Are you sitting on a dormant account and wondering how to reactivate it? You're not alone; many people overlook their old accounts until they realize there's still potential value waiting to be unlocked. Whether it's an old savings account, a forgotten investment, or a loyalty program with rewards, reactivating your account can open doors to new opportunities. Stick around to discover the simple steps you can take to bring your dormant accounts back to life!

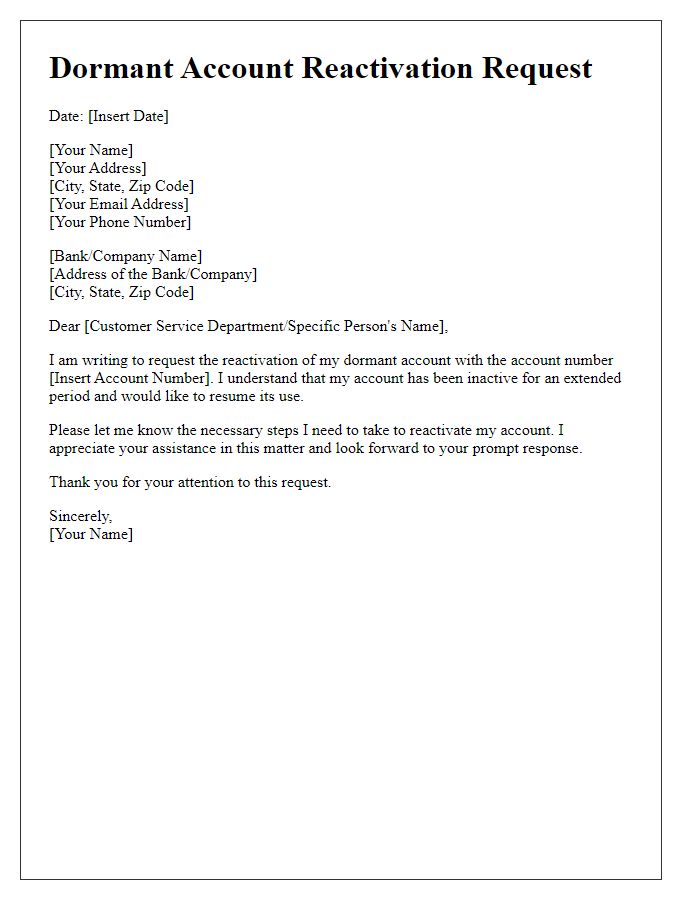

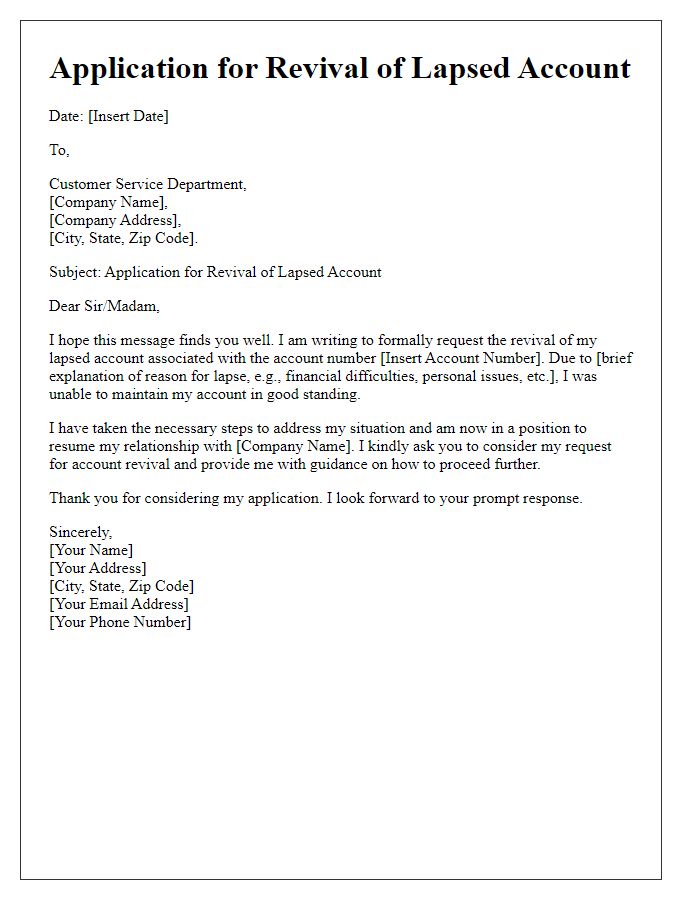

Account Holder Information

Dormant accounts, defined as accounts with no activity for a specified period (often 12 months), require proper reactivation procedures. Account holder information, including name, address, phone number, and email, is crucial for verifying identity. Financial institutions typically assess if any outstanding fees or account minimums apply. Procedures may involve confirming personal identification through documents like a government-issued ID or utility bills. Once verified, the institution may require account holder consent for reactivation and disclosure of account activity options. Additionally, the account holder may need to update contact information to ensure future communication is accurate and timely.

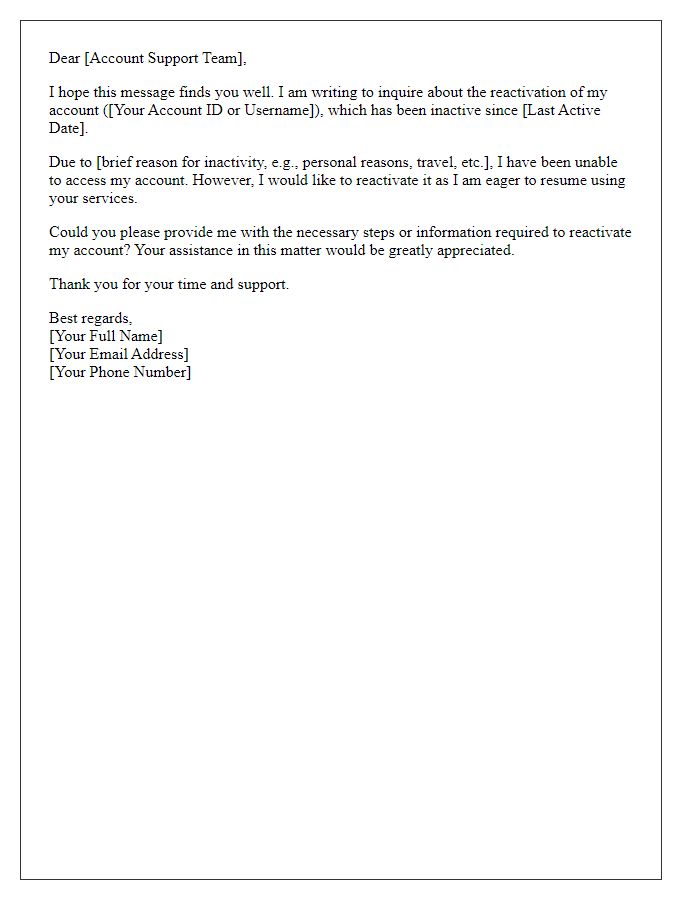

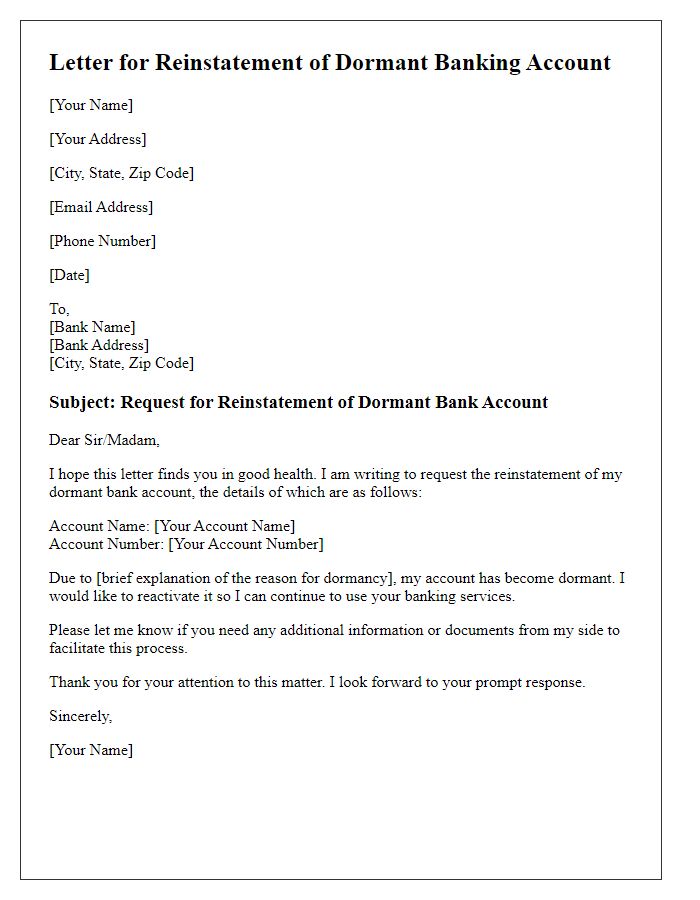

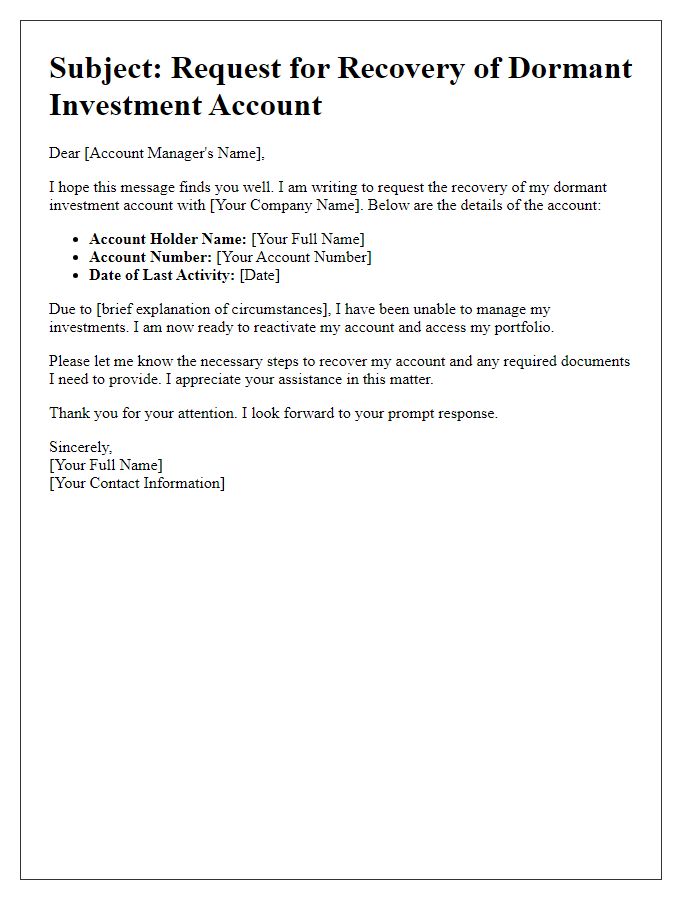

Account Details Clarification

Dormant accounts often refer to financial accounts that have had no activity for a period of time, typically around 12 months. Reactivating a dormant account can involve clarifying account details such as account number (e.g., #123456789), account holder's name (e.g., John Doe), and associated email address (e.g., johndoe@email.com). Institutions may require verification of identity through government-issued identification (e.g., driver's license or passport) along with additional documentation for compliance purposes. Customers may need to provide updated information regarding their current address or contact details to ensure communication remains effective moving forward. Regulatory frameworks such as the Bank Secrecy Act may also influence the reactivation process, ensuring that all reactivated accounts are properly monitored for unusual activity.

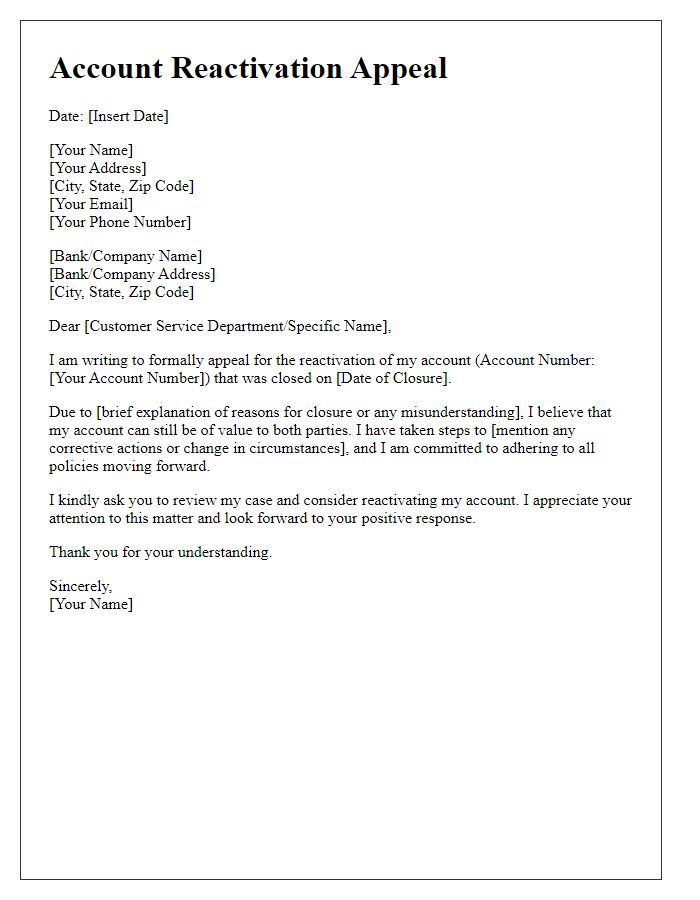

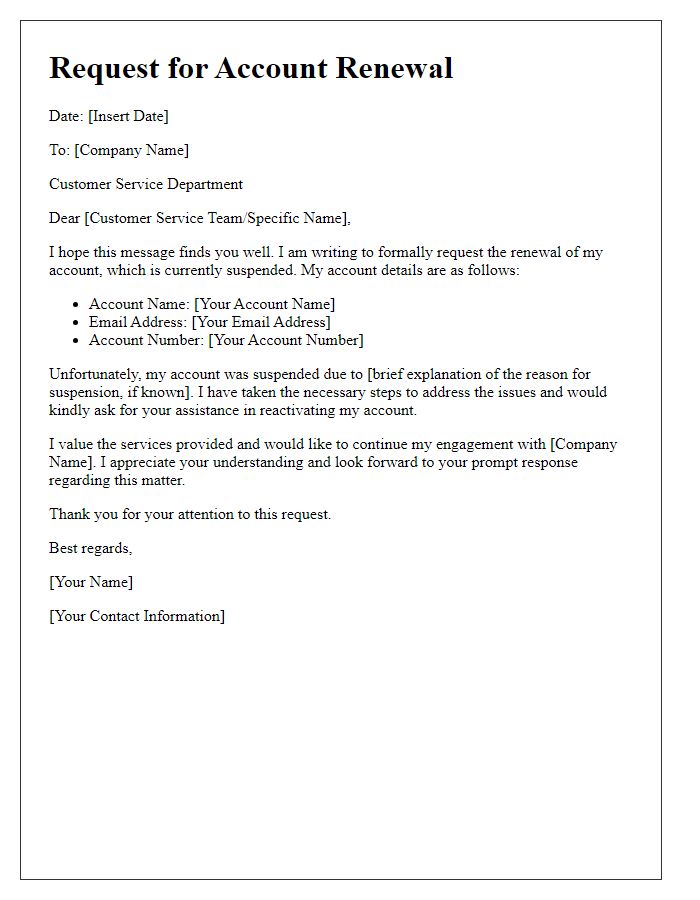

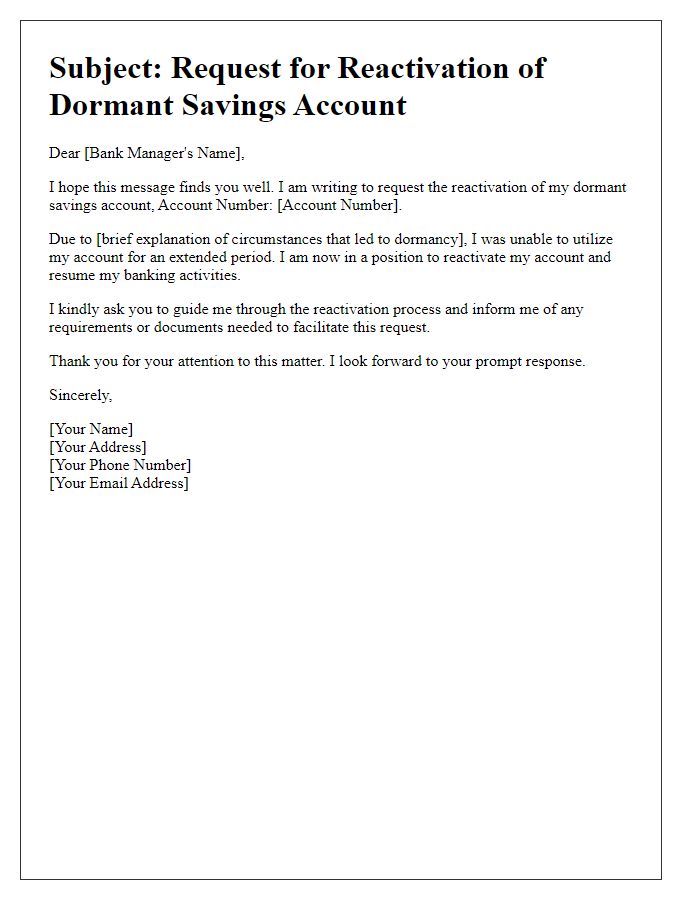

Reactivation Request Statement

Dormant accounts, defined as accounts inactive for over twelve months, often require reactivation procedures. Financial institutions, like banks, may impose fees or additional verification steps to restore account accessibility, which can vary by entity. For example, the rigorous authentication process might include providing personal identification documents or answering security questions. Customers with dormant accounts may need to visit their local branch, such as one located in New York City, to reactivate their accounts in person or submit formal reactivation requests through secure online platforms. In addition, some institutions may offer incentives, such as waived fees for early reactivation, to encourage account utilization.

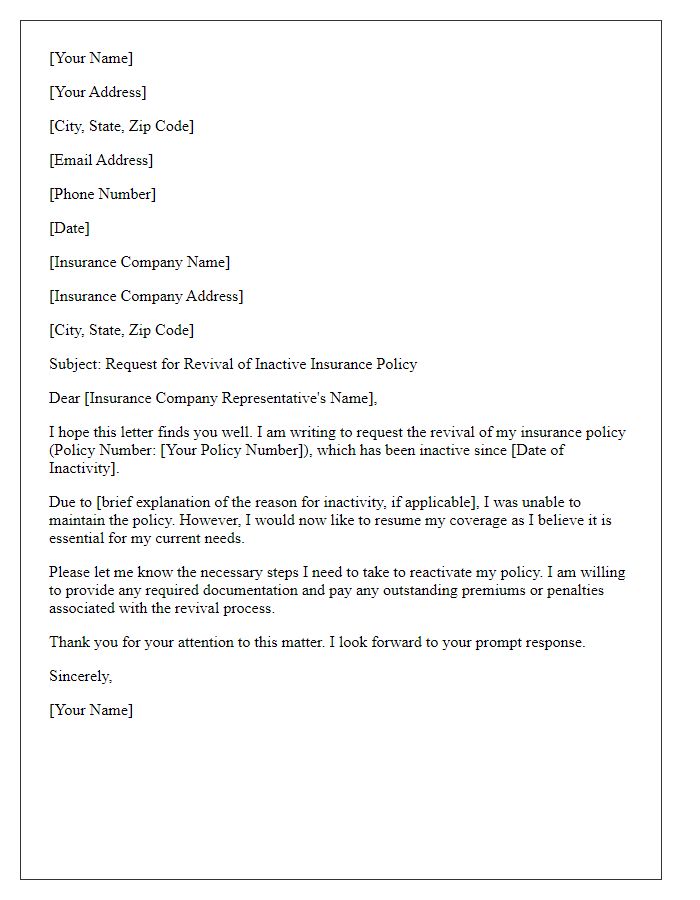

Compliance and Identification Documents

Dormant accounts, characterized by inactivity over a specific period (often 12 months or more), require reactivation processes to comply with regulatory standards. Customers must provide identification documents such as government-issued photo IDs (including passports or driver's licenses) to verify identity. Additionally, proof of address (like utility bills or bank statements) dated within the last three months may be necessary. Financial institutions often enforce these measures to prevent fraud and ensure data accuracy, protecting both the institution and the account holder. Reactivation typically involves completing a form or process outlined by the institution, with some requiring the customer to physically visit a branch or submit documents electronically through secure portals.

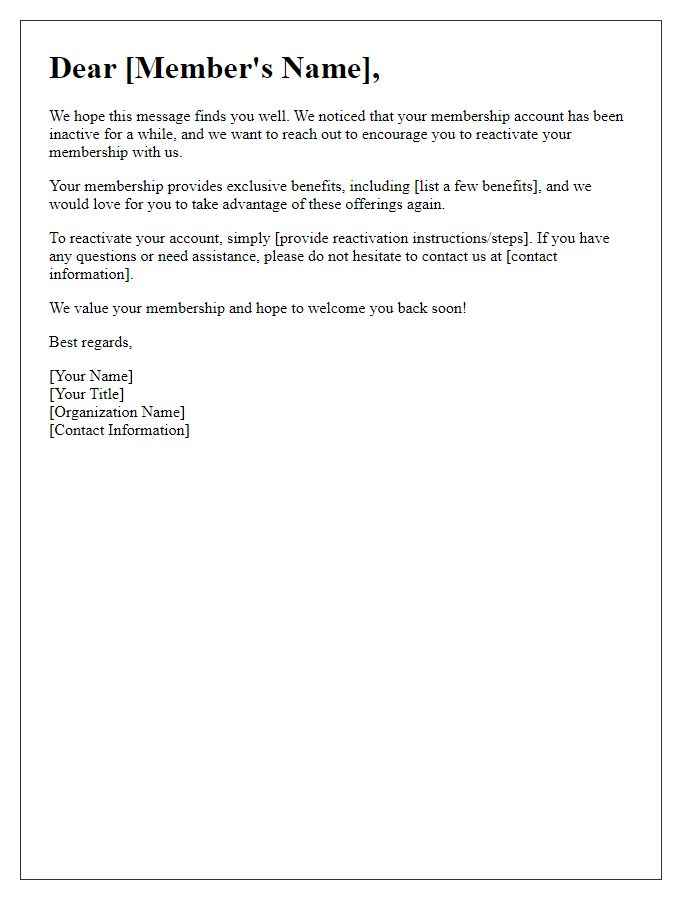

Contact Information for Assistance

Dormant account reactivation requires specific steps to restore access to inactive accounts, typically characterized by no transactions for an extended period, often over 12 months. Users seeking assistance should provide personal details, such as name, account number, and contact information. Financial institutions use this data to verify identity and facilitate the reactivation process. Many banks may require additional identification, such as a government-issued ID or utility bill, to confirm residency. Users can often find dedicated customer support hotlines or online chat options on the institution's website, ensuring prompt assistance.

Comments