Are you curious about how your experiences with our account services stack up? We understand that your feedback is invaluable to us and can significantly enhance our offerings. It's essential for us to hear your thoughts on our service quality and where you think we can improve. So, let's dive into the detailsâread on to learn more about how you can share your insights through our quick survey!

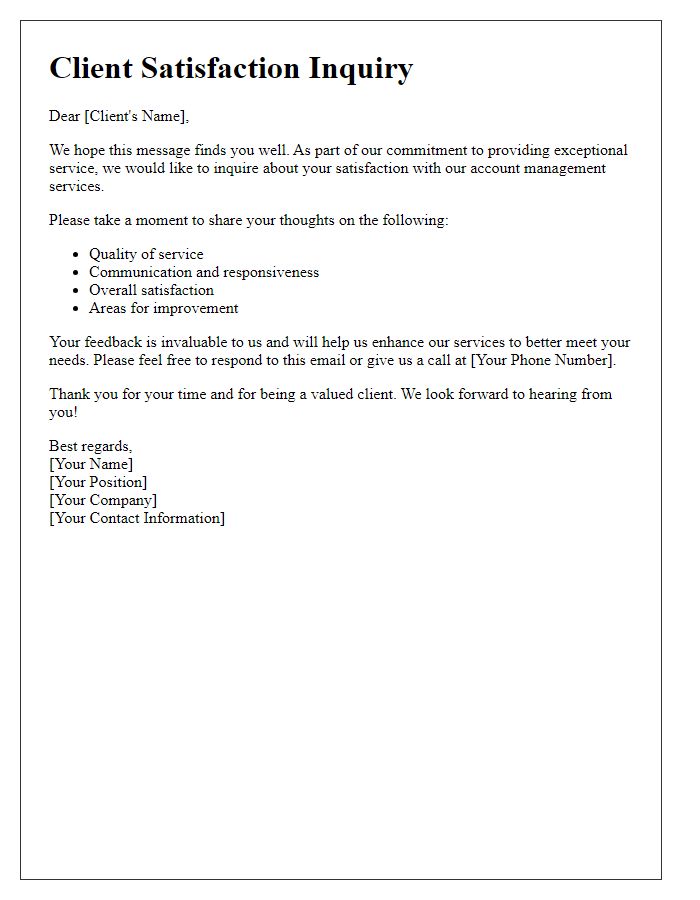

Clear subject line

Subject lines for account service satisfaction surveys should be succinct yet descriptive to capture attention effectively. Use phrases like "Your Feedback Matters: Help Us Improve Our Service" or "Share Your Experience: Account Service Satisfaction Survey" to encourage recipients to engage. Clear communication of the purpose will enhance participation rates. Ensure the subject conveys urgency, importance, or value to the recipient, as this increases the likelihood of response.

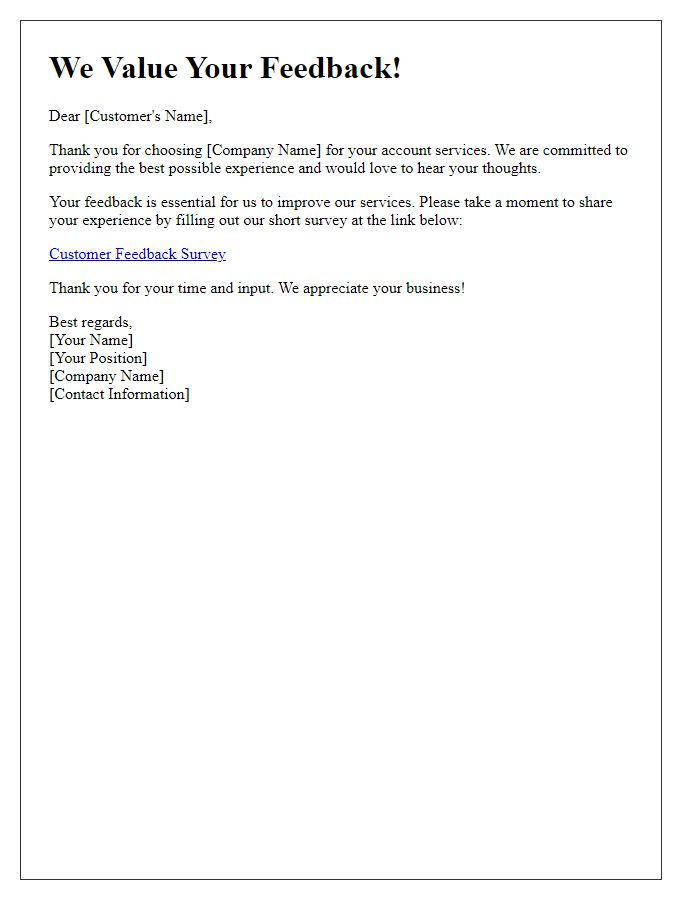

Personalized greeting

A personalized greeting for an account service satisfaction survey can create a positive first impression and set the tone for insightful feedback. For example, "Dear [Customer's Name], we truly value your engagement with [Company Name] and hope this message finds you well. Your experiences matter greatly to us, and we invite you to share your thoughts on our account services following your recent interactions." This approach ensures that the customer feels recognized and appreciated, encouraging them to participate in the survey and provide meaningful feedback.

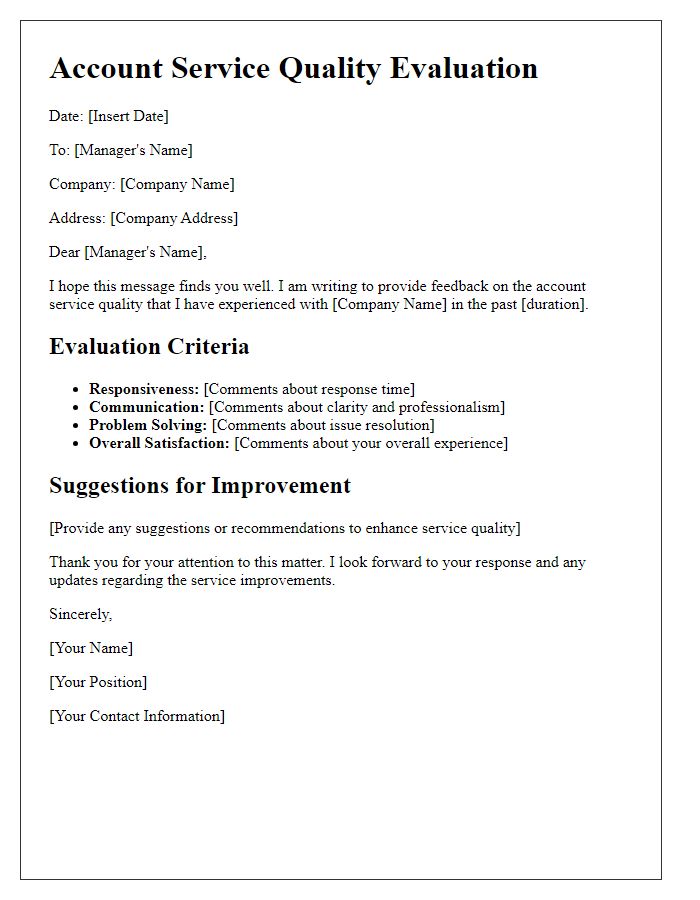

Purpose of the survey

The account service satisfaction survey aims to gather valuable feedback from customers regarding their experiences with account management services offered by financial institutions. Understanding customer perceptions, preferences, and expectations helps improve service quality and identify areas for enhancement. The survey focuses on various aspects such as responsiveness, accuracy in account handling, customer support satisfaction, and overall service efficiency. By analyzing the collected data, organizations can implement targeted strategies to enhance customer relationships, increase loyalty, and ensure that services align with customer needs. Engaging customers in this process contributes to a comprehensive understanding of service effectiveness and fosters continuous improvement within the financial services sector.

Instructions and link to survey

Customer satisfaction is vital for service improvement in the account management sector. An online survey seeking client feedback aims to assess the quality of service provided by financial institutions. Instructions for participating include accessing a provided link, completing the concise questionnaire in approximately five to ten minutes, and submitting responses promptly. The survey covers key aspects encompassing communication, effectiveness, and overall customer experience. Valuable insights garnered from this feedback will direct enhancements in service offerings. The link to the survey will be included in the correspondence sent to clients, ensuring data privacy and confidentiality throughout the process.

Thank you note and incentive

Customer satisfaction surveys play an essential role in evaluating account service quality. Implementing a survey can yield valuable feedback that helps improve services. Incentives such as discounts or gift cards can encourage participation. A personalized thank you note enhances customer relations and shows appreciation for their time. Consider using a phrase like "Your feedback is crucial in shaping our services." Surveys could be distributed via email or social media channels, ensuring ease of access for respondents. Timing is significant; surveys sent shortly after service interactions can lead to more accurate and relevant data collection.

Comments