Are you in need of a bank reference letter but unsure how to craft one? A well-structured letter can make all the difference in establishing your credibility and trustworthiness to potential lenders or landlords. In this article, we will walk you through a simple yet effective template that you can easily tailor to your specific needs. So, let's dive in and help you secure that bank reference with confidence!

Clear Subject Line

A bank reference request involves obtaining a letter from the bank verifying a customer's account standing. This letter may be crucial for processes such as loan applications or business partnerships. A clear subject line should guide the recipient's understanding of the letter's purpose, for example: "Request for Bank Reference for Account Verification." The request emphasizes the need for verification of account balance and transaction history, typically including specific time frames like the last six months. Providing account details, such as account number and account holder name, alongside the purpose of the request, can facilitate efficient handling by the bank officer, often seen in business contexts requiring credit assessments or landlord verification processes.

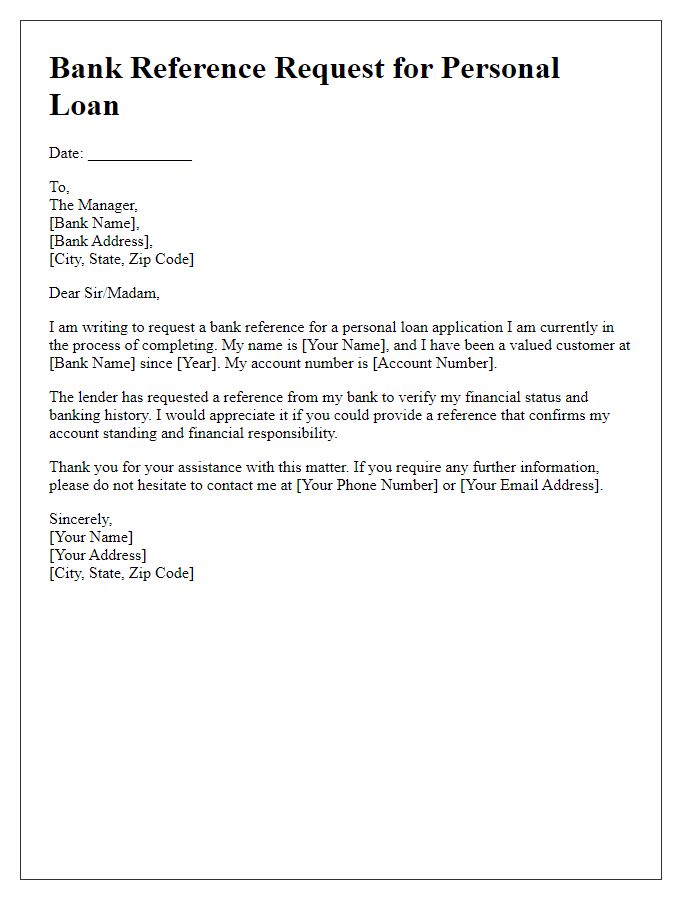

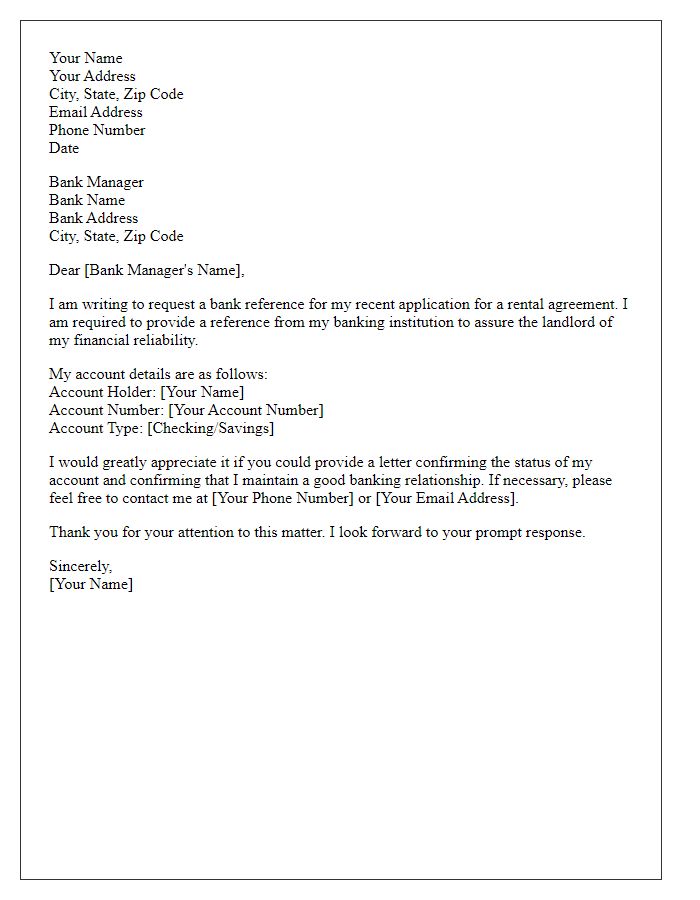

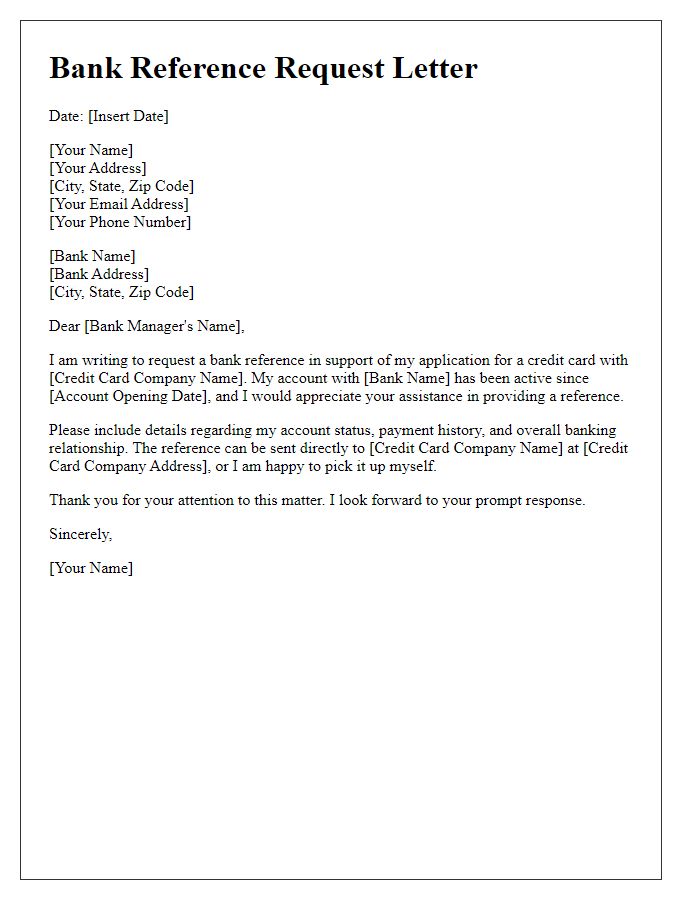

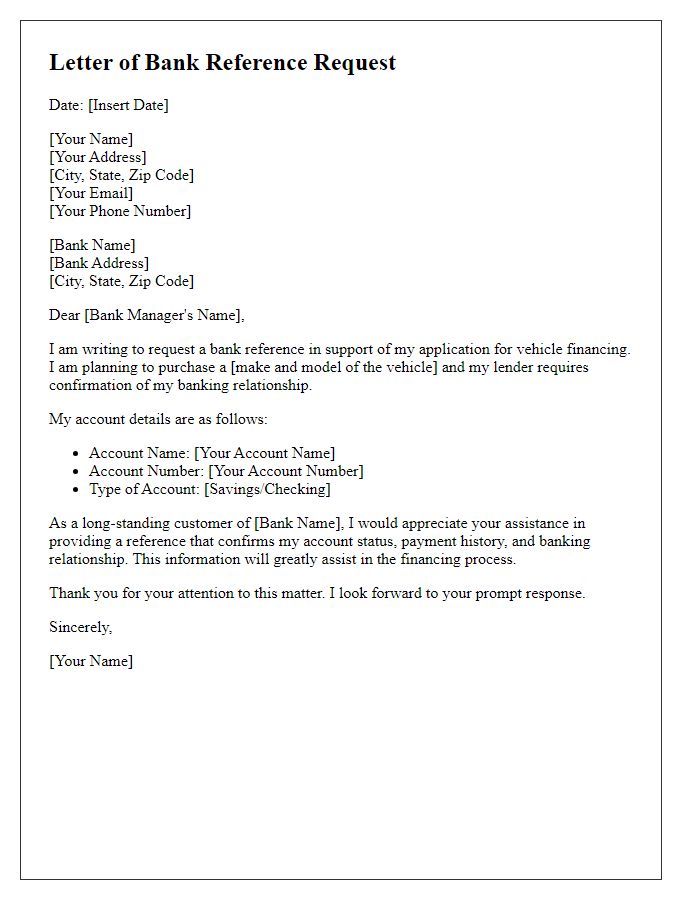

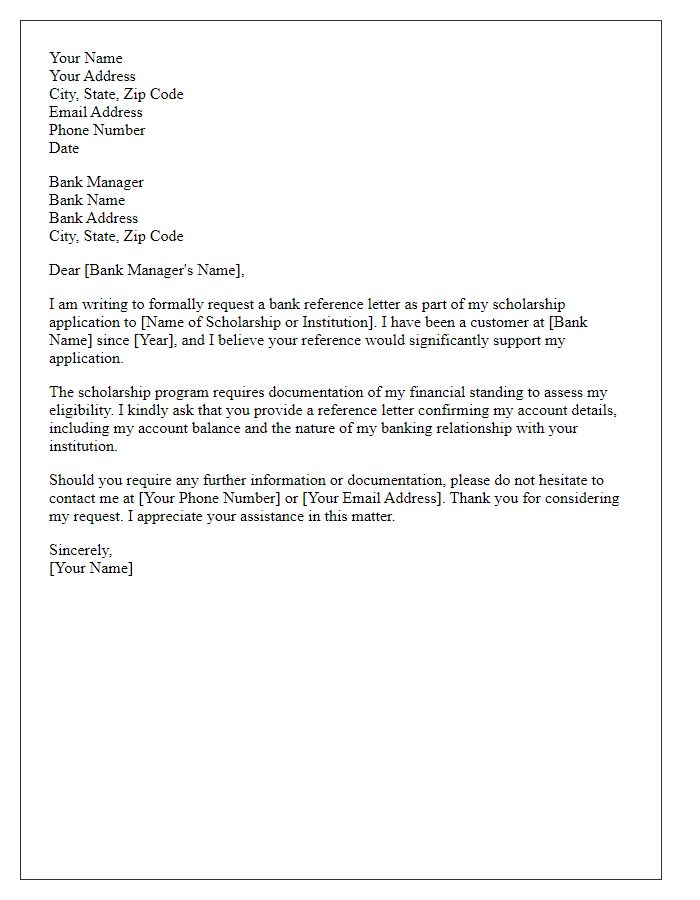

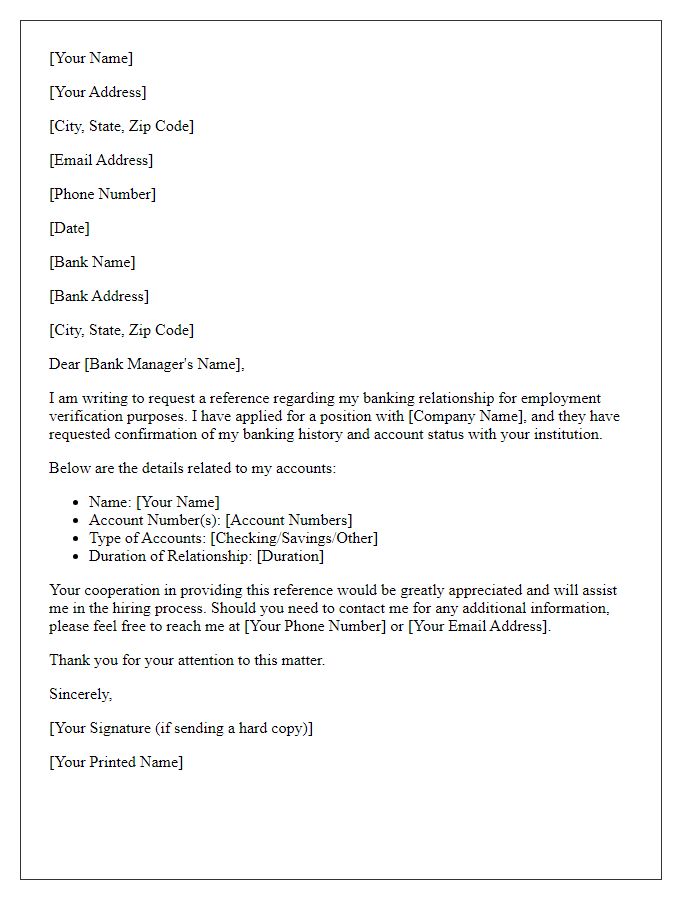

Applicant's Personal Information

The applicant's personal information, such as full name, date of birth, and address, plays a crucial role in the bank reference request process. Full name, typically including middle names, ensures accurate identification within banking systems. Date of birth, usually formatted as MM/DD/YYYY, assists in verifying the identity of the individual, especially when distinguishing between similarly named people. Address, which includes street number, street name, city, state, and ZIP code, provides a physical location tied to the applicant, necessary for confirming residency and preventing fraudulent activities. Accurate and complete personal information enhances the efficiency and security of the banking reference request.

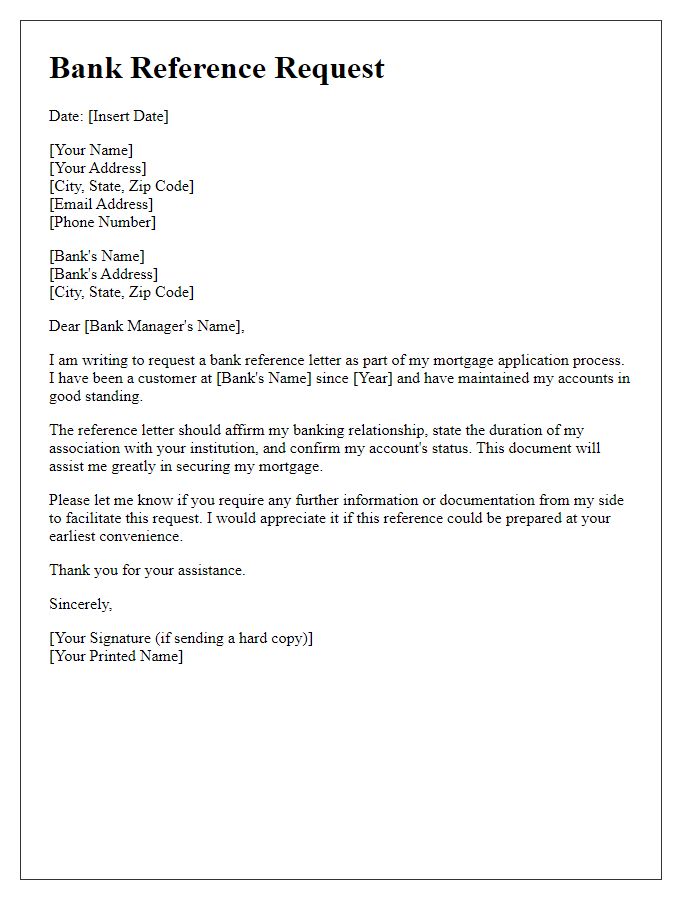

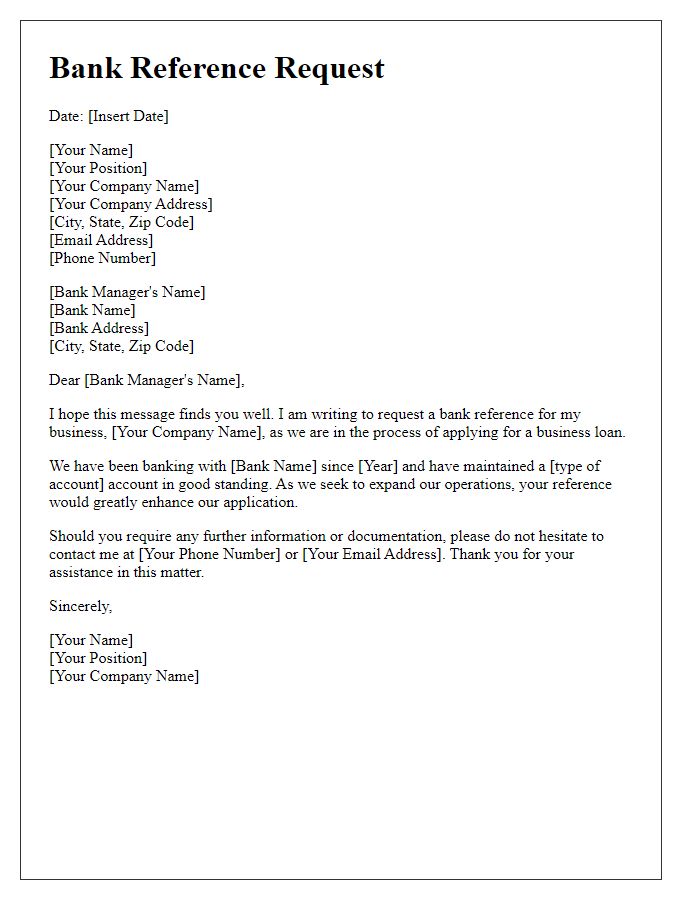

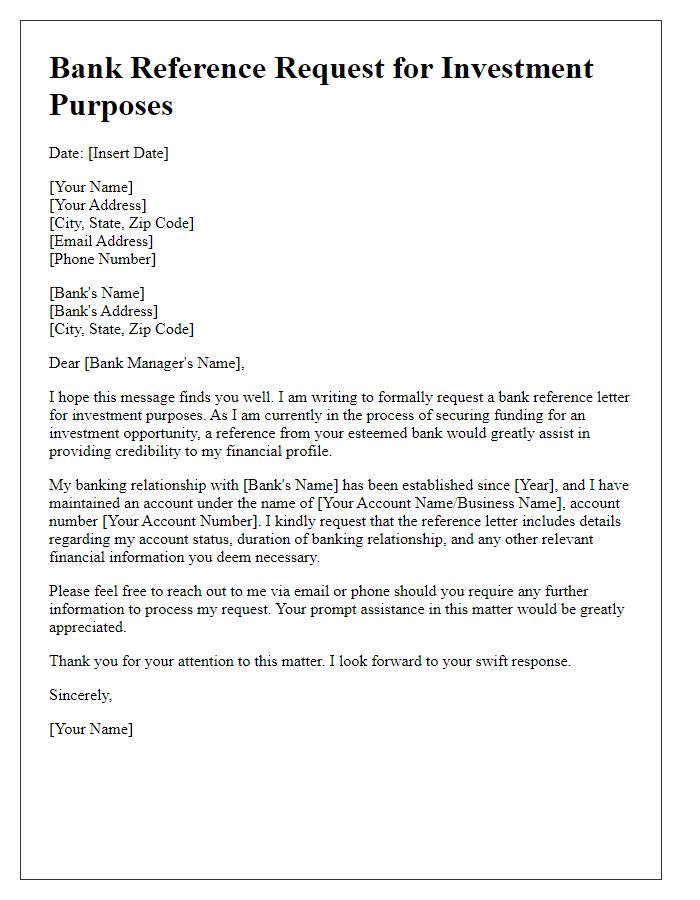

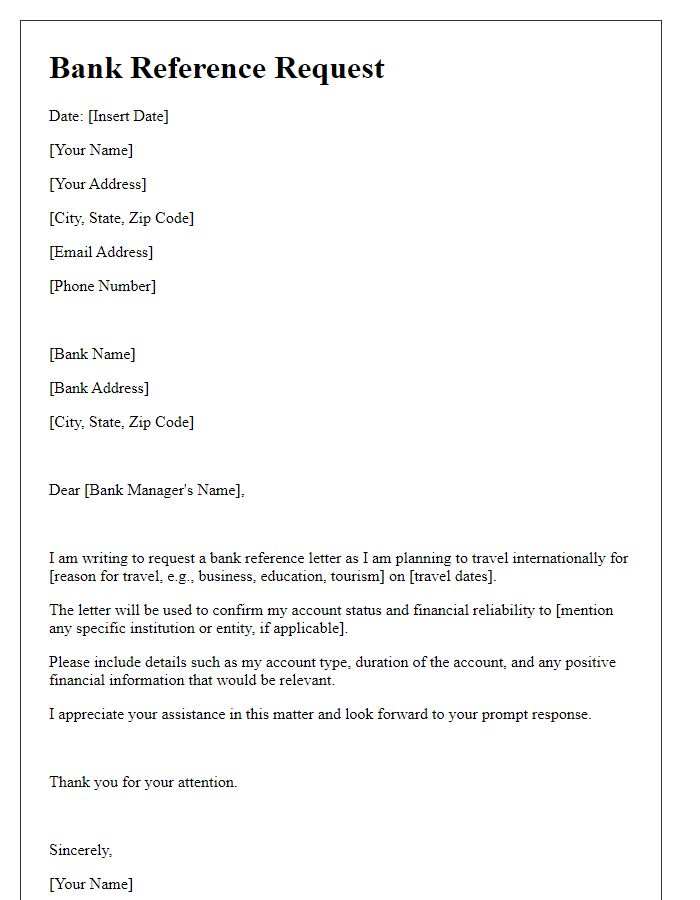

Purpose of Reference Request

A bank reference request serves as a formal inquiry to a financial institution to obtain verification of an individual's or business's banking history. This document often includes specific details like account types (e.g., savings, checking, or loan), duration of account maintenance (often several years), and transaction behaviors (frequent deposits, withdrawals) to provide a clear picture of financial responsibility. Institutions such as banks or credit unions may require this reference for purposes such as loan approvals, rental agreements, or employment verifications. A well-structured request should clearly state the purpose (e.g., securing a mortgage, applying for rental property) and the necessary information needed, such as confirmation of account balance or general reliability as a customer.

Details of Banking Relationship

A banking relationship reference request involves a formal document outlining the duration, nature, and specifics of the banking association. Information typically includes the account types, transaction volumes, payment history, and any special considerations regarding the account holder. For instance, an individual or business might request validation from institutions such as Bank of America or Citibank, delineating their checking and savings account status, along with insights into their financial behavior over the past five years. Notable factors like creditworthiness, overdraft occurrences, and regular deposit activities serve as critical indicators of financial reliability. Additionally, the request might specify the purpose, whether for loan applications, visa requirements, or business transactions, underscoring the need for a detailed and accurate reference from the banking institution.

Contact Information for Further Queries

Contact information is essential for facilitating any further inquiries related to financial transactions or bank services. Typically, companies or individuals may provide a dedicated phone number (such as +1-800-123-4567) for direct communication, which operates from 9 AM to 5 PM (local time) on weekdays. Alternatively, email addresses (like support@bankname.com) should be available for written correspondence, ensuring that all queries receive formal acknowledgment and detailed responses. Social media channels (such as @BankName on Twitter) may also serve as platforms for immediate assistance. Bank branches usually display local office contacts, which can enhance accessibility, especially for in-person discussions.

Comments