Have you ever experienced the unsettling feeling of realizing you've fallen victim to credit card fraud? You're not alone, as many individuals face this alarming situation each year, often leaving them confused about what steps to take next. It's crucial to know the right procedure for alerting your credit card company and protecting your finances. In this article, we'll guide you through the essential steps and offer tips on safeguarding your personal informationâso keep reading to arm yourself with the knowledge you need!

Recipient's Information

Credit card fraud alerts are critical for protecting financial assets and personal information. The initial step involves notifying the account holder (recipient) through secure channels, such as encrypted email or official app notifications. Personal data like name, address, and contact number must be verified to ensure accuracy. Additionally, providing unique identifiers, such as card numbers (last four digits), is essential for clarifying the account in question. Clear instructions about immediate actions must be included, emphasizing the importance of reporting suspicious transactions within specific timeframes (typically 48 hours). Furthermore, the recipient should be informed about potential identity theft risks connected to compromised accounts.

Alert Notification Statement

Credit card fraud alert procedures involve systematic notifications for affected account holders. These alerts typically include information about suspicious transactions, often detected through advanced algorithms (monitoring patterns and thresholds) on platforms such as Visa and Mastercard. An alert notification statement must clearly outline the steps to verify transactions, the importance of checking recent activity, and immediate reporting channels, such as dedicated hotlines operating 24/7. Users should note the urgency, as unauthorized activities can escalate quickly; notably, users in high-risk areas like online shopping may face heightened vulnerability. Furthermore, safeguarding personal information through secure practices is crucial in mitigating risks associated with identity theft.

Incident Description and Date

Credit card fraud alerts can significantly impact customer trust and financial security, with incidents often occurring during peak shopping seasons such as Black Friday (the day after Thanksgiving in the United States) or Cyber Monday (the first Monday after Thanksgiving). Fraudulent transactions may appear on statements, often ranging from small amounts (less than $10) to larger purchases (over $1,000), typically without the cardholder's consent. Affected cardholders need immediate communication regarding the fraudulent activity, usually within 24 to 48 hours of detection, to mitigate risks. Card issuers may also implement robust procedures, including transaction monitoring systems, fraud detection algorithms, and customer notification protocols, to ensure timely responses to potential fraud incidents.

Required Immediate Actions

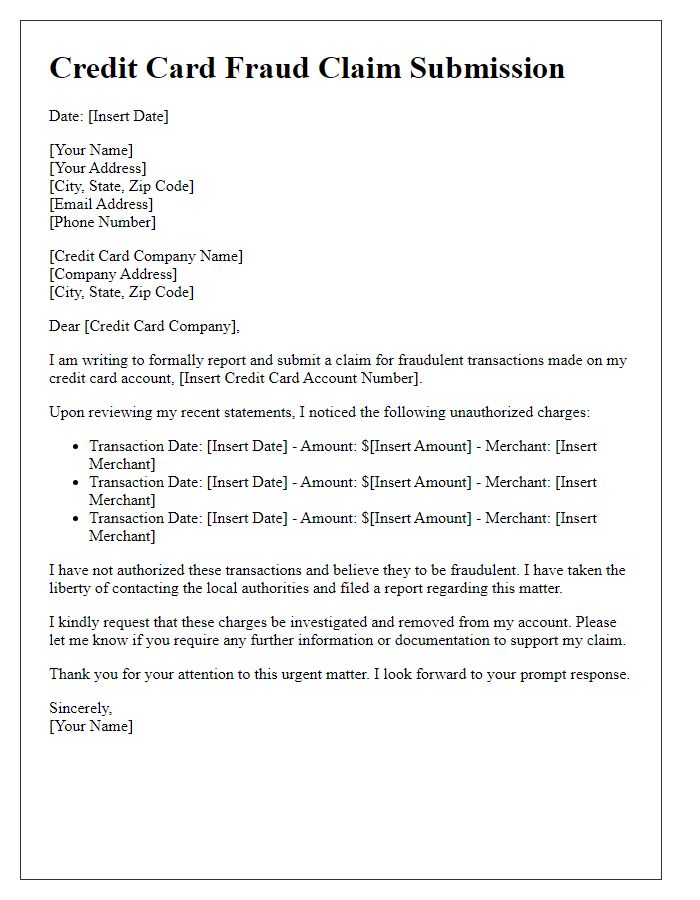

Credit card fraud alerts require immediate actions to protect financial security. Upon noticing suspicious activity, such as unauthorized transactions exceeding $100 or unfamiliar merchant names, contact the issuing bank's fraud department directly. Report the discrepancies promptly using the customer service number on the back of the card. Request the cancellation of the compromised card and obtain a replacement card with a new account number. Monitor recent transactions for additional unauthorized charges and gather relevant documentation to support the fraud claim. It's essential to file a report with the Federal Trade Commission (FTC) and consider placing a fraud alert with credit bureaus like Equifax, Experian, or TransUnion to prevent further identity theft.

Contact Information for Support

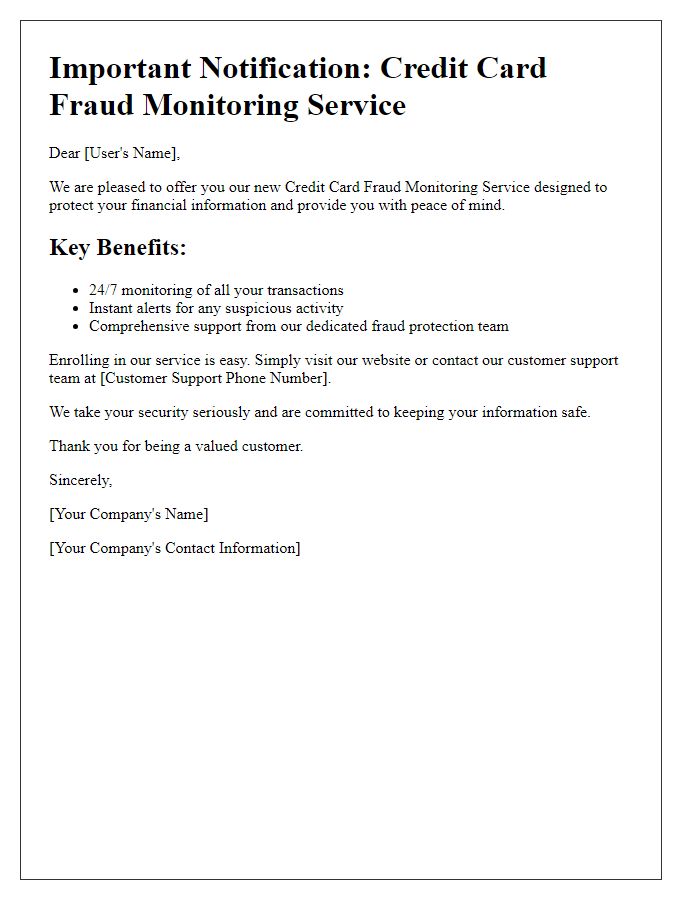

Credit card fraud alerts are essential for maintaining financial security. Immediate actions should be taken upon suspicion of fraudulent activity. Customers should promptly contact the issuer, typically located on the back of the card, which often includes a toll-free support number. Major credit card companies, such as Visa and MasterCard, can assist with 24/7 fraud alert services. Additionally, reporting to credit bureaus like Experian, TransUnion, and Equifax can help safeguard against identity theft. Using secure online portals provided by these institutions can expedite the alert process, ensuring swift monitoring and potential investigation into unauthorized transactions.

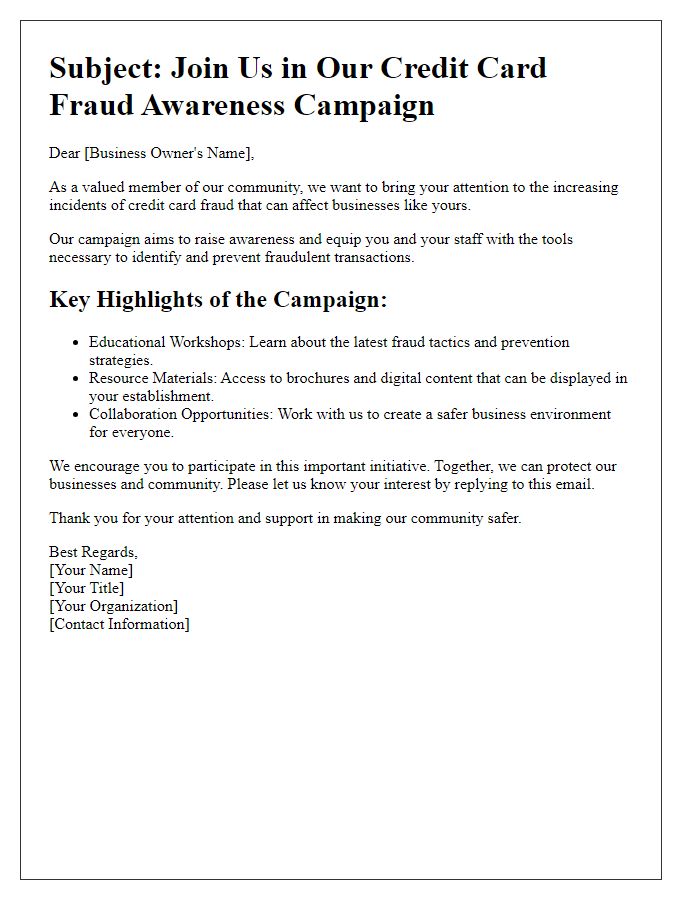

Letter Template For Credit Card Fraud Alert Procedure Samples

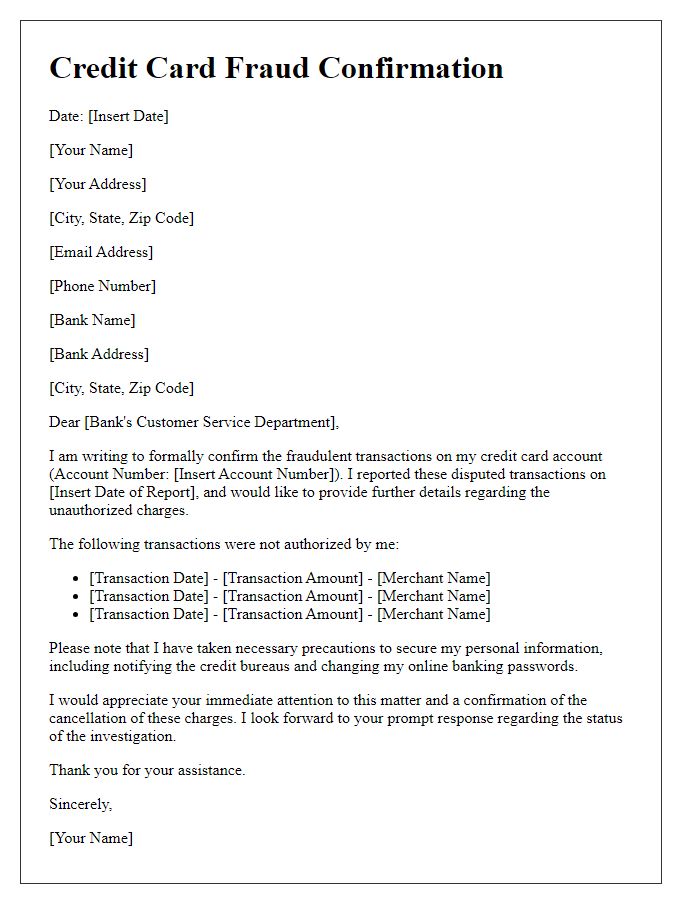

Letter template of credit card fraud confirmation for disputed transactions

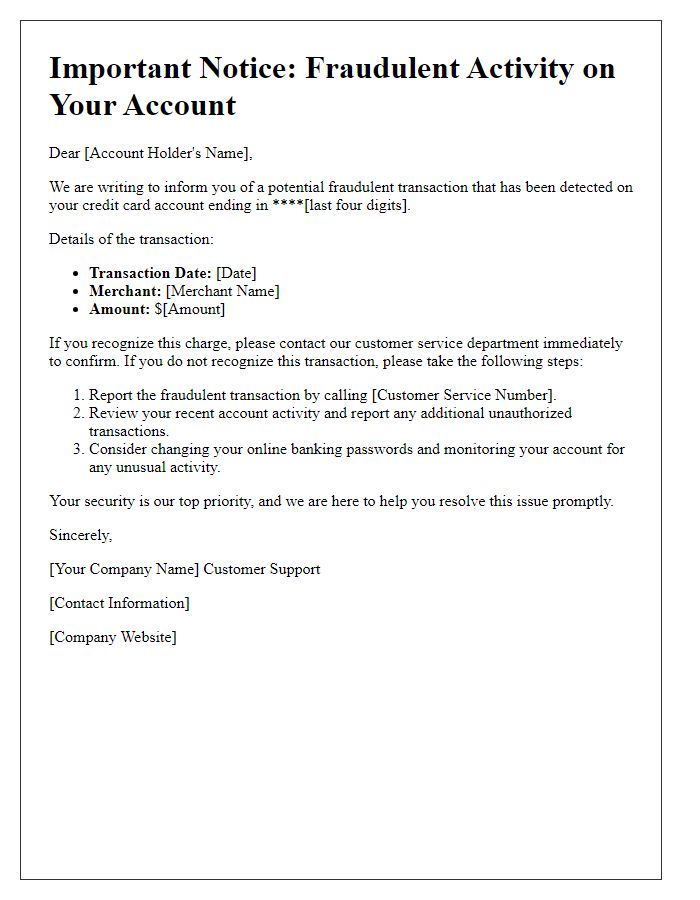

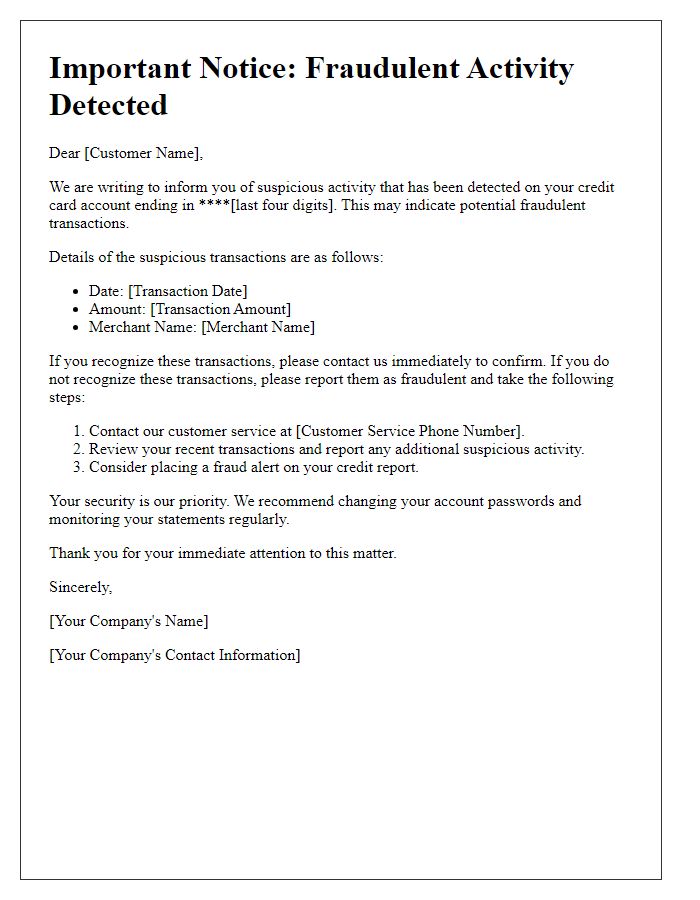

Letter template of credit card fraud resolution communication for account holders

Comments