Are you tired of the stress that comes with unexpected account overdrafts? If so, enrolling in overdraft protection is a simple and effective way to safeguard your finances and avoid those pesky fees. This service can provide you with much-needed peace of mind, ensuring that your essential transactions go through even when your balance is low. Curious to learn more about how overdraft protection works and the benefits it offers? Keep reading!

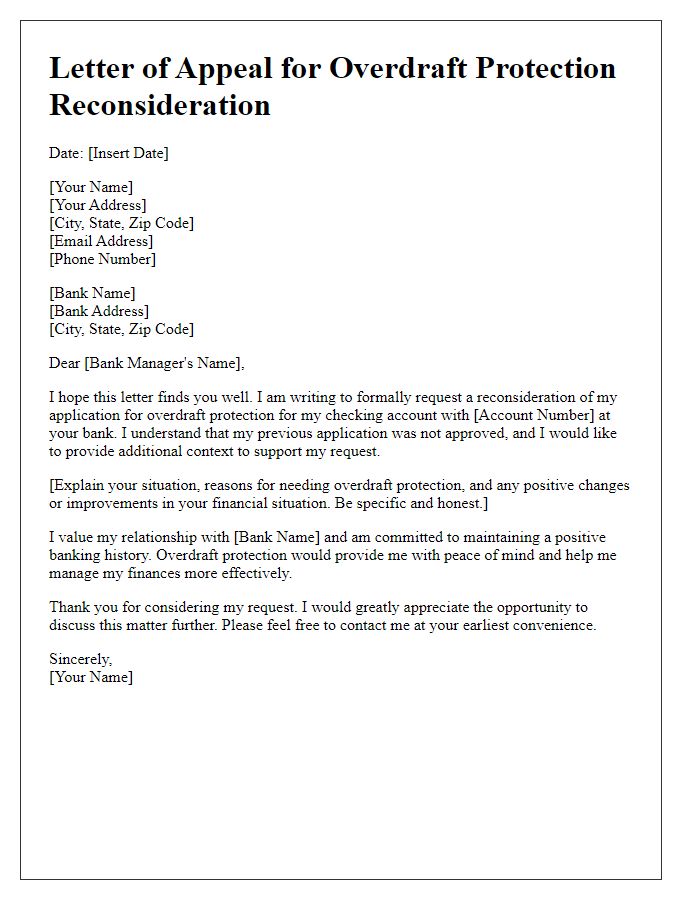

Account Holder Information

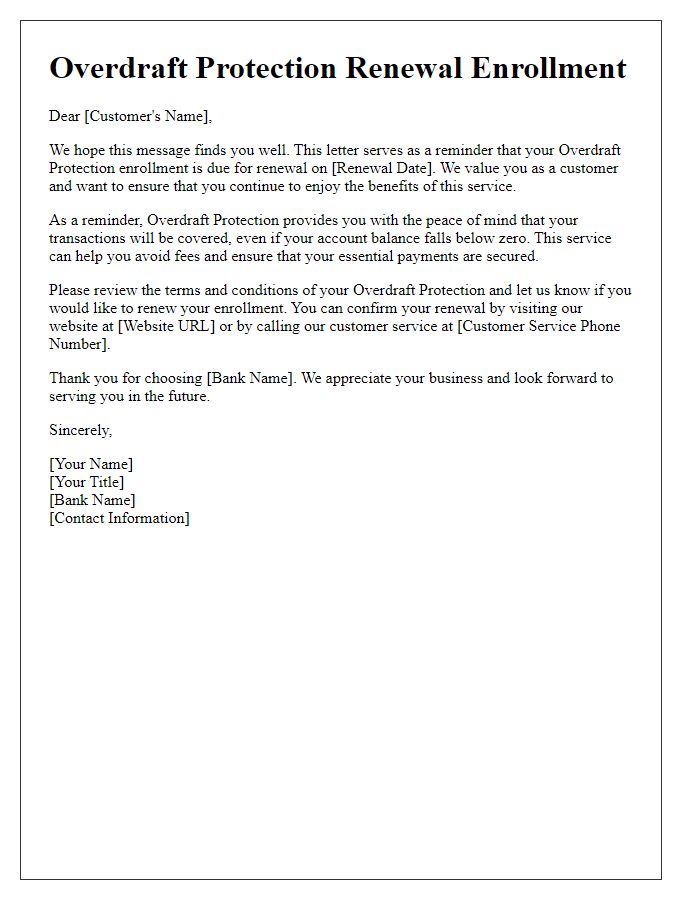

Overdraft protection programs, offered by financial institutions like Wells Fargo or Bank of America, provide a safety net for checking accounts, preventing declined transactions due to insufficient funds. Account holders, such as individuals or small businesses, may enroll in these programs to protect against overdraft fees, which can average around $35 per incident. In 2021, banks generated over $33 billion in overdraft fees, highlighting the financial implications of overdraft situations. These programs typically link a savings account or credit card as a backup source of funds, allowing transactions to process up to a predetermined limit, ensuring essential payments like rent or utilities can be made even in times of financial shortfall.

Terms and Conditions

Overdraft protection enrollment offers customers a safety net for managing their checking account funds. This service enables account holders to avoid insufficient funds fees when transactions exceed available balances, typically up to a preset limit (often $500 to $1,000 depending on the bank). Users must understand the associated terms and conditions, which may include fees per transaction (ranging from $30 to $35), interest rates on overdrawn amounts (averaging between 18% to 25%), and repayment timelines. It is crucial to recognize that while overdraft protection can provide immediate relief, recurring reliance may lead to substantial debt and diminished financial health. Additionally, banks require consent for enrollment and often offer the option to decline further overdraft coverage within a stipulated timeframe after the initial activation. Compliance with institution-specific policies is essential for maintaining account status and avoiding penalties.

Authorization for Enrollment

Overdraft protection enrollment provides a safety net for bank account holders, preventing rejected transactions due to insufficient funds. Account holders (individuals or businesses) can authorize their banks to link their checking accounts to an overdraft protection plan. Common plans often include a savings account or a credit account as a backup source of funds. Many banks impose fees for overdraft protection services, typically ranging from $30 to $35 per transaction. Enrollment usually requires completing a form containing essential information: account number, personal identification details, and acknowledgment of terms and conditions. Banks may offer different levels of protection, impacting consumer convenience and financial management. Understanding the implications of overdraft fees and limits is crucial for informed decision-making.

Financial Institution Details

Enrolling in overdraft protection provides financial security during unexpected circumstances. Overdraft protection safeguards against insufficient funds when transactions exceed account balances at financial institutions like banks or credit unions. Institutions may charge fees for this service, often ranging from $20 to $35 per overdraft occurrence, depending on policies. Customers can avoid declined transactions or bounced checks this way, ensuring smoother payment processing. Many financial institutions offer different tiers of overdraft protection, each with distinct coverage levels, enabling customers to select a plan that aligns with their financial strategy. Read the terms and conditions, and understand any associated fees before enrolling for optimal financial management.

Signature and Date

Overdraft protection enrollment provides a safety net for checking account holders at financial institutions. This service ensures that transactions are approved, even if the account balance dips below zero, typically for a fee. Important details include the enrollment process, usually requiring a completed form and consent, set fees per transaction, and the maximum overdraft limit, which varies by bank policies. Recent statistics show that approximately 25% of bank customers utilize this service, often to avoid declined purchases, returned checks, and associated penalties. Understanding terms and interest rates related to overdraft facilities is crucial for responsible account management.

Comments