Losing a checkbook can be a stressful experience, but notifying your bank about it doesn't have to be complicated. When drafting your letter for a replacement, clarity is key; you want to ensure you cover all necessary details without overwhelming yourself. Start with your account information, explain the situation briefly, and then request the replacement. Curious about how to structure your letter for maximum effectiveness? Keep reading!

Clear Identification Details

The loss of a checkbook can cause significant inconvenience, especially for managing personal finances. It is crucial to promptly notify the bank, providing clear identification details such as the account holder's full name, account number (typically a 10 to 12-digit number), and the last known balance. Additionally, specifying the date of loss, which can help in detecting unauthorized transactions, is essential. The request for a replacement checkbook should mention any specific series or check numbers, if known, to aid in preventing fraud. Contacting customer service from a verified phone number, often found on the bank's official website, ensures communication with authorized personnel.

Incident Description

A lost checkbook can pose significant risks to personal security and financial stability. The incident often occurs in various locations such as shopping centers, public transportation, or during travel, where personal belongings may inadvertently be misplaced or stolen. Checkbooks, which typically contain multiple checks (often 20-50) with pre-printed account numbers, can lead to unauthorized transactions if they fall into the wrong hands. Prompt notification to the bank is crucial to prevent unauthorized use, requiring immediate reporting of the lost checkbook, followed by request for a replacement. Financial institutions recommend reviewing account statements (monthly or weekly) for any suspicious activity to safeguard funds post-incident. Additionally, utilizing fraud alerts or credit monitoring services can provide an additional layer of security in the aftermath of a lost checkbook incident.

Contact Information

Lost checkbooks can present significant risks of identity theft and financial loss, prompting the need for immediate replacement notifications to banking institutions. Customers should report a lost checkbook to their bank, providing essential details such as account number, checkbook number, and date of loss. Banks typically require verification of identity, which may include personal information such as Social Security number and recent transaction history. Quick communication can prevent unauthorized use of checks, ensuring financial security for account holders. Additionally, requesting a stop payment on any missing checks enhances protection against fraudulent activities.

Security Measures Undertaken

Loss of a checkbook can signal potential security risks, prompting immediate action. During this event, financial institutions typically recommend notifying them within 24 hours to prevent unauthorized access. Customers should monitor accounts for suspicious transactions exceeding typical spending patterns. Additionally, proactive steps include placing a security freeze on accounts, issuing stop payments on lost checks, and updating online banking passwords to enhance protection. Implementing identity theft protection services also adds another layer of security against future risks. Regularly reviewing credit reports for anomalies can help detect early signs of misuse.

Request for Prompt Action

Lost checkbooks can lead to significant financial risk, especially concerning unauthorized access to bank accounts. Individuals should act quickly to mitigate potential issues. The Federal Reserve reported that around 30% of adults in the United States experienced check fraud in 2022, with losses averaging $1,000. It is crucial to notify the issuing bank immediately about the loss to prevent any fraudulent activities. To replace a lost checkbook, banks such as Bank of America or Chase typically require customers to verify their identity, either through answering security questions or providing personal identification. The replacement process can take anywhere from 5 to 10 business days, depending on the bank's policies. Additionally, tracking the disappearance of the checkbook, usually issued with a specific series of numbers, can aid in identifying unauthorized transactions.

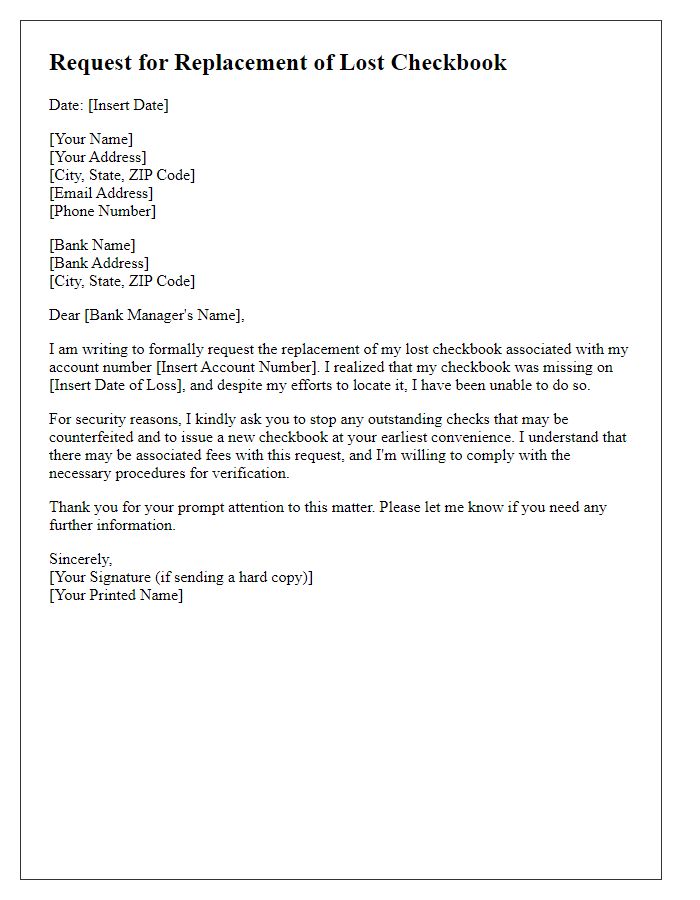

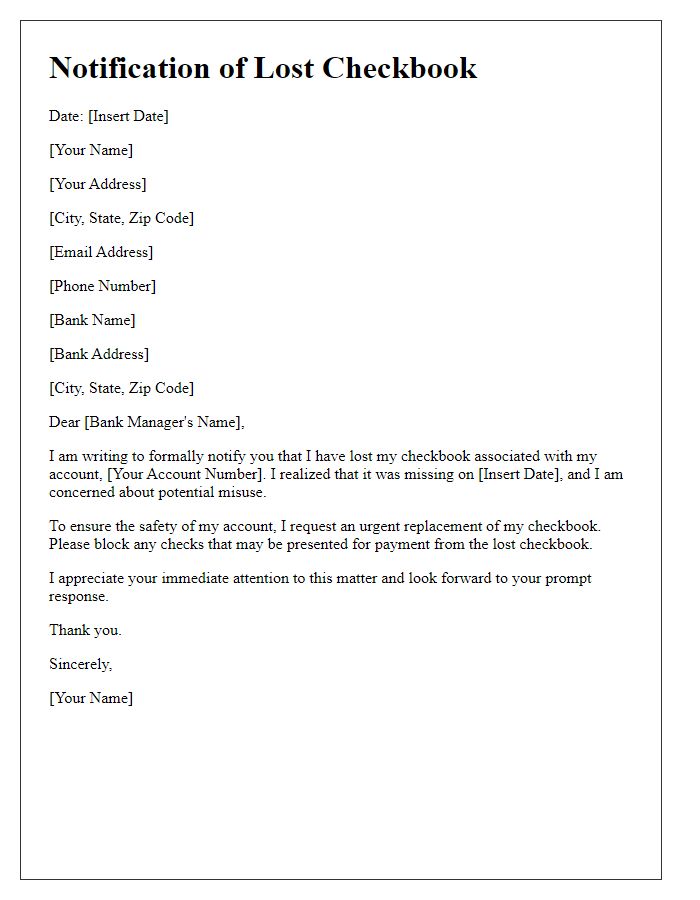

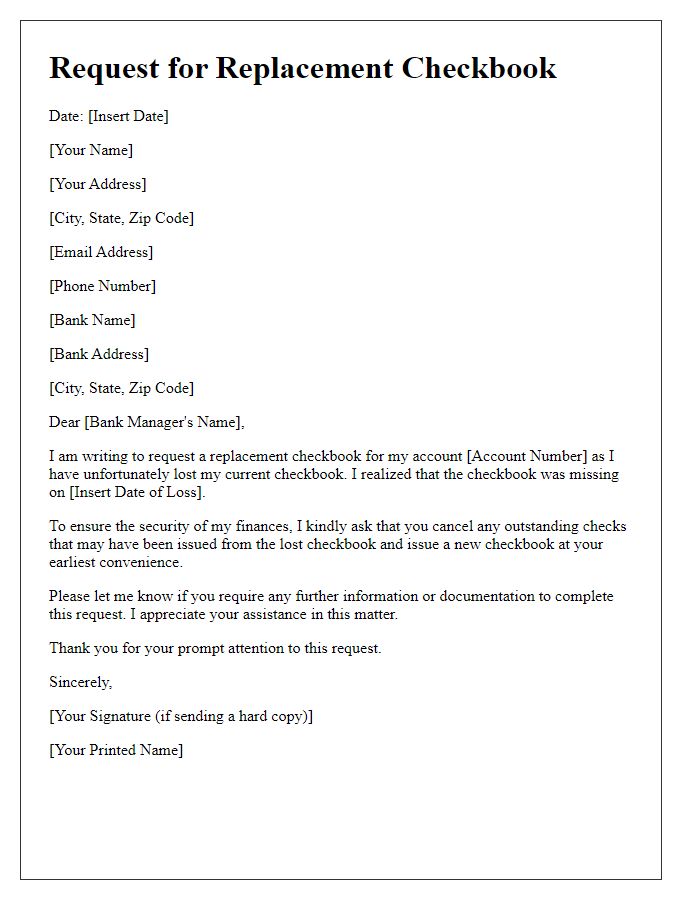

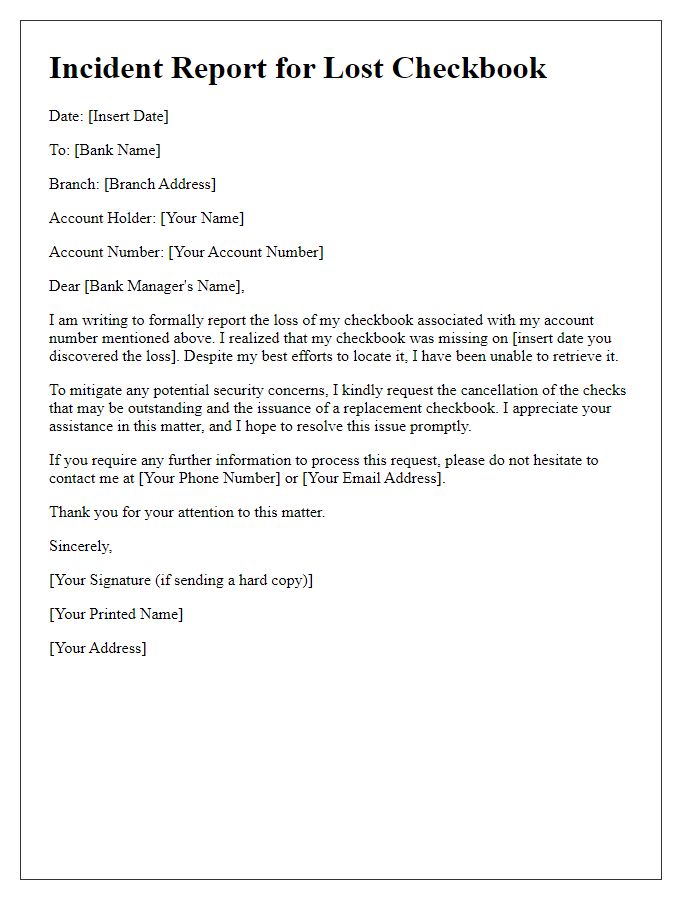

Letter Template For Lost Checkbook Replacement Notification Samples

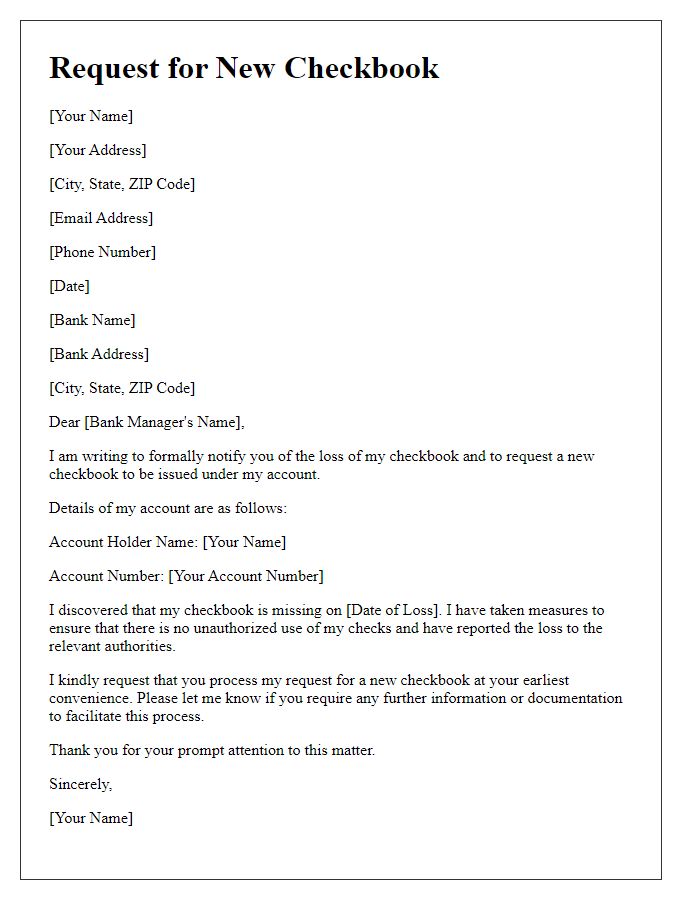

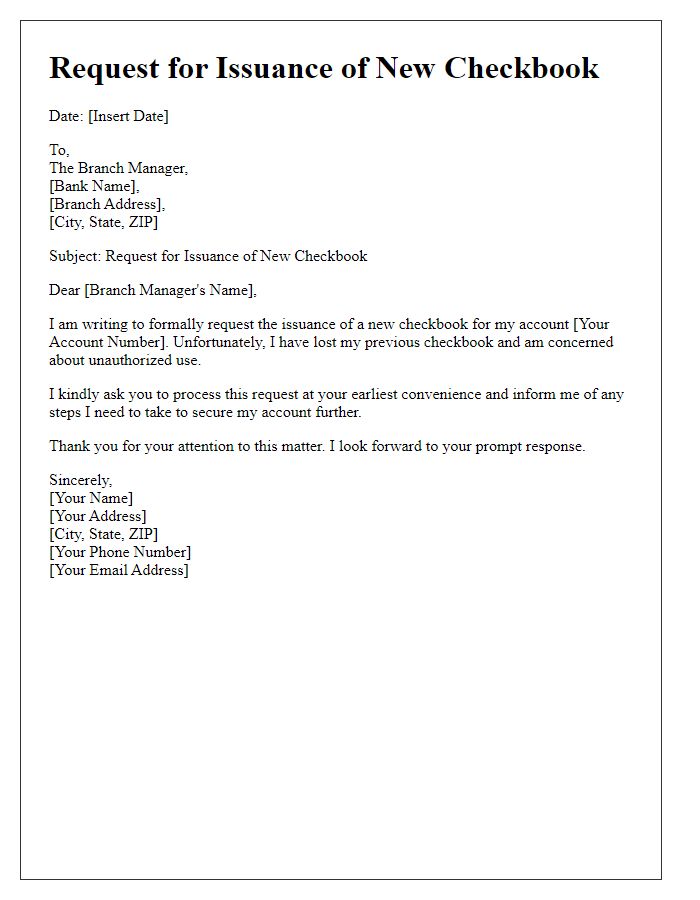

Letter template of notification for requesting new checkbook due to loss.

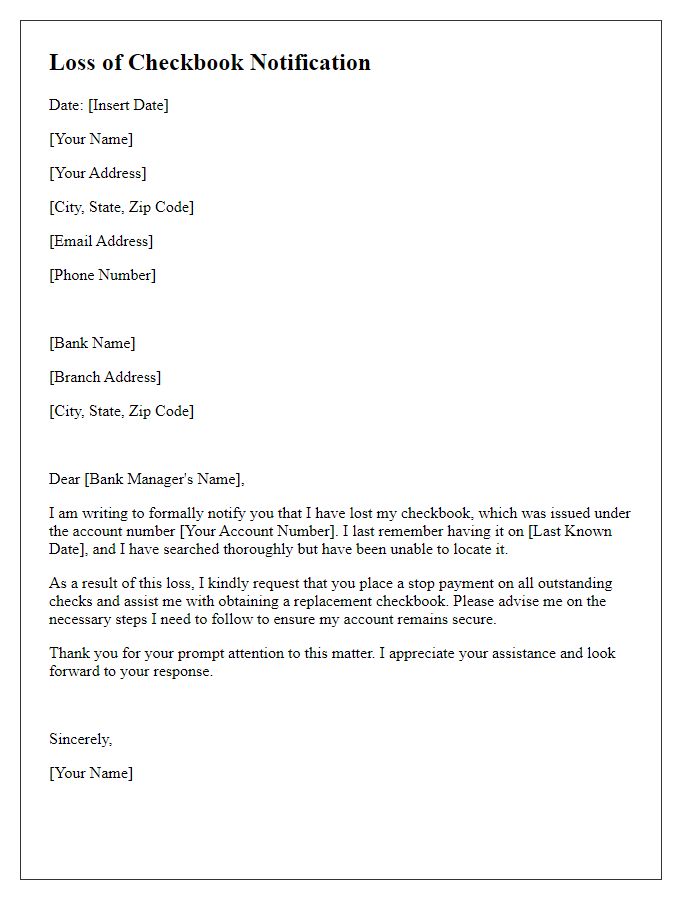

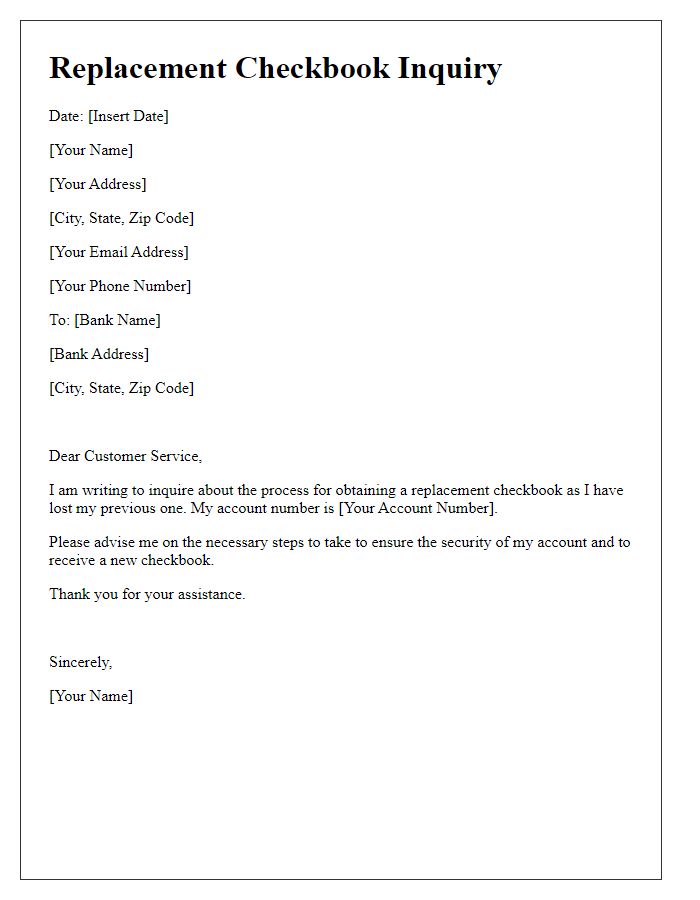

Letter template of alert regarding lost checkbook and replacement needed.

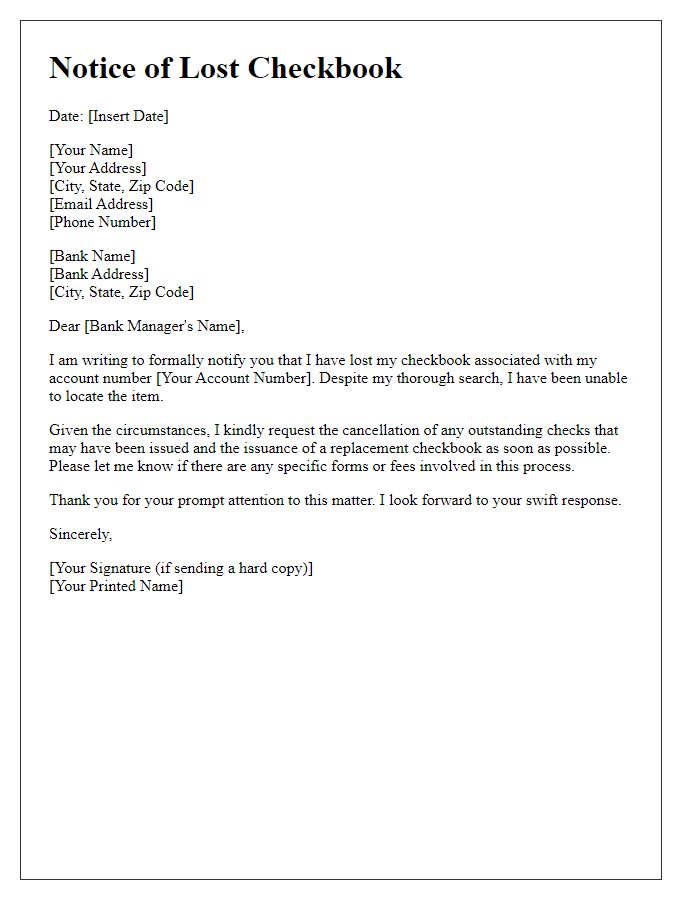

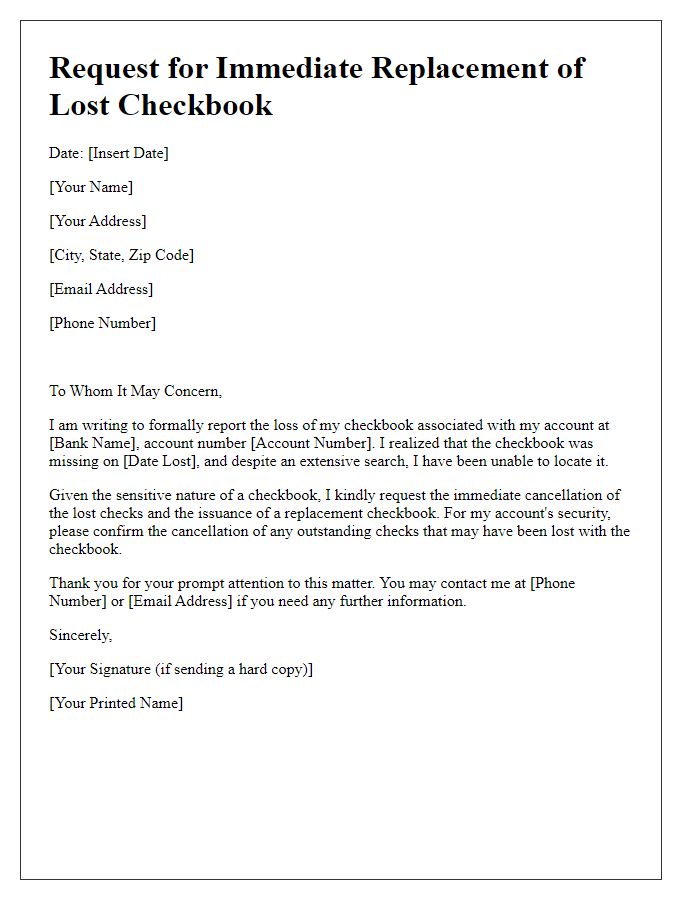

Letter template of formal notice of lost checkbook and need for replacement.

Comments