Are you feeling overwhelmed by debt and looking for a way out? Crafting a debt settlement offer letter can be your first step towards regaining financial control and reducing what you owe. In this article, we'll discuss the essential elements to include in your letter, ensuring it effectively communicates your situation and your desire to negotiate. Ready to take charge of your financial future? Let's dive in!

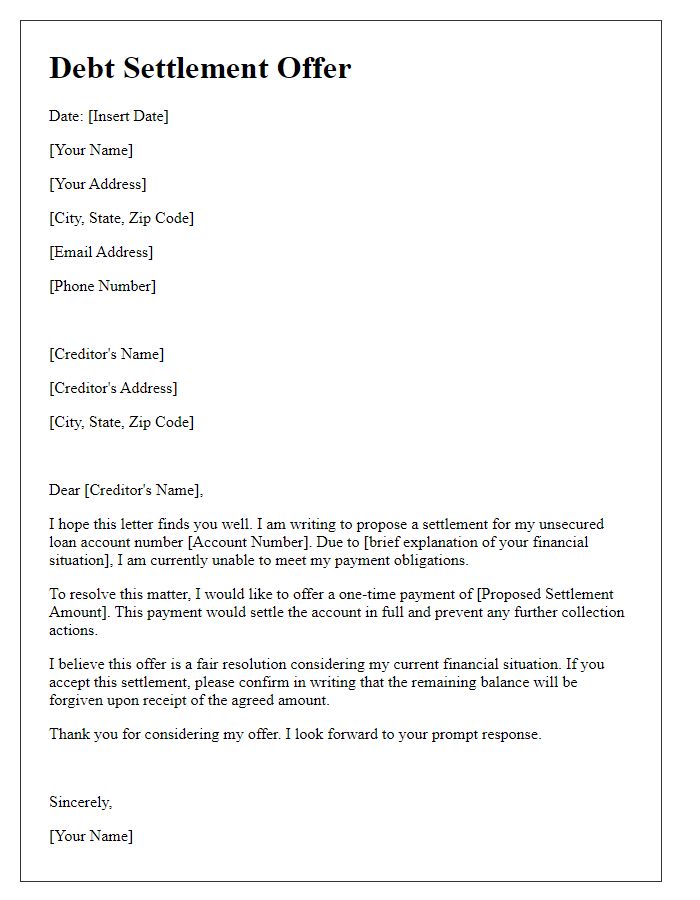

Creditor's Contact Information

Debt settlement offer letters are crucial in negotiating reduced payment amounts with creditors. Effective communication with the creditor's contact information can facilitate smooth negotiations. Include the creditor's full name (e.g., Citibank, Chase), address (with city, state, and zip code), and primary contact person's name and title (like Collections Manager or Customer Service Representative). Additionally, include the creditor's phone number and email address, ensuring direct lines to initiate communication or address any questions. Accurate information allows for timely responses, enhancing the likelihood of reaching a favorable settlement agreement.

Your Account Details

In attempts to alleviate financial strain, debt settlement offers can provide a strategic solution for individuals facing outstanding balances. In a typical scenario, account details such as account number (e.g., 1234567890) and outstanding balance (e.g., $5,000) are reviewed. The settlement proposal may suggest a reduced payment (e.g., $3,000) to resolve the debt, often contingent upon timely payment conditions or specific deadlines (such as 30 days from acceptance). Important considerations include the potential impact on credit scores (e.g., a decrease of up to 100 points) and formal agreements, ensuring both parties have a clear understanding of the new payment obligations. Furthermore, documenting communications with creditors (e.g., through certified mail) can provide a safeguard during negotiations.

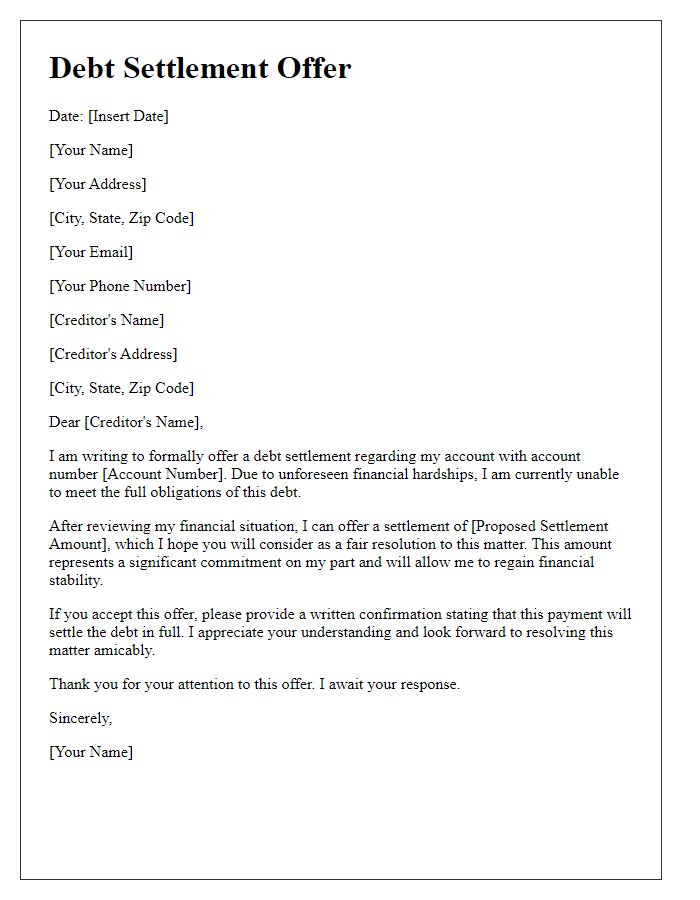

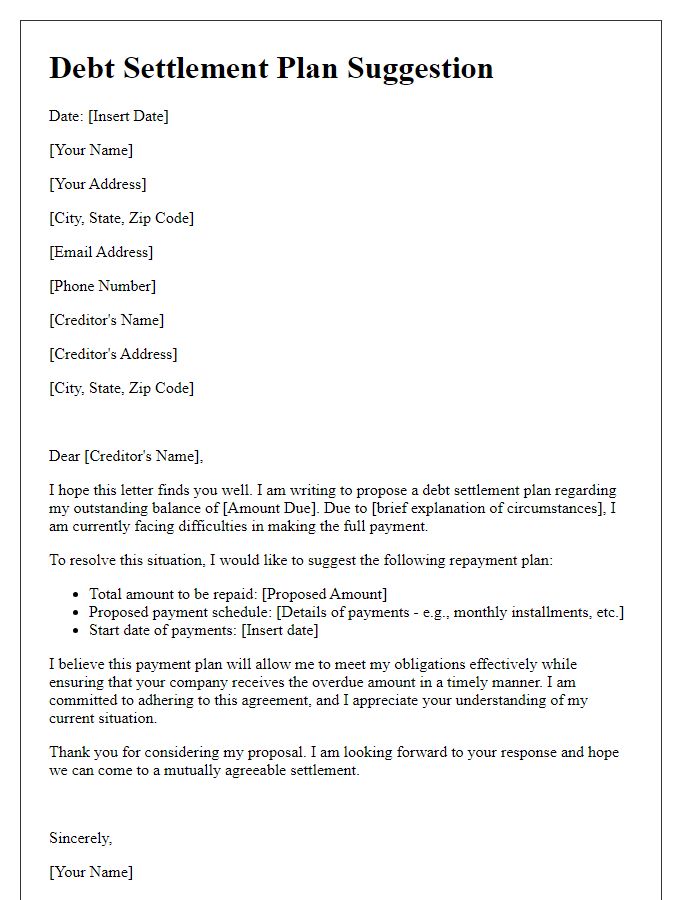

Proposed Settlement Amount

The proposed settlement amount offers a strategic resolution to outstanding debts, typically negotiated between a debtor and a creditor. This figure often represents a reduced total, aiming to alleviate financial burden while providing the creditor with a quicker recovery of funds. Commonly, the proposed settlement amount can amount to 40% to 60% of the total debt owed, depending on factors such as the debtor's financial situation and the creditor's policies. For example, a credit card debt totaling $10,000 may be settled for approximately $4,000 to $6,000, allowing both parties to close the account and move forward. Successful debt settlements can improve credit scores and restore financial stability, making them a vital tool for individuals or businesses facing financial difficulties.

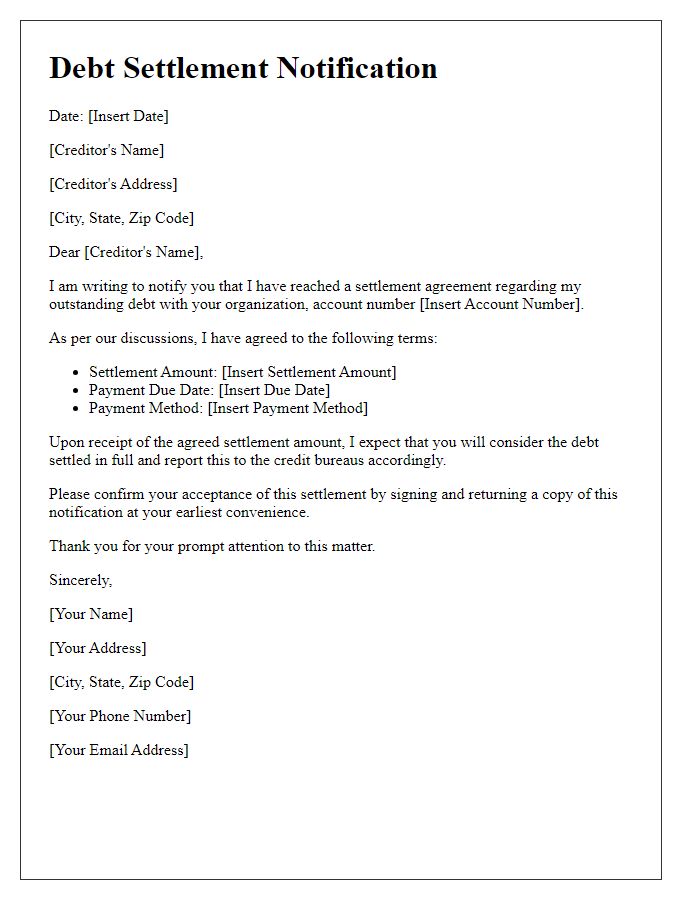

Payment Terms and Conditions

Debt settlement agreements often outline specific payment terms and conditions agreed upon by both parties to resolve outstanding debts. The settlement amount represents a reduced percentage of the total owed debt, often 30-70% less than the original balance. Payment methods may include lump-sum payments or structured installments over a specified period, such as 3-24 months. Additionally, the agreement may stipulate deadlines for payments, potential penalties for missed payments, and the requirement for the creditor to report the settled debt to credit bureaus, helping to improve the debtor's credit score over time. A detailed breakdown of any fees or costs associated with the settlement process should also be provided to ensure transparency.

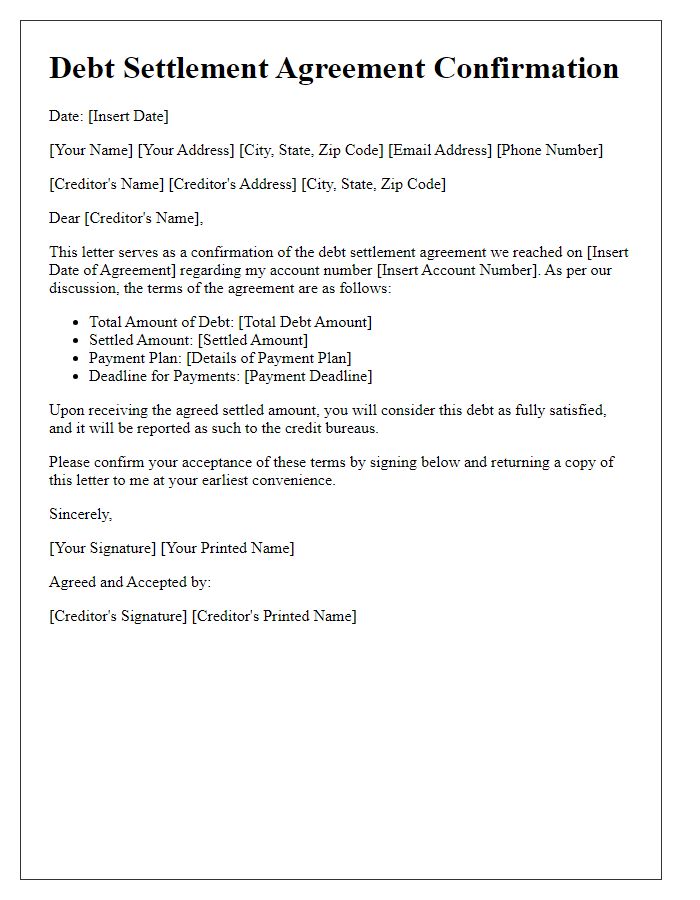

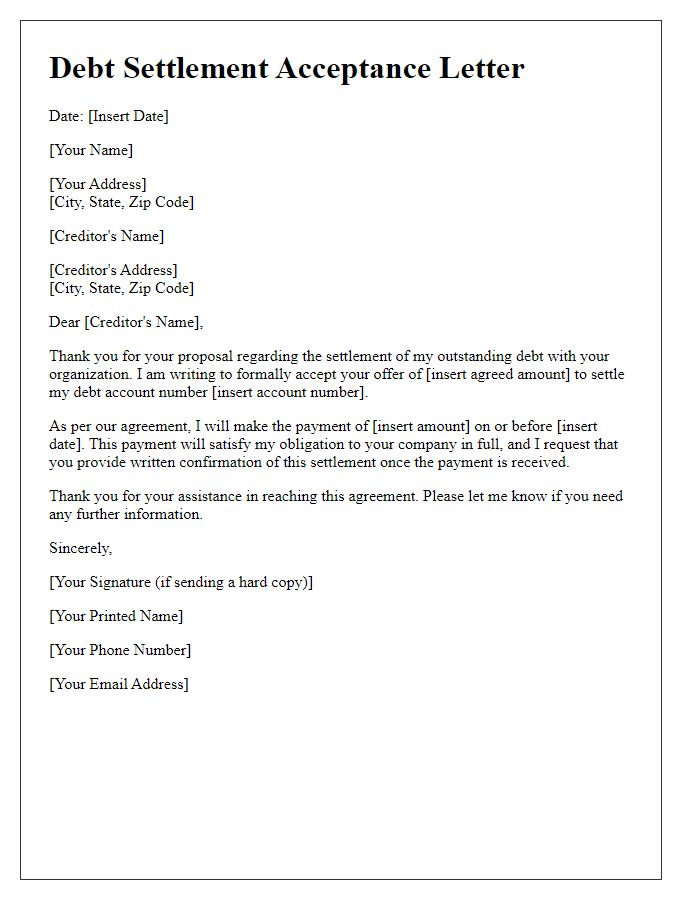

Request Confirmation in Writing

A debt settlement offer requires clear communication and documentation to ensure both parties are aligned on the terms. A borrower may propose a settlement to a creditor, potentially agreeing to pay a reduced amount, which often requires a specific percentage of the total debt. For instance, a debtor owing $10,000 could propose to pay $6,000 as full settlement. Key elements include specifying the due date for payment, which is critical for both planning and record-keeping. Additionally, request confirmation in writing to formally document the agreement and protect against future disputes, ensuring the creditor formally acknowledges acceptance of this proposal. Include details such as account numbers and previous communications for clarity and tracking.

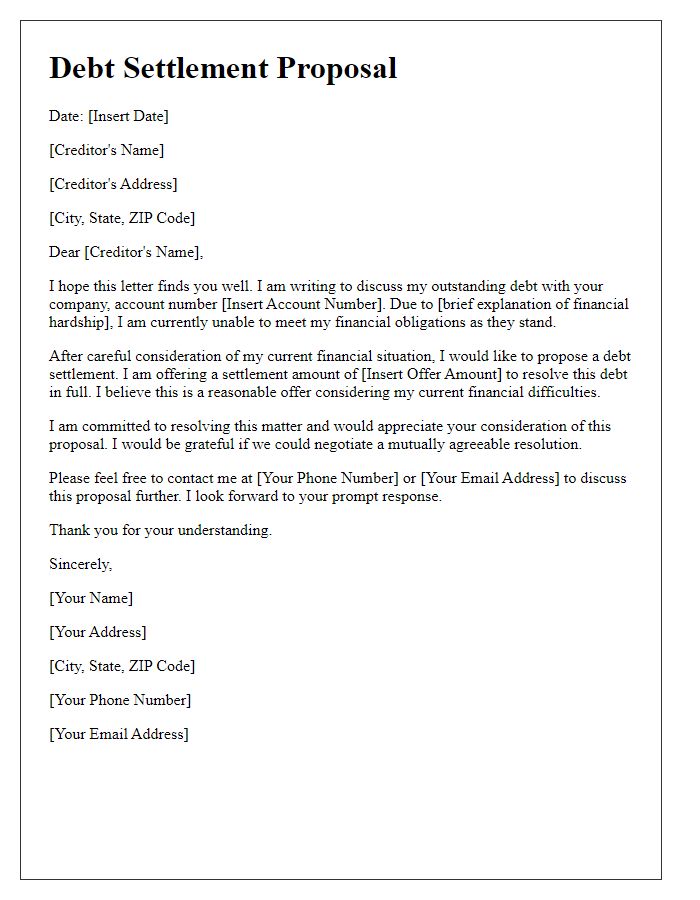

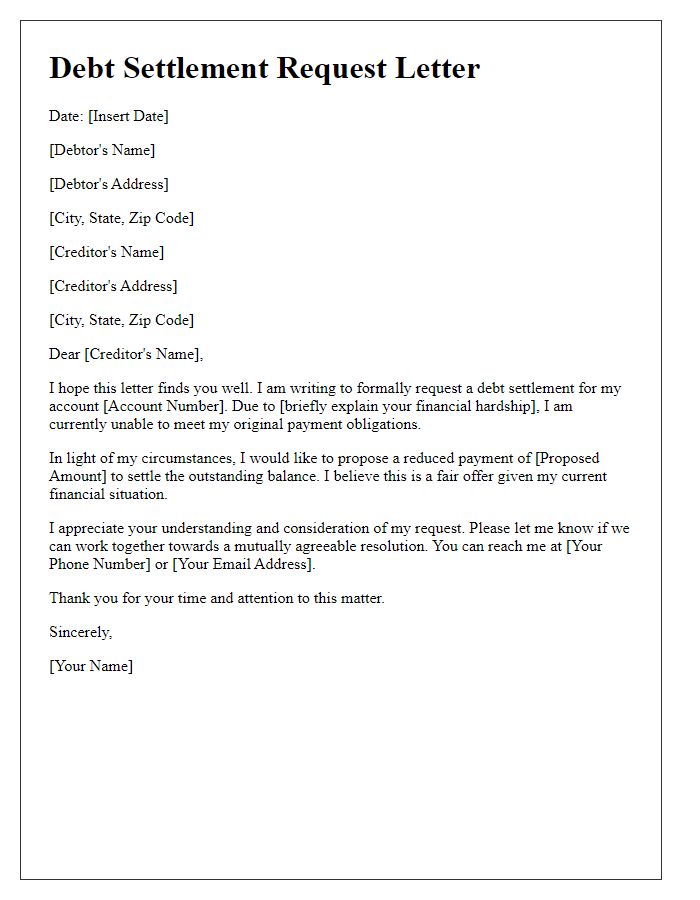

Letter Template For Debt Settlement Offer Samples

Letter template of debt settlement communication for third-party representation

Comments