Are you feeling overwhelmed by your student loans and considering a deferment? You're not aloneâmany students find themselves in need of a temporary break from payments due to a variety of circumstances. In this article, we'll guide you through a straightforward letter template to request a student loan deferment, making it easier for you to focus on your studies or personal challenges. Let's dive in and explore how you can take a step towards financial relief!

Personal Information

When requesting a student loan deferment, detailed personal information is essential for the loan servicer to identify your account accurately. Include your full name, which should match your loan documents, and your permanent address, providing clarity on your residency status. Your student ID number is crucial for university-related loans, while your Social Security number acts as a unique identifier within federal databases. Specify the loan account numbers for each loan you seek to defer, ensuring all relevant accounts are addressed. Additionally, listing your current phone number and email address facilitates swift communication regarding your deferment status. Remember to mention any specific circumstances, such as enrollment in further education or unemployment, that justify your deferment request.

Loan Account Details

Student loan deferment requests require specific account information to facilitate processing. This includes the Loan Account Number, which is a unique identifier for the borrower's loan, enabling the lender to retrieve the correct records. Borrowers should specify the type of loan, such as Federal Direct Subsidized or Unsubsidized Loans, as various terms and conditions apply. The lender's contact information, including the mailing address and customer service phone number, needs to be included for any follow-up. Additionally, it's important to provide personal information like full name and Social Security Number for identification purposes. The deferment request date should also be indicated, as it helps establish the timeline for repayment suspension.

Reason for Deferment Request

Student loan deferment requests often stem from various personal and financial circumstances. Common reasons include financial hardship, enrollment in higher education, active military duty, or medical issues. A student might encounter a temporary loss of employment or unforeseen expenses, such as medical bills, which directly impact their ability to make monthly payments. Additionally, students pursuing further studies at accredited institutions may seek deferment while focusing on their education without the burden of loan payments. Each reason carries its own documentation requirements and qualifications as defined by loan servicers, making it essential for borrowers to clearly articulate their specific situations when requesting deferment.

Supporting Documentation

When seeking student loan deferment, it is essential to submit comprehensive supporting documentation to validate your request. Required documents may include proof of income, such as recent pay stubs or a tax return for low-income verification. In cases of unemployment, an official termination letter from your employer or a notice from the unemployment office showcasing benefits is crucial. Medical hardships necessitate documentation from healthcare providers outlining diagnoses and treatment plans. Additionally, if pursuing higher education, acceptance letters or enrollment verification from accredited institutions confirm continued educational engagement. Properly organizing and submitting these documents can significantly influence the success of your deferment request.

Contact Information for Follow-up

Students experiencing financial hardship often seek deferment on federal student loans, such as Direct Loans or Federal Family Education Loans (FFEL), to pause payment obligations. Deferment applications may require submission to loan servicers, such as Nelnet or FedLoan Servicing, where personal details must be accurately provided. Relevant documentation to support claims of financial difficulty, including recent pay stubs or unemployment notices, should accompany the request. Each servicer possesses specific criteria for deferment eligibility, with typical conditions ranging from continuing education status to active military duty. Timely communication with the loan servicer can avoid unnecessary accruement of interest, ensuring better management of financial responsibilities.

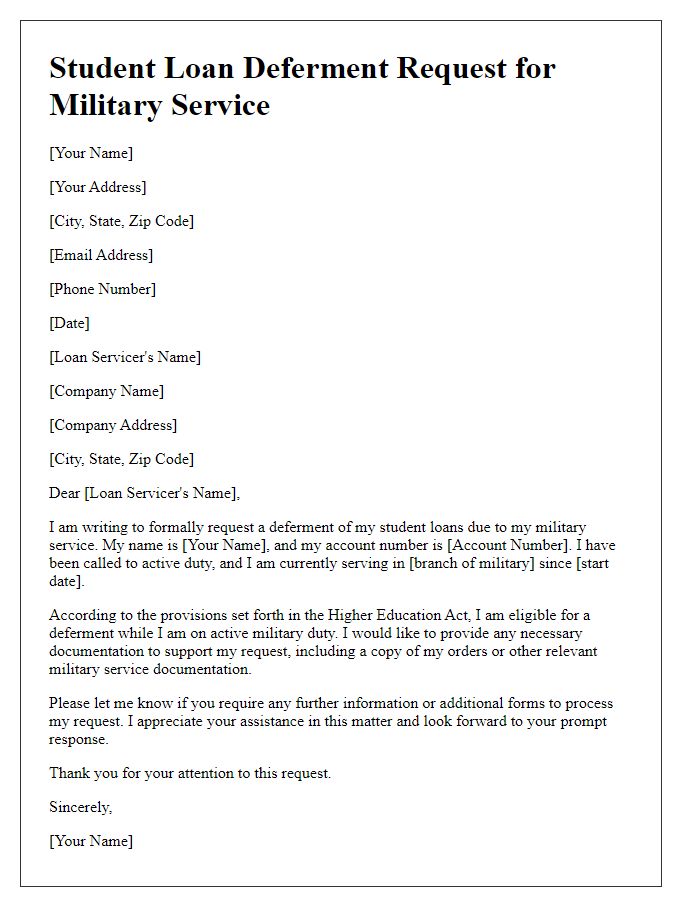

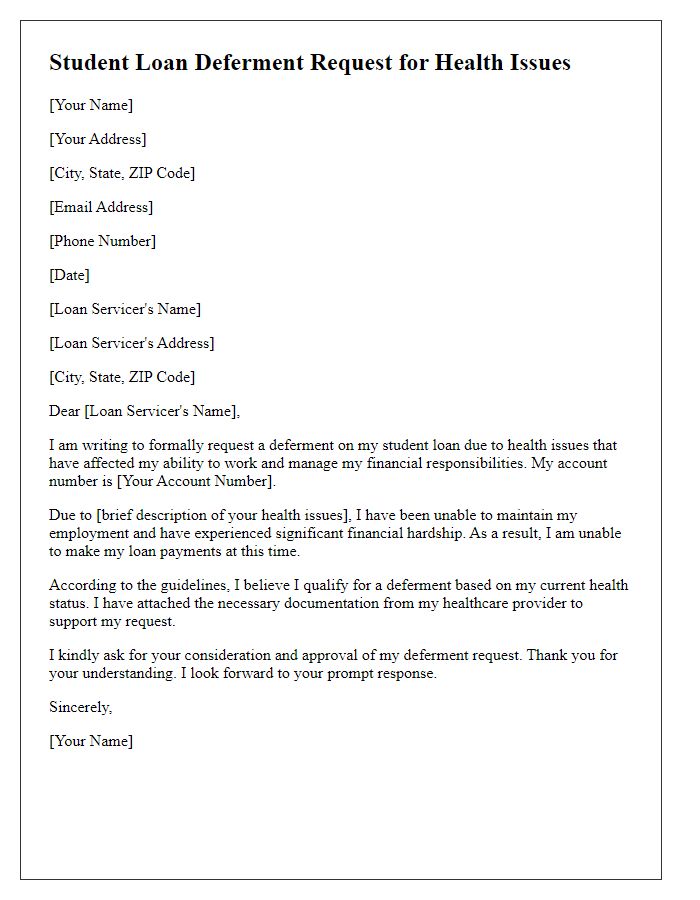

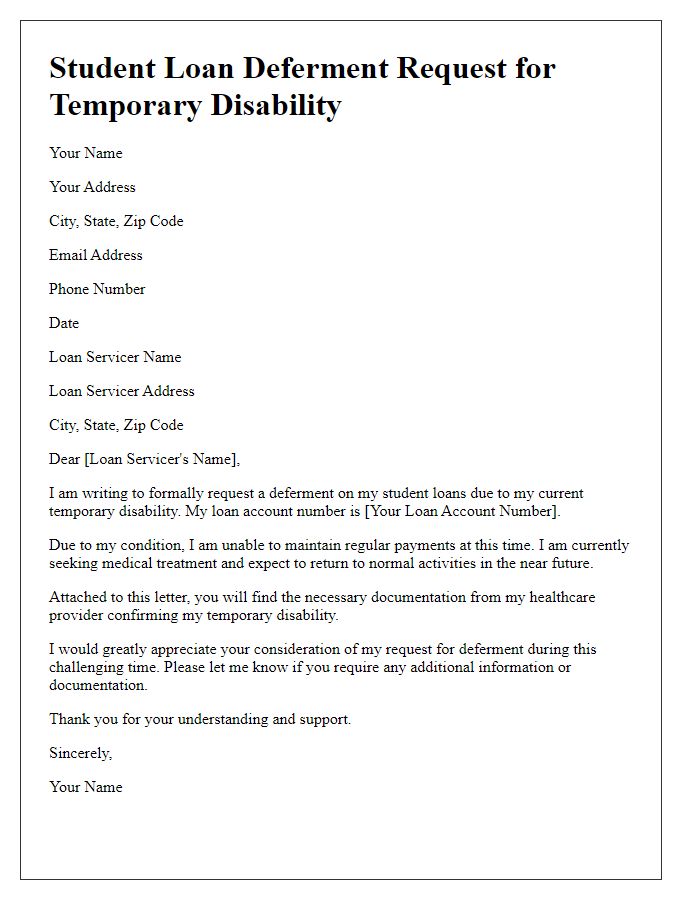

Letter Template For Student Loan Deferment Request Samples

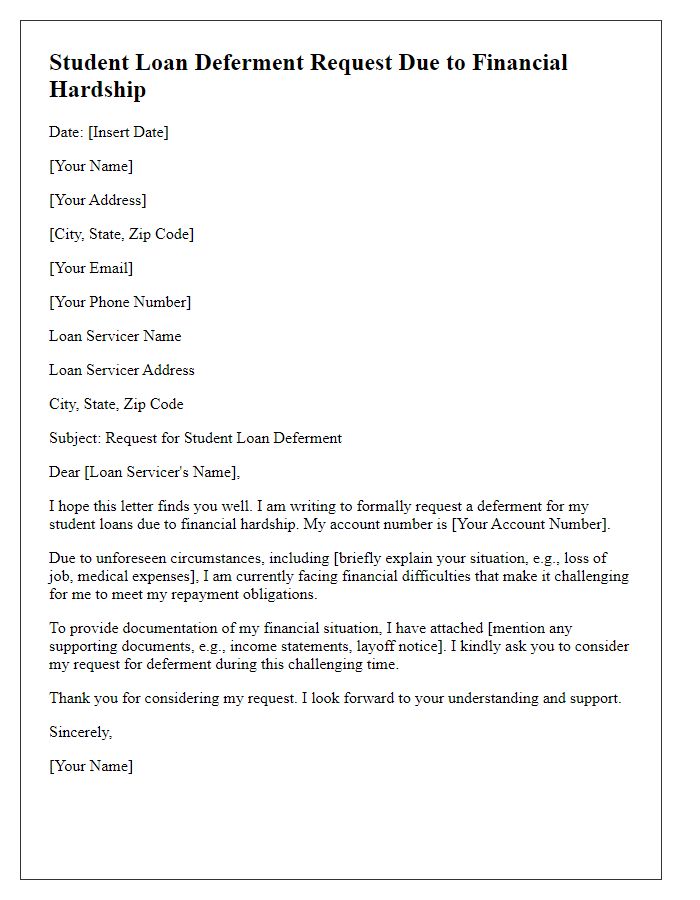

Letter template of student loan deferment request due to financial hardship.

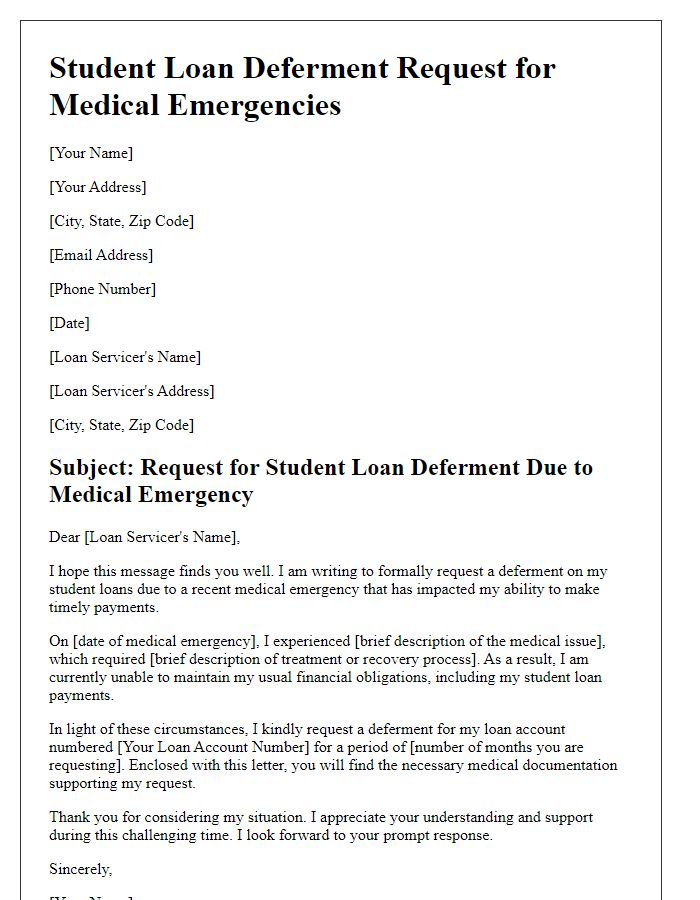

Letter template of student loan deferment request for medical emergencies.

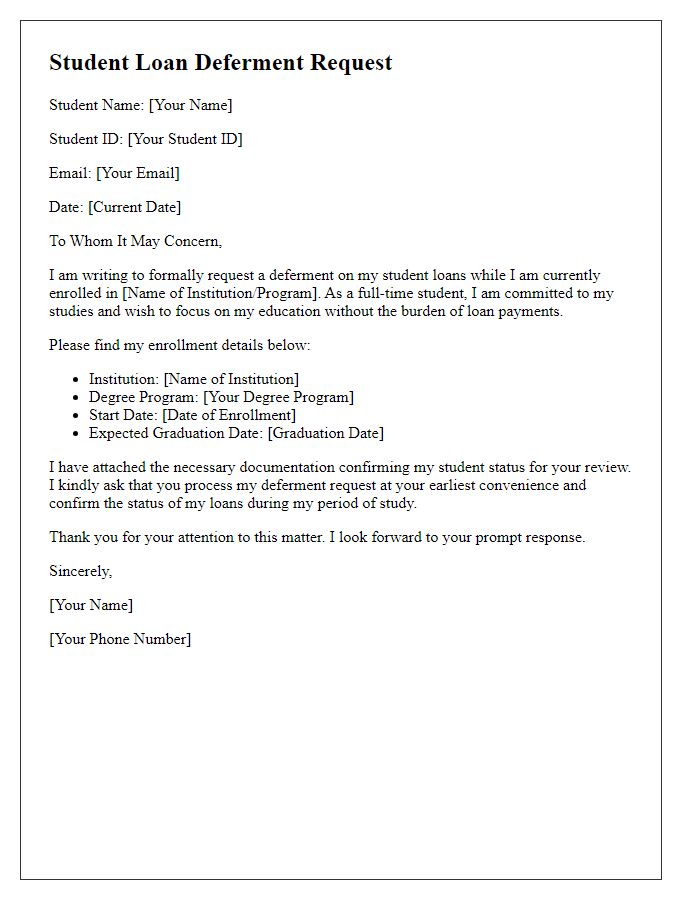

Letter template of student loan deferment request while attending school.

Letter template of student loan deferment request for family responsibilities.

Letter template of student loan deferment request for educational leave.

Comments