Are you looking to secure a bank guarantee but unsure how to get started? Writing a formal request can seem daunting, but it's simpler than you think! In this article, we'll walk you through a letter template that clearly outlines your need for a bank guarantee and ensures your request is well-received. So, let's dive in and explore the essential elements that make your request stand out!

Clear subject line and reference number

A bank guarantee issuance request requires meticulous attention to detail and clarity in communication. A precise subject line should include terms like "Request for Bank Guarantee Issuance" followed by a unique reference number such as "BG-2023-001." This effectively categorizes the request for easy tracking. Providing necessary details within the body of the request enhances its clarity. Mention recipient information, including the bank's name and contact details, alongside the specific amount required for the guarantee, such as $100,000 for a construction project bond. Clearly outline the purpose of the bank guarantee, for example, "to secure performance in accordance with Contract No. 12345." Essential attachments could include identification documents, proof of business registration, and any prior correspondence or agreements related to the guarantee request. A succinct, professional tone is important to convey urgency and facilitate a prompt response.

Company and bank details

A bank guarantee is an essential financial instrument used to assure the performance of an obligation. A company seeking such a guarantee must provide specific details, such as the bank's name (e.g., Bank of America), the company's registered address (e.g., 123 Business Rd, Suite 456, New York, NY 10001), and the account number related to the guarantee request. Clear identification of the purpose for the guarantee, such as securing a contract with a supplier (e.g., XYZ Manufacturing Co.) for $100,000, must be stated. Moreover, including the duration of the guarantee, typically ranging from six months to three years, helps clarify the agreement. Providing comprehensive details reduces misunderstanding and expedites the processing of the request, making it crucial to exhibit thoroughness and accuracy.

Specific guarantee amount and currency

A bank guarantee issuance request involves specific details about the required guarantee amount and currency, essential for ensuring the transaction's clarity. A business may require a bank guarantee of $500,000 USD for a real estate transaction in New York City. This provision ensures the seller receives assurance of payment before finalizing the sale. The currency (USD) is crucial in international transactions, as fluctuations in exchange rates can significantly affect the guarantee's value. Additionally, the request typically includes details of the beneficiary, the purpose of the guarantee, and the validity period, commonly spanning 12 months. This structured approach facilitates the prompt issuance of the guarantee by the bank, streamlining the transaction process and fostering trust between parties.

Purpose and duration of the guarantee

Businesses frequently request bank guarantees for various purposes, including securing contracts or ensuring payment. A bank guarantee serves as a financial safety net, assuring involved parties that financial obligations will be met. The duration of the guarantee can vary significantly, ranging from a few months for short-term projects to several years for long-term agreements. For instance, a construction company may seek a guarantee lasting 12 months to cover the successful completion of a project in New York City, valued at $1 million. This guarantee protects stakeholders such as suppliers and contractors, ensuring any financial risks associated with the contract are minimized. The request should clearly articulate the specific purpose, such as "completion of contract obligations," along with the exact timeframe needed for the guarantee's effectiveness.

Contact information for further correspondence

A bank guarantee issuance request requires specific details to ensure proper processing. Accurate contact information is essential for further correspondence, enabling efficient communication between the requesting party and the financial institution. This should include the name of the requester, the company's registered address, phone numbers, and email addresses for immediate response. Detailed note on information may include country codes for phone numbers and the official website for additional inquiries, ensuring clarity in communication. Accurate documentation enhances the likelihood of prompt action and reduces the chance of misunderstandings.

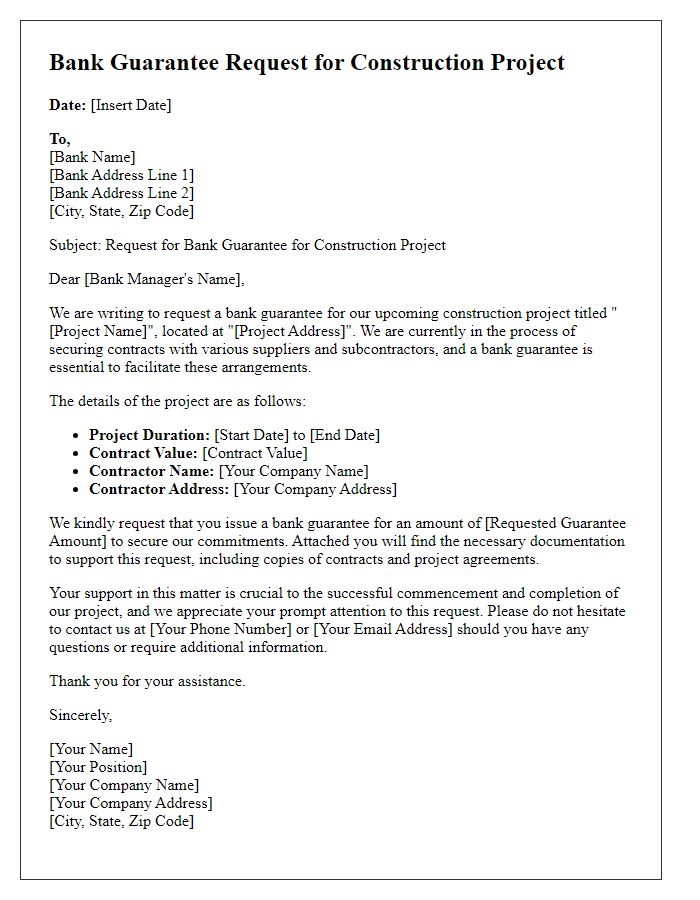

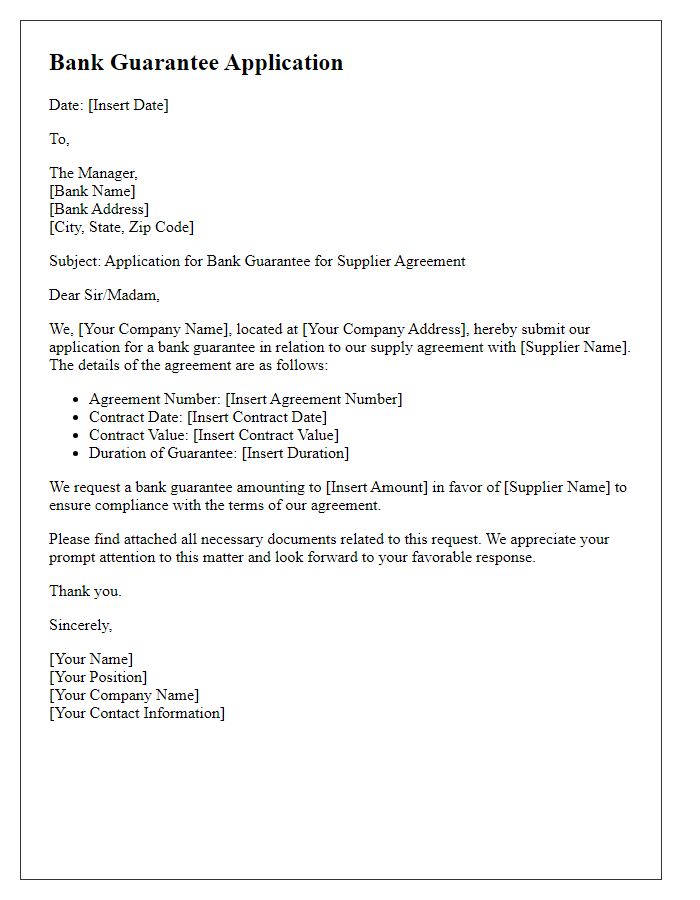

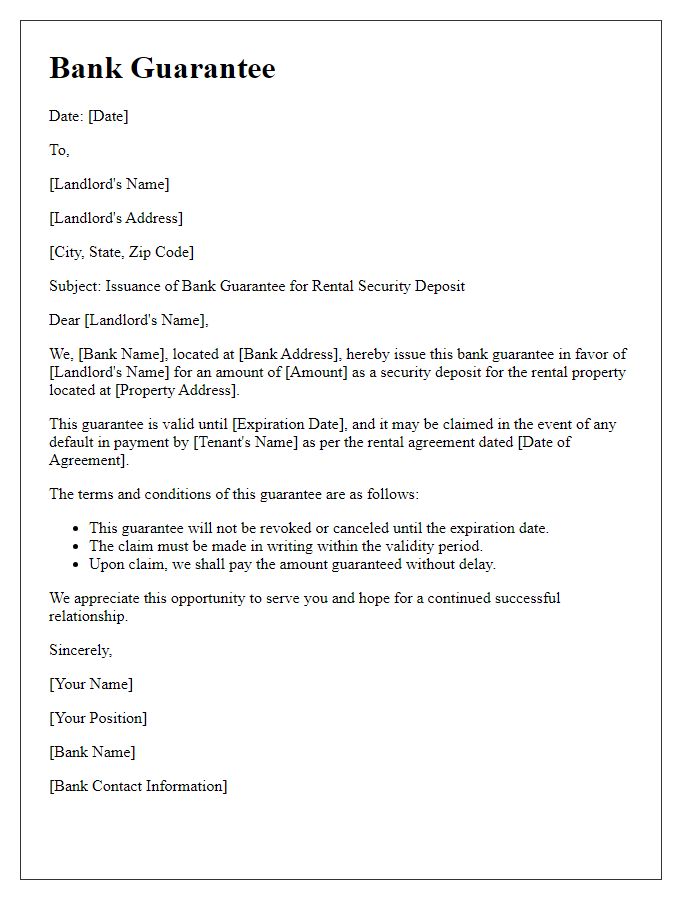

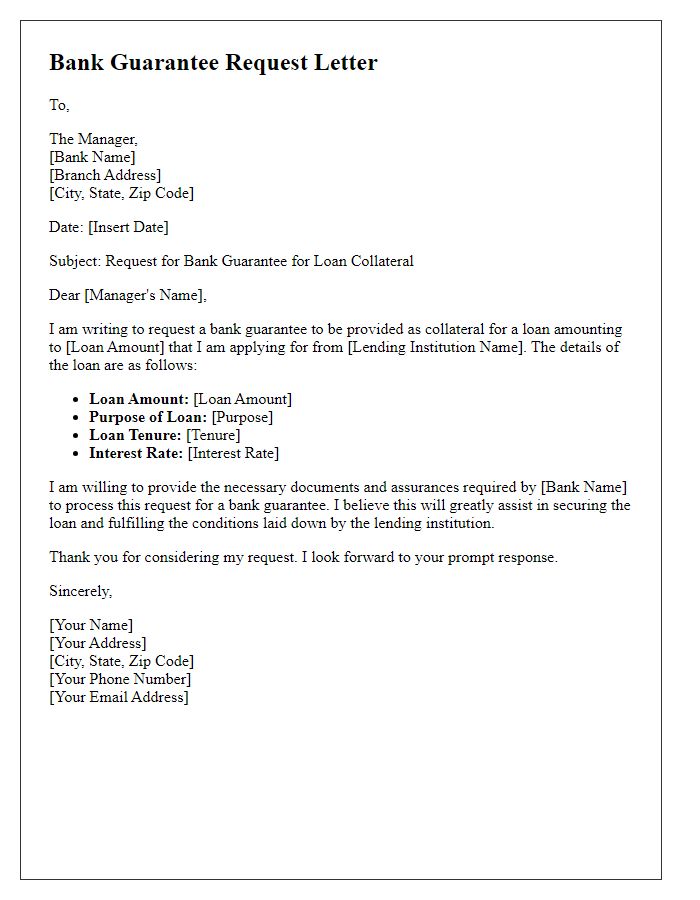

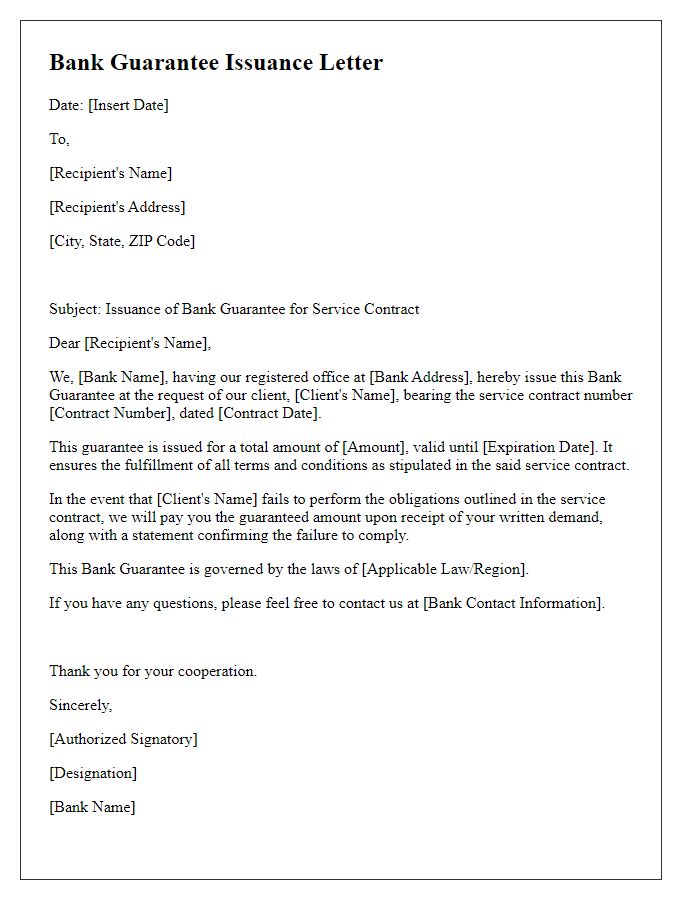

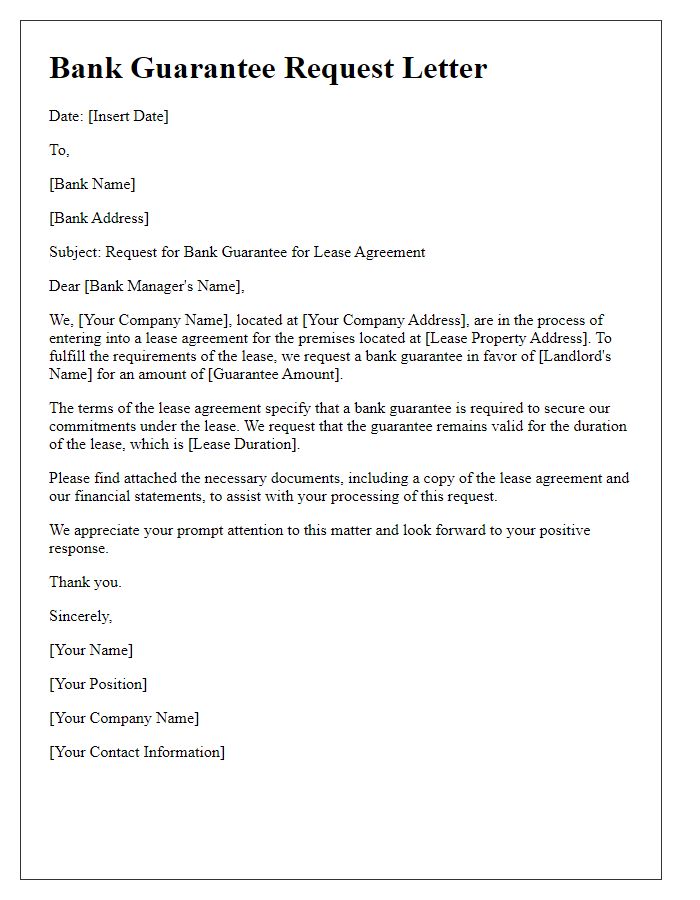

Letter Template For Bank Guarantee Issuance Request Samples

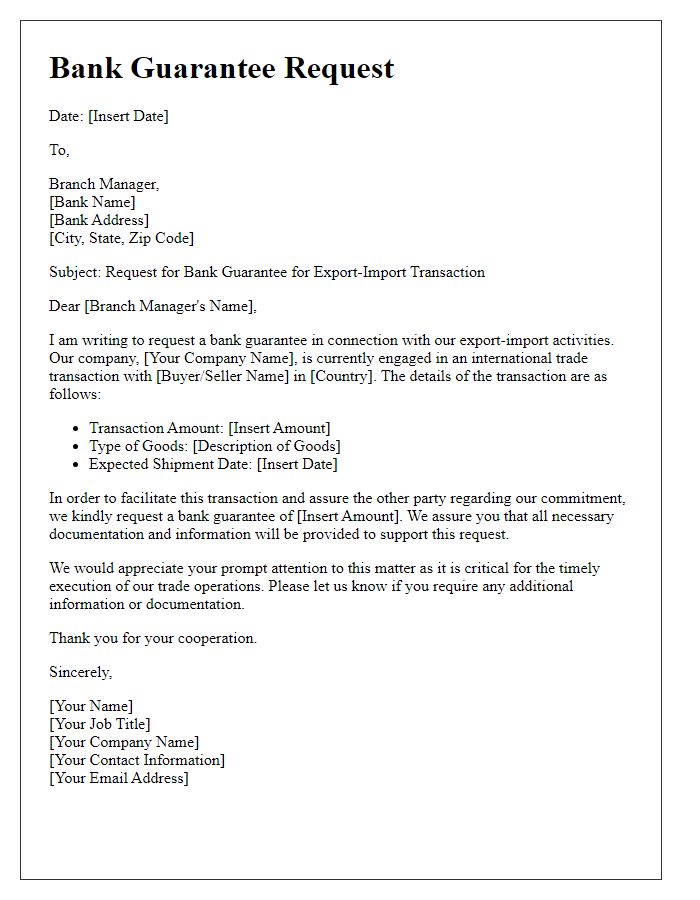

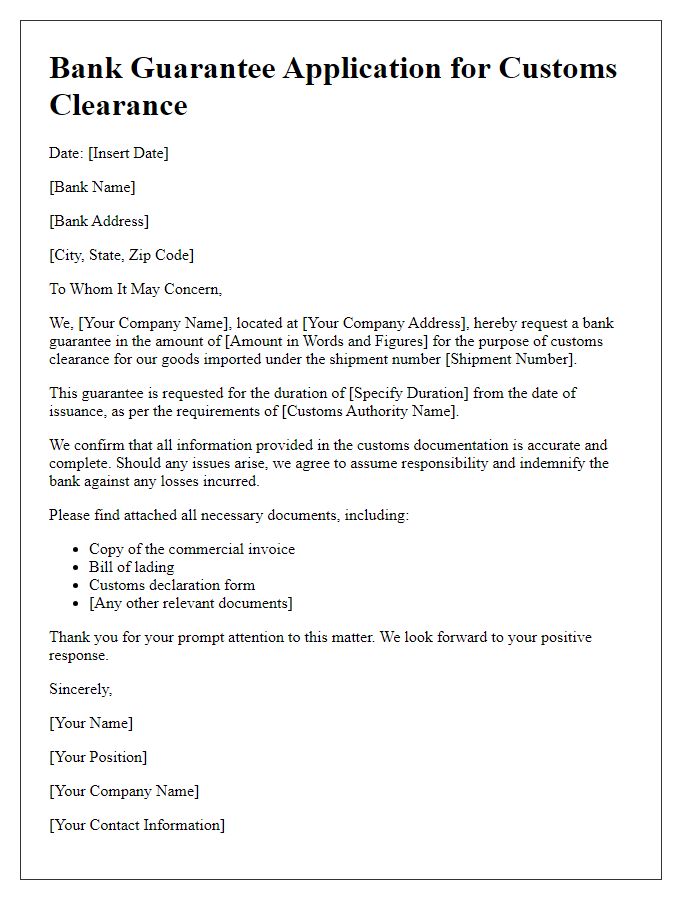

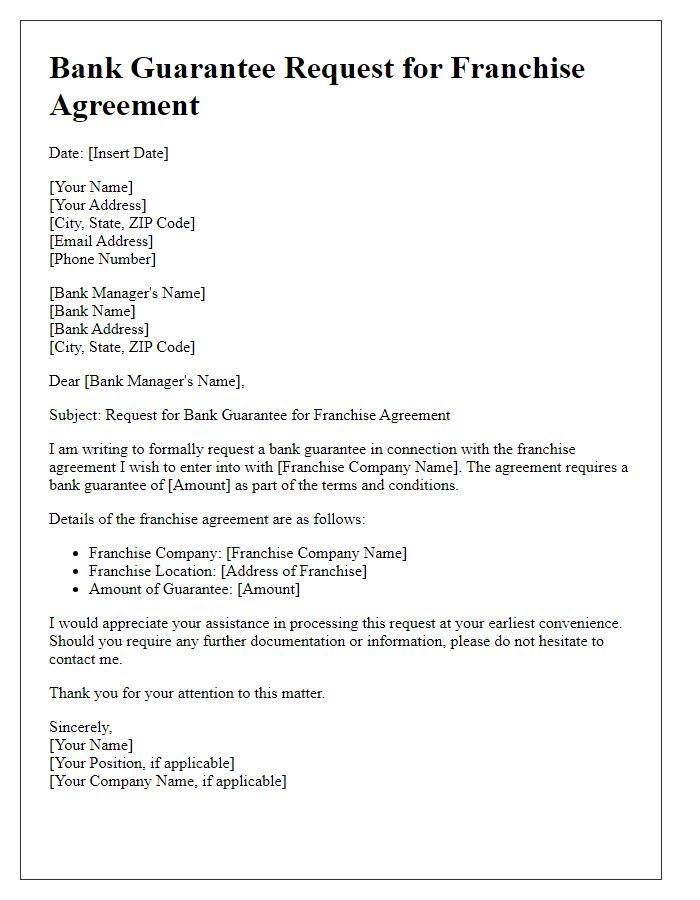

Letter template of bank guarantee request for export-import transaction.

Comments