Are you curious about how to make your money work harder for you? Interest-bearing accounts can be a fantastic way to grow your savings while maintaining easy access to your funds. With various options available, you might be wondering which one suits your financial goals best. Join us as we explore the different types of interest-bearing accounts and find the perfect fit for your needs!

Account Type Variability

Interest-bearing accounts, including savings accounts and money market accounts, offer individuals the opportunity to earn interest on deposited funds. Savings accounts typically yield lower interest rates, around 0.01% to 1.5%, but provide easy access to funds, while money market accounts can offer higher rates, often between 0.5% and 2.5%, in addition to limited check-writing capabilities. Financial institutions, such as JPMorgan Chase, Bank of America, and Wells Fargo, may present different features or requirements, like minimum balance thresholds, which can range from $0 to $2,500. Account holders should assess these variables along with the Federal Insurance Corporation (FDIC) coverage limitations to ensure the safety of their deposits, which safeguards up to $250,000 per depositor, per insured bank. Evaluating promotional offers, such as introductory rates, can lead to maximizing interest earnings during the initial months after account opening.

Interest Rate Conditions

Interest-bearing accounts, such as savings accounts at financial institutions like banks, often feature varying interest rates based on market conditions. For example, national averages show that traditional savings accounts may offer interest rates around 0.05% to 0.10%, while high-yield savings accounts can provide rates exceeding 2% APY (Annual Percentage Yield) as of October 2023. Conditions influencing these rates include account minimum balance requirements, tiered interest structures, and promotional offers with specific duration limits. Institutions may revise rates based on Federal Reserve interest rate changes or economic indicators, impacting customer returns on deposits. Understanding these dynamics is crucial for optimizing returns on personal finances in today's fluctuating economic climate.

Minimum Balance Requirements

Interest-bearing accounts, such as high-yield savings accounts and money market accounts, often come with minimum balance requirements that can significantly affect the account's growth potential. For example, many financial institutions, like JPMorgan Chase and Bank of America, may require a minimum balance of $1,000 or more to earn interest at competitive rates, often ranging from 0.5% to 2%. Failure to maintain this minimum balance can result in monthly maintenance fees, which can diminish overall returns. Customers should also consider promotional offers that certain banks provide, such as higher interest rates for the first six months, to maximize savings. Understanding these requirements and their implications on account performance is crucial for individuals looking to grow their finances.

Withdrawal and Deposit Flexibility

Interest-bearing accounts offer various options for managing withdrawals and deposits, providing account holders with financial flexibility. Standard savings accounts, typically offered by banks like JPMorgan Chase and Bank of America, allow easy access to funds while earning interest, often ranging from 0.01% to 0.50% annually. Money market accounts, available at institutions such as Wells Fargo, provide a higher interest rate (up to 2.00% in some cases) along with limited check-writing capabilities. Certificates of Deposit (CDs) at credit unions like Navy Federal may yield higher returns, often exceeding 4%, though they require locking in funds for a specified term, usually between 6 months and 5 years. These various account types empower customers to choose the level of liquidity necessary based on personal savings goals and financial situations.

Customer Support and Accessibility

Interest-bearing accounts offer customers a variety of financial opportunities to grow savings while maintaining accessibility. Many institutions, such as banks and credit unions, provide these accounts with competitive interest rates that can range from 0.01% to over 3%, depending on the account type and balance. Customers can access their funds through various channels, including ATMs, online banking platforms, and mobile applications, ensuring convenience at their fingertips. Accessibility features, such as voice command options and screen reader compatibility, enhance the user experience for individuals with disabilities. Customer support teams are essential, providing assistance via phone, live chat, and email, ensuring that clients receive timely information about account features, fees, and options for optimizing their investment strategies. Prioritizing customer needs enables seamless interactions with interest-bearing accounts, facilitating effective financial management.

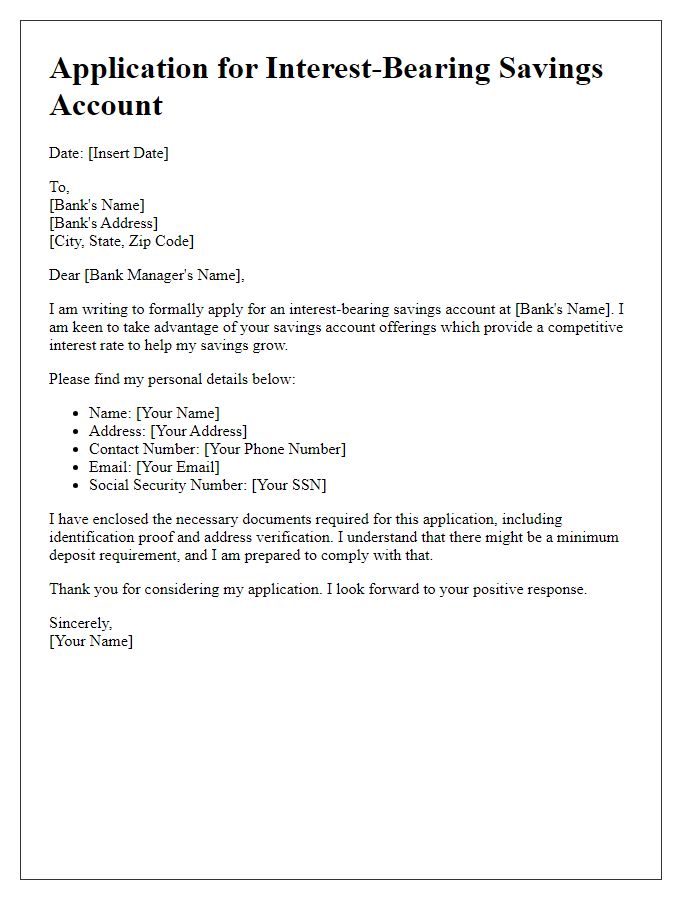

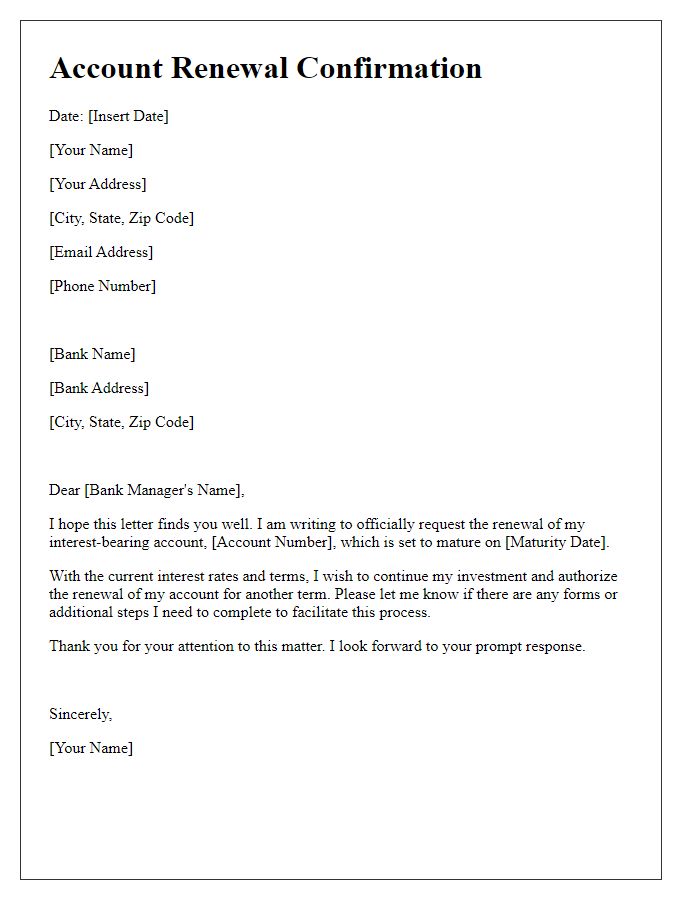

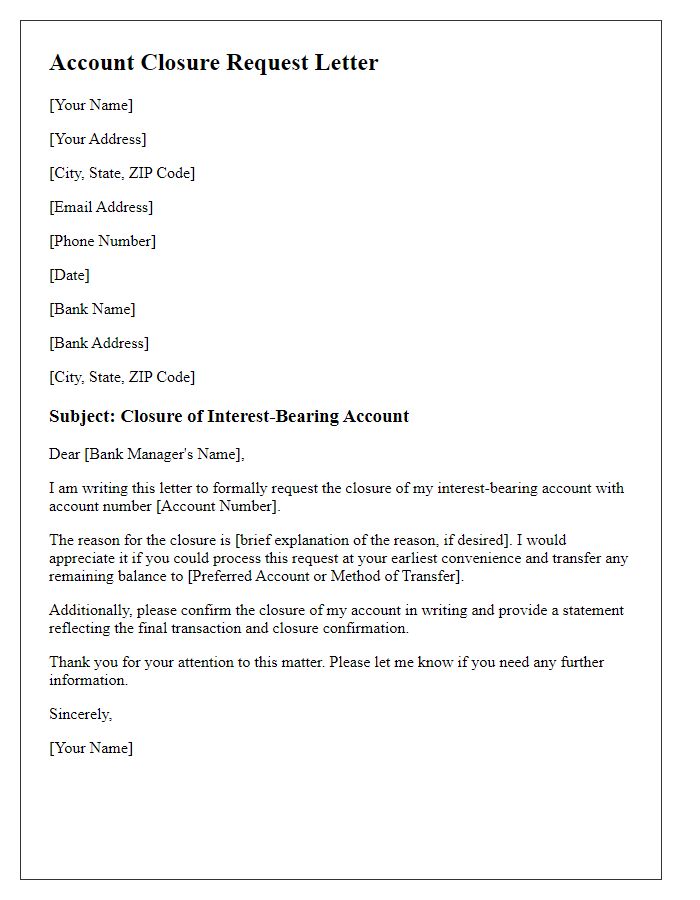

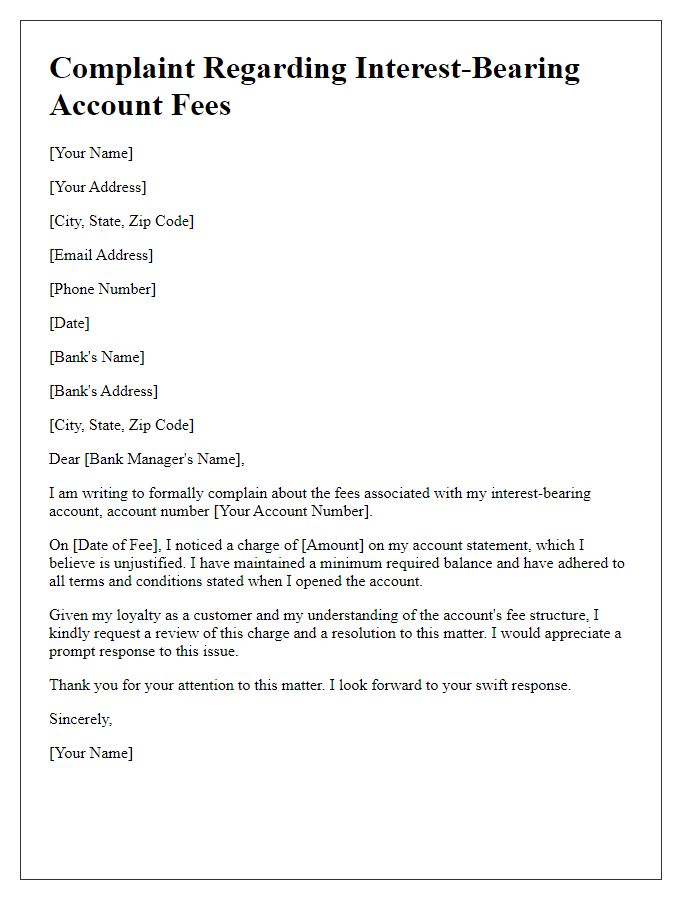

Letter Template For Interest-Bearing Account Options Samples

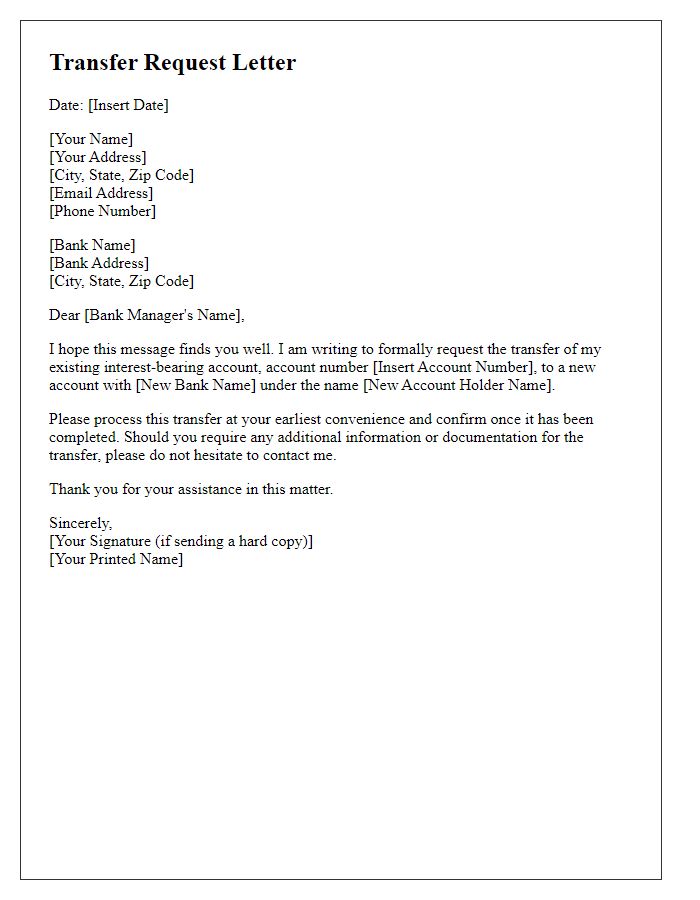

Letter template of transfer request for existing interest-bearing account

Comments