Are you feeling overwhelmed by unexpected interest charges on your accounts? You're not aloneâmany people are discovering that interest recalculation can make a significant difference in their finances. In this article, we'll guide you through the process of crafting a compelling letter to request a reevaluation of your interest rates, ensuring your voice is heard. So, grab a cup of coffee and let's dive deeper into how you can effectively communicate your concerns!

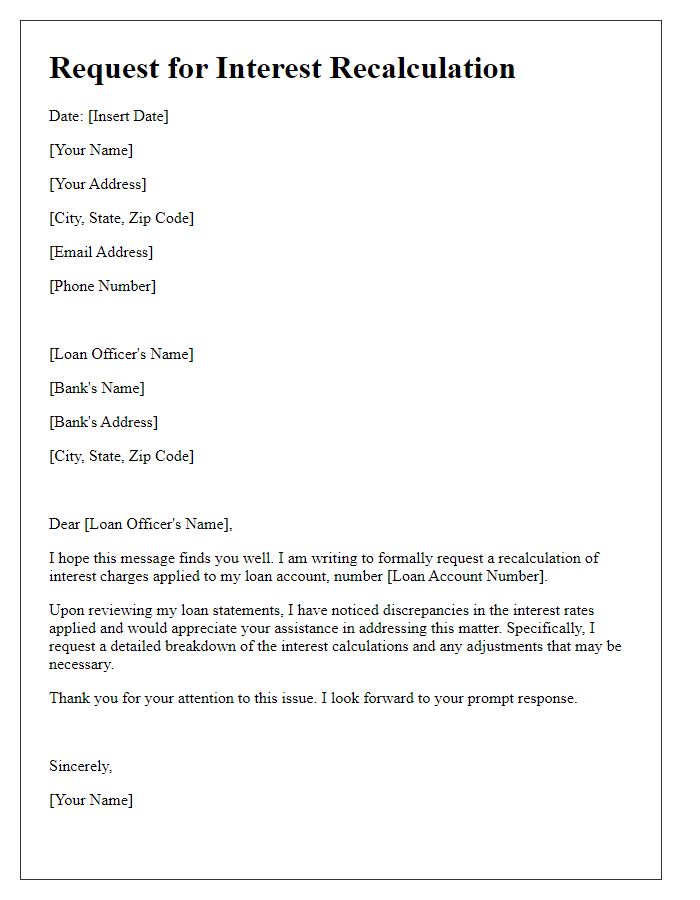

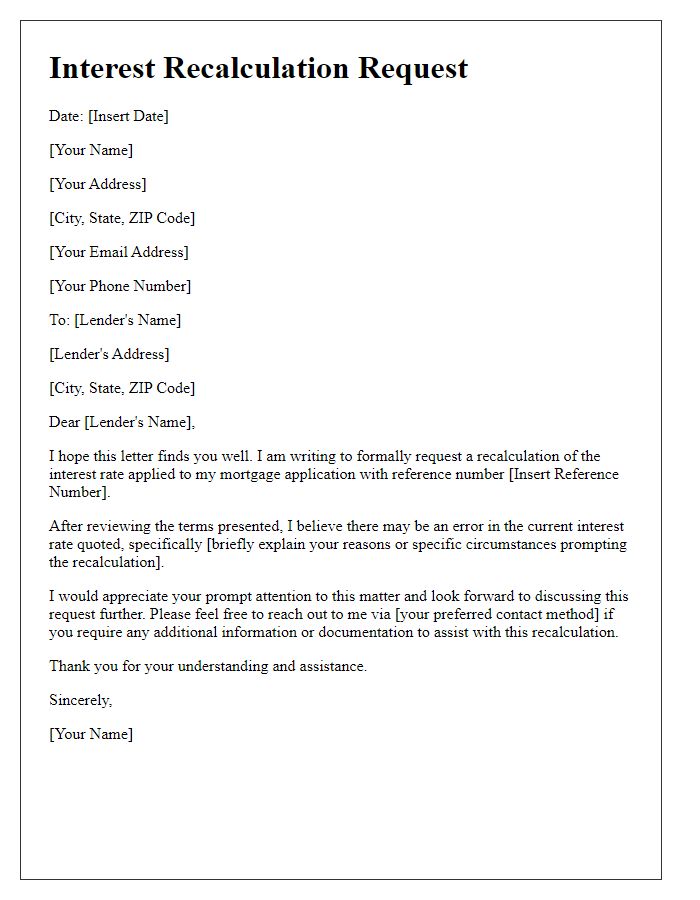

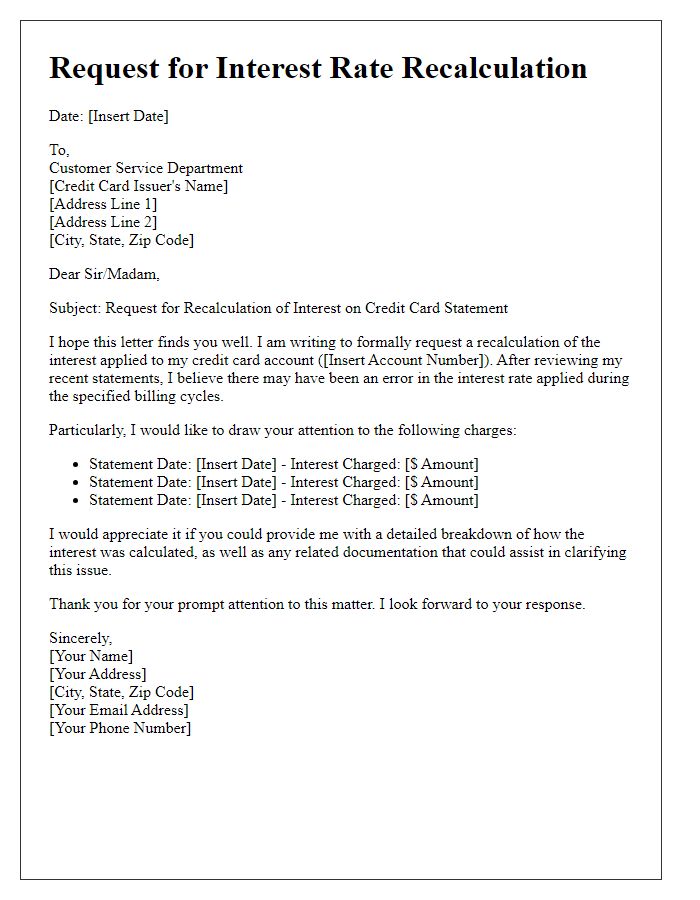

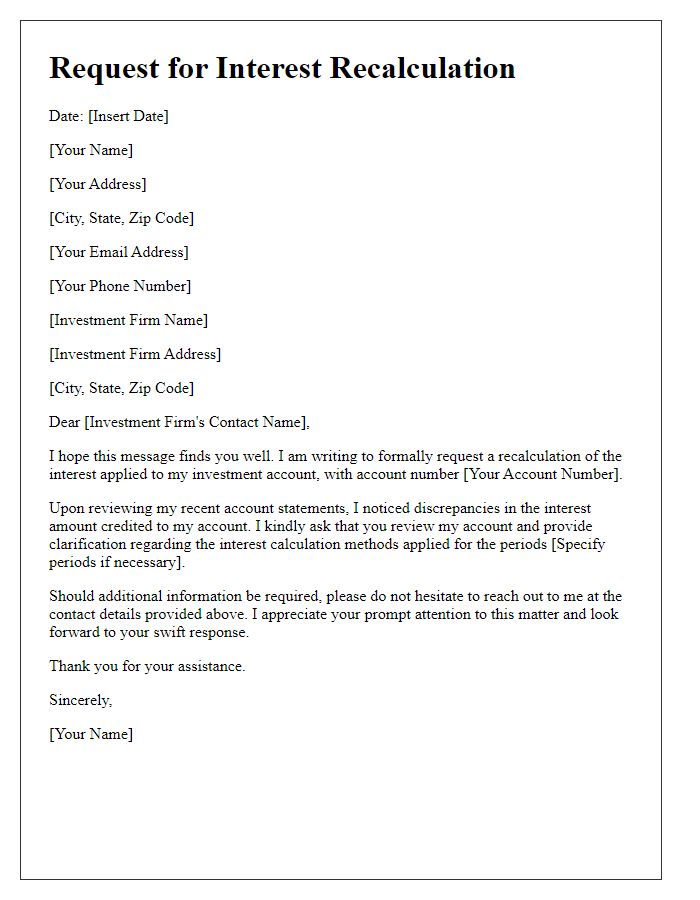

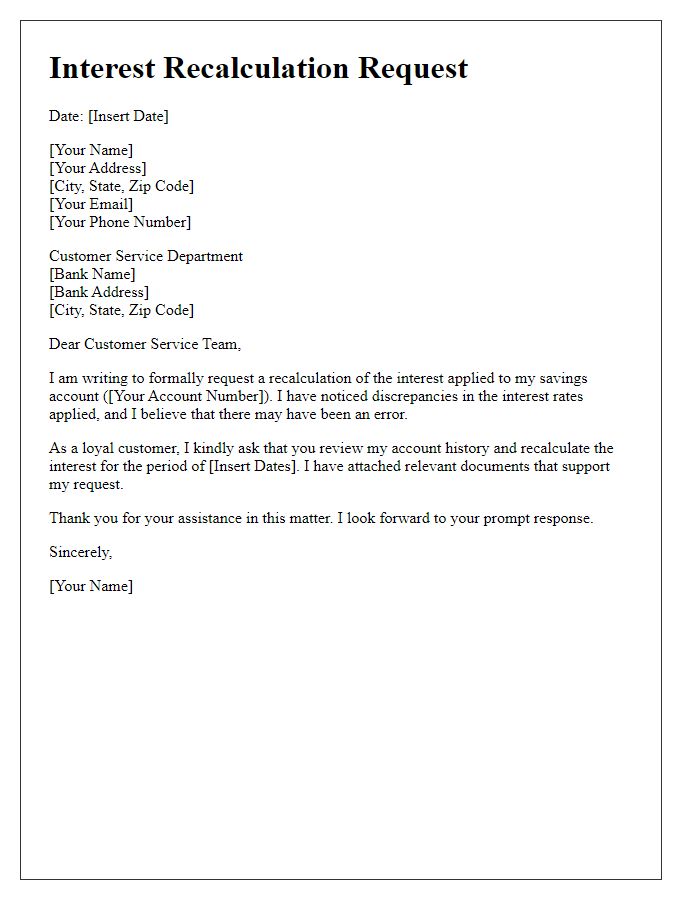

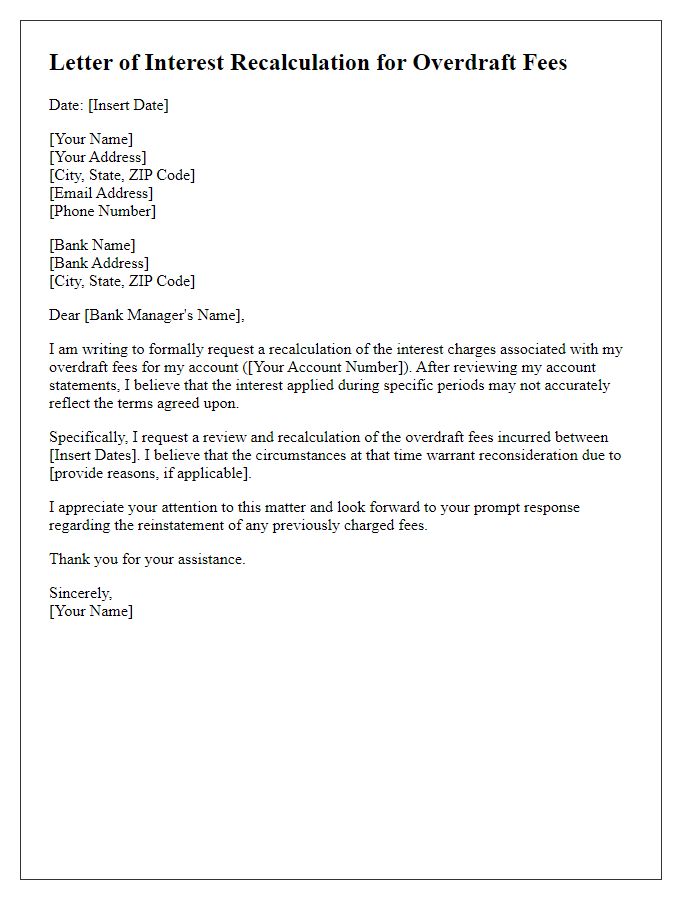

Recipient Information

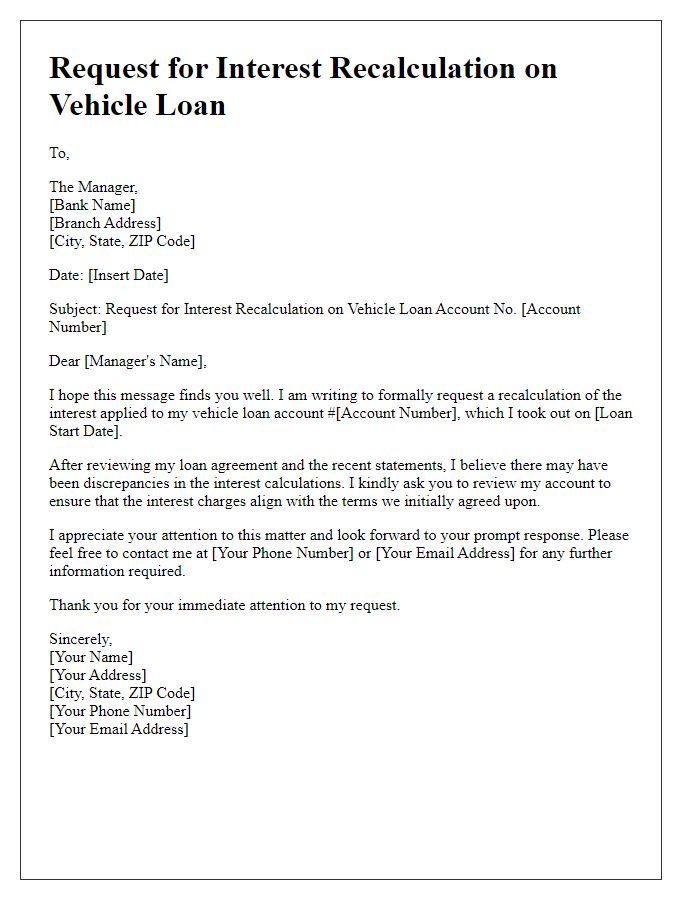

In the bustling financial hub of downtown Manhattan, a growing number of individuals engage in recalculating interest on various financial products, including loans and savings accounts. Many consumers find discrepancies in interest calculations, often stemming from variable interest rates fluctuating in response to the Federal Reserve's monetary policy changes. Loan documents may not clearly detail these shifts, leading to confusion and potential overcharges surpassing 1% annually on a principal amount of $10,000. Notifying the financial institution, such as Bank of America, is crucial to initiate a formal request for recalculation, ensuring clarity and transparency in financial dealings for clients. Engaging with customer service professionals, following up with documentation, and referencing specific account numbers enhance the likelihood of prompt resolution.

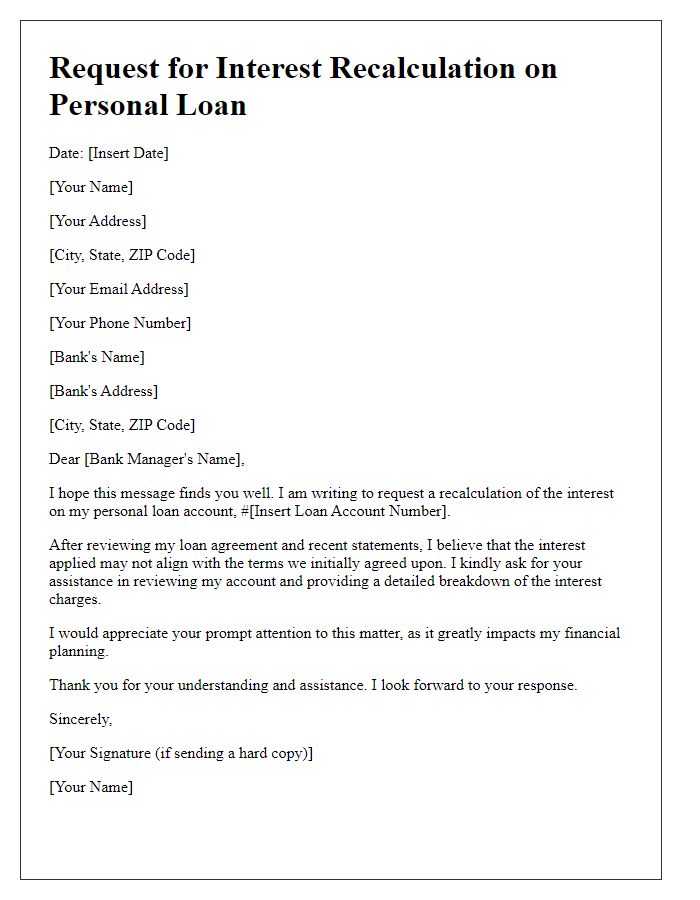

Sender Information

A borrower may initiate an interest recalculation request to their financial institution to reassess loan terms. Detailed information typically includes the borrower's full name, loan account number (e.g., 123456789), current address (e.g., 123 Main St, City, State, ZIP Code), and contact information (such as phone number and email). This information allows the lender to accurately identify the borrower and their account, ensuring an efficient review process. Additionally, including specific reasons for the recalculation request, such as changes in the interest rate landscape or errors detected in previous calculations, can provide necessary context for the lender's evaluation.

Clear Subject Line

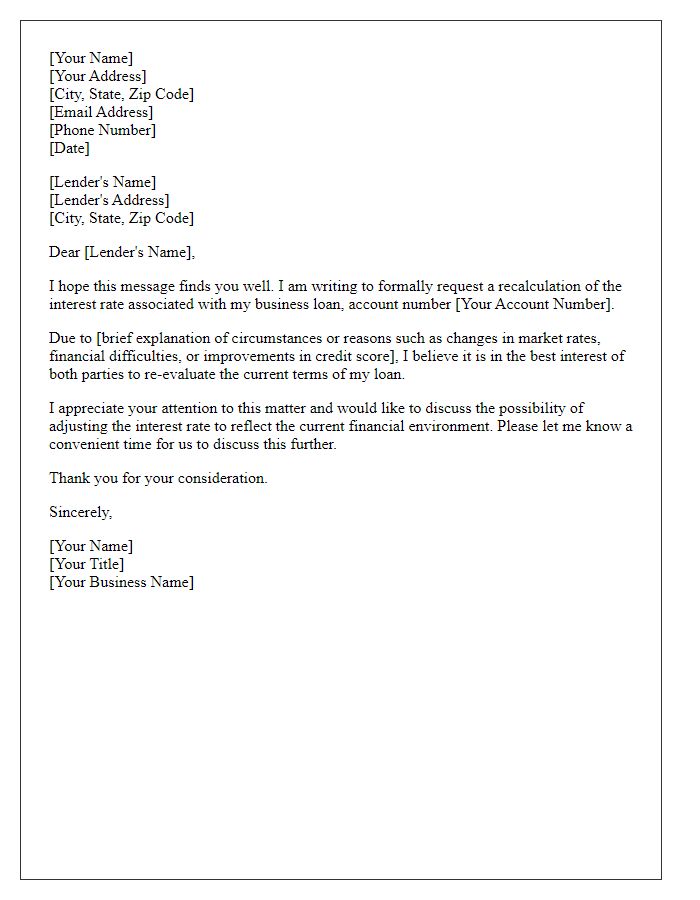

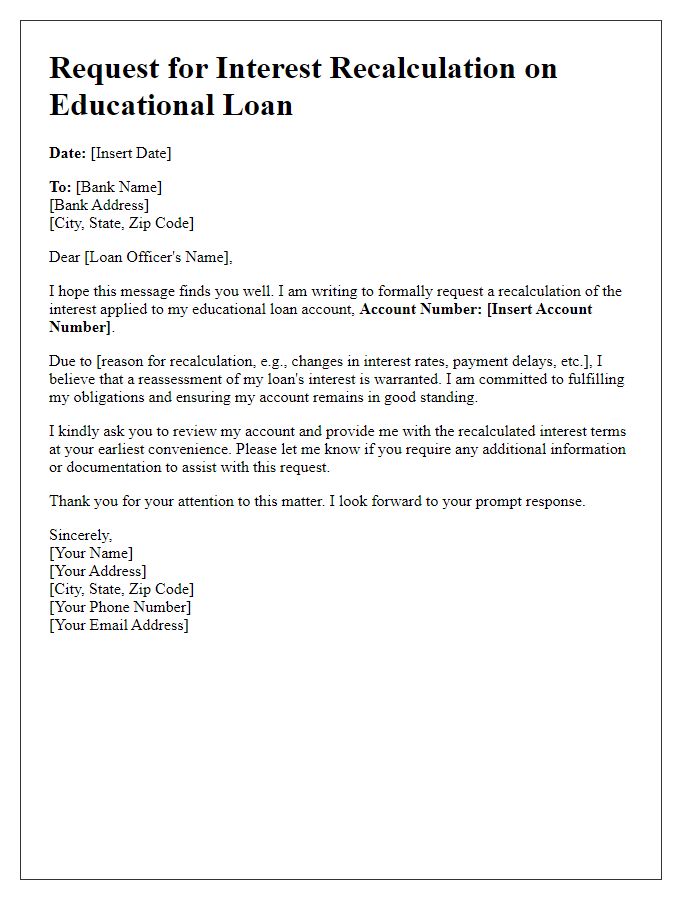

Interest recalculation requests are essential for ensuring accurate financial records and maintaining transparency. Financial institutions, such as banks or credit unions, often require borrowers to submit a formal request for adjusting interest amounts on loans or credit accounts. This process typically involves referencing specific account numbers, loan terms, and any applicable policies that govern interest calculations. Providing clear, concise details helps streamline the review process. Additionally, individuals may include supporting documents such as payment histories or previous correspondence to substantiate their claims, expediting the reassessment of interest charges.

Request Details

Interest recalculation requests are crucial for individuals seeking accuracy in financial statements. Borrowers, such as homeowners in mortgage agreements or consumers with personal loans, often need to ensure that interest rates comply with contractual stipulations. Specific events, like changes in the Federal Interest Rate or promotional offers from lenders, can impact overall financial obligations. Recalculating interest based on accurate principal amounts, current rate adjustments, and any applicable fees is essential for maintaining transparency. Individuals must outline details clearly, providing account numbers and timestamps of significant communications with financial institutions, ensuring efficient processing of their requests.

Closing and Contact Information

To initiate an interest recalculation request, individuals must provide essential details such as account identification numbers, which uniquely identify the financial account impacted. It is crucial to specify the original agreement date, typically reflecting a significant event in the financial timeline, such as loan initiation. Closing location, which refers to the physical or virtual setting where the transaction occurs, should be mentioned clearly to ensure accurate processing. Contact information, including phone numbers and email addresses, enables swift communication between parties involved, facilitating the resolution of any discrepancies in interest calculations. Comprehensive documentation, including any prior correspondence related to the interest recalculation, may enhance the request's credibility and speed of processing.

Comments