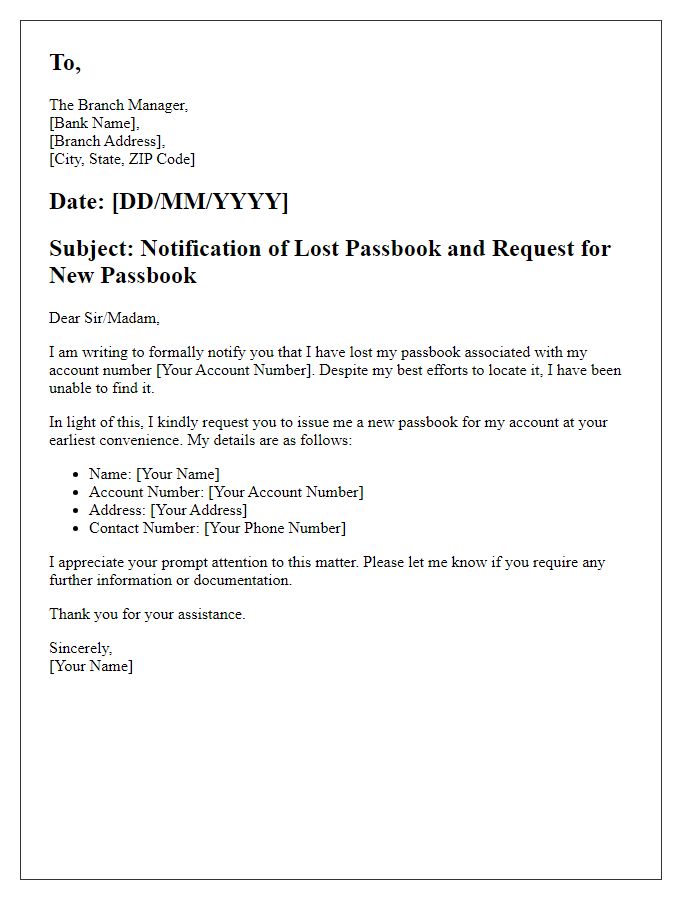

Letter template of notification to bank about lost passbook and request for new one.

Letter template of appeal for urgent replacement of lost savings passbook.

Letter template of request for duplicate passbook following theft incident.

Letter template of statement for lost passbook and plea for expedited replacement.

Comments