Are you considering applying for a business line of credit but unsure where to start? Writing a compelling letter is key to presenting your case effectively to lenders. In this article, we'll walk you through a simple yet powerful template that outlines the essential components of your request. So, grab your notepad and let's dive into the details that'll help you secure that all-important funding!

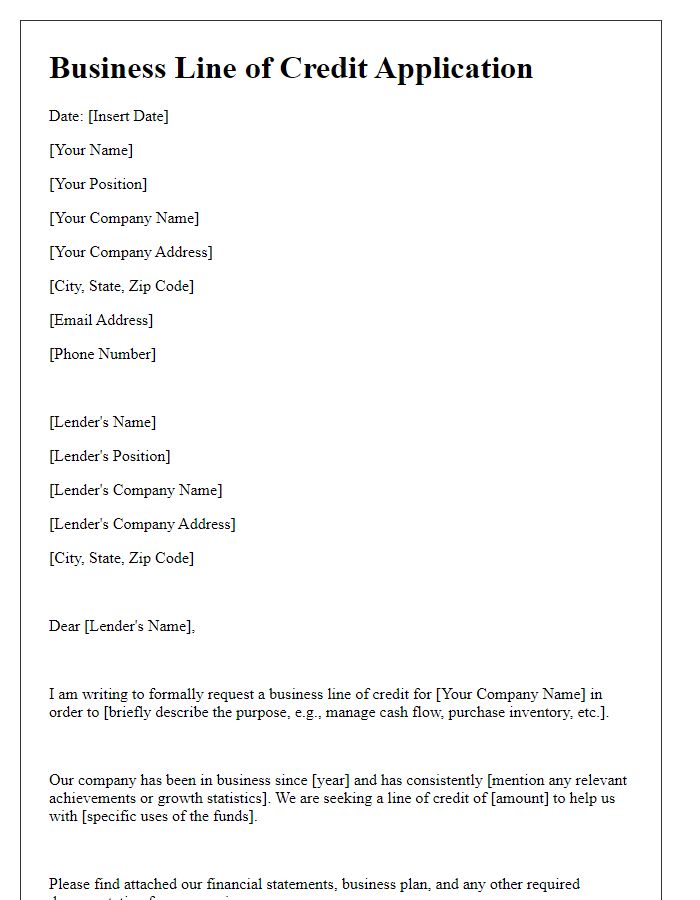

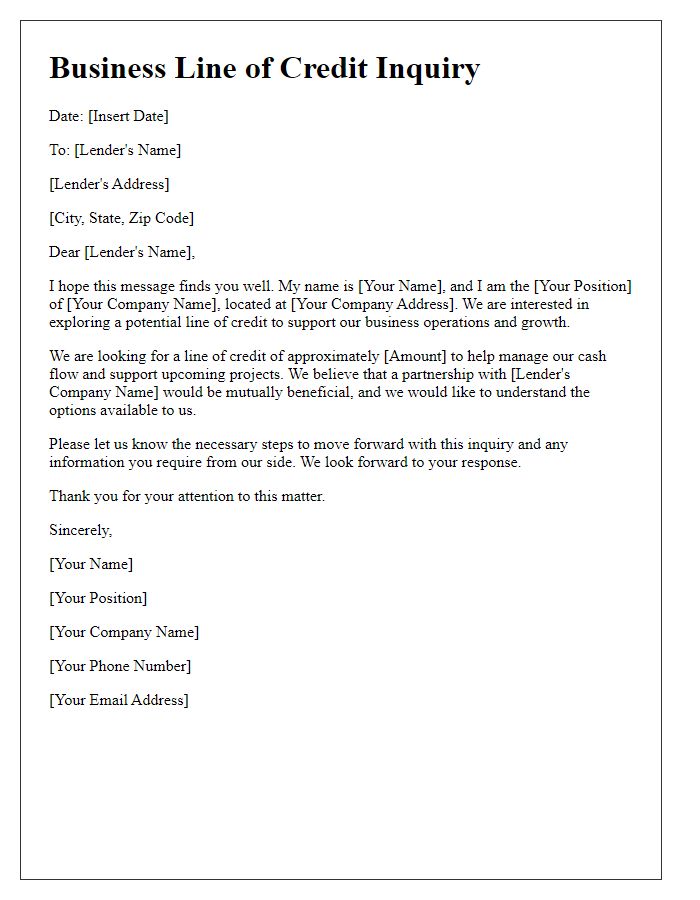

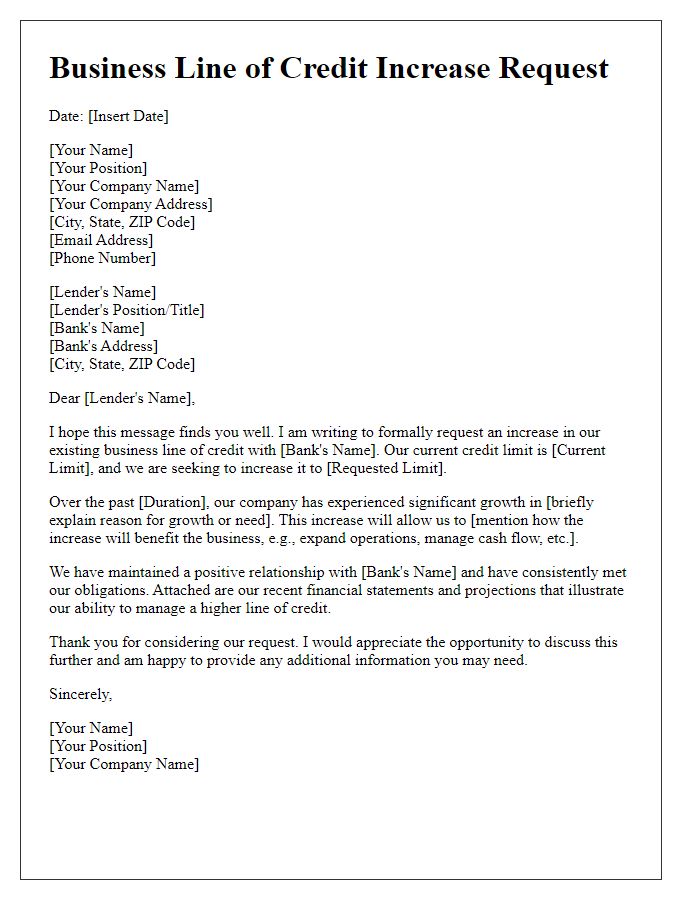

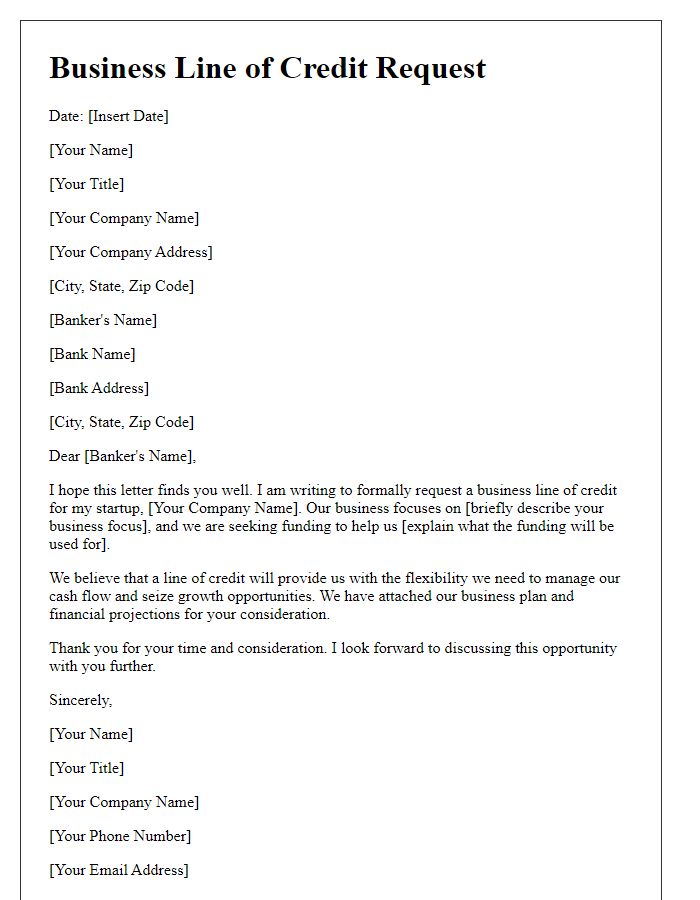

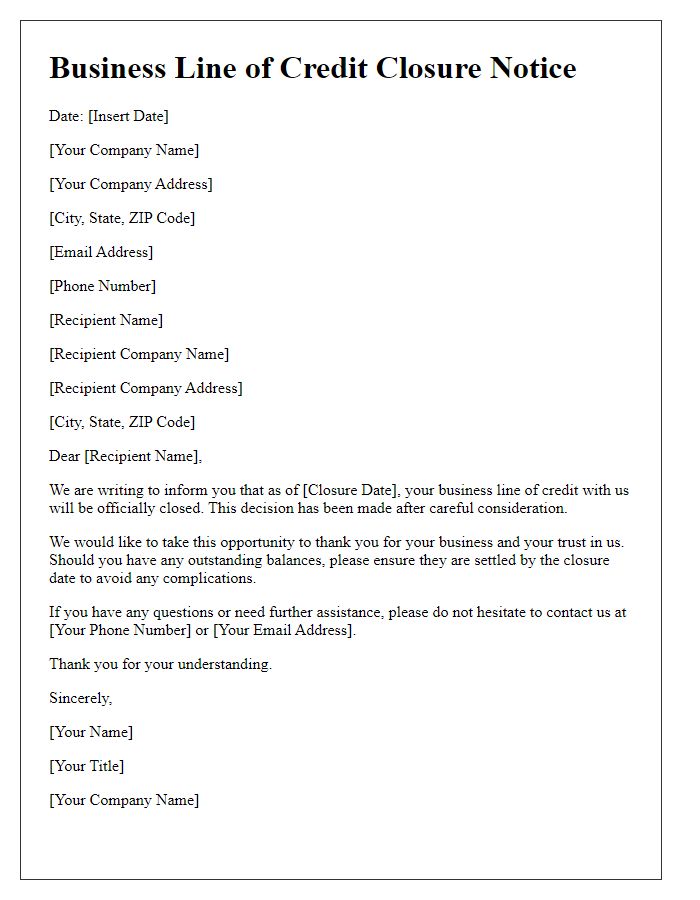

Professional Header

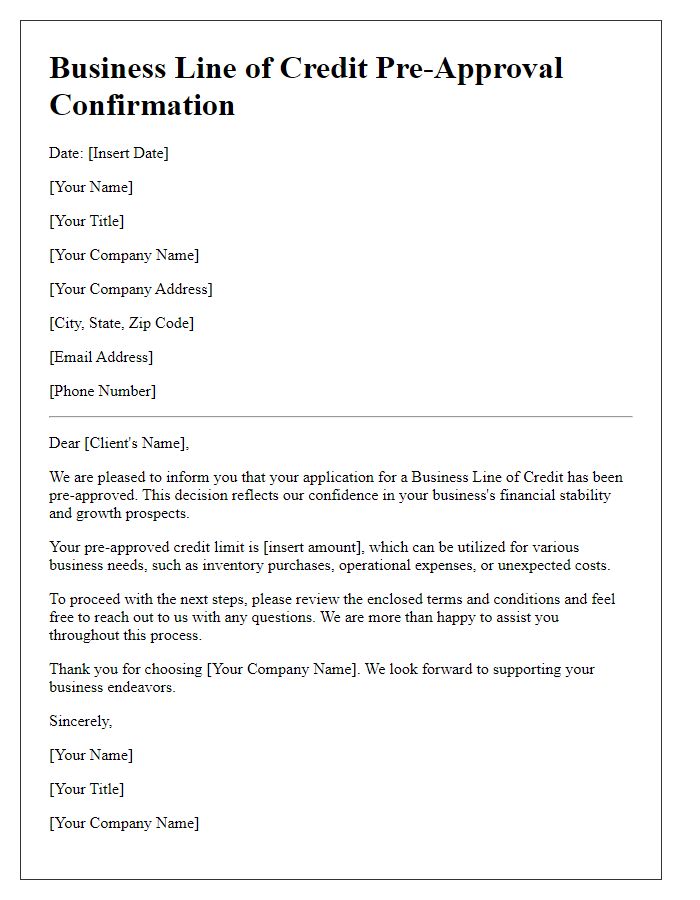

A business line of credit is a flexible financial tool that allows businesses, particularly small and medium enterprises, to access funds up to a predetermined limit as needed. These limits, often ranging from $10,000 to $5,000,000, enable companies to manage cash flow effectively while covering unexpected expenses. Financial institutions such as banks or credit unions typically assess the applicant's creditworthiness, including credit score and business financial statements, to determine eligibility. Interest rates can vary significantly, often influenced by market conditions and the borrower's credit profile, and are generally charged only on the drawn amount. The ability to draw, repay, and redraw funds creates an adaptable financing solution tailored to the unique needs of a business, fostering growth and operational stability.

Clear Purpose Statement

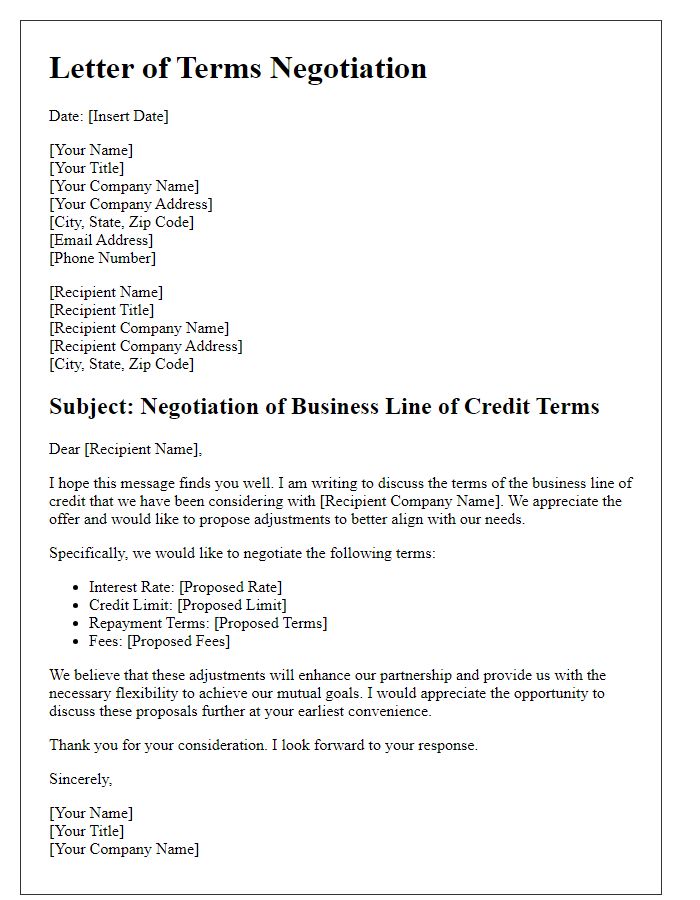

A clear purpose statement is essential for applying for a business line of credit as it outlines the specific needs and intentions behind the funding request. Businesses often seek lines of credit to manage cash flow fluctuations, enabling timely payments to suppliers and operational expenses. For instance, a small retail shop may require $50,000 for seasonal inventory purchases, addressing the need for capital to capitalize on high-demand periods such as the holiday season. A purpose statement should articulate how the funds will be directly utilized to enhance operational efficiency, support growth initiatives, or address unexpected expenses, providing lenders with confidence in the investment's potential return.

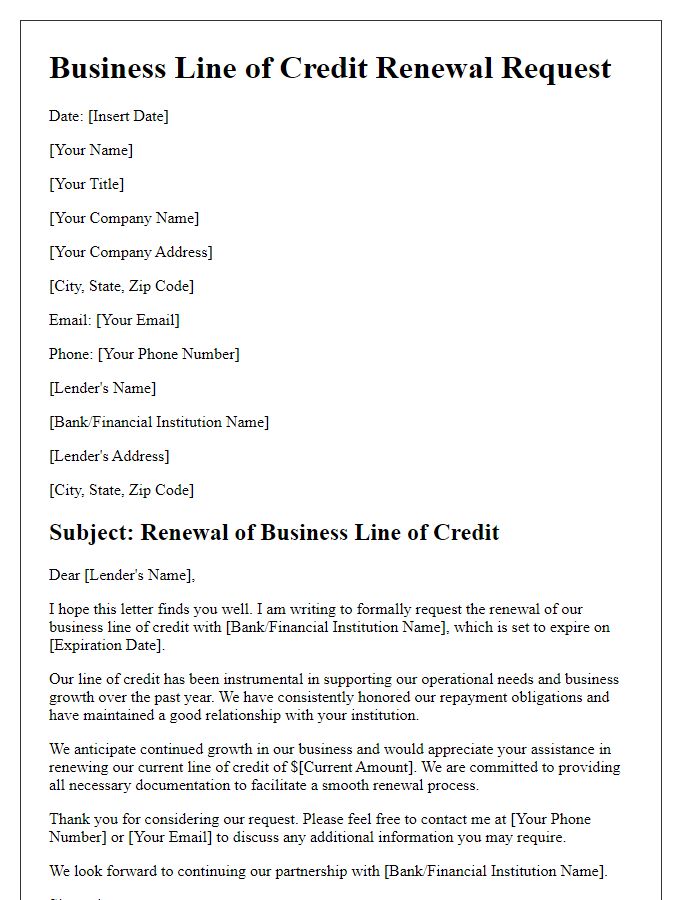

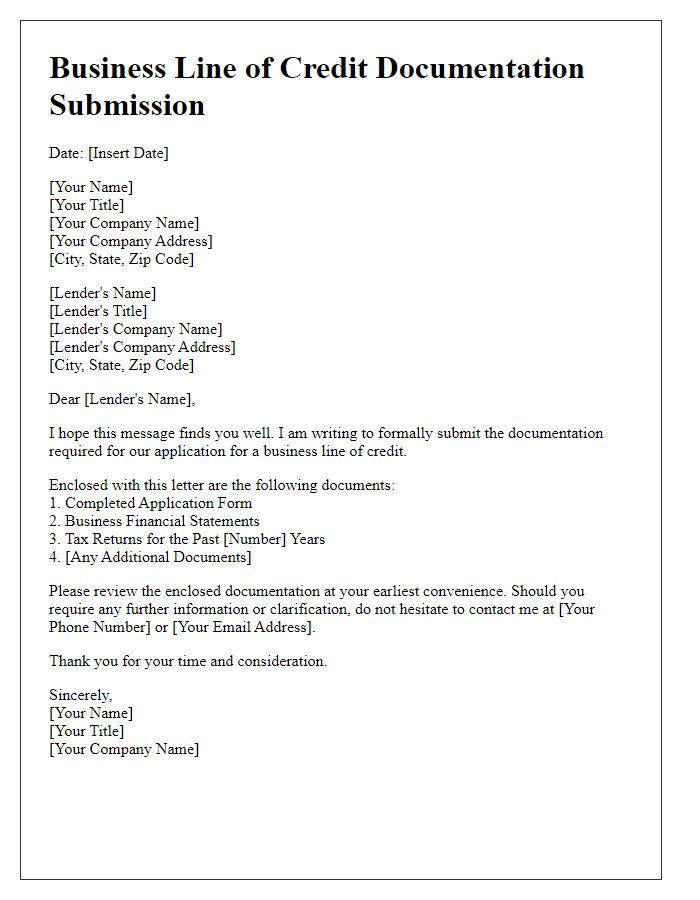

Detailed Borrowing Proposal

A detailed borrowing proposal for a business line of credit outlines the specific financial requirements and advantages for the lending institution. The company seeking the line of credit should include its legal business name, established in 2010 in San Francisco, California, with an annual revenue of $2 million. A concise description of the business operation is critical, highlighting the competitive edge in the tech industry and a growing customer base of 5,000 clients. The proposal should detail the amount requested, such as $100,000, alongside a clear justification of how these funds will be allocated, including details like inventory purchasing, marketing campaigns, or operational expenses. Furthermore, inclusion of the repayment plan, which may span 12 to 24 months with an interest rate of 7%, showcases financial responsibility and an understanding of credit obligations. Lastly, attaching financial documents, such as recent profit and loss statements, tax filings, and current balance sheets, adds credibility to the proposal, demonstrating stability and a defined growth trajectory.

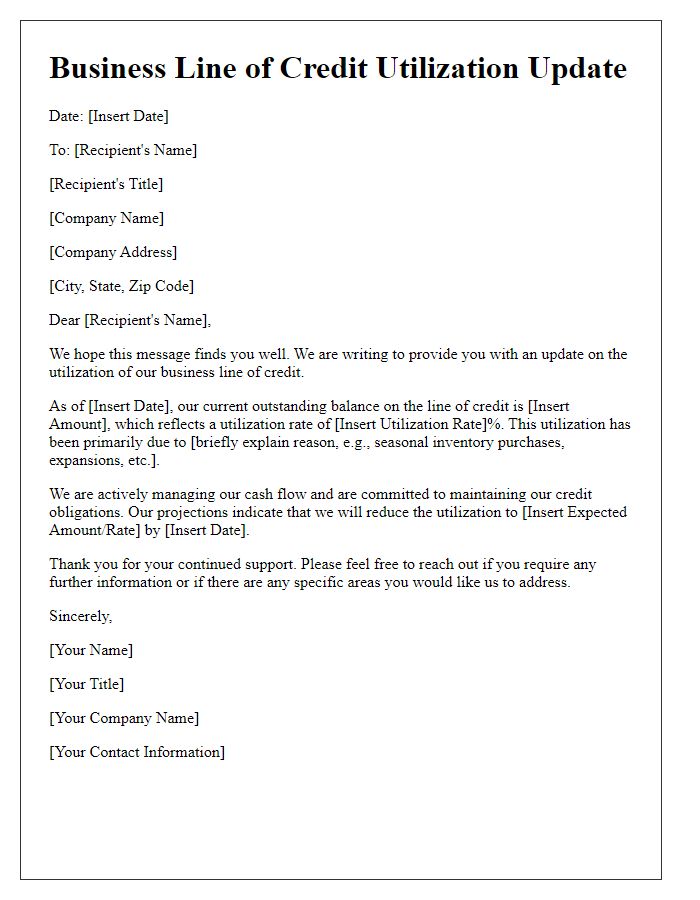

Financial Information & Justifications

A business line of credit serves as a financial resource, enabling businesses to access funds quickly as needed. Typical loan amounts range from $10,000 to $1 million, depending on factors such as revenue and creditworthiness. Financial information showcases crucial figures, including annual revenue and expenses, which will influence the lender's assessment. Justifications highlight the specific uses of the credit line, such as inventory purchases, operational costs, or unexpected expenses, emphasizing the importance of liquidity in maintaining business operations. Presents a strategic approach to managing cash flow, ultimately supporting sustained growth and stability in a competitive market.

Contact Information & Closing

A business line of credit provides companies with flexible financing options for managing cash flow and covering unexpected expenses. Businesses can access funds up to a certain credit limit, which can range from $10,000 to over $1 million, depending on financial health and lender policies. Interest rates may vary significantly, typically between 7% and 25%, based on the borrower's creditworthiness and market conditions. Establishing a relationship with a local bank or credit union in the business's geographic area may result in better offers or terms. Maintaining open communication with the lender can facilitate the process for future expansions or additional funding requests.

Comments