Hey there! If you've ever found yourself sifting through heaps of paperwork trying to understand your account statement, you're definitely not alone. In this article, we'll break down the essentials of what an account statement summary entails and why it's crucial for managing your finances. From tracking spending trends to identifying discrepancies, a well-organized summary can truly be your financial roadmap. So, let's dive in and explore how to make the most out of your account statement summary!

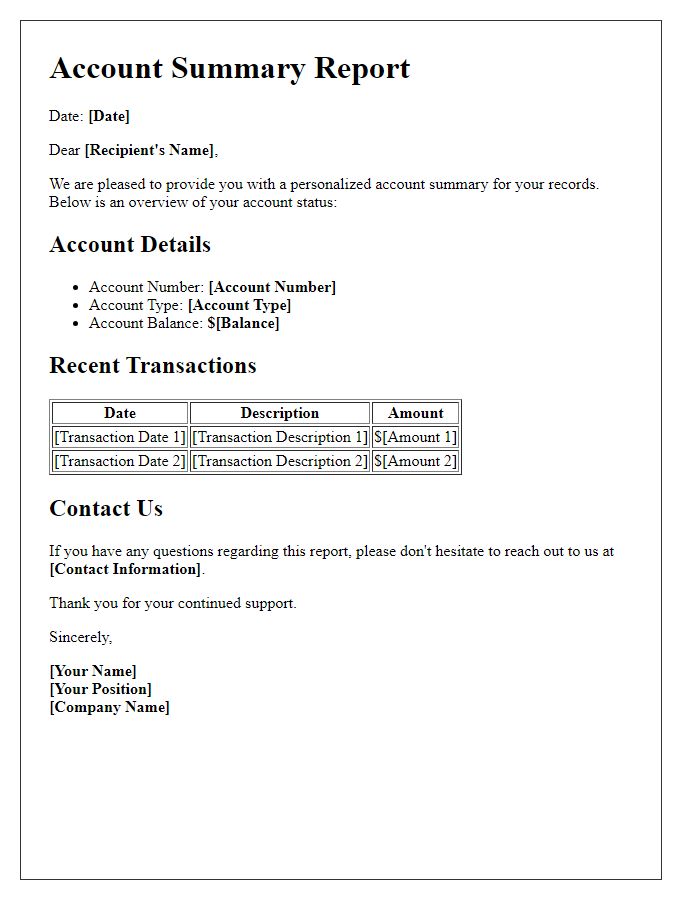

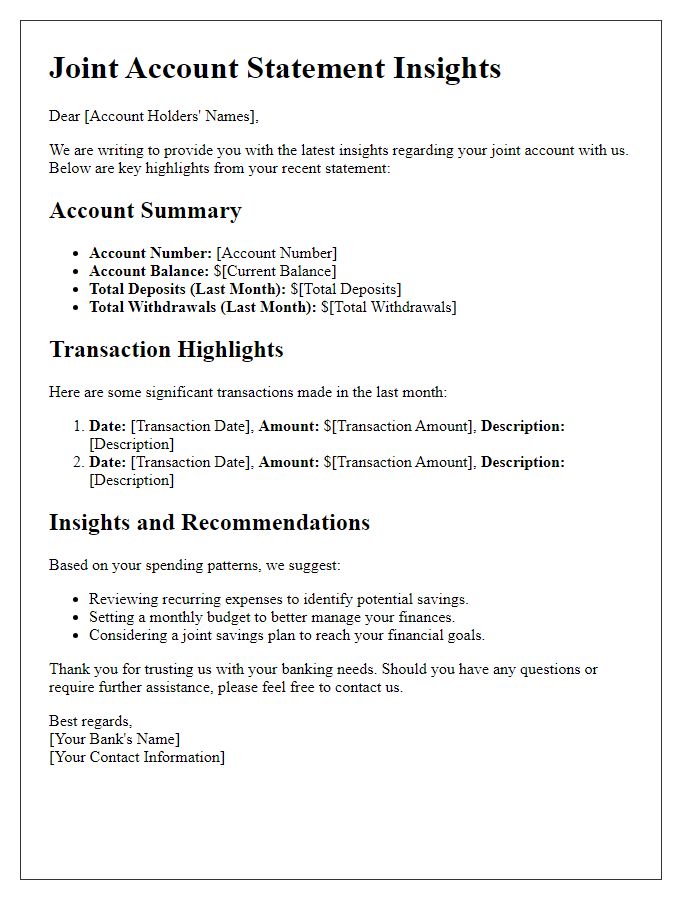

Personalization and branding

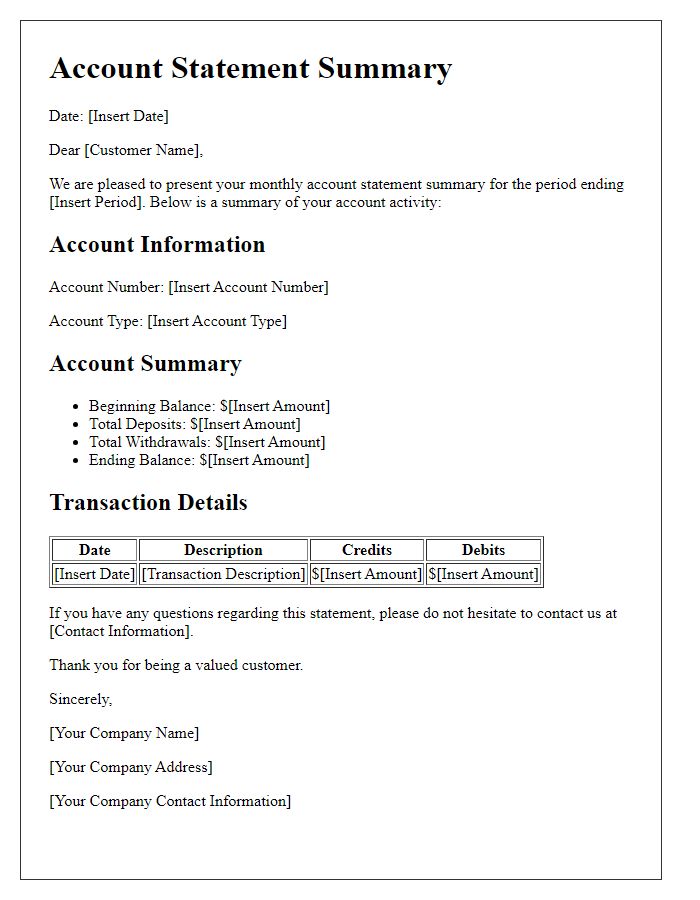

Account statement summaries serve as vital financial documents, providing an overview of transactions and balances for various accounts, such as checking, savings, or credit cards. Personalization elements, like the customer's name and account number, enhance user engagement and ensure clarity. Branding components, including the company's logo and color scheme, create a cohesive identity that reinforces trust and recognition in the financial services sector. Each statement may highlight key figures, such as total deposits, withdrawals, and current balance, alongside a summary of recent transactions from the past month, ensuring customers maintain insight into their financial health. Its delivery format, whether via mail or secure digital channels, also plays a crucial role in accessibility and convenience for account holders.

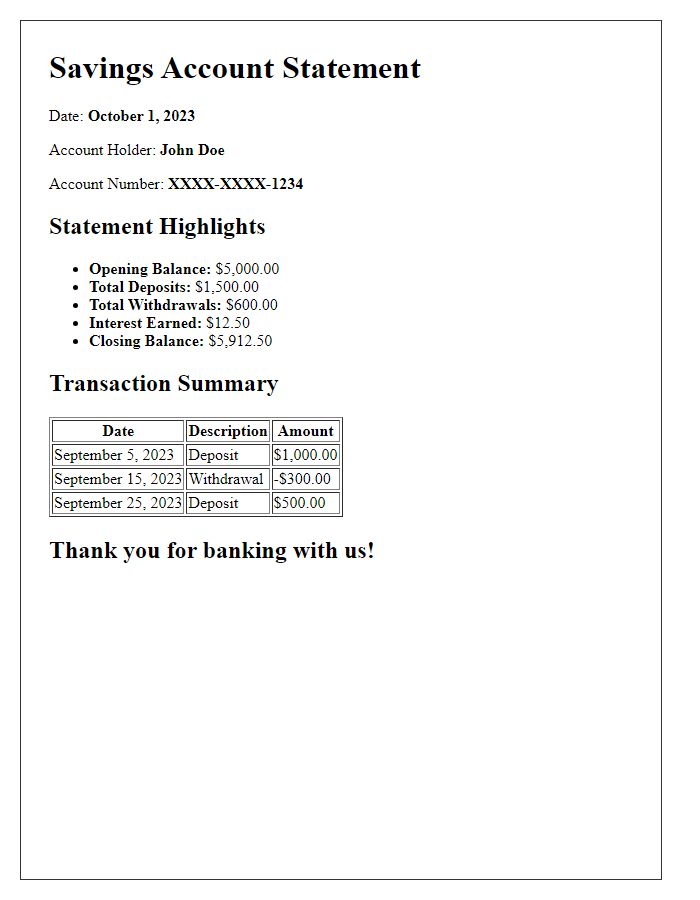

Clear and concise language

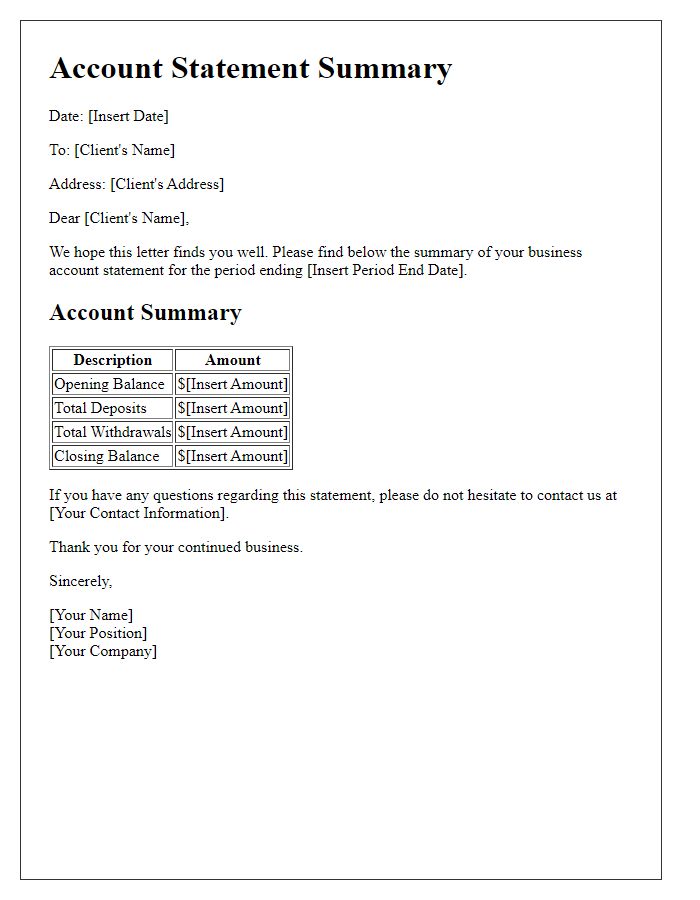

The monthly account statement summarizes transactions for July 2023, including deposits, withdrawals, and current balance. Notable deposits included a payroll credit of $2,500 on July 15 and a transfer of $500 from savings on July 22. Withdrawals consisted of weekly grocery purchases averaging $150, with a total of $600 for the month. The beginning balance on July 1 stood at $5,000, while the ending balance reached $6,500 after considering all transactions. Fees incurred during this period amounted to $25, associated with ATM withdrawals outside the network. All details are accurate as of July 31, 2023.

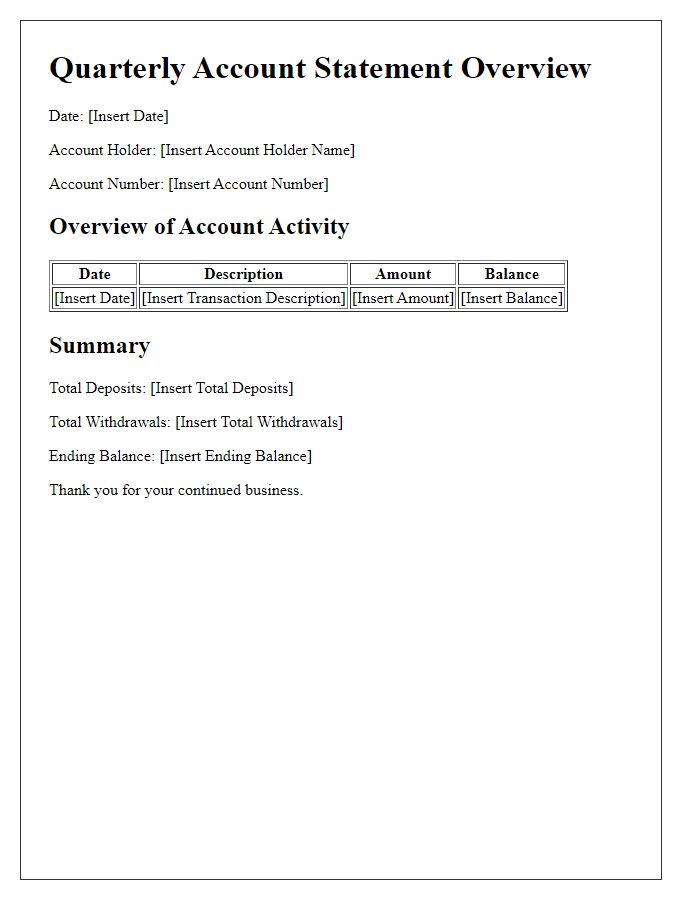

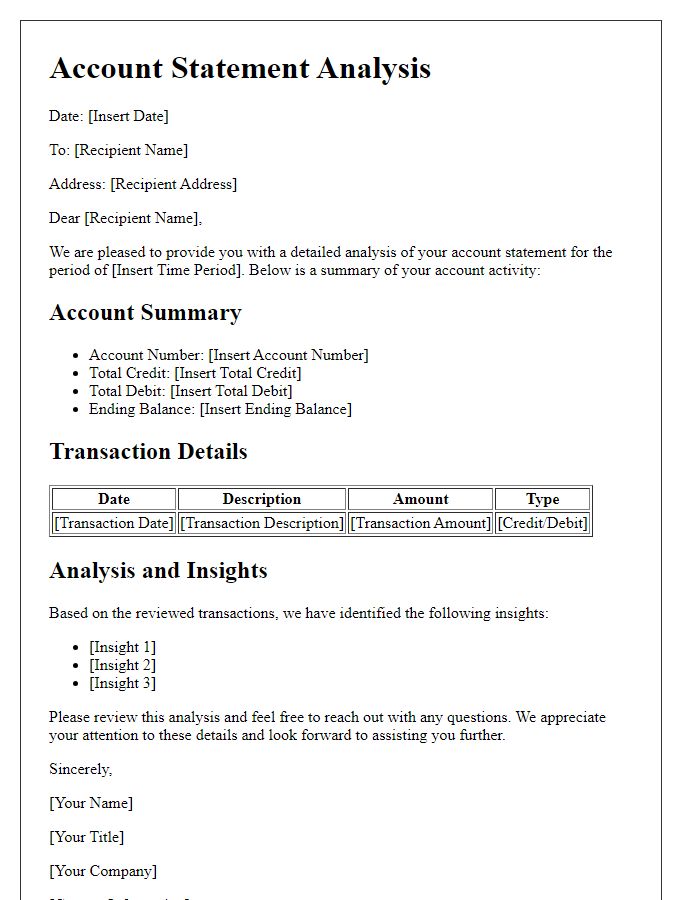

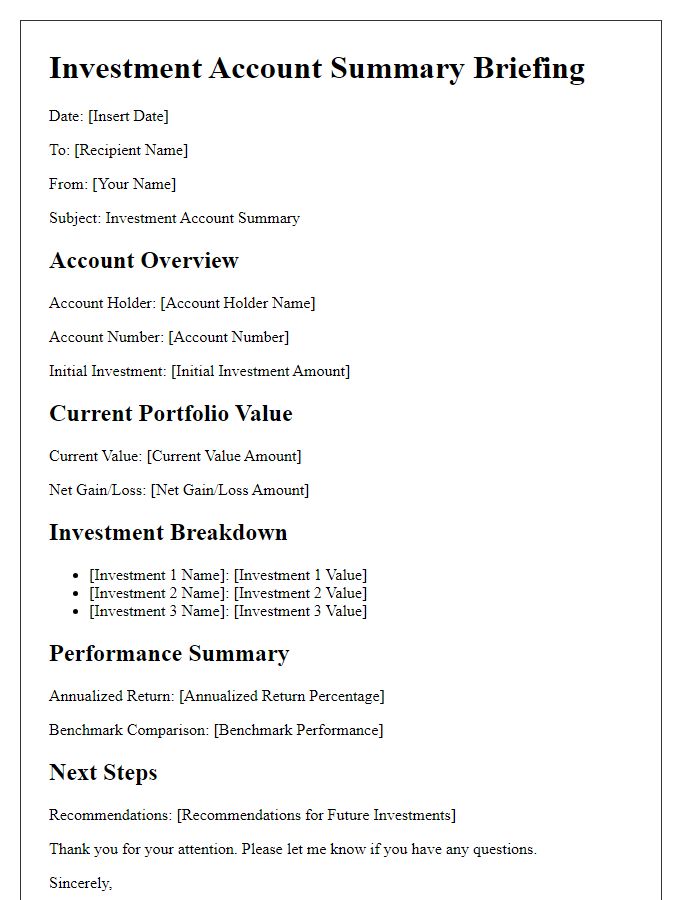

Statement period and details

The account statement summary for the period from January 1, 2023, to March 31, 2023, provides a comprehensive overview of financial activities. The document highlights total deposits of $15,000, including direct deposits from employer XYZ Corporation. Notable withdrawals were recorded at approximately $10,500, consisting of utility payments, monthly rent of $2,500 for a two-bedroom apartment in downtown Springfield, and various retail purchases. The closing balance as of March 31, 2023, stands at $22,550, reflecting a healthy cash flow and savings accumulation. Transaction details indicate an average monthly spending of $3,500, primarily on living expenses and discretionary purchases, showcasing budgeting insights.

Transaction summary and breakdown

The account statement summary provides a comprehensive overview of financial transactions for the period from January 1, 2023, to March 31, 2023. Total credits amount to $5,000, originating from various deposits including salary payments, direct transfers, and refunds. Total debits stand at $3,200, reflecting expenditures such as utility bills, grocery purchases, and subscription services. Significant transactions include a $1,500 deposit on February 15, 2023, from a freelance project, and a $600 withdrawal on March 7, 2023, for home improvement expenses. The ending balance as of March 31, 2023, is $4,300, highlighting an overall growth in funds during the period. Transaction categories are broken down into essential spending, discretionary spending, and savings contributions for better financial planning insights.

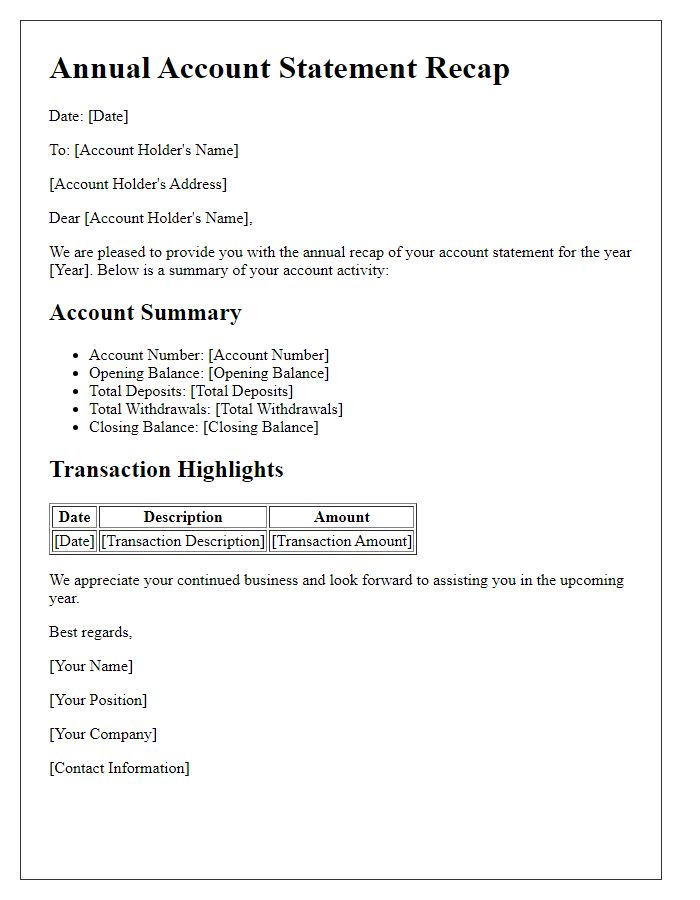

Contact information and support options

Contact information for customer support can be crucial for resolving account-related inquiries. Phone numbers such as the dedicated support line, typically available Monday through Friday from 9 AM to 5 PM, allow customers to speak directly with representatives. Email support, often reachable at a specific domain (e.g., support@financialinstitution.com), provides an alternative for those who prefer written communication. Live chat options on the official website offer real-time assistance during business hours. Additionally, FAQ sections frequently address common issues, enabling users to obtain quick answers without needing direct interaction. Social media channels, like Twitter or Facebook, provide platforms for engagement and support updates, enhancing customer service accessibility.

Comments