Are you feeling overwhelmed by the thought of foreclosure on your home? You're not alone, as many find themselves in challenging financial situations that can lead to this tough reality. Fortunately, there are steps you can take to create a solid loan foreclosure avoidance plan that offers hope and a pathway to recovery. Join us as we explore practical strategies and insights to help you safeguard your home and regain financial stabilityâread on to discover more!

Personal Information

A loan foreclosure avoidance plan involves detailed personal information that includes essential identifiers such as full name, address, and contact information. Diligence in providing the current financial status, including total income, monthly expenses, and outstanding debts, is crucial for clarity when seeking assistance. Essential documentation, such as bank statements from the past three months, tax returns for the previous year, and the current loan statement reflecting the remaining balance and payment history, must be prepared. Additionally, outlining any recent changes in employment status or unforeseen financial hardships can greatly support the case for loan modification or alternative solutions. The involvement of local housing counseling agencies, which can offer guidance, may also be considered in crafting this plan.

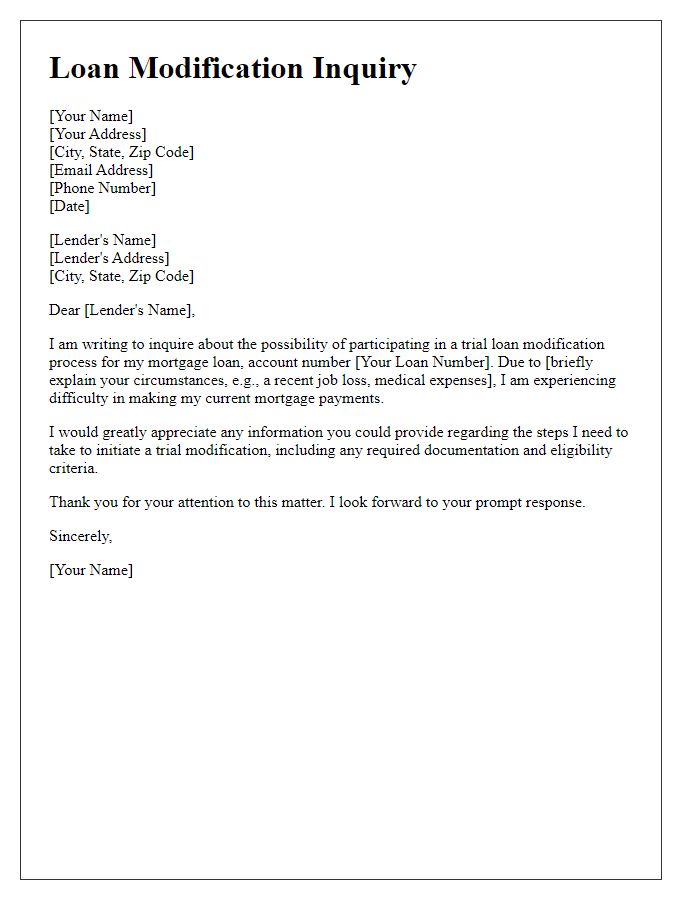

Loan Details

The loan details encompass critical information regarding mortgage agreements and financial commitments. The principal amount often ranges from $100,000 to $500,000, determining the total debt owed based on factors like property location and market conditions. An interest rate, typically between 3% and 6%, impacts monthly payments, influencing affordability for homeowners. The term of the loan may last 15 to 30 years, dictating the repayment schedule and long-term financial planning. Additionally, late fees or penalties can arise after missed payments, often adding up to $30 per occurrence, escalating financial strain on borrowers. Understanding loan details is vital for effective foreclosure avoidance strategies.

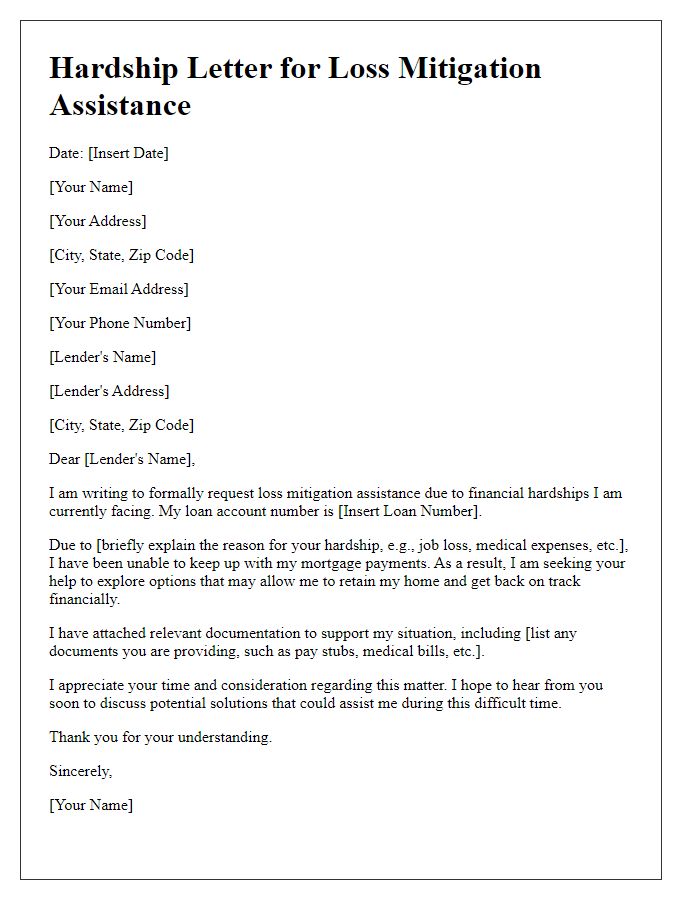

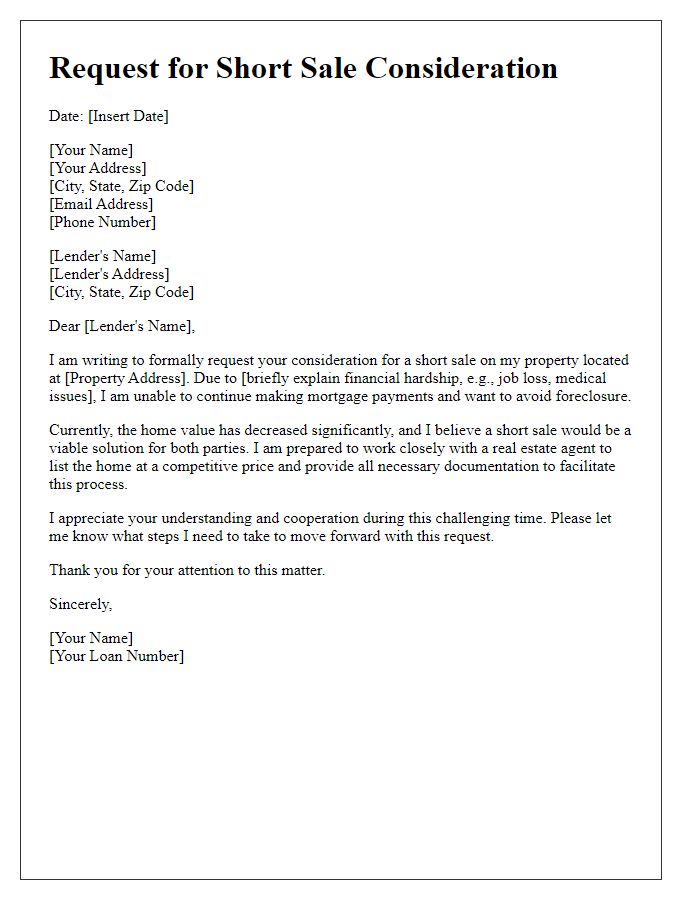

Financial Hardship Explanation

Homeowners facing financial hardship often seek solutions to prevent loan foreclosure. A financial hardship explanation details the circumstances leading to difficulty in mortgage payments. Events such as job loss, medical emergencies, or family issues can contribute to the inability to meet financial obligations. For instance, a homeowner in Atlanta, Georgia, may have experienced a sudden job loss affecting their annual income by over 50%. Additionally, rising living costs, especially in urban areas like San Francisco, California, can exacerbate financial strain. Effective communication with lenders is crucial, as providing detailed documentation, such as unemployment statements or medical bills, can enhance the chances of receiving a loan modification or forbearance plan. Understanding the local housing market trends and available assistance programs can also significantly aid homeowners in navigating their financial difficulties and avoiding foreclosure.

Proposed Payment Plan

A proposed payment plan for avoiding loan foreclosure typically includes the borrower's commitment to repayment, a detailed schedule with specific amounts, and the timeline for making payments. The plan may outline the current loan balance, including principal and accrued interest, with potential adjustments based on previously missed payments or changing financial situations. The borrower should communicate with the lender to establish agreed-upon monthly payment amounts, which may reflect the borrower's capability to pay, such as 30% of their income or an amount aligned with their budget. Additionally, the plan should propose a specific duration for the repayment period, ideally 12 to 24 months, reassessing the borrower's financial status before the end of this period to ensure ongoing compliance and potentially avoid future delinquent payments. Keeping open communication with the lender, documenting all agreements, and adhering to the payment schedule are critical steps for the borrower in avoiding foreclosure.

Required Supporting Documents

The loan foreclosure avoidance plan necessitates submission of specific supporting documents to facilitate a comprehensive review. Essential documents include the signed mortgage agreement, detailing loan terms and obligations, along with recent pay stubs, showcasing income stability from employment. Current bank statements, preferably from the last two months, are required to demonstrate cash flow and financial reserves. Additionally, tax returns from the previous two years, offering insight into overall financial health, are necessary. A written hardship statement, clearly outlining the circumstances leading to financial difficulty, should accompany these documents. Any pertinent documentation regarding other debts, such as credit card statements or personal loans, will aid in assessing the overall financial situation.

Letter Template For Loan Foreclosure Avoidance Plan Samples

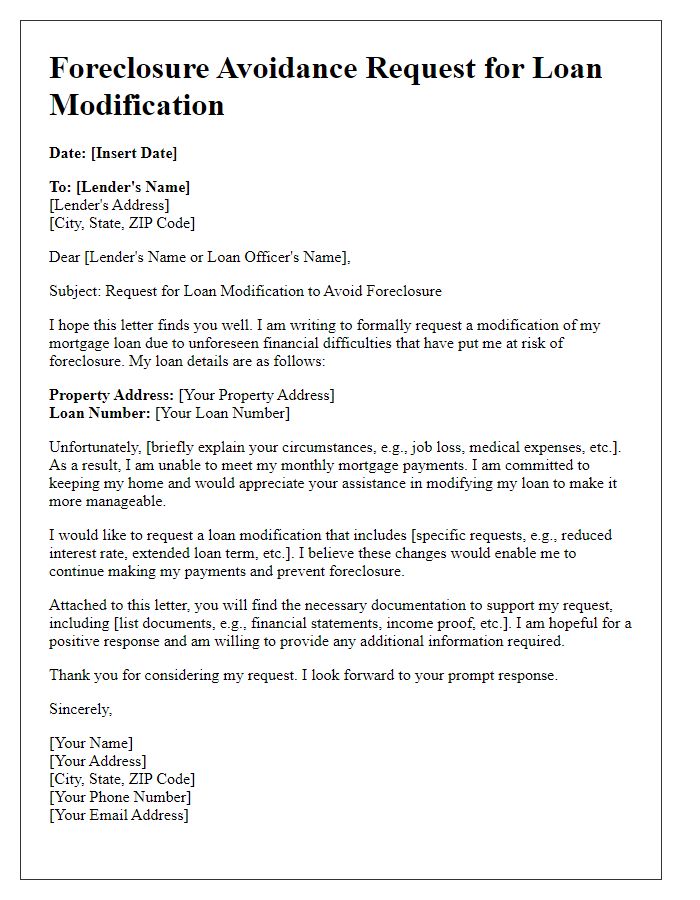

Letter template of foreclosure avoidance request for loan modifications.

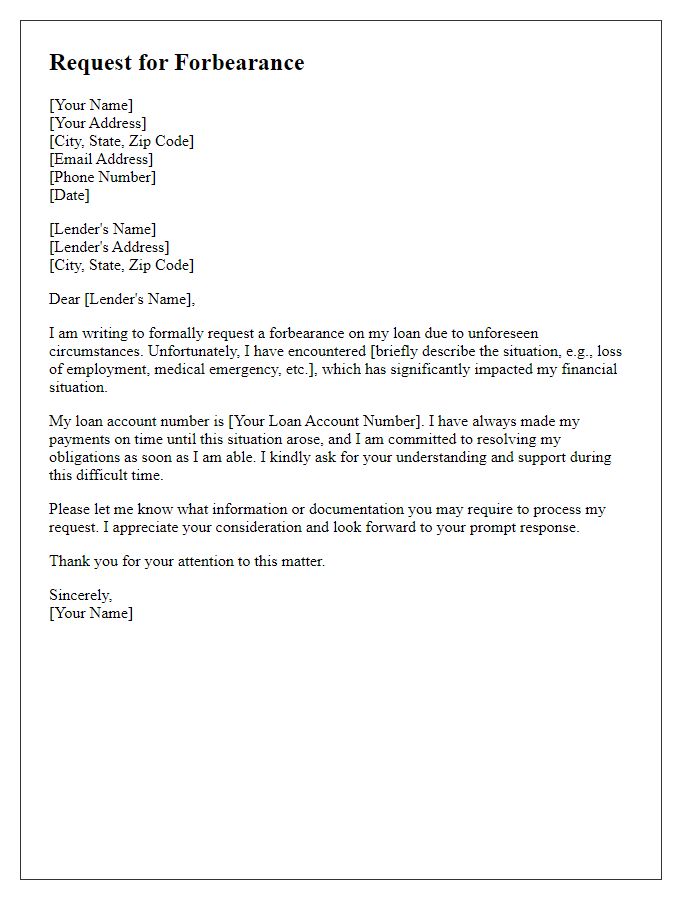

Letter template of request for forbearance due to unforeseen circumstances.

Comments