When it comes to sharing important audit reports, clarity and professionalism are key. A well-structured letter not only sets the tone for the information being communicated but also ensures that recipients understand the significance of the findings. This article will explore essential elements and templates to streamline your audit report distribution process. Join me as we dive deeper into creating effective communication strategies for your audit reports!

Clarity and Conciseness

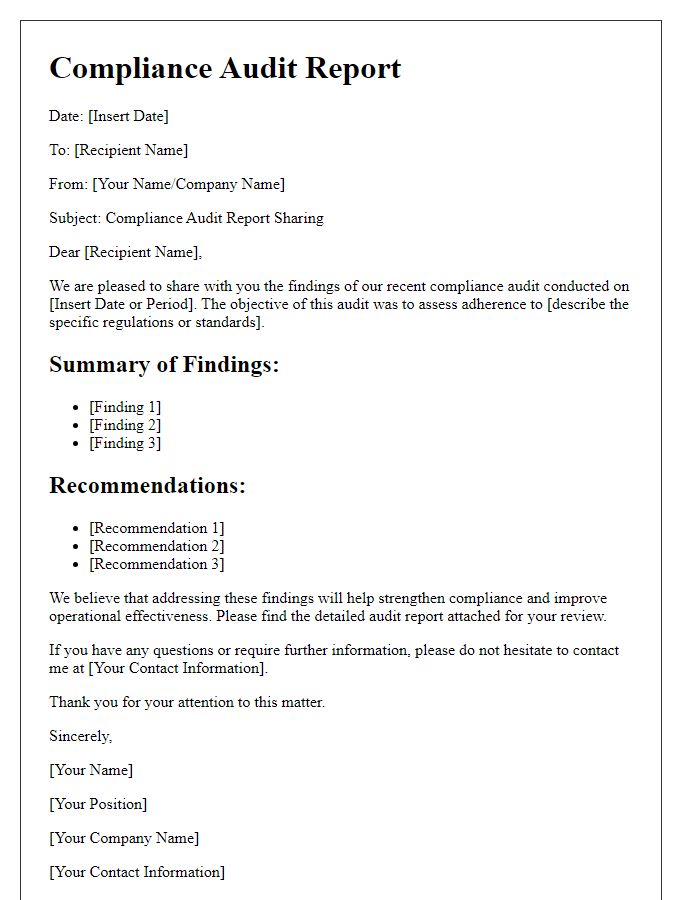

Audit reports serve as vital documents detailing financial performance and compliance. Distribution of these reports requires a clear and concise format to ensure comprehensibility. Key elements such as executive summaries provide overarching insights, while detailed findings explain specific areas of concern, including discrepancies (usually quantified in numerical terms) and recommendations for improvement. Utilizing standardized templates enhances recognition in various departments, ensuring that stakeholders easily understand the implications. Additionally, incorporating visuals like charts or graphs can illustrate complex data effectively, facilitating discussions during meetings. Timely distribution (ideally within two weeks of report finalization) is crucial to uphold transparency and foster accountability within organizations.

Professional Tone

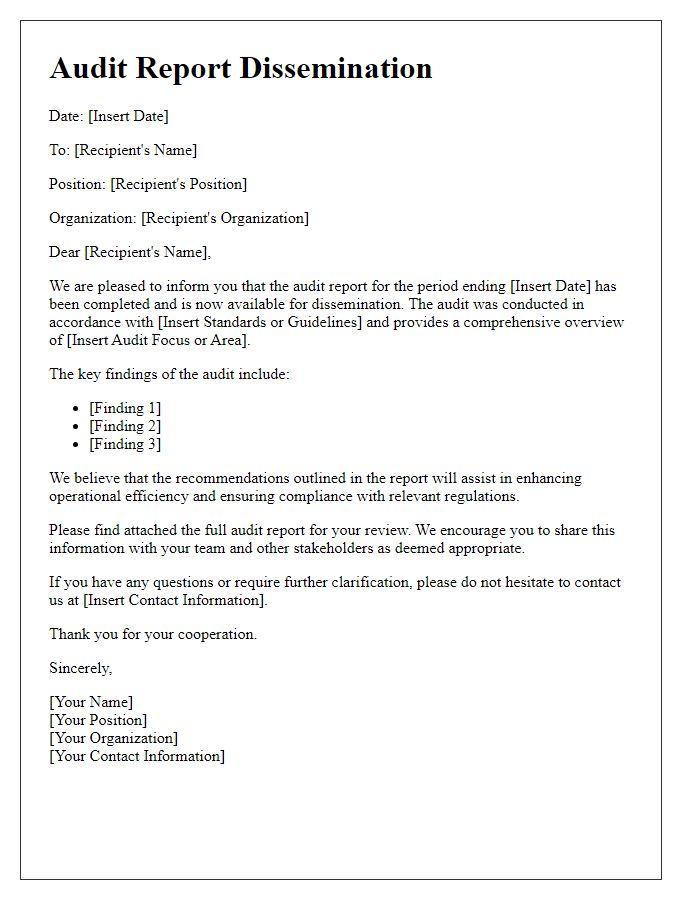

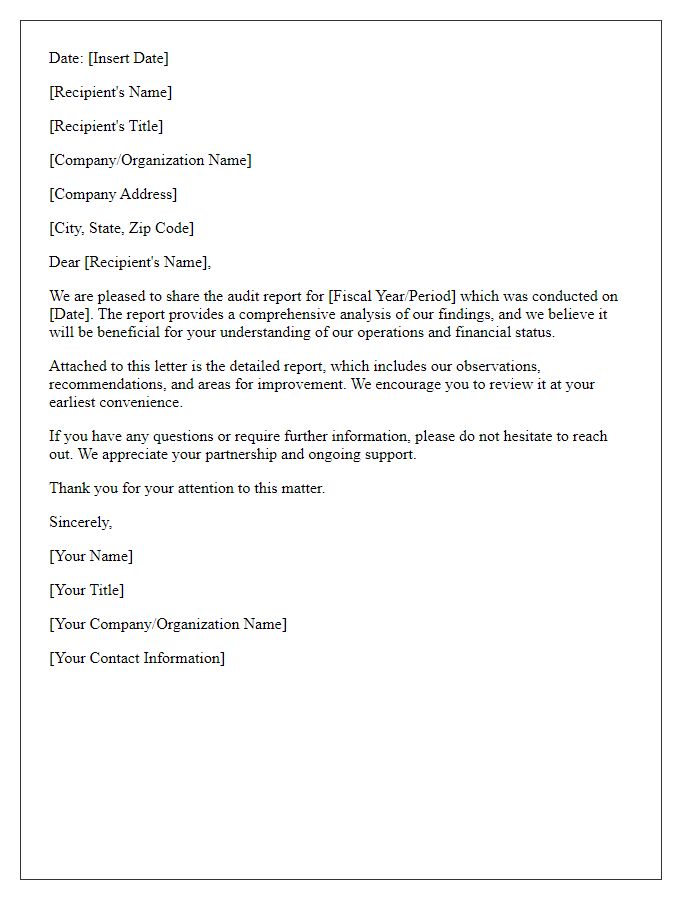

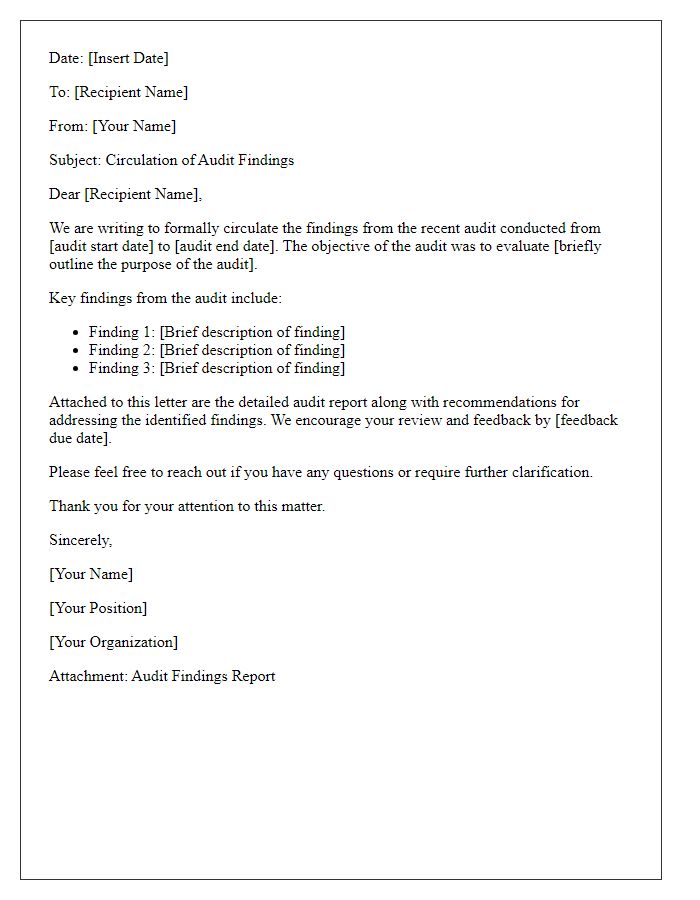

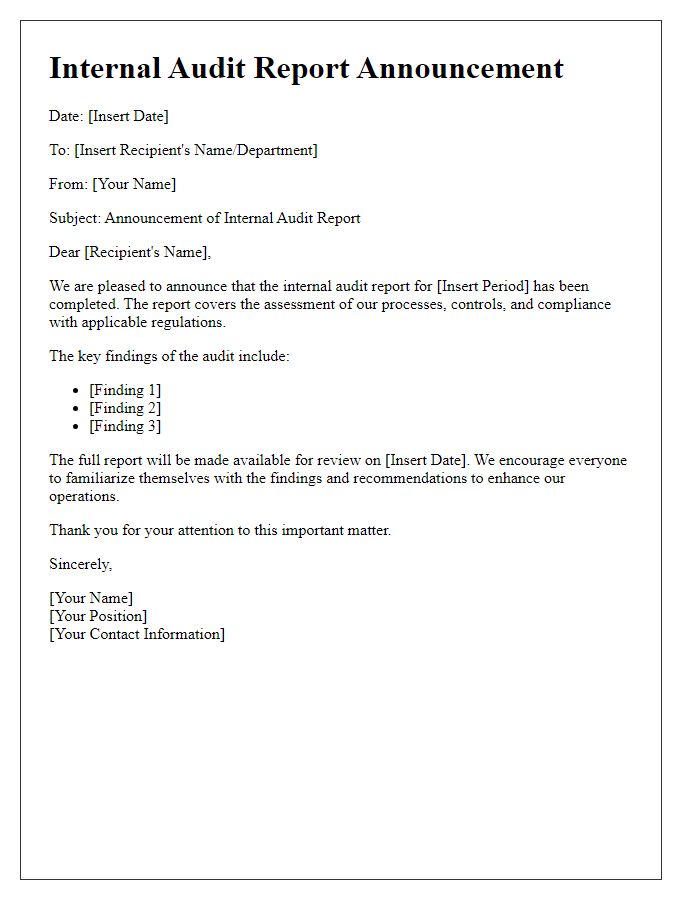

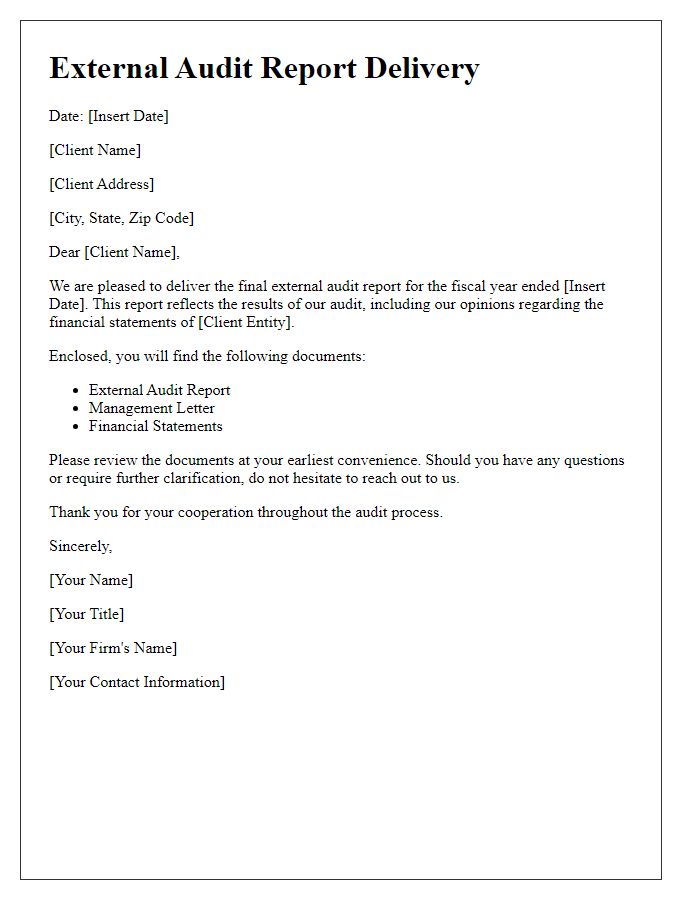

An effective audit report dissemination strategy is crucial for ensuring transparency and accountability in organizations like corporations, nonprofits, or government entities. Timely distribution of the audit report, especially after financial reviews for fiscal years, typically occurring around December or January, enhances stakeholder awareness. Including key stakeholders such as board members, management teams, and regulatory bodies ensures that essential findings are communicated. Often, a summary of significant audit findings, including areas of compliance or discrepancies, should be highlighted to facilitate understanding. Proper channels for distribution may include secure email communications or dedicated platforms, ensuring that sensitive information remains protected. Regular follow-ups, such as quarterly meetings, may enhance dialogue around the audit's implications and foster a culture of ongoing improvement.

Accurate Distribution List

An accurate distribution list for an audit report is essential for ensuring that key stakeholders receive critical information regarding financial procedures and compliance checks. This list should include internal parties such as the Chief Financial Officer (CFO) responsible for overall financial oversight, department heads supervising various operations, and the Internal Audit Manager overseeing audit implementation. Additionally, external parties, including regulatory agencies like the Securities and Exchange Commission (SEC) or clients whose interests may be impacted, should also be included in the distribution list. Timely delivery of the audit report, typically within a week of completion, aids in immediate remedial actions if discrepancies arise, thus promoting organizational transparency and accountability.

Secure Transmission Methods

Secure transmission methods play a crucial role in maintaining the integrity and confidentiality of sensitive data during the distribution of audit reports. Utilizing encryption protocols such as Advanced Encryption Standard (AES) and Transport Layer Security (TLS) ensures that reports remain secure from unauthorized access during transmission over networks. Effective methods include Virtual Private Networks (VPNs) for remote access and secure file transfer protocols (SFTP) that provide a more secure alternative to traditional File Transfer Protocol (FTP). Additionally, utilizing secure email services with features like end-to-end encryption allows for safe document sharing among stakeholders. Implementing multi-factor authentication (MFA) systems adds another layer of security, ensuring that only authorized personnel can access and view the audit reports.

Adherence to Regulatory and Company Policies

An audit report on Adherence to Regulatory and Company Policies provides an essential evaluation of compliance standards within organizations. Regulatory compliance refers to the adherence to laws such as the Sarbanes-Oxley Act (2002) for financial practices, or the Health Insurance Portability and Accountability Act (HIPAA, 1996) regarding patient data privacy. Company policies encompass internal guidelines like ethical conduct codes or safety protocols established by the organization. Findings from the audit may indicate areas of risk, such as non-compliance incidents affecting sectors like finance or healthcare, and highlight necessary corrective actions to improve adherence. The distribution of this report is crucial, as it informs stakeholders--including executives, compliance officers, and board members--about the overall compliance landscape and actionable insights for enhancing adherence to regulatory frameworks and internal policies.

Comments